Ethereum mirrors 2016 trend as price stalls: Are more ETH losses likely?

- ETH may see a reduction rally in September.

- Nonetheless, losses in This fall might be doubtless for the altcoin, per analyst.

Ethereum’s [ETH] worth has been consolidating above $2500 for over per week, a boring situation for crypto merchants who stay off volatility.

Nonetheless, based on famend crypto analyst Benjamin Cowen, the most important altcoin may expertise solely a short restoration in September earlier than counting attainable additional losses in This fall. Cowen’s projection was primarily based on the same ETH sample noticed in 2016.

‘#ETH / #USD month-to-month candles proceed to trace 2016 completely. If it continues to play out, it will recommend #ETH is inexperienced in September, after which crimson Oct-Dec.’

Supply: X

What’s subsequent for ETH worth?

Nonetheless, QCP Capital cautioned that ETH may drop even decrease if the Fed makes a giant downward revision in September.

‘A big downward revision, or an particularly dovish Powell, may probably reverse the 2-week fairness rally and push #BTC and #ETH under assist ranges.’

Apparently, the above blended ETH views have been prevalent throughout the crypto neighborhood for some time. ETH bear and bull camps have put ahead robust arguments for worth prospects, deepening its uncertainty.

Nonetheless, Cowen identified {that a} robust ETH rally might be possible in early 2025.

‘Then in 2025 #ETH turns inexperienced for some time.’

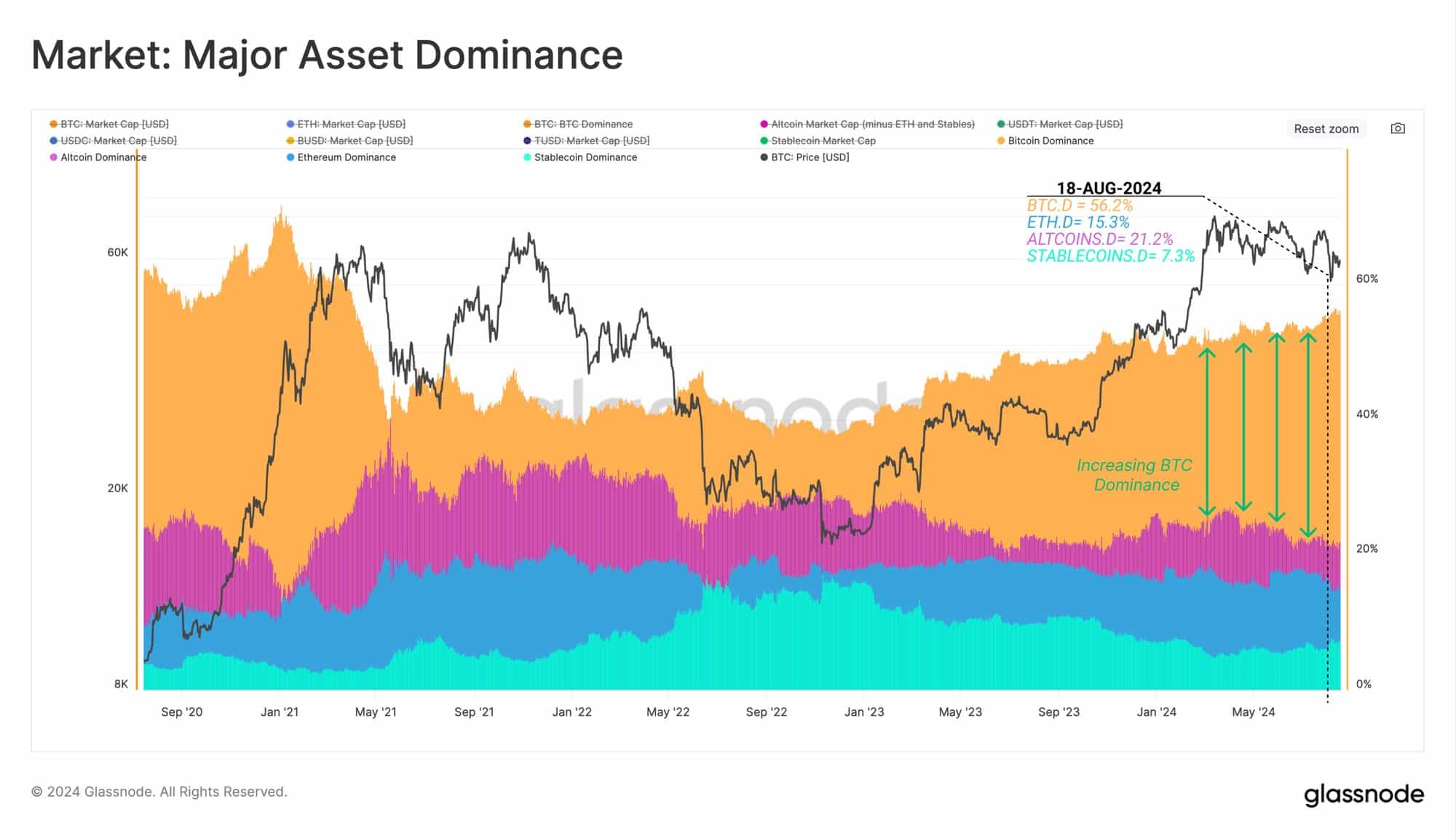

Within the meantime, Glassnode highlighted that Ethereum’s market dominance has dropped from 16.8% to fifteen.2% since crypto bottomed in late 2022.

