Ethereum struggles at $2.8K: Will the bulls push through?

- The bullish triangle sample might see ETH breakout towards $3,350

- Unenthusiastic demand might harm the possibilities of a breakout

Ethereum [ETH] was buying and selling beneath the resistance zone at $2.8k which was unbeaten since August. The latest transfer upward was sluggish and lacked explosive momentum, however has been step by step increase since September.

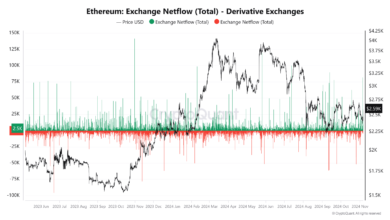

Destructive change netflows confirmed that accumulation was in progress, but it surely was unclear if this was sufficient to push costs previous the three-month highs.

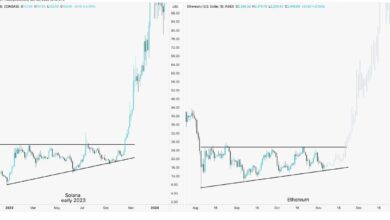

Ascending triangle sample guarantees $3.3k for ETH

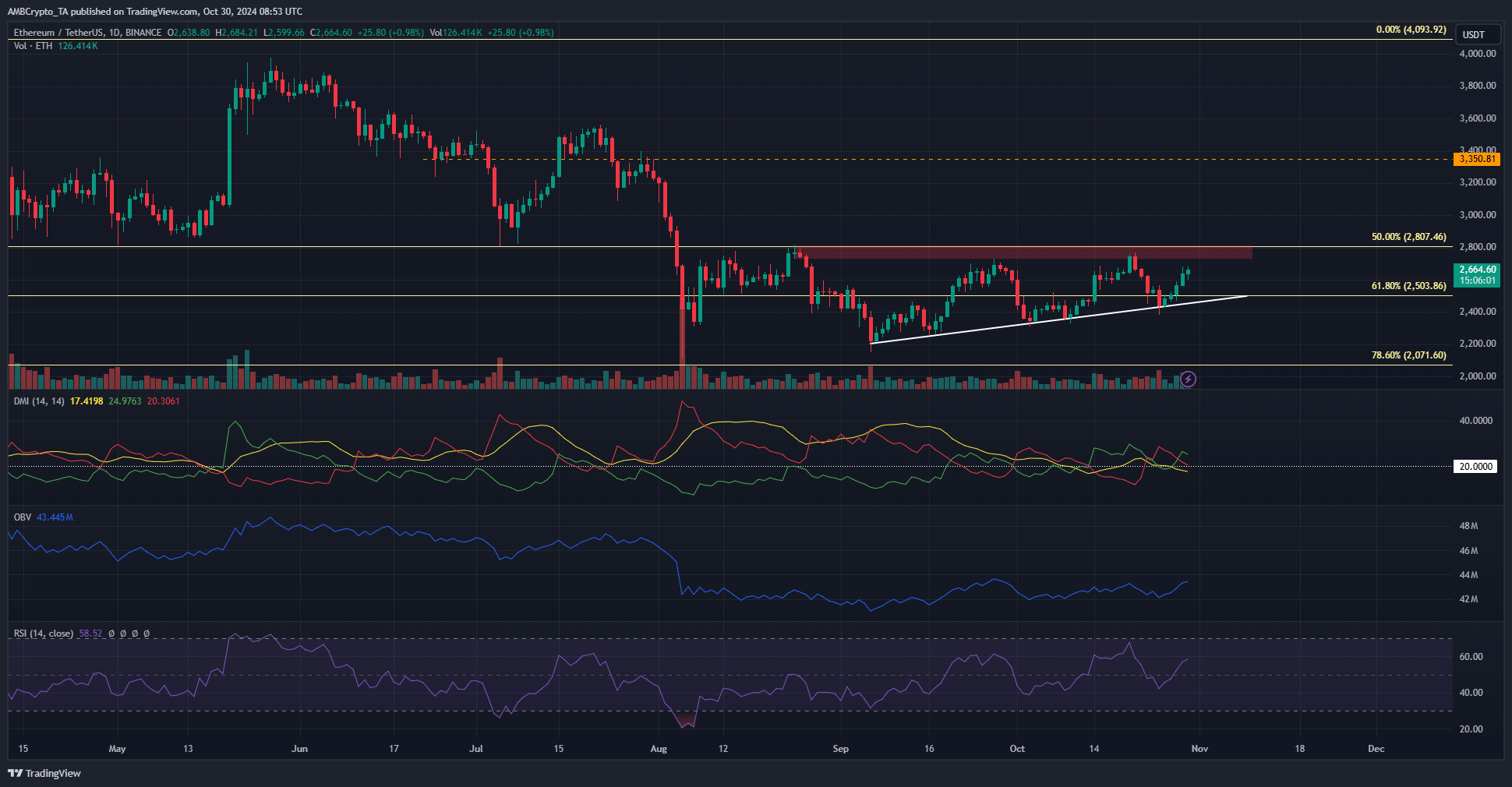

Supply: ETH/USDT on TradingView

Since September, Ethereum has been forming a sequence of upper lows. It was unable to climb previous the $2.8k resistance zone, forming an ascending triangle sample. The OBV has slowly trended greater over the previous two months however was nicely beneath the degrees it maintained in June and July.

