ETH must hold $2264 support level to continue the bullish scenario

- ETH has surged by 4.36% over the previous month.

- Ethereum was experiencing an upward momentum, signaling extra features if $2264 assist holds.

Since hitting a neighborhood low of $2309, Ethereum [ETH] has seen a robust upward momentum. Thus, the current features have outweighed the losses to show October inexperienced.

The truth is, on the time of writing, Ethereum was buying and selling at $2525. This marked a 2.44% improve over the previous day. Equally, ETH has surged by 4.36% on month-to-month charts with an extension to the bullish development by a 1.53% rise on weekly charts.

Trying additional, the altcoin has seen a surge in buying and selling actions. As such, its buying and selling quantity has elevated by 35.51% to $12.43 billion.

As anticipated, these market circumstances have left crypto analysts speaking concerning the altcoin’s trajectory. Considered one of them is the favored crypto analyst Man of Bitcoin who has prompt that the present bullish situation is legitimate if ETH holds above $2264.

Market sentiment

Within the evaluation, Man of Bitcoin posited that ETH is transferring sideways, implying it’s in a consolidation vary.

Supply: X

In response to him, the present actions on worth charts present weak point thus indicating a possible draw back.

Subsequently, the analysts argue that the bullish situation recognized is simply legitimate so long as ETH trades above $2264.

With the altcoin holding this stage, utilizing the Elliot wave evaluation, the potential subsequent transfer is Wave -C of iii at $3096. This means that the worth vary is inside the third wave which is strongest and has the potential for additional features.

Nonetheless, if the altcoin fails to carry this stage and experiences a breakdown, it’s going to indicate that Wave -iv is transferring to the draw back.

What ETH charts say..

Undoubtedly, the evaluation offered by Man of Bitcoin gives a cautious future outlook. Nonetheless, it’s important to counter-check and decide what different market indicators indicate.

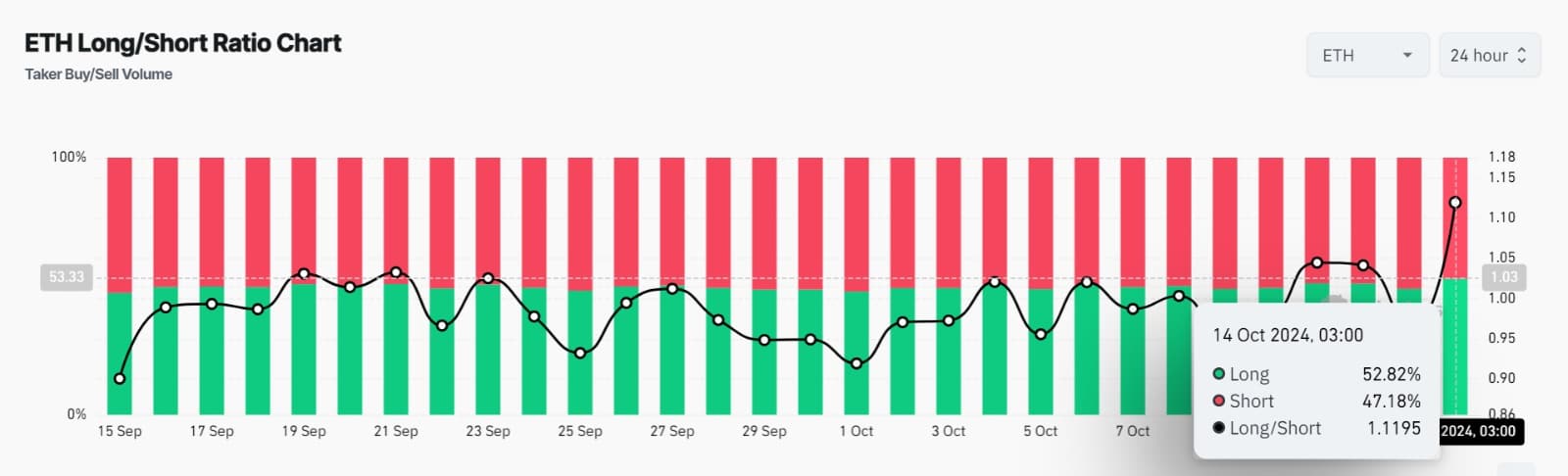

Supply: Coinglass

For instance, Ethereum’s Lengthy/Quick ratio has remained above over the previous 24 hours. At press time, ETH’s lengthy/brief ratio was 1.1195 signaling elevated demand for lengthy positions.

