Solana price hits ATH against Ethereum: Can ETH reclaim its dominance?

- Solana’ fast appreciation in opposition to Ethereum displays a major worth motion shift.

- Now, ETH’s long-term outlook wants reassessment to revive its former dominance.

Whereas market volatility is inherent to the crypto world, latest evaluation by AMBCrypto means that Solana worth [SOL] might not be experiencing a fleeting surge, however relatively the start of a bigger pattern that would form future market cycles.

In easy phrases, this rising sample factors to a deeper shift. The upward momentum of Solana in opposition to Ethereum [ETH] could turn into a extra persistent characteristic, relatively than a short-term anomaly, threatening Ethereum’s longstanding dominance within the blockchain ecosystem.

A recurring sample

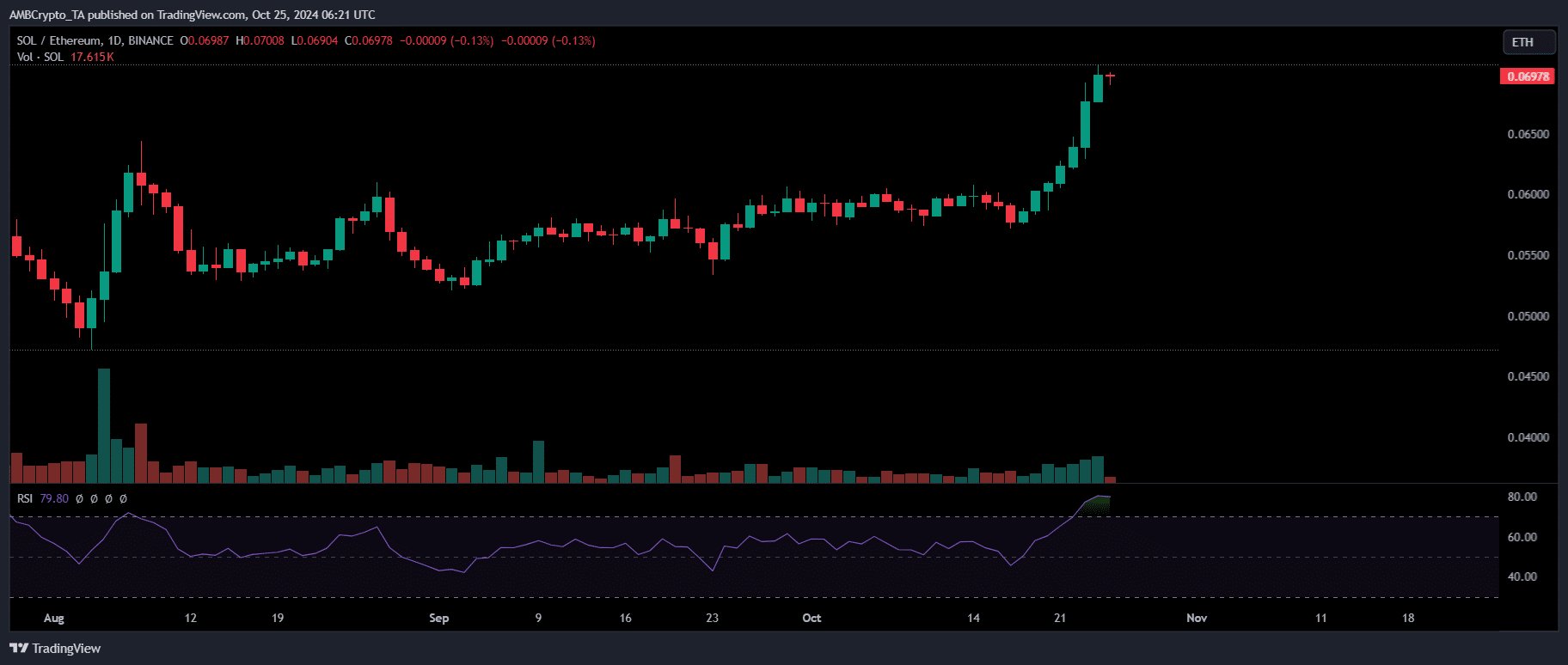

In August, the Solana to Ethereum ratio (SOL/ETH) reached an unprecedented excessive of 0.06179, indicating a major surge in Solana’s worth relative to Ethereum. This achievement got here amid a tumultuous $500 billion sell-off within the markets.

Regardless of these challenges, SOL rebounded impressively, leaping 48% from a low of $110 to $163 in simply three days. In the meantime, ETH noticed a extra modest 15% restoration, rising from $2,157 to $2,463.

Supply : TradingView

At the moment, the SOL/ETH pairing has surged to a brand new ATH of 0.06987, coinciding with an overheated market as Bitcoin reached a peak of $70K.

Nevertheless, not like earlier cycles, ETH has proven no indicators of restoration. As an alternative, it has recorded each day increased lows accompanied by lengthy purple candlesticks, falling from $2.7K to $2.4K in below 5 buying and selling days.

In distinction, SOL has held regular, breaking by the important thing psychological barrier at $160 to commerce at $174 at press time, bolstered by a bullish MACD crossover.

This recurring sample throughout excessive volatility, notably when BTC hits resistance, reveals a notable capital shift towards SOL over ETH.

If this pattern continues – which seems doubtless – SOL’s rising worth may threaten ETH’s dominance, making it the popular high-cap asset for these seeking to mitigate dangers every time Bitcoin peaks.

Components driving Solana upward

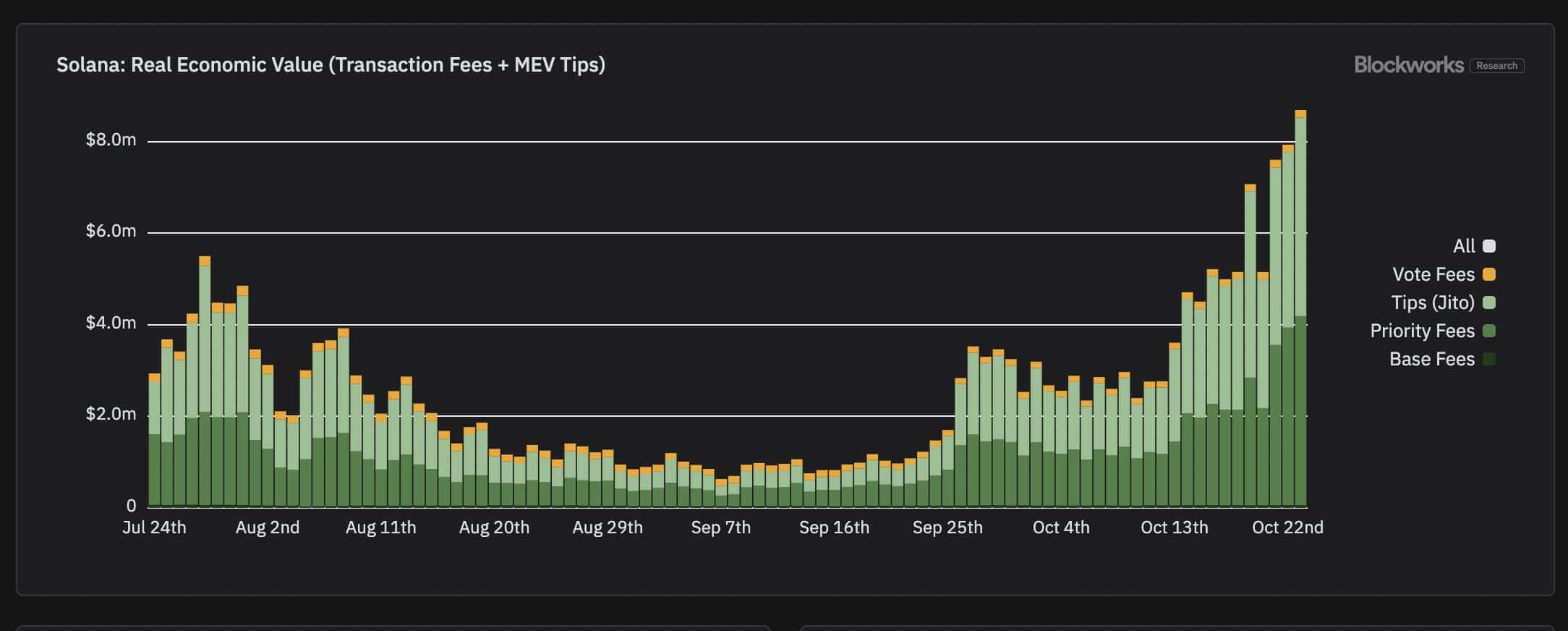

Earlier, critics claimed Solana’s low charges made the chain economically unsustainable. Quick ahead lower than 12 months, and Solana has not solely flipped Ethereum in transaction charges but in addition in miner extractable worth (MEV) ideas.

This shift illustrates that Solana’s worth motion is just not solely influenced by Bitcoin’s fluctuations; relatively, it’s pushed by its sturdy inner design.

Supply : Blockworks

Moreover, Solana has garnered vital consideration from the memecoin neighborhood, with half of the top eight memecoins by market cap now primarily based on the Solana community.

One standout, Goatseus Most [GOAT], an AI-driven memecoin, has skilled practically a 100% weekly surge, prompting wallets to carry SOL to capitalize on the memecoin craze.

That is supported by a latest post that exposed a considerable stash of SOL staked in a brand new pockets, totaling over 150K SOL acquired up to now three days, valued at roughly $26 million.

ETH fundamentals are below strain

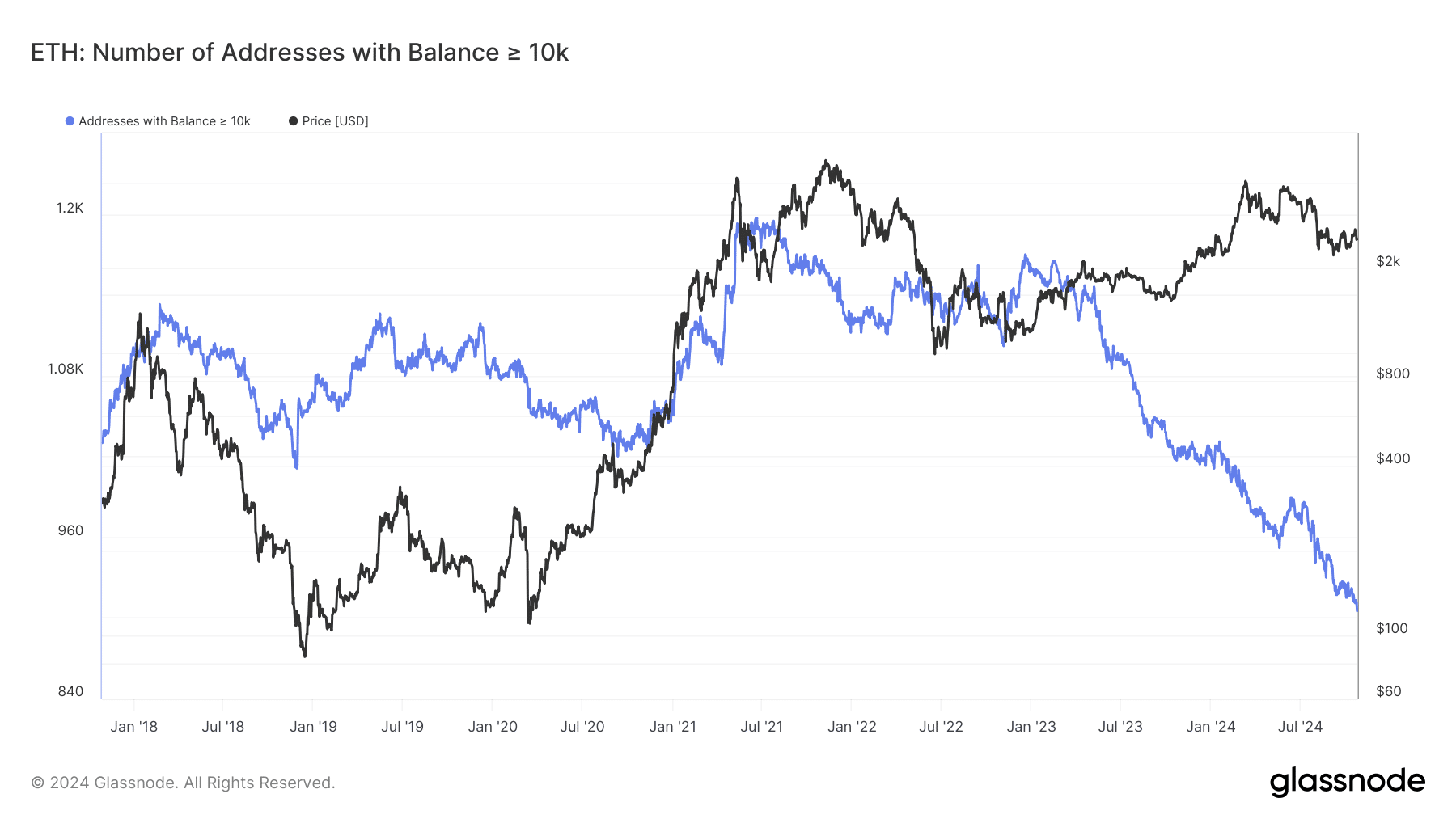

The fundamentals that after positioned ETH because the main altcoin are actually below strain, because the variety of wallets holding greater than 10K ETH has fallen to a seven-year low.

Supply : Glassnode

Definitely, ETH’s long-term prospects require reevaluation. As investor confidence wanes, Ethereum should handle these challenges to reclaim its place.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

If not, points corresponding to scalability, excessive charges, and competitors from rising platforms like Solana may reverse the altcoin hierarchy, hindering ETH’s means to learn from capital shifts out there.

At the moment, Ethereum is valued at $2,464, reflecting a 6% decline over the week, with its market cap down by 4%.