This lukewarm demand might weaken the dimensions of the breakout. As issues stand, a each day session shut above $2.8k would ideally attain the $3,350 degree.

This breakout may not be imminent and will take a couple of days to materialize. A dip towards $2.5k was additionally a risk. The RSI, although bullish, didn’t sign a transparent pattern in October. The DMI agreed with this, and at press time the ADX (yellow) was falling beneath 20.

Extra quantity considerations on the decrease timeframes

Supply: Coinalyze

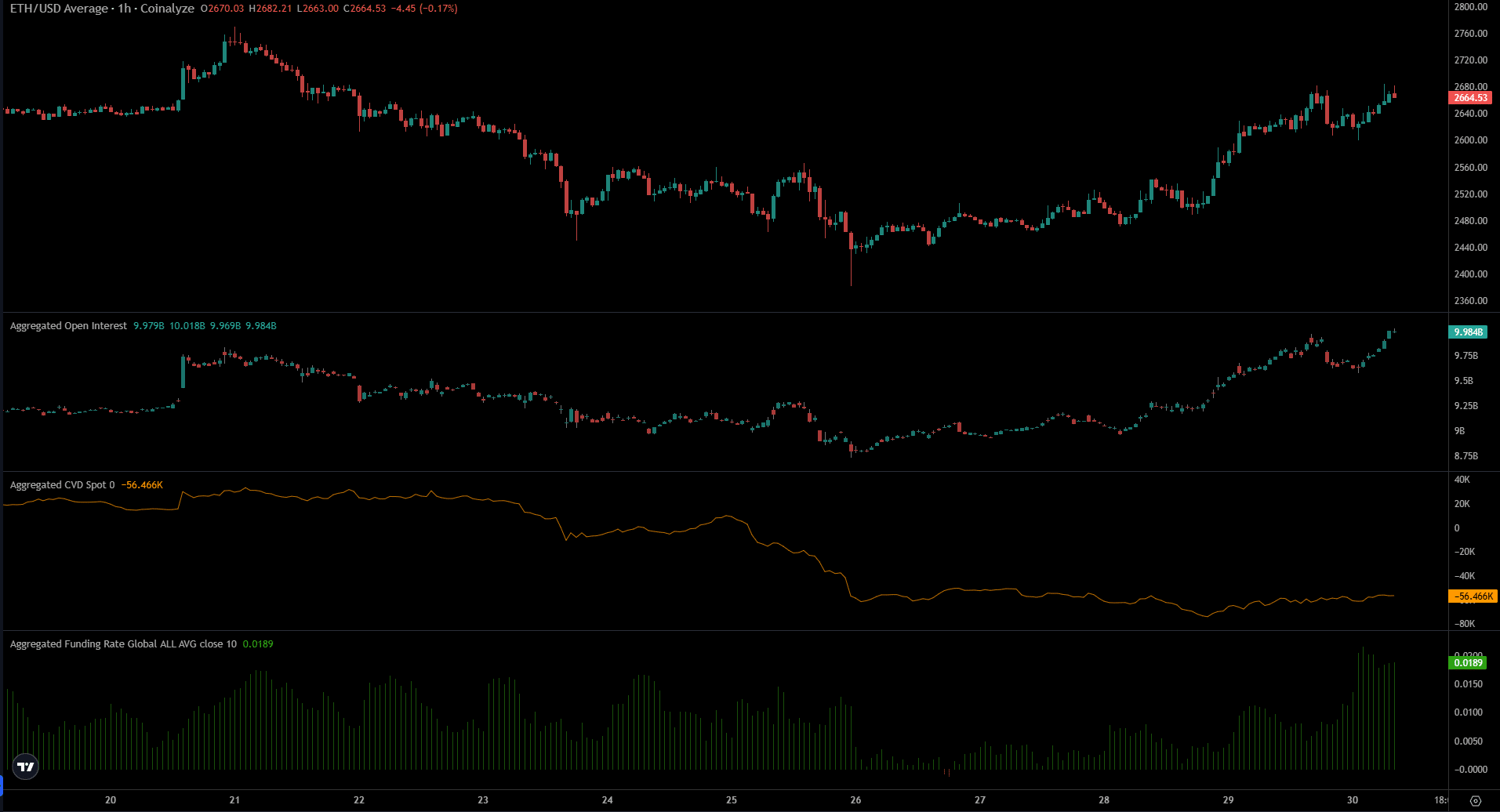

The Open Curiosity and the value have been strongly trending upward prior to now three days. The funding price additionally surged greater over the previous 24 hours. Collectively they indicated agency bullish perception within the decrease timeframes.

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

But, the spot CVD failed to choose up despite the fact that ETH is up by 9.4% for the reason that twenty sixth of October. This lack of spot demand alongside the weak point the OBV exhibited raised questions concerning the bulls’ power.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion