Ethereum: Liquidation levels indicate move toward $2.8k resistance

- Ethereum regained a bullish construction however the downtrend was nonetheless in play.

- The previous help zone at $2.9k might be the subsequent worth goal.

Ethereum [ETH] has not been in a position to match the efficiency of Bitcoin [BTC]. This was mirrored within the ETH/BTC chart, which might be forming an area backside. In comparison with the US greenback, the token is predicted to carry out significantly better within the coming days.

The liquidation ranges and the worth motion charts gave clues {that a} 5% transfer northward is probably going, however any positive aspects past that would want a significant intrusion from patrons.

Ethereum approaches an area excessive and pivotal resistance zone

Supply: ETH/USDT on TradingView

The market construction on the every day timeframe was bullish after the worth beat the newest decrease excessive at $2,464. The RSI was additionally above impartial 50 to point the momentum has modified path.

Nevertheless, this doesn’t imply the pattern is bullish- the pattern has been bearish since June, after the tried restoration failed in Might. The OBV agrees with this assertion and has been trending downward since March to indicate weak shopping for strain for essentially the most half.

There was a bearish order block on the $2.8k stage. The market construction had flipped bearishly from this native excessive in mid-August, marking it as a robust provide zone.

Ethereum will possible go to this resistance, however a breakout relies on market-wide sentiment and information developments.

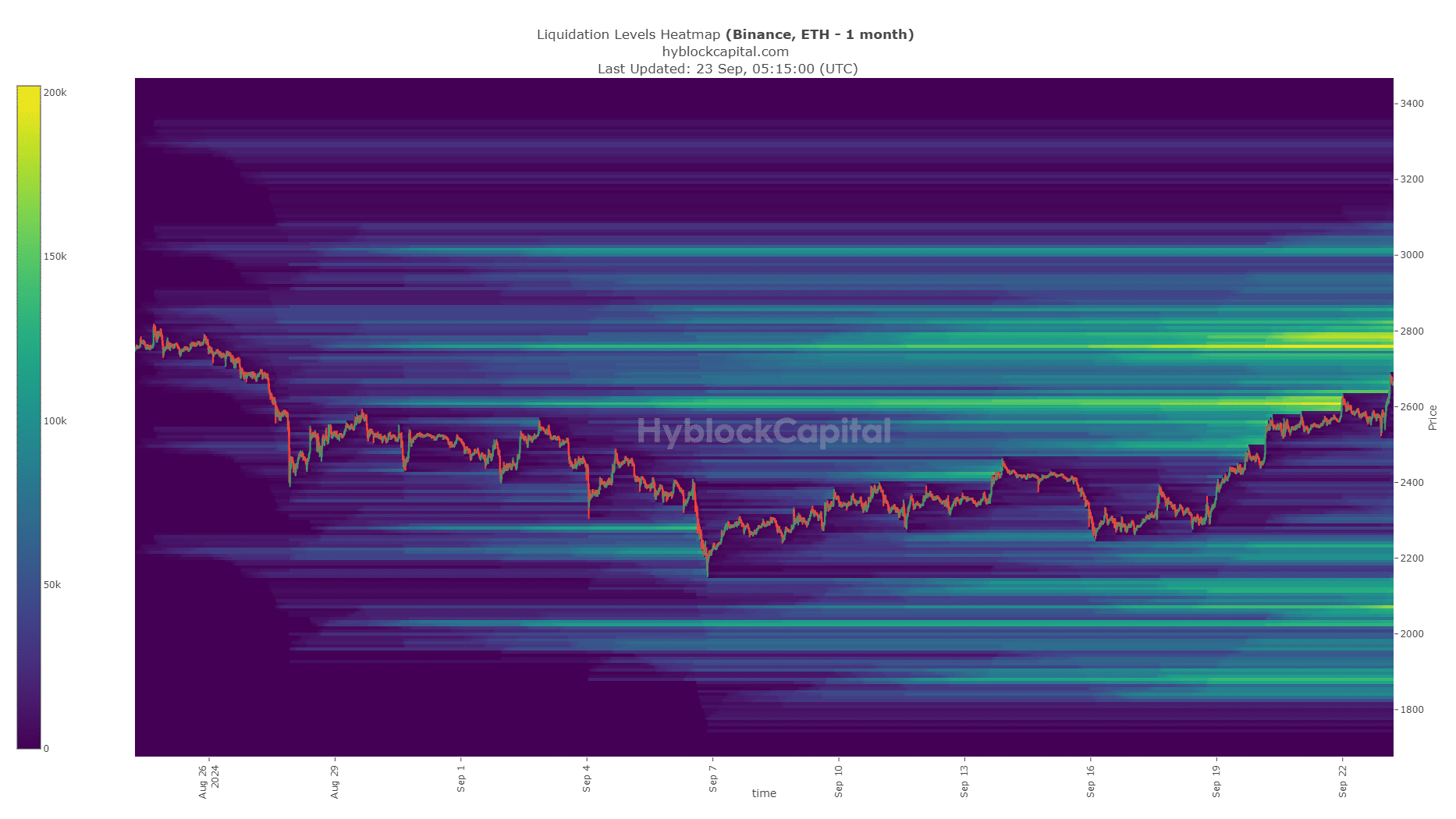

One other piece of proof for the $2,800 goal

Supply: Hyblock

The $2.8k area has a big cluster of liquidation ranges, highlighting it as a key magnetic zone within the quick time period. Due to this fact, on this week of buying and selling, it’s anticipated that Ethereum will sweep this area earlier than a possible reversal.

