Mapping how Ethereum’s price can return to $3,400 and beyond

- Traders began to build up ETH when altcoin’s worth dropped from $3.4k

- NVT ratio revealed that Ethereum was undervalued on the charts

Ethereum [ETH], the world’s largest altcoin, hit a brand new excessive on a selected entrance this week, a excessive unseen for greater than a 12 months. Notably, it occurred whereas the market recorded a slight pullback on the charts.

Will this newest improvement change the situation once more in ETH’s favor?

Ethereum hits a milestone!

IntoTheBlock, lately shared a tweet revealing an fascinating replace. The tweet revealed that Ethereum recorded an enormous hike in outflows final week. To be exact, the quantity exceeded $1 billion, which was a degree final seen again in Could 2023. The replace additionally instructed that Bitcoin [BTC] additionally recorded the same surge in outflows throughout the identical time.

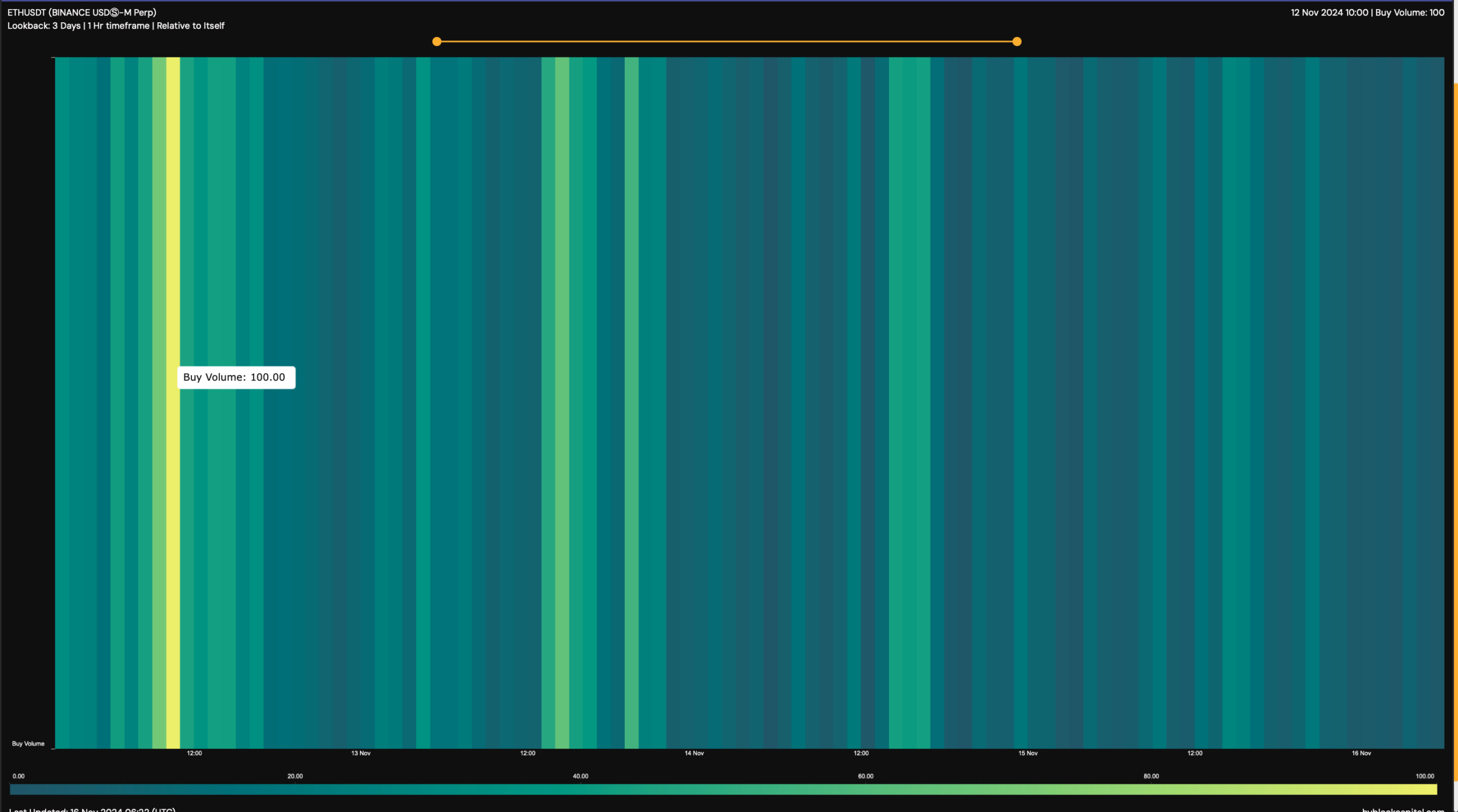

A rise in outflows implies that accumulation is excessive. A attainable motive behind this improvement could possibly be ETH’s pullback from $3.4k. Hyblock Capital’s knowledge additionally advised the same story as ETH’s purchase quantity hit 100 on 12 November.

This was the identical day as when ETH’s worth began to drop after hitting $3.4k. This instructed that buyers have been planning to purchase the dip, hoping for an additional worth hike within the quick time period.

