Ethereum options spike: ETH to surge to $3K by December?

- ETH confirmed renewed curiosity throughout the choices market.

- Regardless of short-term challenges, it advised a bullish outlook for ETH in This autumn.

Ethereum [ETH] has lagged behind its main friends, equivalent to Bitcoin [BTC] and Solana [SOL], regardless of US spot ETF approval in Q2. Nevertheless, on Friday, the thirteenth of September, there was sturdy renewed curiosity within the largest altcoin.

In line with the Singapore-based crypto buying and selling agency QCP Capital, ETH choices spiked with a lot curiosity in contracts concentrating on $3k by the year-end. A part of the agency’s weekend word read,

“The choices market witnessed renewed curiosity in ETH, with over 20k contracts concentrating on the $3k degree by December 27. The year-end outlook for ETH could possibly be shaping as much as be important.”

ETH’s bullish revival

For context, choices information and quantity are forward-looking indicators that provide future worth expectations and total market sentiment.

So, the above surge within the choices market, together with Open Curiosity (OI) charges, indicated bullish expectations and potential worth appreciation in This autumn.

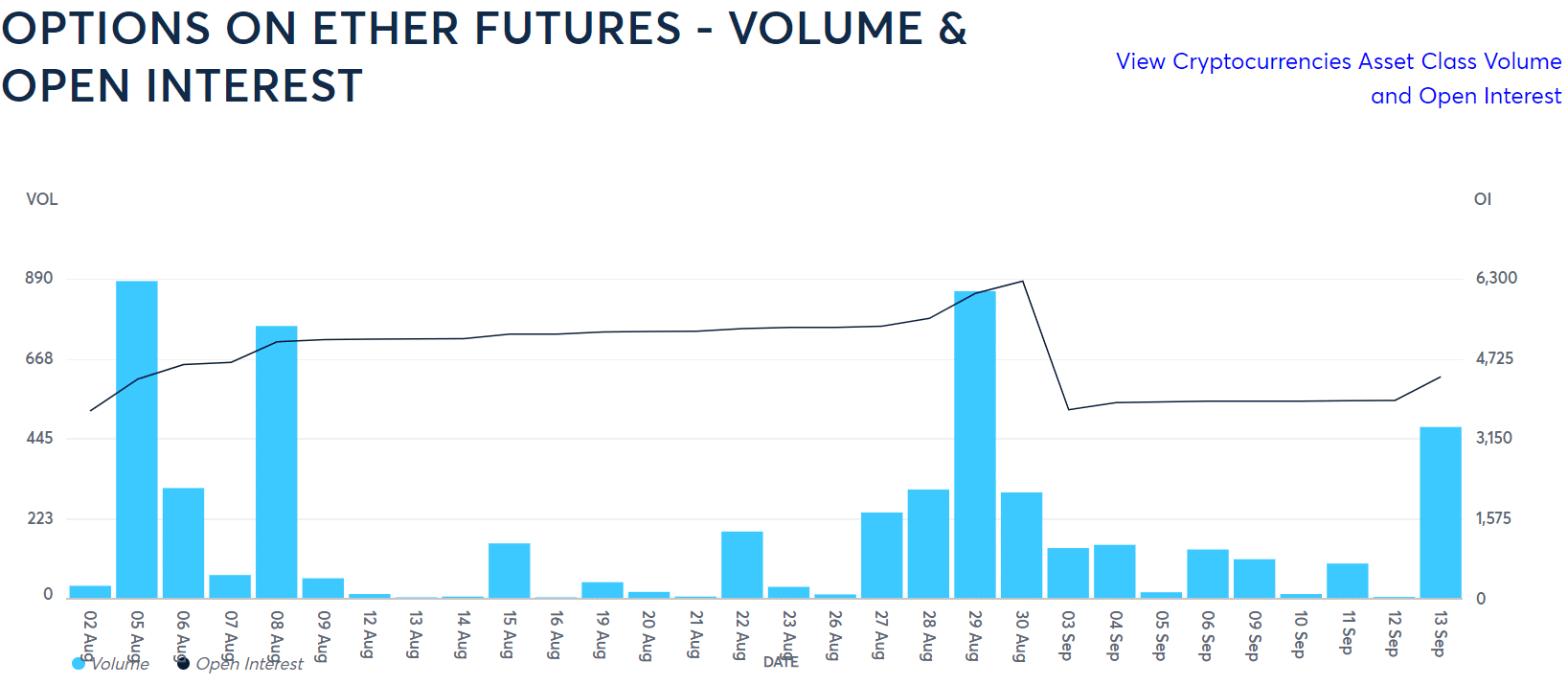

The Chicago Mercantile Trade (CME) data confirmed QCP Capital’s outlook.

On the thirteenth of September, ETH recorded a pointy uptick in quantity and OI for the primary time this month. The OI surged to $3.1 billion whereas quantity hiked practically to $700 million, reinforcing institutional curiosity within the altcoin.

Supply: CME

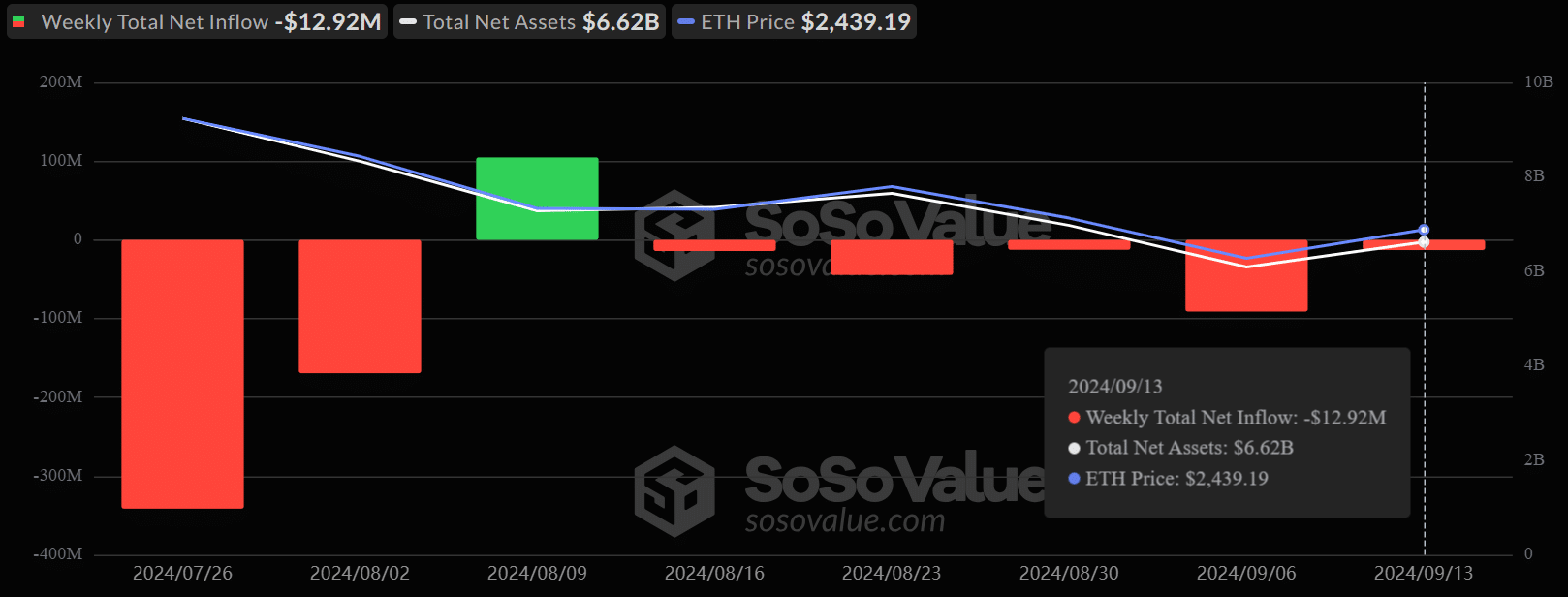

Regardless of the elevated choices exercise, the spot market noticed minimal demand from US ETH ETFs on Friday.

The merchandise noticed a cumulative $1.5 million in every day influx, however it was web damaging on the weekly depend. They bled $12.92 million final week, a pattern that was but to be reversed to strengthen sturdy investor confidence.

Supply: Soso Worth

Nevertheless, Coinbase analyst David Duong blamed ETH’s muted worth efficiency on the present market construction. Duong famous that crypto traders have been tied to different altcoin positions, limiting capital circulation to ETH.

One other potential short-term problem to ETH’s worth was a spike in change reserves. About 100k tokens moved to exchanges forward of the Fed fee resolution on the 18th of September.

Within the meantime, ETH was valued at $2.4k at press time, up 5% previously seven days of buying and selling.