A reversal is anticipated solely as a result of the $2.8k-$3k area has been a major help/resistance zone since April. It’s prone to have many sellers, however bulls might overpower them, particularly if Bitcoin continues to rally larger.

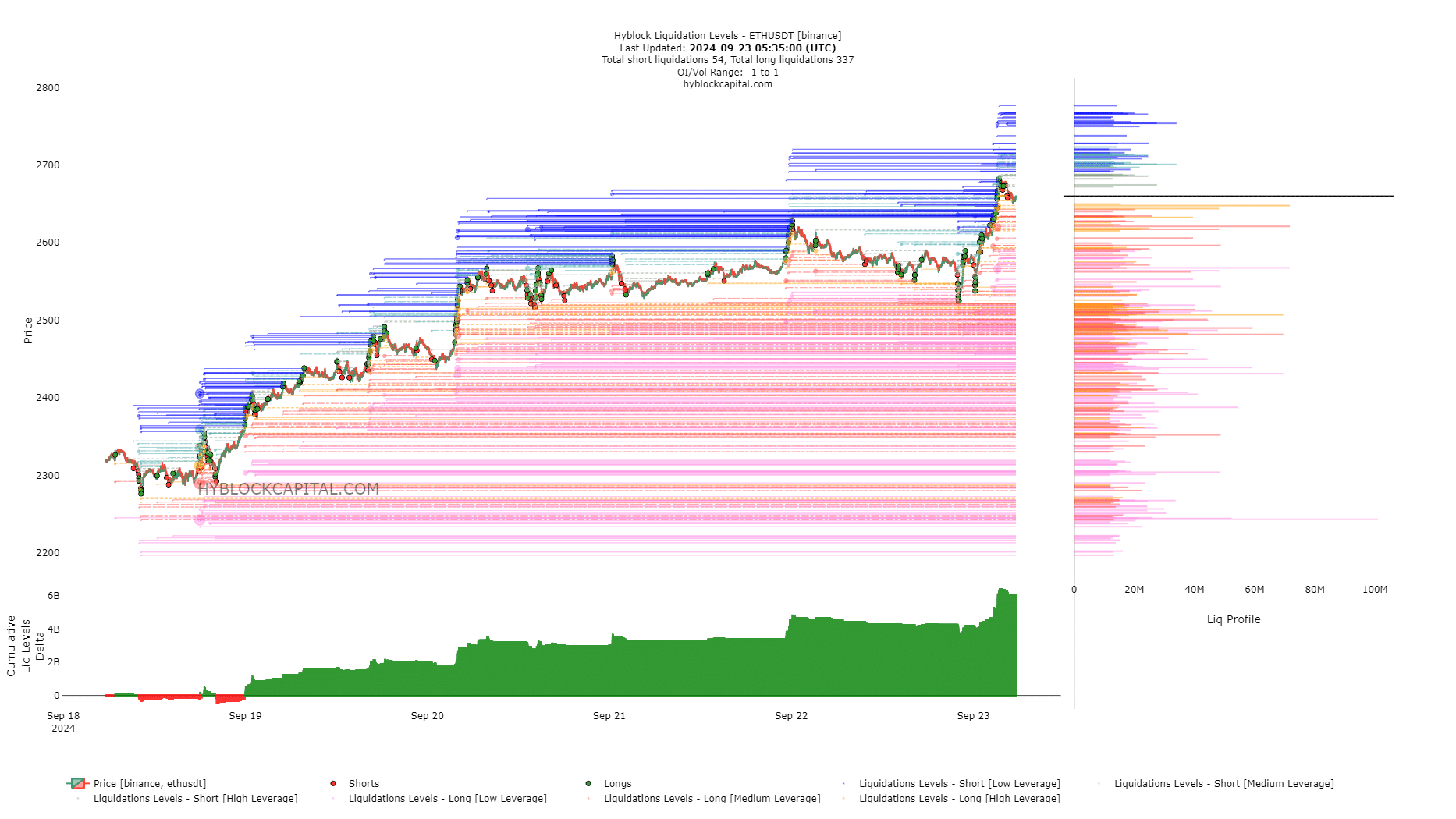

Supply: Hyblock

Within the quick time period, there have been high-leverage lengthy positions on the $2,647 and $2,621 ranges that might be focused in a liquidity hunt.

Learn Ethereum’s [ETH] Value Prediction 2024-25

The constructive cumulative liq ranges delta instructed a near-term worth retracement was potential.

The following week or two is predicted to be bullish for Ethereum. A transfer towards $2.8k-$2.9k is probably going. Additional positive aspects would depend upon market sentiment and the energy of the patrons which will probably be on show within the buying and selling quantity.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion