As Ethereum nears critical support level, THIS hints at potential reversal

- The ETH/USDT pair revealed a cumulative quantity delta divergence.

- Ethereum is more likely to bounce from essential help.

Ethereum[ETH], the second-largest cryptocurrency, has develop into the main target of consideration as merchants and buyers put together for This autumn 2024 amidst widespread market uncertainty.

Latest evaluation of the ETH/USDT pair revealed a cumulative quantity delta (CVD) divergence. As ETH costs make equal highs whereas CVD kinds decrease highs, this divergence suggests a possible reversal.

CVD divergence sometimes indicators weak shopping for stress, implying that Ethereum may see additional worth modifications.

Supply: Hyblock Capital

If the orderbook depth stays fixed, ETH would possibly create decrease highs, but when the depth will increase, increased costs are anticipated.

ETH/USDT at a key help

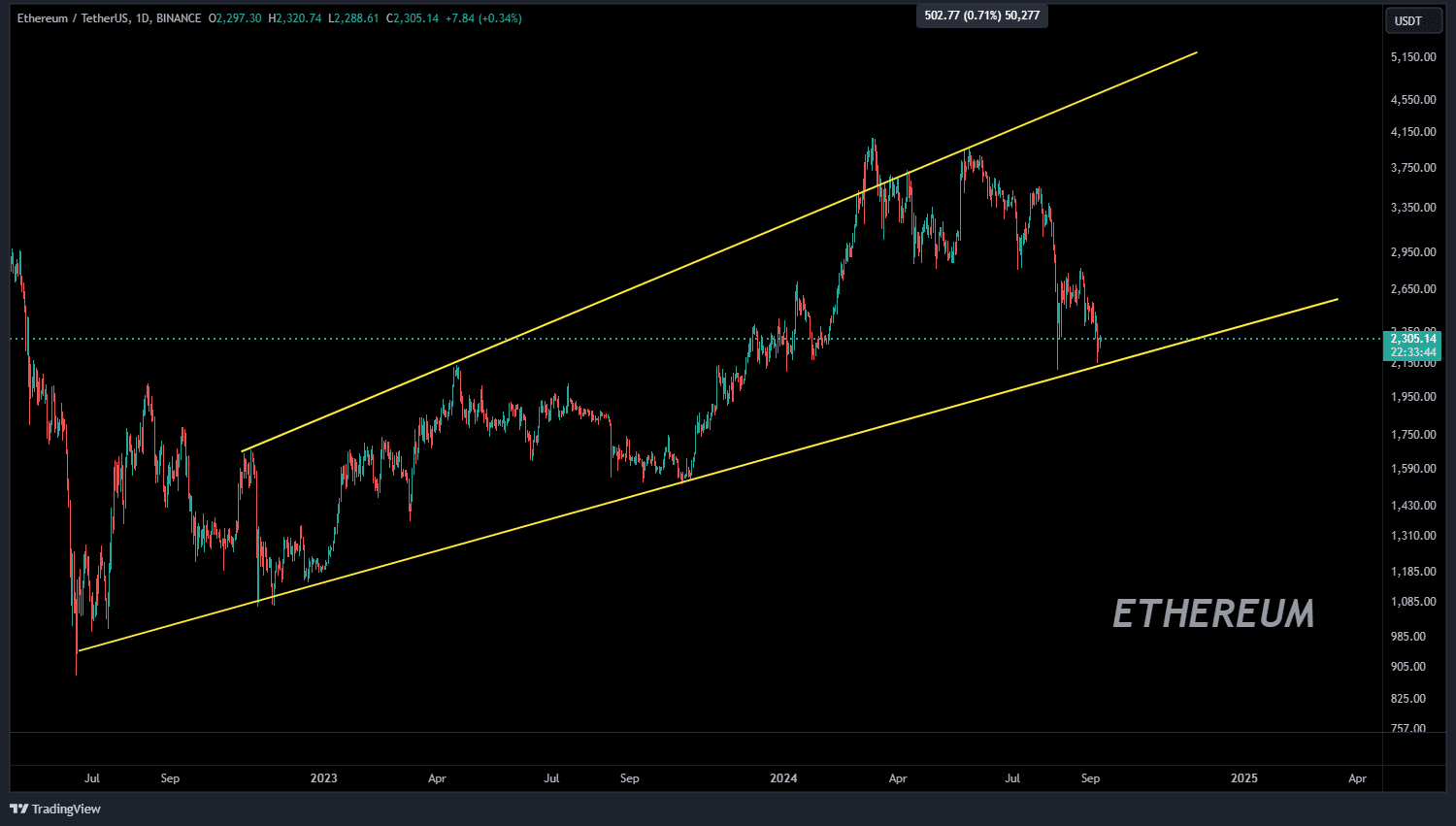

Analyzing Ethereum’s worth motion revealed that ETH/USDT was at an important help degree at press time, forming a broadening ascending wedge on increased timeframes.

