Ethereum repeats 2021 pattern – What this means for ETH

- The triple backside sample steered a possible breakout as ETH eyed the $3,500 resistance.

- Trade outflows and RSI ranges pointed to a attainable bullish transfer, however community development remained flat.

Ethereum [ETH] is poised for a major breakout as merchants noticed a triple backside sample forming in 2024, paying homage to its 2021 rally.

With ETH buying and selling at $2,314, up 0.31% within the final 24 hours at press time, this setup has sparked optimism that This fall may ship substantial good points.

Can the triple backside drive a bullish reversal?

The triple backside is a widely known sample, typically indicating a bullish reversal. In 2021, Ethereum adopted an analogous construction earlier than launching into a large rally.

If Ethereum maintains this trajectory, a breakout above $3,500 can additional gasoline investor confidence.

To substantiate bullish momentum, Ethereum should break by important resistance ranges. The $2,800 mark is the primary main hurdle, and surpassing it may set the stage for a take a look at of $3,500.

Supply: X

What about ETH’s energy?

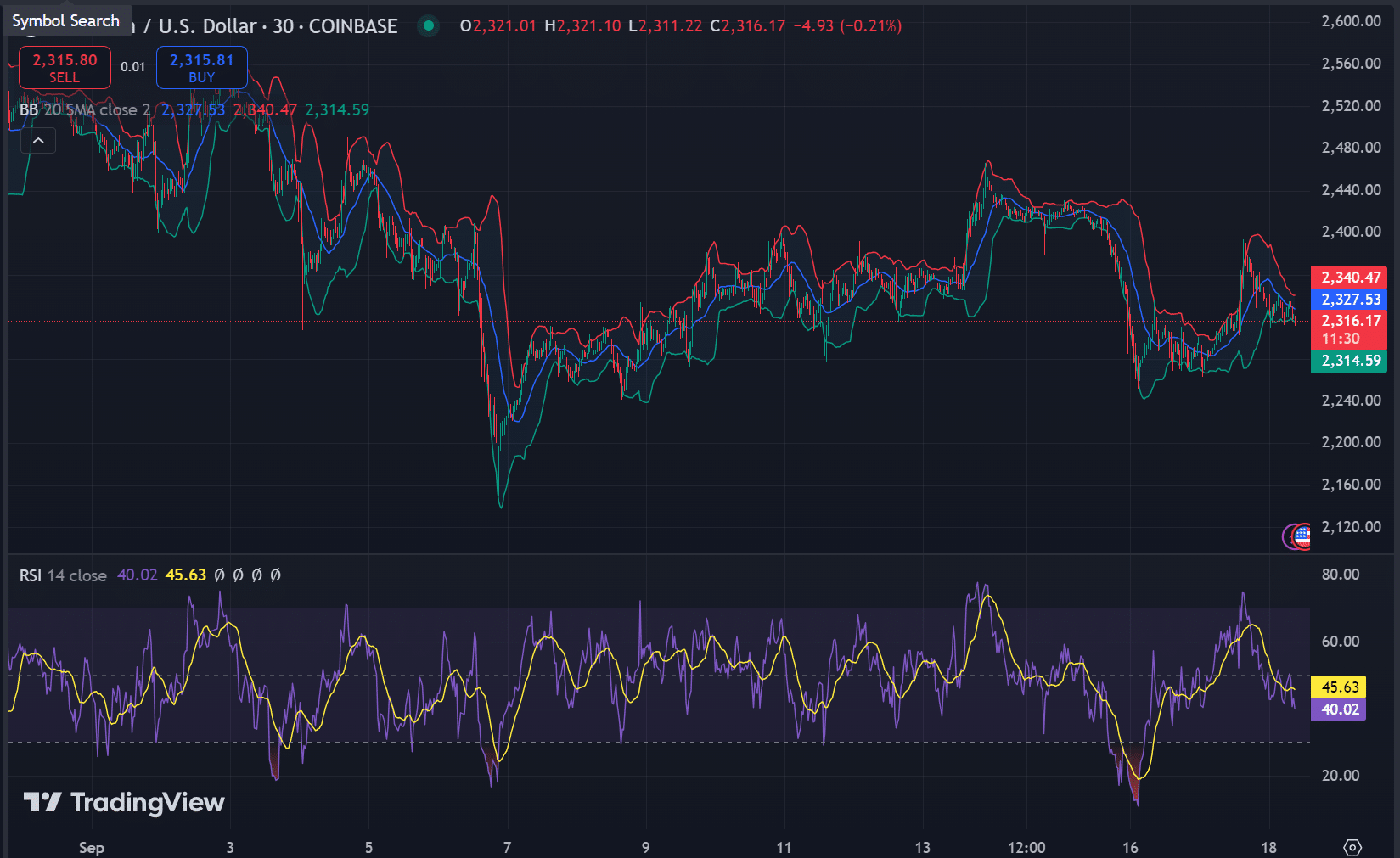

Technical indicators confirmed a promising outlook for Ethereum. The Relative Energy Index (RSI) was 45.63 at press time, signaling that ETH is neither overbought nor oversold.

The Bollinger Bands (BB) indicated that ETH was buying and selling in a decent vary, with potential volatility on the horizon.

A breakout above the higher band may set off a powerful rally, making these indicators essential to observe within the coming days.

Supply: TradingView

Are alternate flows pointing to a rally?

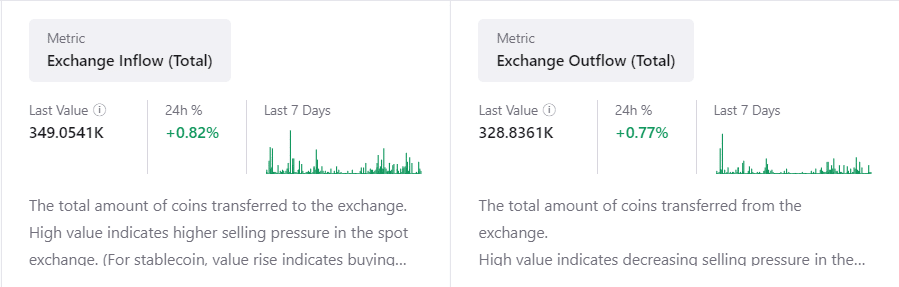

Trade circulate knowledge confirmed combined indicators however lent towards a possible bullish transfer at press time.

Trade inflows have elevated by 0.82% in 24 hours, reaching 349.05K ETH at press time, signaling some promoting stress as merchants transfer cash onto exchanges.

Nevertheless, alternate outflows have risen by 0.77% in 24 hours to 328.83K ETH at press time, displaying that many traders have been nonetheless holding their cash off exchanges.

If outflows continued to rise, it may point out lowered promote stress and rising confidence in ETH’s upward potential.

Supply: CryptoQuant

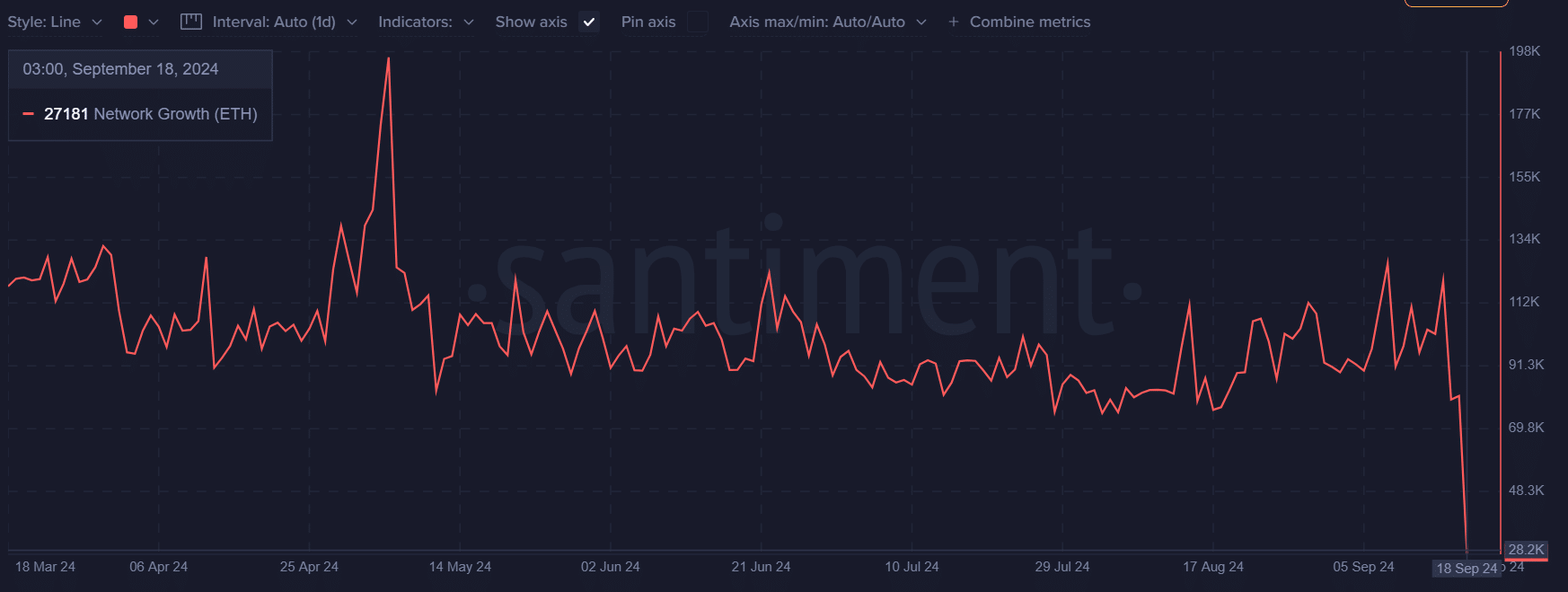

Community development: Is Ethereum increasing?

Ethereum’s community development remained comparatively sluggish, with 27,181 new addresses added not too long ago and a 0.24% development fee during the last 24 hours till press time.

The impartial sign steered that whereas Ethereum’s community is secure, it isn’t seeing a surge in new person exercise.

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Will This fall ship the breakout?

Ethereum stands at a pivotal second. Whereas technical patterns just like the triple backside, RSI, and Bollinger Bands point out a possible breakout, the community development and combined alternate flows recommend some warning.

With volatility anticipated, This fall will possible decide whether or not Ethereum can break by key resistance ranges and recapture the bullish momentum that drove its 2021 rally.