Crypto week ahead for Bitcoin, Ethereum: How market sentiment can challenge shorts

- Crypto market has reclaimed the $2 trillion mark

- BTC and ETH nonetheless maintain over 60% of the market

The crypto market declined considerably over the previous week, with the overall market capitalization dropping under the $2 trillion mark. This decline was accompanied by a surge in lengthy liquidation volumes as costs fell throughout main cryptocurrencies.

Nevertheless, the market is now displaying indicators of a reversal. And, the outlook for the crypto week forward seems constructive, in comparison with the earlier week.

Crypto week forward: Market capitalization

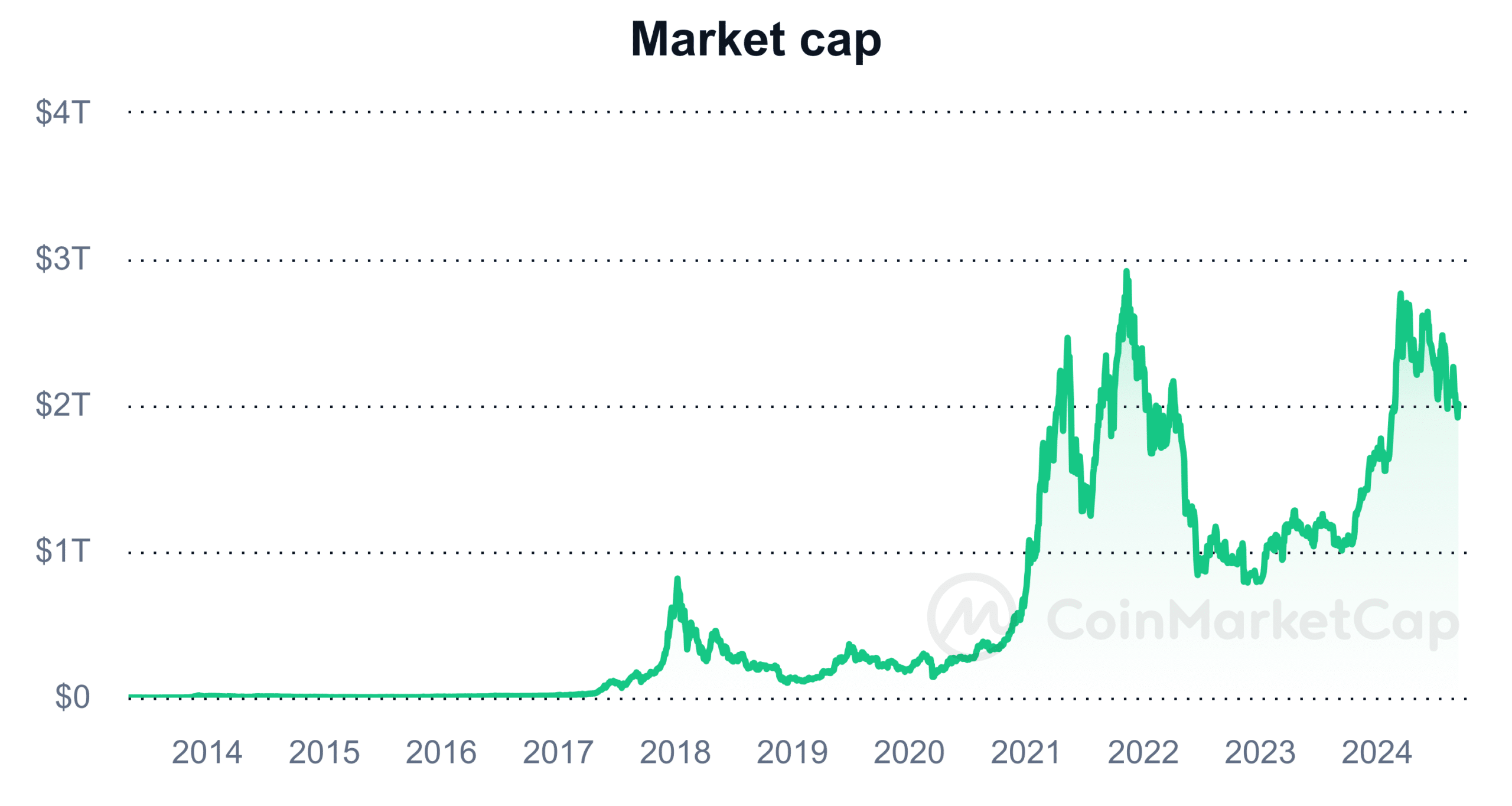

An evaluation of the crypto market capitalization on CoinMarketCap revealed that the market has had bouts of depreciation in latest weeks. Essentially the most important drop occurred final week, bringing the overall market capitalization all the way down to round $1.9 trillion.

