Ethereum headed for short squeeze? What’s going on with ETH

- ETH pulled again beneath $2,600 after encountering sturdy resistance above $2,700.

- The pullback might be a lure that might set ETH up for a possible brief squeeze as leverage soars.

Ethereum [ETH] was on the third day of a bearish retracement after encountering resistance above $2700. Nevertheless, there’s hypothesis that the pullback is likely to be short-lived.

A current CryptoQuant analysis advised that the ETH brief positions have surged above the $2,700 worth stage.

This confirmed that many anticipated a retracement as a result of earlier resistance at this worth stage. At present, promote strain has overtaken demand, pushing the value to $2584, at press time.

The evaluation warned that the surge in shorts and urge for food for leverage might expose ETH to a short-squeeze state of affairs.

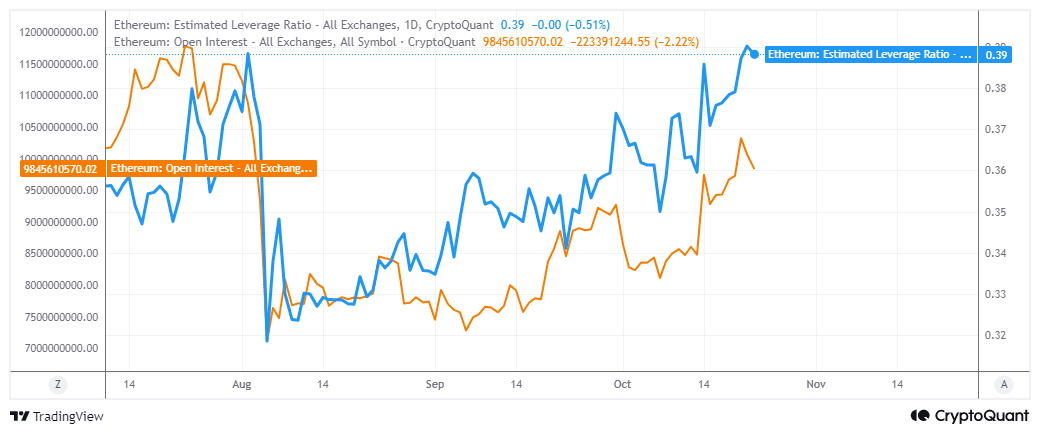

Ethereum’s Open Curiosity has been rising for the reason that sixth of September. This indicated a renewed curiosity within the derivatives phase.

Extra importantly, ETH’s estimated leverage ratio lately soared to ranges final seen in early July.

Supply CryptoQuant

A surge in overleveraged shorts might underscore fertile floor for whales to shake issues down by pushing costs up. However what are the chances of this taking place?

Assessing ETH demand to ascertain a brief squeeze

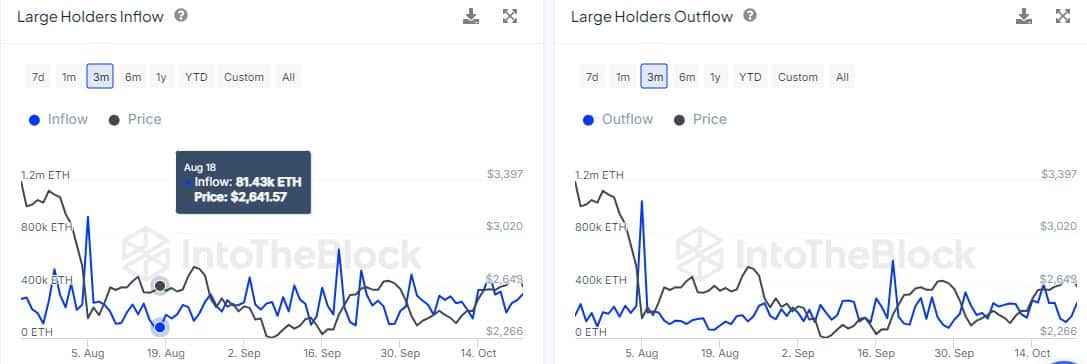

The largest signal {that a} brief squeeze might be on the best way was if the whales began aggressively accumulating.

Based on stats on IntoTheBlock, ETH flowing into massive holder addresses grew from 194,280 cash on the nineteenth of October to 335,870 cash, on the twenty second of October.

This confirmed that enormous holders have been accumulating extra ETH as costs dipped.

Supply: IntoTheBlock

Then again, massive holder outflows grew from 122,380 ETH on the twentieth of 0ct0ber to 267,180 ETH on the twenty second of October.

This meant the quantity of Ethereum bought was barely greater than the online buys, which is in step with the bearish worth motion throughout the identical interval.

Regardless of bears dominating, massive holders purchased extra cash than they bought. Within the final 24 hours, they bought 68,690 ETH, price over $177 million.

The info means that an try by the whales, to push the value again up, may already be in play.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Because of this the coin might be set for an attention-grabbing second half of the week, probably characterised by one other rally and an try to push previous the most recent resistance zone.

Ethereum was liable to risky situations, and the extent of Open Curiosity and urge for food for leverage has been rising.