Ethereum long traders trapped: Will ETH decline in Q4 as well?

- Ethereum merchants trapped in longs as market declines.

- Ethereum reveals energy in income and TVL dominance.

Ethereum [ETH] continues to play a serious position within the cryptocurrency market, and as we enter the final quarter of the 12 months, a number of key components are anticipated to affect its worth motion.

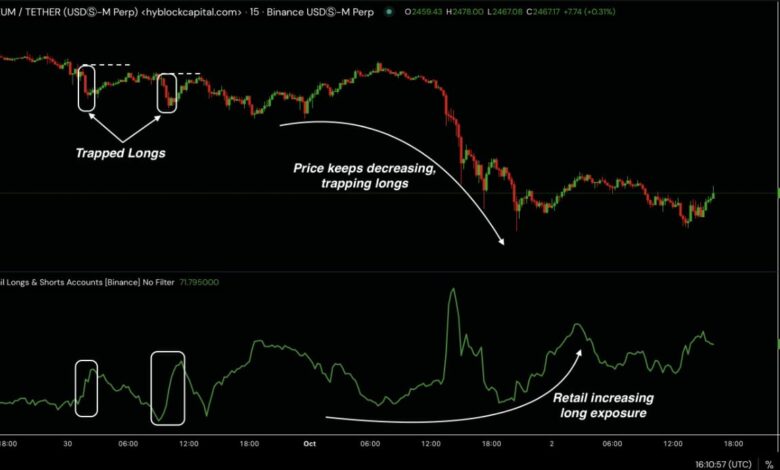

Towards the tip of September, retail merchants elevated their publicity to Ethereum, making an attempt to capitalize on worth dips. Nonetheless, this led to many being trapped in shedding positions as ETH continued to say no.

With comparable patterns reappearing, merchants are cautious about whether or not ETH will proceed to fall within the last months of the 12 months.

Supply: Hyblock Capital

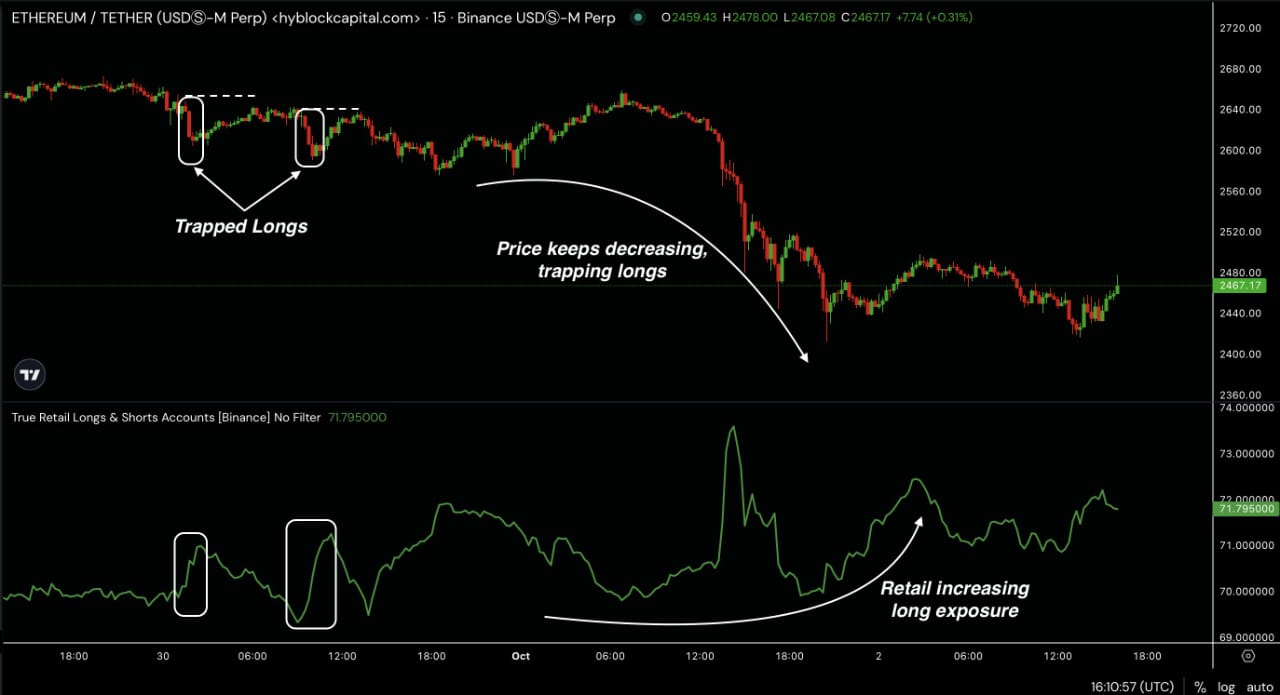

ETH worth motion indicators bearishness

Ethereum’s latest worth motion, it appears probably that the ETH/USD pair may proceed to say no. On the each day chart, ETH is buying and selling beneath the 150, 50, and 20 exponential transferring averages (EMAs), signaling a bearish development.