The worth drops in main property like Bitcoin and Ethereum primarily drove this decline.

Supply: CoinMarketCap

Nevertheless, it has rebounded over the previous three days, hitting the $2 trillion threshold once more. Together with this restoration, main cryptocurrencies have proven constructive uptrends, suggesting the market may see additional positive aspects within the week forward.

If this pattern holds, it may start a extra constructive section for the crypto market.

Crypto week forward: Market liquidations

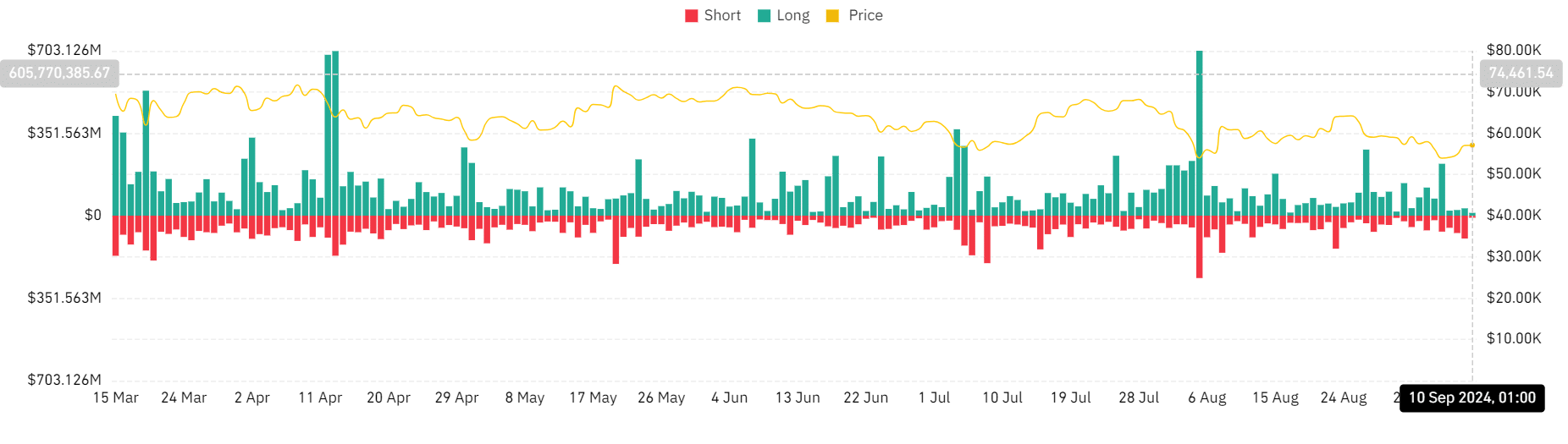

An evaluation of the overall liquidations chart on Coinglass revealed that the market noticed a surge in liquidations over the previous week, with lengthy liquidation volumes dominating. This confirmed the noticed market capitalization decline. The info additionally underlined that lengthy liquidations totalled over $520 million, whereas brief liquidations amounted to round $223 million.

Nevertheless, because the market started to recuperate, the quantity of lengthy liquidations fell and brief liquidations noticed an uptick. This shift suggests the market could also be regaining upward momentum and brief positions could also be more and more in danger.

Supply: Coinglass

If this pattern continues, the week forward will likely be difficult for brief positions. Particularly as rising asset costs could result in extra brief liquidations. With the market displaying indicators of restoration, merchants holding brief positions could face rising strain as bullish sentiment returns.

Bitcoin and Ethereum leads market dominance

An evaluation of the final seven days confirmed that Bitcoin (BTC) has misplaced over 3% of its worth whereas Ethereum (ETH) famous a steeper decline of over 6%. Regardless of these declines, nevertheless, each property proceed to dominate the cryptocurrency market.

Bitcoin’s market capitalization, at press time, was round $1.13 trillion, representing 56.5% of the overall crypto market. Ethereum’s market capitalization stood at $282.9 billion, with a dominance of 14.6%.

These two property stay probably the most influential within the cryptocurrency area, and their worth actions will considerably affect the general market trajectory of the crypto week forward.