ETH’s $3,200 test: Will Ethereum whales drive the rally or cause a setback?

- Ethereum’s value surge to $3,200 attracts consideration to Ethereum whales and long-term holders.

- Elevated whale exercise may gas additional progress, however profit-taking by LTHs might restrict upside.

After months of consolidation, Ethereum [ETH] has rallied considerably in response to a surge in Bitcoin’s worth, bringing it to a essential resistance degree round $3,200.

The approaching weeks might be pivotal, as market individuals monitor the actions of long-term holders (LTHs) and Ethereum whales. Their conduct may both propel Ethereum’s value greater or introduce recent promoting strain, testing the sustainability of this newest rally.

Ethereum’s value enhance

Ethereum’s value has rallied not too long ago, nearing a key resistance degree round $3,200 following months of consolidation round $2,700.

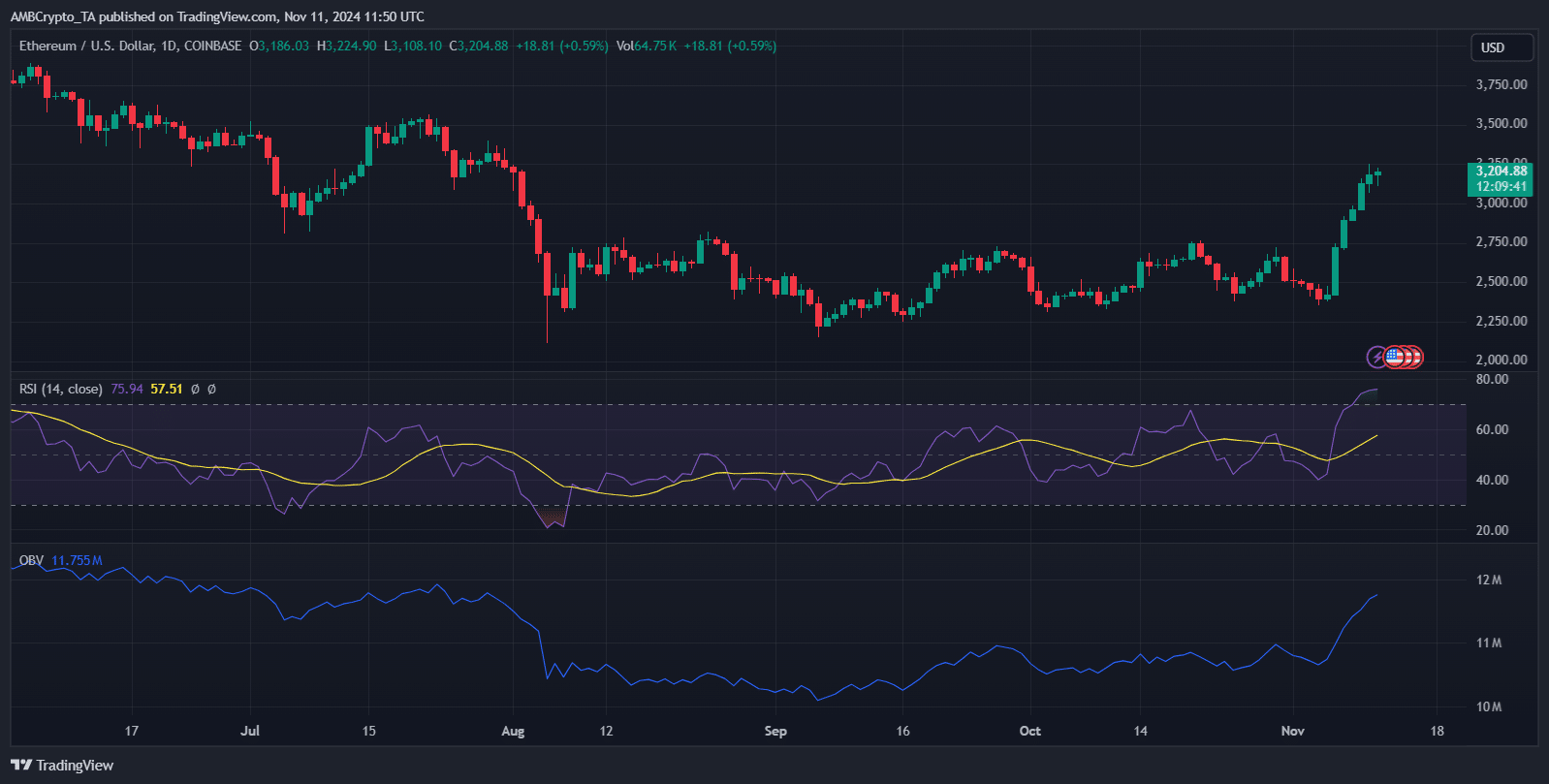

Supply: TradingView

The 14-day RSI stood at roughly 76, indicating overbought situations and suggesting a possible for value consolidation or a pullback as merchants might begin to take income.