A double backside sample might kind alongside the ascending trendline, doubtlessly signaling an upward transfer. Nonetheless, a break under this help degree may result in additional worth declines.

On the every day chart, ETH can be shaping a double backside on the $2,100 mark, a key level for potential restoration.

Supply: TradingView

A fee reduce may catalyze Ethereum’s bounce in This autumn, following the development of different cryptocurrencies lately.

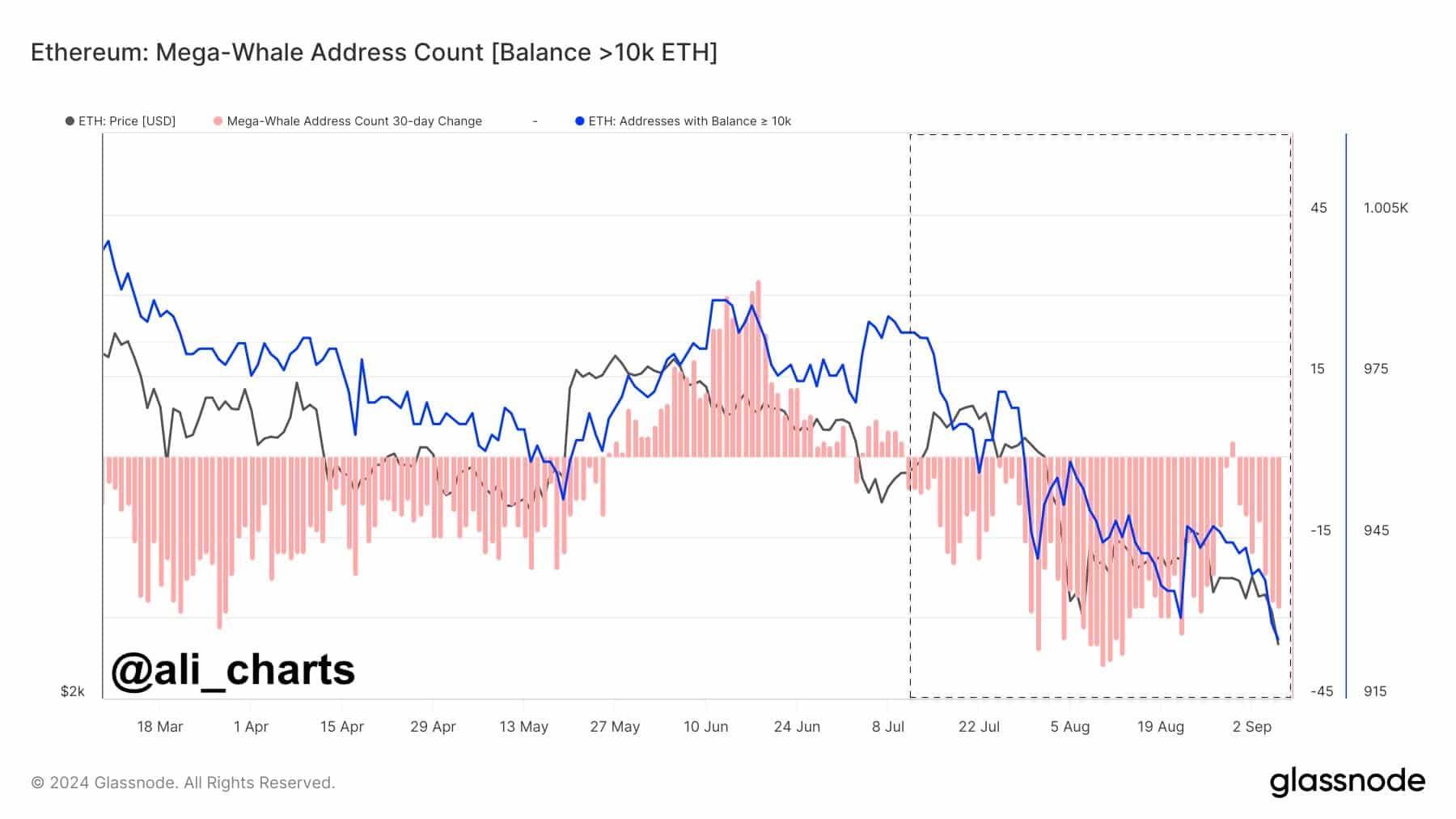

Mega whale handle rely

The mega whale handle rely, representing holders with over 10K ETH, has steadily declined, indicating weaker confidence from massive buyers.

