Ethereum whale sells 6,900 ETH – Is it time to worry now?

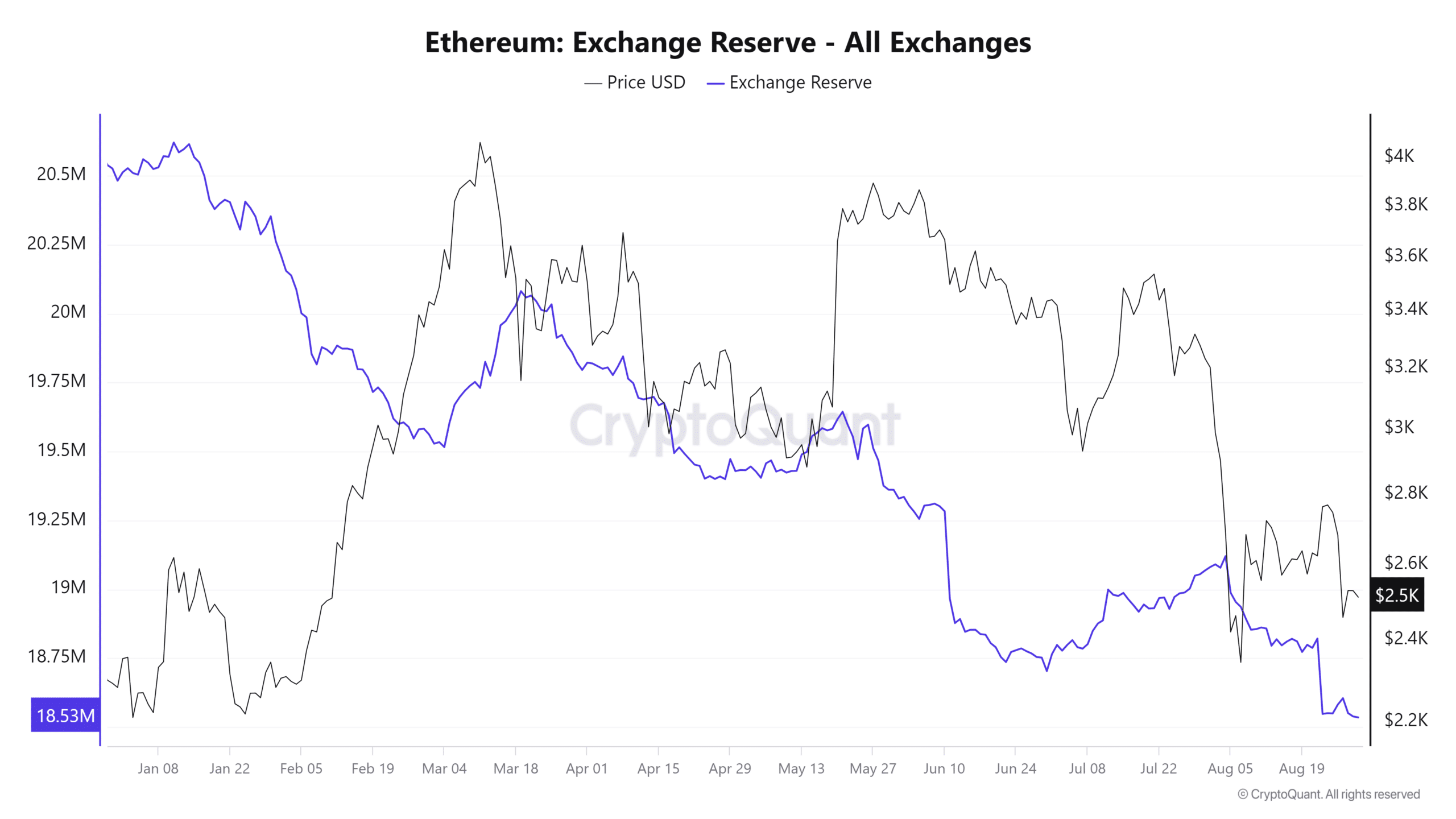

- ETH trade reserves declined to round 18.5 million ETH

- ETH, at press time, remained under key worth ranges

Ethereum has confronted resistance at key worth ranges over the previous few weeks. This has probably contributed to the choices made by some giant holders, or “whales,” to dump parts of their holdings. Regardless of this promoting exercise, nonetheless, the continued decline in ETH trade reserves has continued.

Ethereum faces sell-offs

Latest knowledge from Lookonchain revealed that an Ethereum whale offered 6,900 ETH, valued at roughly $17.87 million.

This marks a notable shift in conduct for the whale, who was beforehand in an accumulation section from January to Might. Throughout this time, the handle acquired 65,000 ETH price over $196 million. Nonetheless, beginning in July, the whale started promoting off its holdings, offloading over 21,000 ETH.

Regardless of this important sell-off, the netflow metric for Ethereum on CryptoQuant didn’t present a transparent dominance of inflows to exchanges. Dominance of inflows sometimes signifies a possible enhance in promoting strain. As a substitute, the netflow metric advised that inflows and outflows have been nearly balanced – An indication that there has not been a notable spike in both influx or outflow exercise.