Nonetheless, an overbought RSI also can mirror sturdy bullish momentum, which may gas a breakout if sustained.

The OBV was trending sharply upward, indicating sturdy quantity accumulation backing this value motion. This implies that whale exercise may very well be supporting the rally.

Such vital shopping for curiosity is essential for ETH to interrupt by means of the present resistance and maintain additional positive factors. If whales proceed to build up, ETH might push greater.

Whale exercise and its impression

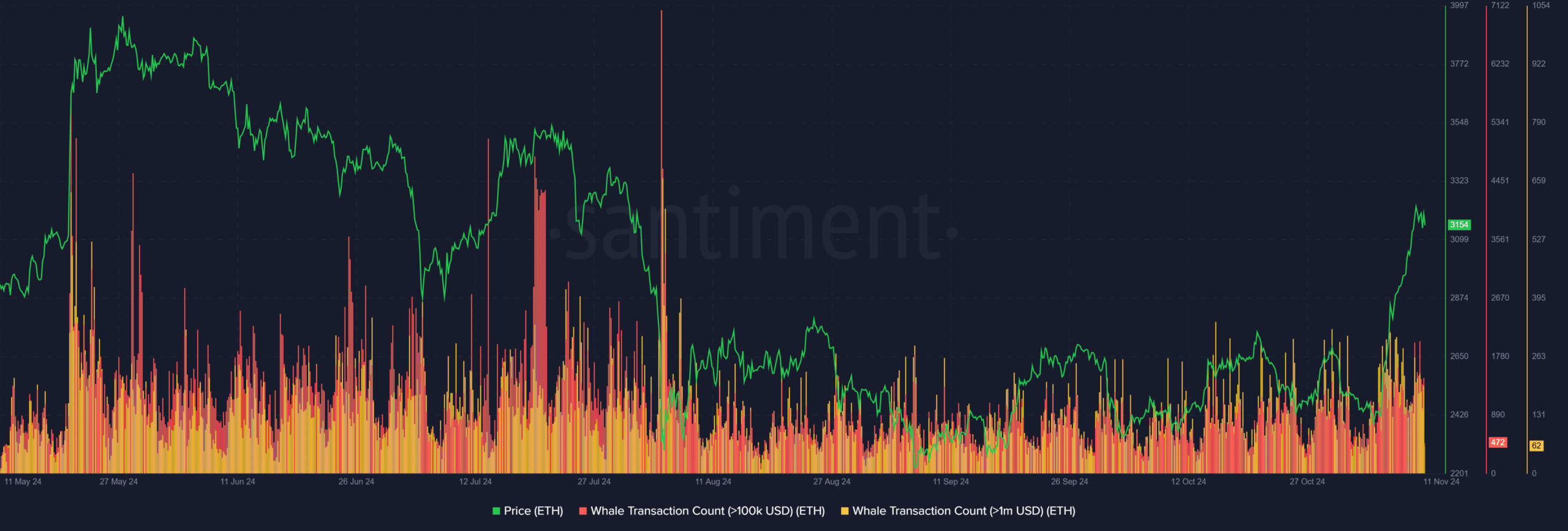

Supply: Santiment

Whales play a pivotal function in Ethereum’s value dynamics. The current surge in whale transaction quantity and regular accumulation underscores their affect in driving the bullish momentum.

This strategic positioning by massive buyers typically alerts confidence in sustained upward motion. Their continued exercise is a robust indicator that the present rally is underpinned by stable, high-capital backing, probably foreshadowing additional value advances.