Whales ceased accumulating ETH in early July, as an alternative they selected to promoting or redistributing their holdings.

Regardless of this, the CVD divergence means that the correction part is likely to be ending. Nonetheless, doubts stay because of the continued decline in mega whale addresses, which may hamper any vital worth reversal.

Supply: Glassnode

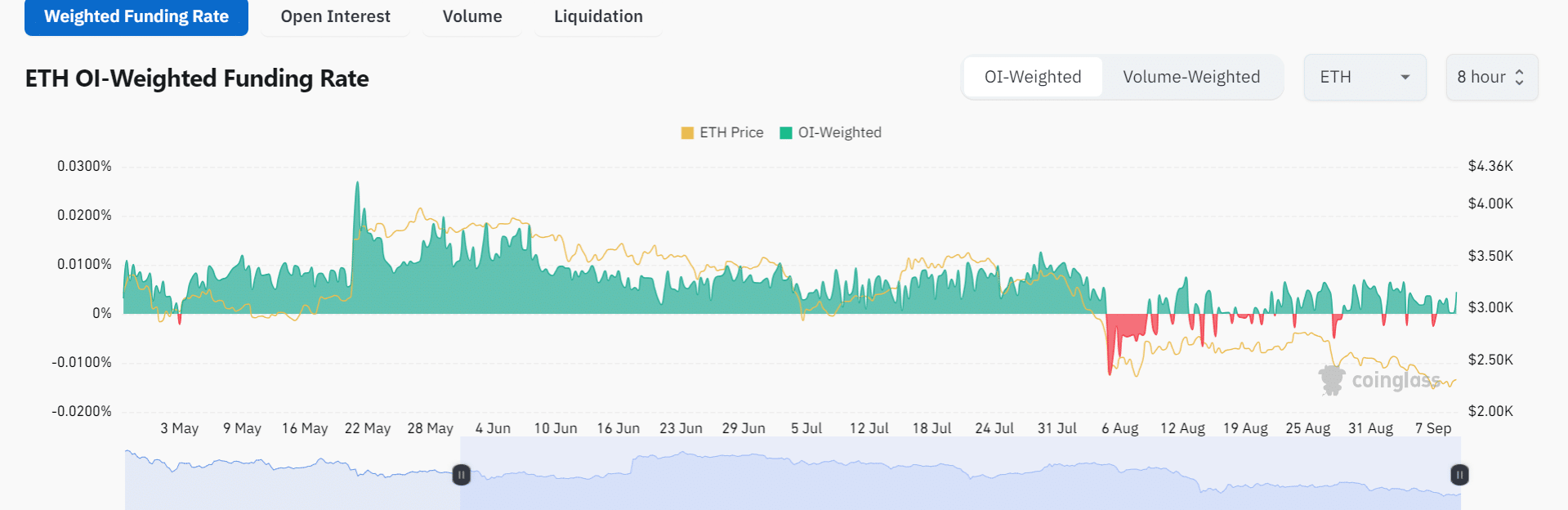

OI-Weighted Funding Charges

Open Curiosity-Weighted (OI-Weighted) Funding Charges for Ethereum, analyzed utilizing Coinglass, confirmed rising inexperienced numbers, a constructive signal for ETH.

Growing OI-Weighted Funding Charges sometimes point out rising dealer curiosity in Ethereum, implying a bullish outlook for the long run.

As merchants return to the market, ETH could also be poised for a worth rebound, significantly because it approaches a important zone that would dictate its subsequent transfer.