This stability in netflows implies that whereas some giant holders, like this whale, are promoting, there have additionally been important withdrawals from exchanges. The dearth of a dominant circulate course factors to a comparatively secure market setting. One the place some members’ short-term promoting is countered by accumulation or holding by others.

Ethereum reserves proceed to say no

An evaluation of Ethereum’s trade reserves indicated that the latest sell-off had minimal impression on halting its total decline. Based on knowledge, after a short hike to roughly 18.6 million ETH on 27 August, the identical declined once more – Hitting 18.5 million ETH.

Supply: CryptoQuant

This sustained fall in trade reserves suggests {that a} important quantity of Ethereum remains to be being withdrawn from exchanges.

The persistence of declining trade reserves is mostly seen as a bullish signal. Particularly because it means that the provision of ETH out there for rapid buying and selling is shrinking. If demand stays secure or rises, this lowered provide might help increased costs or at the least stabilize the market.

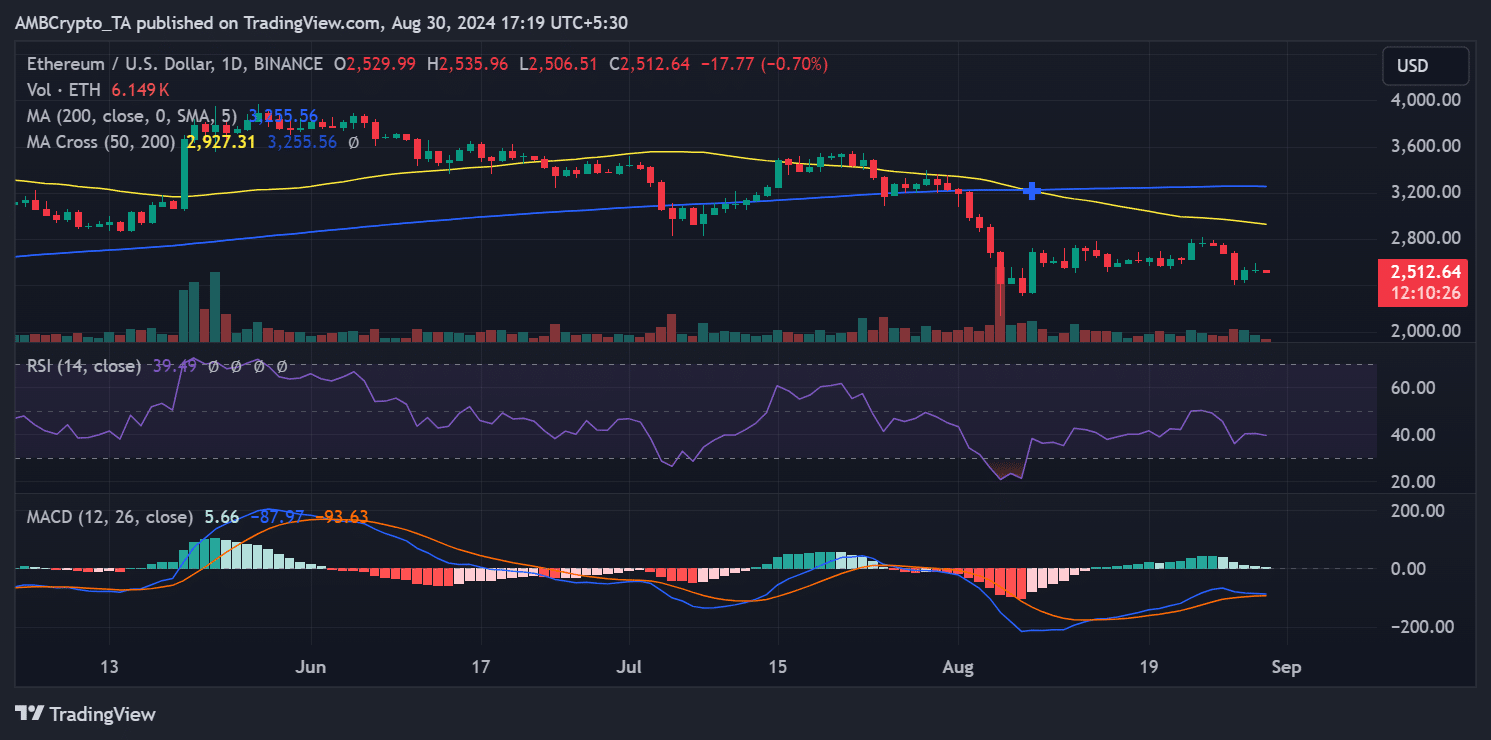

ETH stays bearish

On the time of writing, Ethereum was buying and selling at roughly $2,512, following an nearly 1% decline on the charts. Moreover, an evaluation of its Transferring Common Convergence Divergence (MACD) and Relative Power Index (RSI) revealed that Ethereum, at press time, was in a bearish pattern.

Supply: TradingView

– Learn Ethereum (ETH) Value Prediction 2024-25

The RSI was under 40 – An indication that the asset was in a powerful bearish section.

The MACD’s sign strains had been under zero, regardless of the histogram of the MACD being above zero. This may generally point out a possible shift in momentum. Nonetheless, the general place of the sign strains advised that the bears retained a point of management.