Position of LTHs in Ethereum value motion

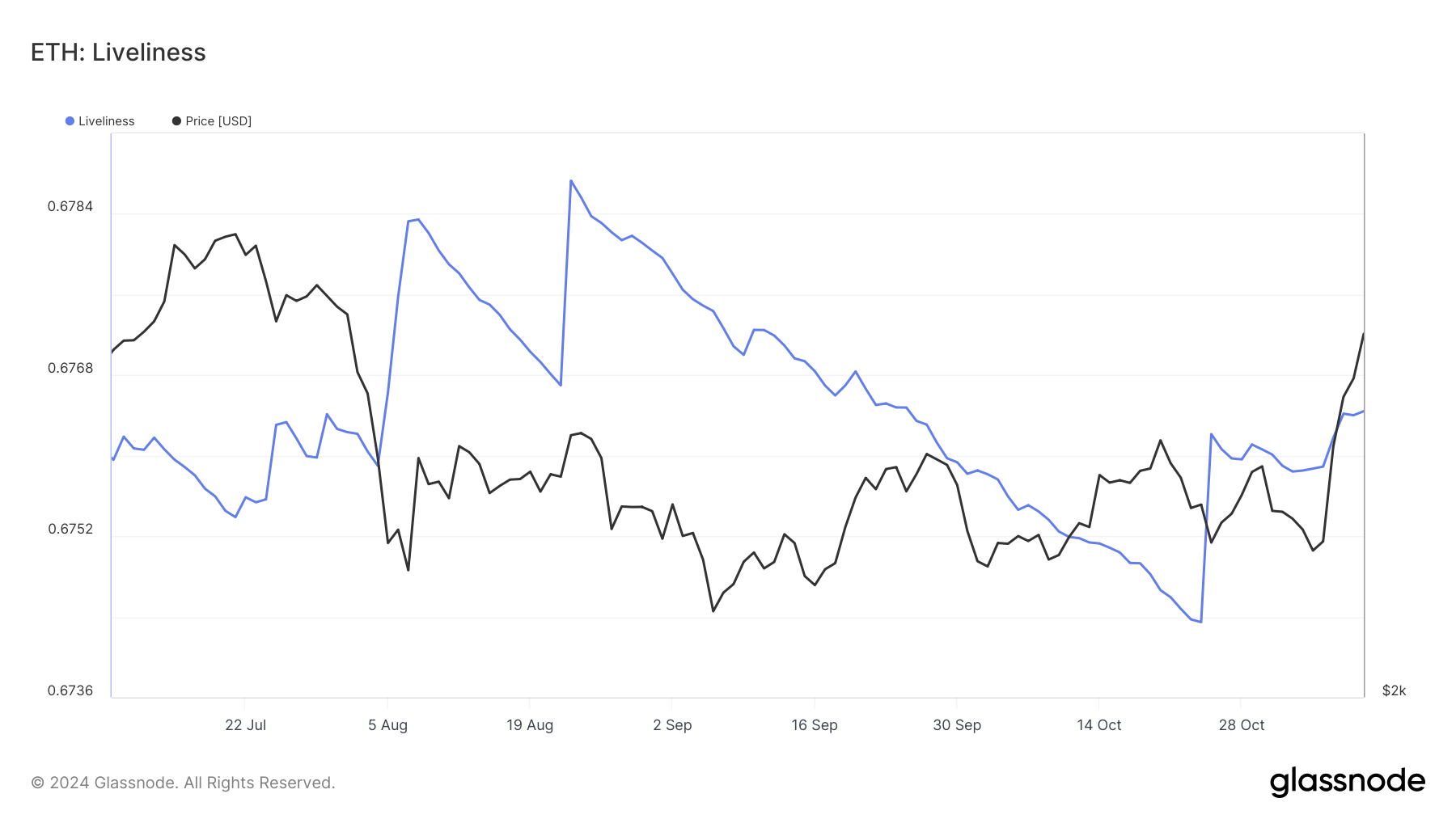

All through September and October, Ethereum’s liveliness was on a gradual decline, hinting at accumulation by long-term holders (LTHs) because the market discovered equilibrium at cheaper price ranges.

LTHs, identified for his or her resilience throughout volatility, typically present a stabilizing drive, absorbing provide and mitigating sharp drops.

Supply: Glassnode

Learn Ethereum Worth Prediction 2024-25

Nonetheless, the current uptick in liveliness amid ETH’s climb towards $3,200 alerts that a few of these seasoned holders could also be taking income.

This delicate change may act as a bellwether for shifting market dynamics – indicating a possible tapering of the rally’s momentum as LTH distribution may introduce renewed provide strain.