‘Because the second largest asset within the ecosystem, Ethereum has recorded a dominance decline of 1.5%, remaining comparatively flat over the previous two years.’

Supply: Glassnode

Quite the opposite, Bitcoin’s [BTC] dominance has surged from 38% to over 56% over the identical interval, underscoring attainable capital rotation to the most important digital asset.

Apparently, even the US spot ETH ETF approvals didn’t increase ETH’s market dominance. Regardless of the ETFs recording web outflows since its debut on account of Grayscale’s ETHE outflows, BlackRock’s ETHA had a wild run. ETHA hit $1B in web inflows in a month.

ETH worth evaluation

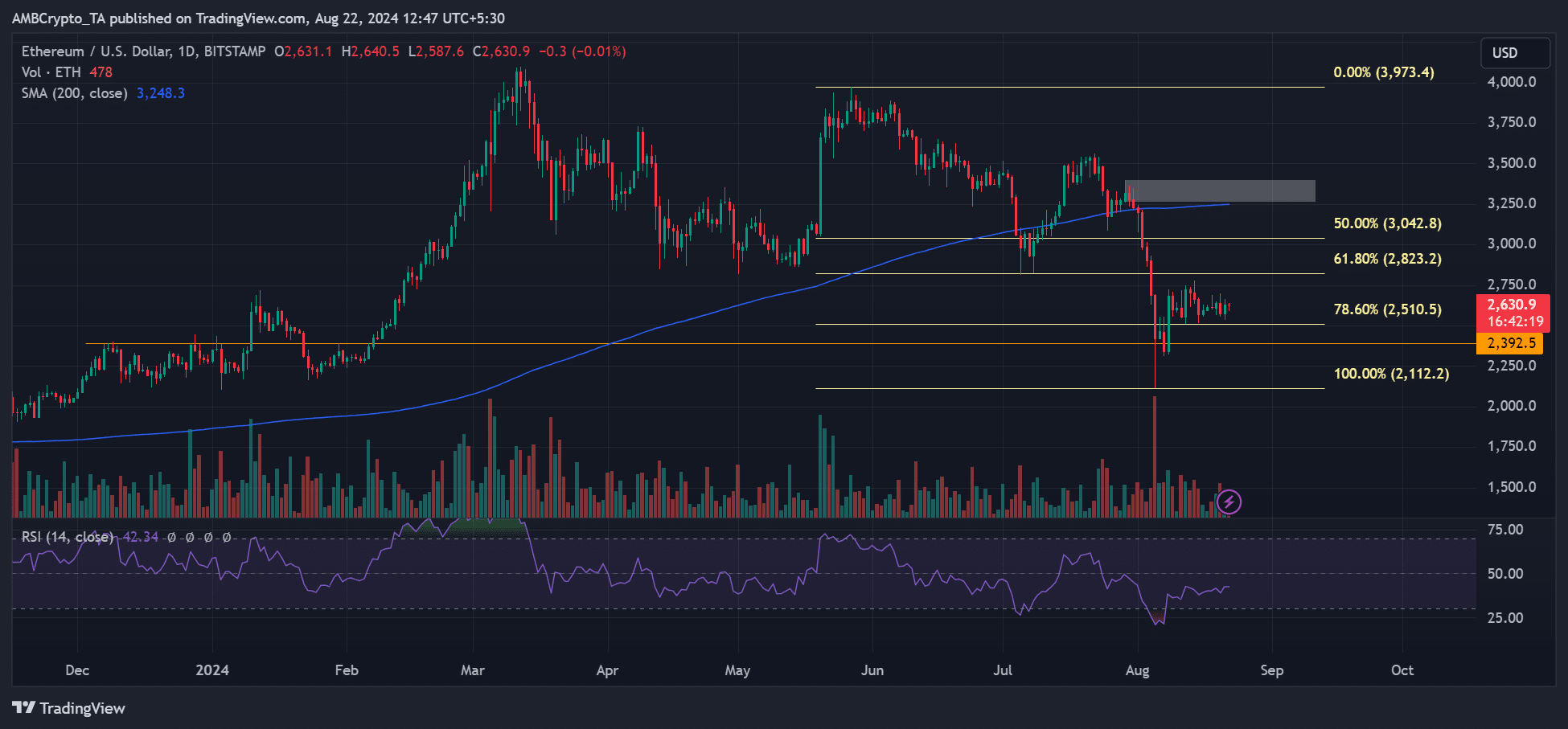

Supply: ETH/USD, TradingView

On the value charts, demand has improved because the dump on August fifth, as indicated by the RSI (Relative Power Index), which has risen from the oversold territory. Nonetheless, demand was not above common, indicating an absence of robust momentum for worth.

As such, key short-term assist ranges to look at have been $2500 and $2300 on the decrease aspect of worth motion. Conversely, if sentiment improved, $2.8k and $3k have been essential short-term bullish targets.