As such, lengthy place holders are dominating the market as they proceed to open new trades.

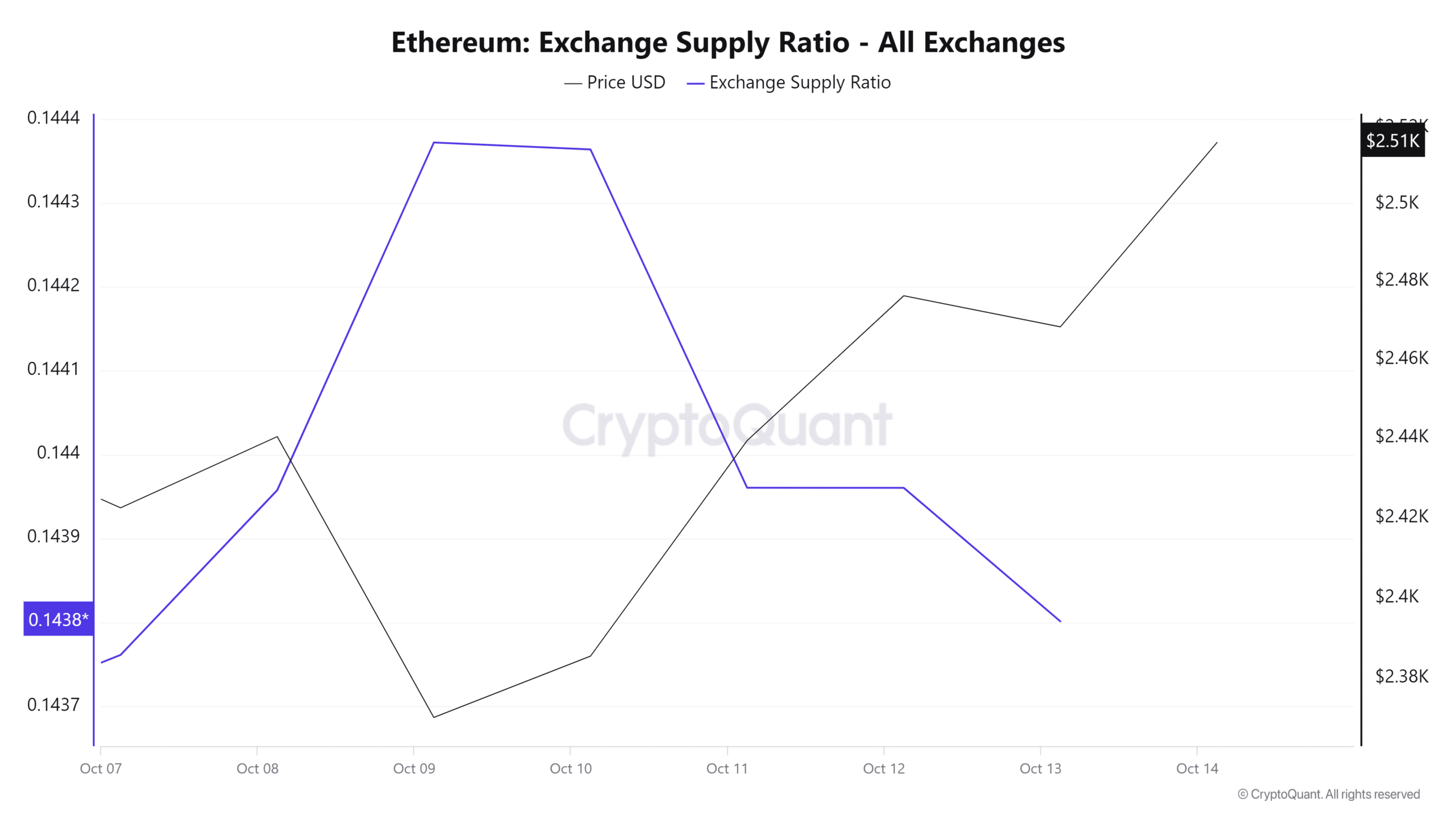

Supply: Cryptoquant

Moreover, Ethereum’s Provide change ratio has skilled a sustained decline over the previous 5 days. A declining provide change provide implies that buyers are opting to carry onto their ETH. This normally reduces tokens in provide leading to to produce squeeze.