That is additional confirmed by the S&P 500 (SPX) index, which has additionally flipped beneath the 150 EMA, including extra weight to the destructive outlook.

Moreover, quantity bars present that sellers stay in management, reinforcing the concept that ETH may disappoint merchants by persevering with to drop.

Supply: TradingView

Impression of ICOs and Grayscale on ETH

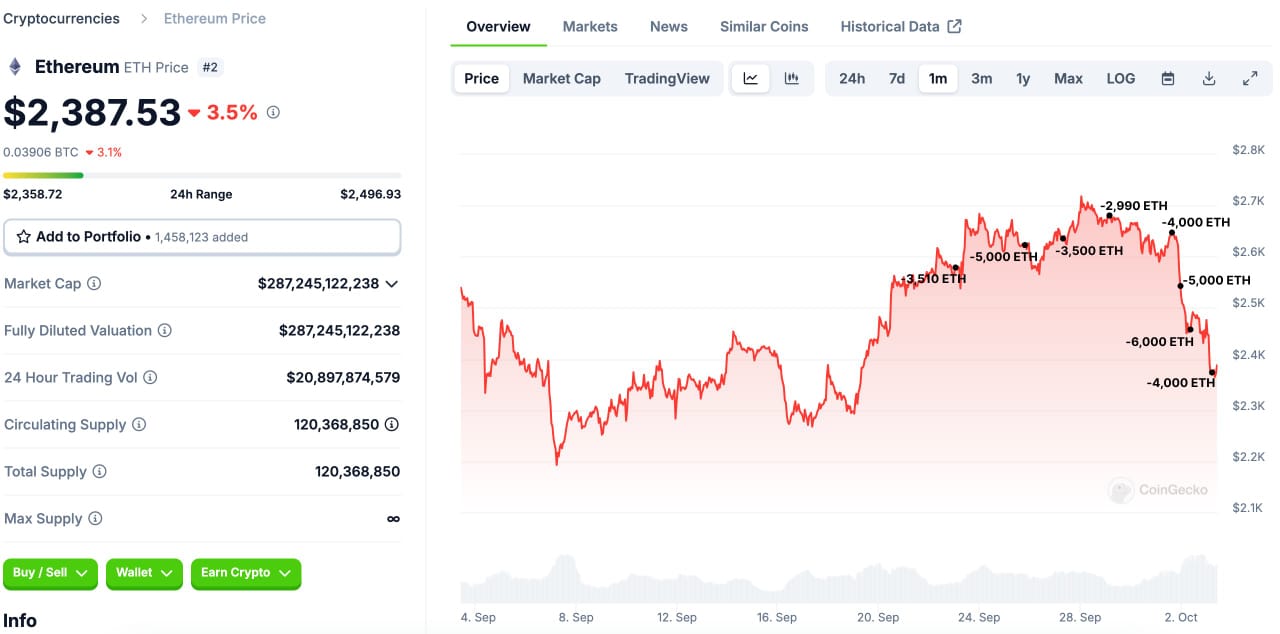

On-chain knowledge provides to the bearish sentiment, notably regarding preliminary coin choices (ICOs) and Grayscale’s exercise. A major Ethereum ICO participant just lately bought 19,000 ETH, value round $47.54 million.

This participant initially obtained 150,000 ETH through the ICO, with a purchase order worth of $46,500, now valued at $358 million.

The truth that early Ethereum whales are promoting off their holdings contributes to the downward stress, particularly since ETH was bearish throughout your entire fourth quarter after a inexperienced September in previous years.

Supply: Lookonchain

As well as, two dormant Grayscale ETF wallets have deposited 5837 ETH, value $14.17 million, into Coinbase in keeping with Onchain Lens.

These wallets had beforehand held 23026 ETH, bought at a mean worth of $1,593 a 12 months in the past.

The motion of those funds, coupled with the wallets nonetheless holding 17,189 ETH, additional signifies that enormous buyers are making strikes that might impression ETH’s worth.

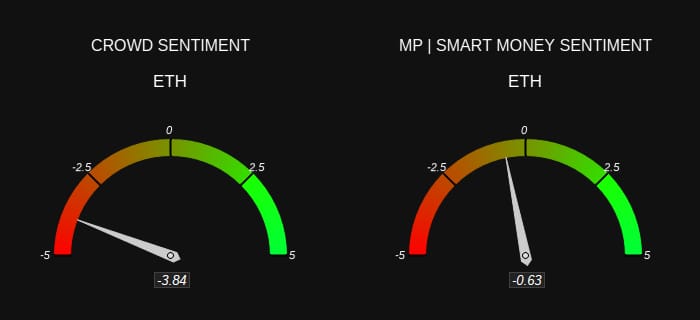

Sentiment amongst merchants

Each retail merchants and bigger buyers appear to share a bearish sentiment relating to Ethereum’s worth. This shift occurred after latest geopolitical occasions precipitated a downturn within the broader crypto market.

Because of this, ETH is anticipated to face extra promoting stress, which may result in additional worth declines within the fourth quarter.

Supply: Market Prophit

Ethereum’s income energy and TVL dominance

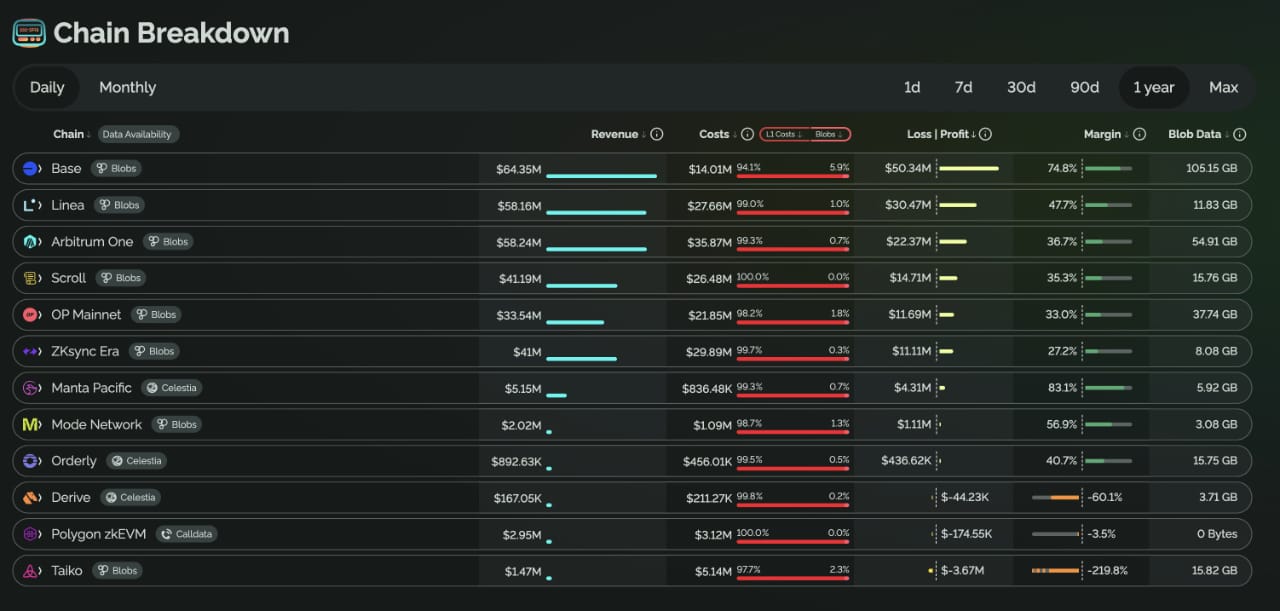

Regardless of the bearish outlook, Ethereum has proven resilience in different areas. The platform has generated over $140 million in gross income throughout 9 completely different chains over the previous 12 months.

As a federated community of economies with ETH as its forex, Ethereum stays a “land of alternative,” which may finally reverse the destructive development.

Furthermore, Ethereum continues to dominate in whole worth locked (TVL) in comparison with different Layer 1 blockchains. Its market cap of $48.7 billion far exceeds rivals like Solana ($5.4 billion) and Sui ($984 million).

Supply: X

This energy in TVL dominance reveals that ETH remains to be main the market, regardless of the bearish indicators and challenges posed by newer blockchains.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Whereas Ethereum faces bearish sentiment within the quick time period, its robust fundamentals and market place might enable it to bounce again in the long term.

Nonetheless, merchants ought to stay cautious as market dynamics proceed to evolve.