Are The Big Players Losing Interest?

Este artículo también está disponible en español.

Ethereum (ETH) holders seem like adopting various methods amid ongoing market uncertainty, newest data from CryptoQuant reveals.

Significantly, in keeping with a latest evaluation by a CryptoQuant analyst underneath the pseudonym ‘Darkfost,’ a noticeable shift in ETH’s investor behaviour is going down.

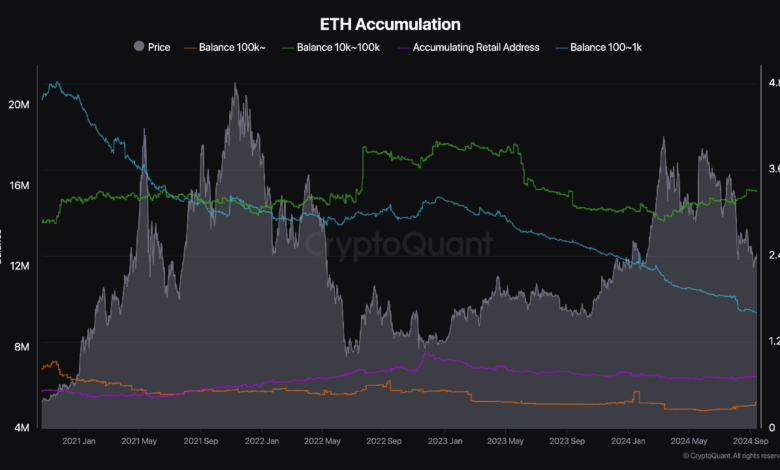

To this point, bigger holders of Ethereum and smaller retail traders are exhibiting indicators of inactivity, whereas mid-sized holders present a measured improve of their holdings.

This divergence in methods amongst these market contributors might present perception into Ethereum’s market sentiment, particularly because it faces a decline in dominance, Darkfost revealed.

Associated Studying

Detailing The Holders Divergence

Darkfost factors out that Ethereum addresses holding greater than 100,000 ETH have been largely inactive. This pattern can also be seen amongst retail addresses, which generally accumulate smaller quantities of ETH.

In distinction, addresses holding between 10,000 and 100,000 ETH are slowly shopping for extra Ethereum. On the similar time, addresses holding between 100 and 1,000 ETH proceed to unload their holdings steadily.

This various conduct amongst completely different investor segments suggests a posh market outlook for Ethereum. The inactivity of huge holders, these with balances exceeding 100,000 ETH, is notable, given their potential affect available on the market.

Often, massive holders embrace institutional traders, exchanges, and main entities that may considerably affect market traits.

Their present reluctance to interact in both shopping for or promoting suggests uncertainty about Ethereum’s near-term prospects. This hesitation may mirror broader market elements, such because the upcoming US Fed fee cuts or the general efficiency of the crypto market.

Notably, with the US fed fee reduce approaching, massive Ethereum holders is likely to be sitting on their palms to see how the market will play out earlier than they put their ft again out there.

However, mid-sized traders, particularly these with 10,000 to 100,000 ETH, are regularly accumulating Ethereum. This gradual however regular shopping for signifies a cautious optimism amongst this group of traders.

These mid-sized holders typically symbolize smaller establishments, crypto funds, or high-net-worth people who could also be trying to capitalize on potential value beneficial properties with out considerably impacting the market.

Their gradual accumulation may sign a perception in Ethereum’s long-term potential, even when rapid beneficial properties seem unsure.

Associated Studying

Ethereum Present Market Efficiency

Following an preliminary rally rising by practically 5% yesterday, Ethereum has now seen a noticeable pullback in value, dropping under $2,400 as soon as once more. At the moment, the asset trades at a value of $2,299, on the time of writing down by 2.1% over the previous day alone.

Apparently, regardless of the noticeable decline, ETH’s day by day buying and selling quantity stays intact, at roughly above $14 billion from yesterday till now.

Featured picture created with DALL-E, Chart from TradingView