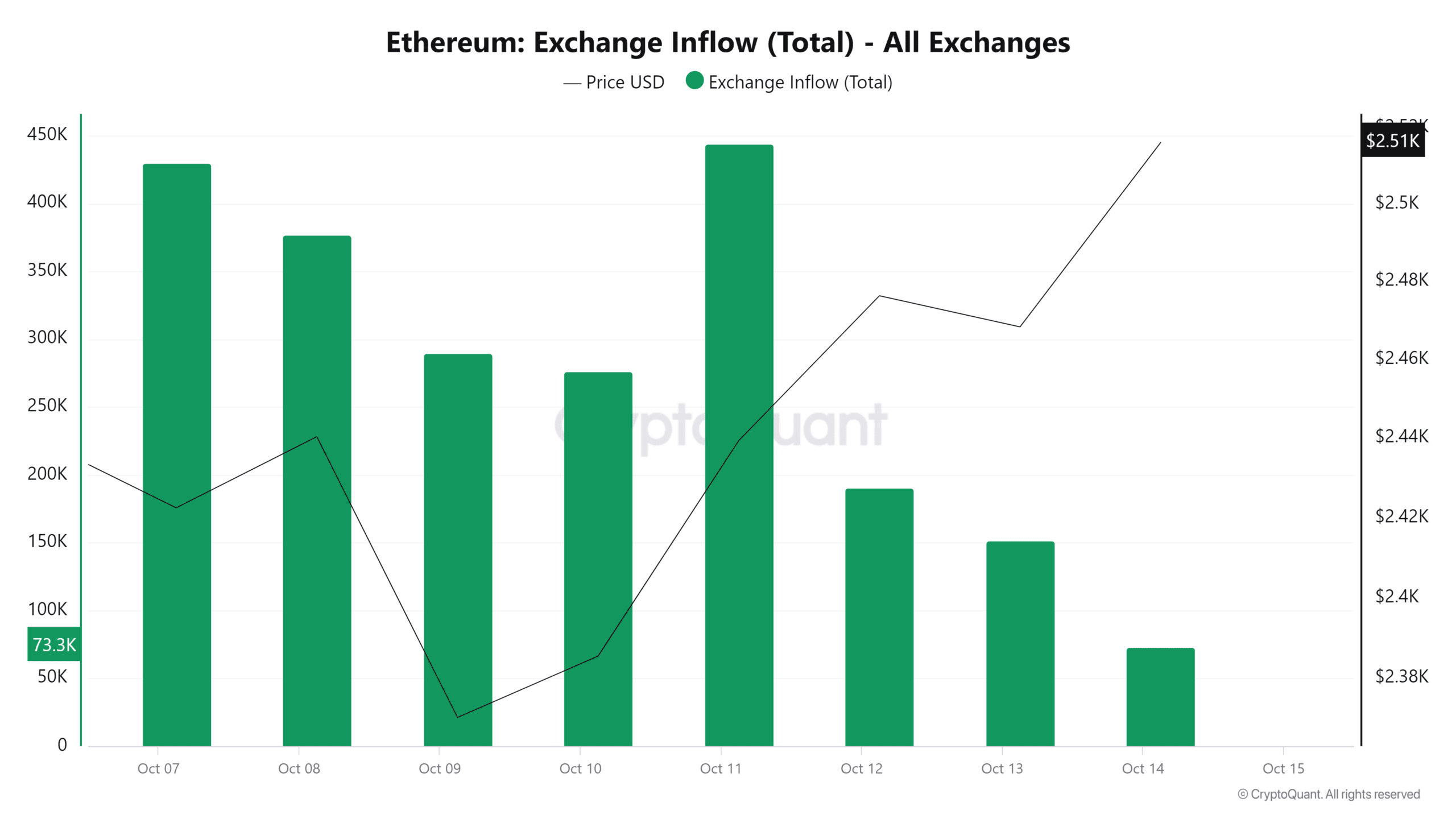

Supply: Cryptoquant

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Lastly, ETH change influx has declined for the final 4 days signaling a shift in market sentiment to holding as illustrated by a decline within the provide change ratio.

Merely put, ETH is in a bullish section, and as noticed by the analyst earlier, that is legitimate so long as the $2264 assist holds. Subsequently, with constructive market sentiment and investor favorability, ETH will try a $2727 resistance stage within the brief time period.