Supply: Coinglass

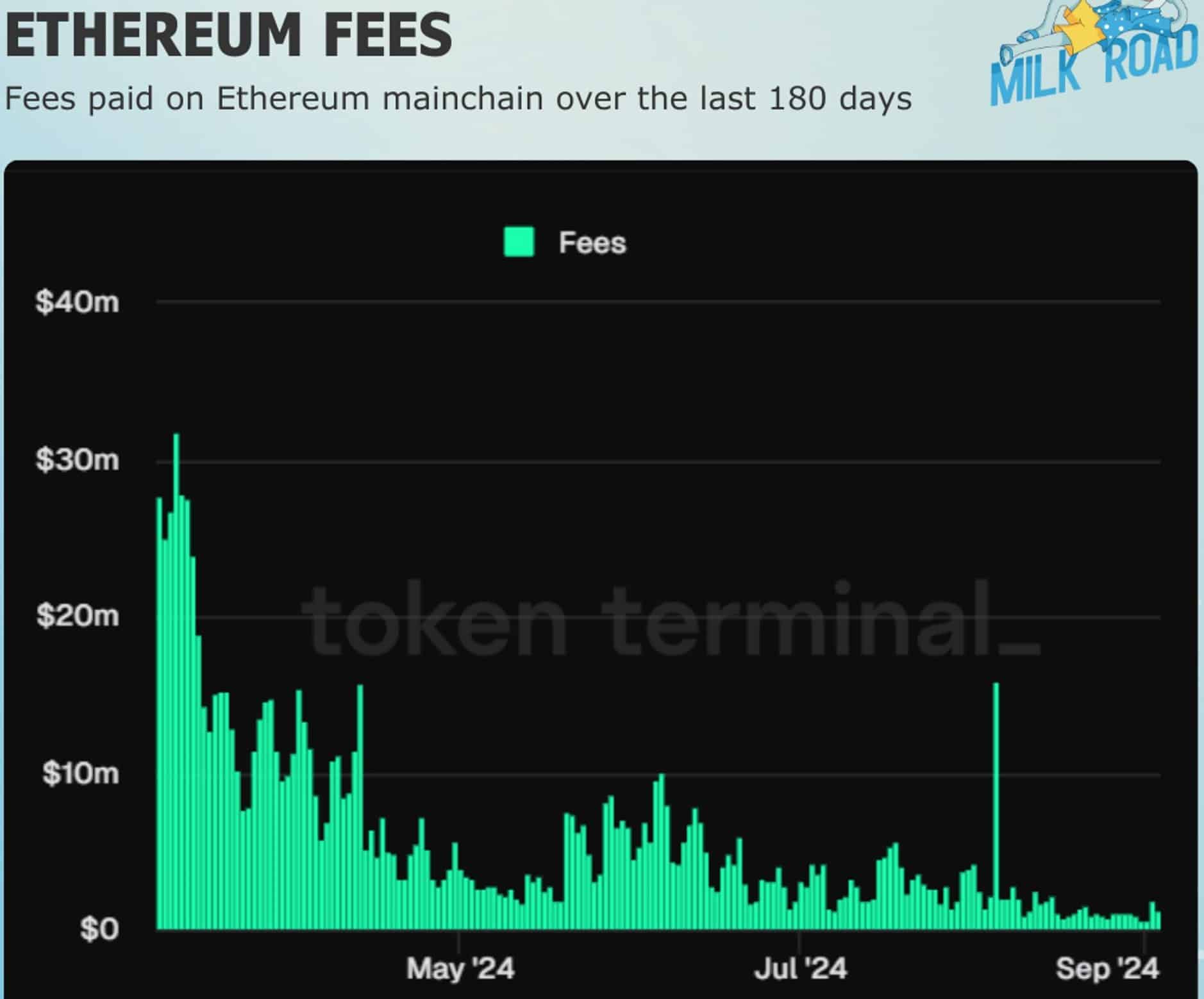

ETH charges on mainnet falling

Ethereum’s mainnet charges have considerably decreased, dropping over 30x previously six months. This has sparked considerations about Ethereum’s long-term viability, however these worries are unfounded.

ETH collects a portion of charges from its Layer 2 options, which boosts its total community exercise. Decrease mainnet charges profit merchants who beforehand prevented ETH attributable to excessive prices.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

This modification may appeal to extra exercise, particularly within the memecoin area, a rising sector.

Supply: Token Terminal

The launch of Ethervista, akin to Solana’s Pump.Enjoyable, can even play a pivotal function in ETH’s worth motion by boosting liquidity for ETH-based memecoins, positioning Ethereum for potential progress in This autumn 2024.