Supply: HyblockCapital

In actual fact, that’s what occurred over the previous couple of days. After dipping to a help close to $3k, ETH’s piece gained some bullish momentum. Its worth surged by practically 3% within the final 24 hours and at press time was buying and selling at $3,117.03.

Moreover, buyers gave the impression to be contemplating shopping for Ethereum, suggesting that its worth might surge additional. This pattern of sustained shopping for was confirmed by ETH’s trade netflows too.

In keeping with CryptoQuant, the token’s web deposits on exchanges have been low, in comparison with the 7-day common. Furthermore, ETH’s Coinbase premium was additionally inexperienced, indicating that purchasing sentiment was robust amongst U.S buyers.

Aside from this, whale exercise round ETH additionally remained excessive. In actual fact, AMBCrypto reported beforehand that whale transactions surged in late October and early November, correlating with ETH’s bull rally.

Will this uptrend maintain itself?

The higher information for buyers was that Ethereum may as effectively handle to maintain this newly gained upward momentum.

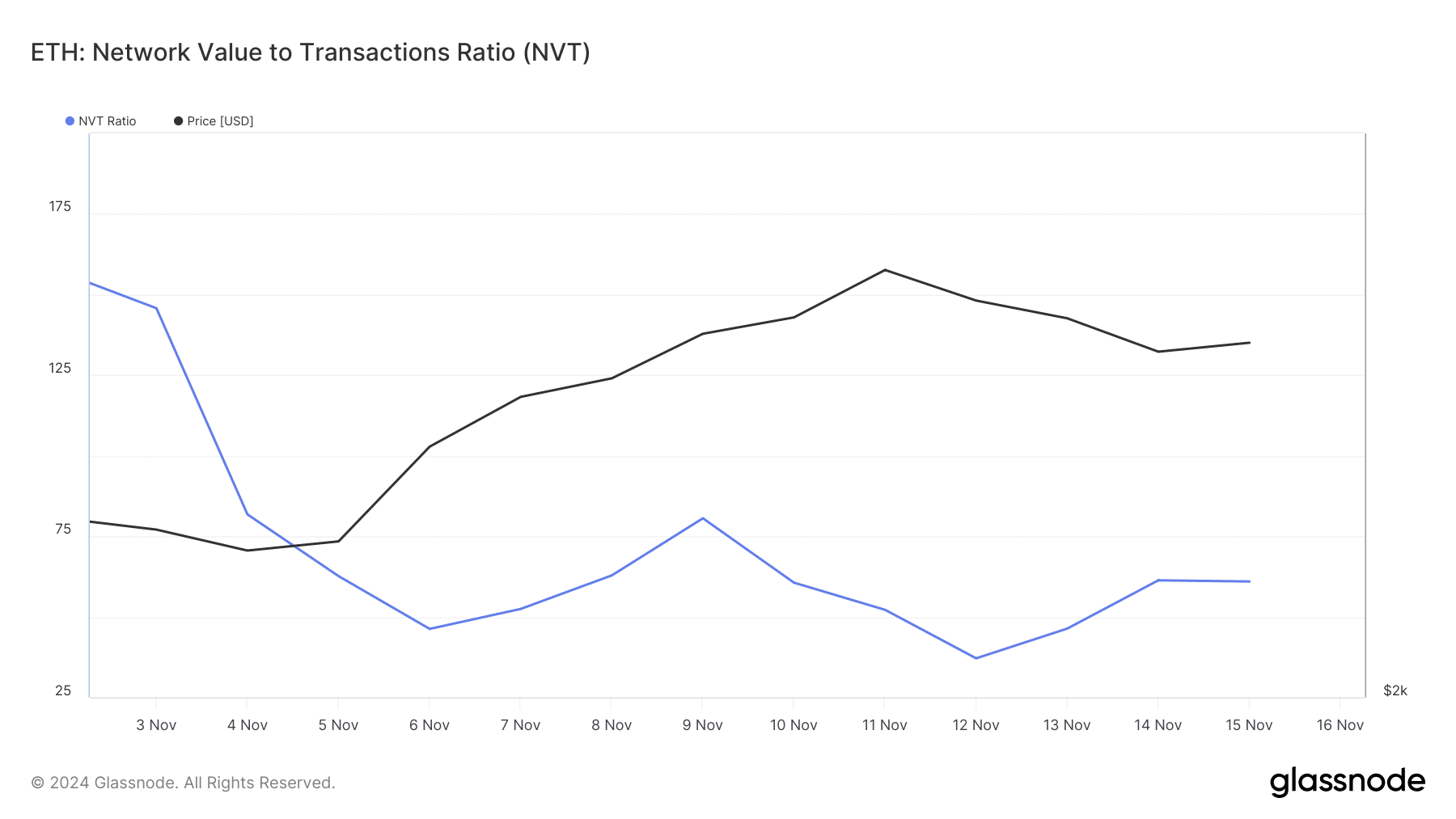

The king of altcoin’s NVT ratio registered a pointy decline over the previous 2 weeks. Each time this metric drops, it implies that an asset is undervalued – Hinting at a near-term worth hike.

Supply: Glassnode

Learn Ethereum’s [ETH] Value Prediction 2024–2025

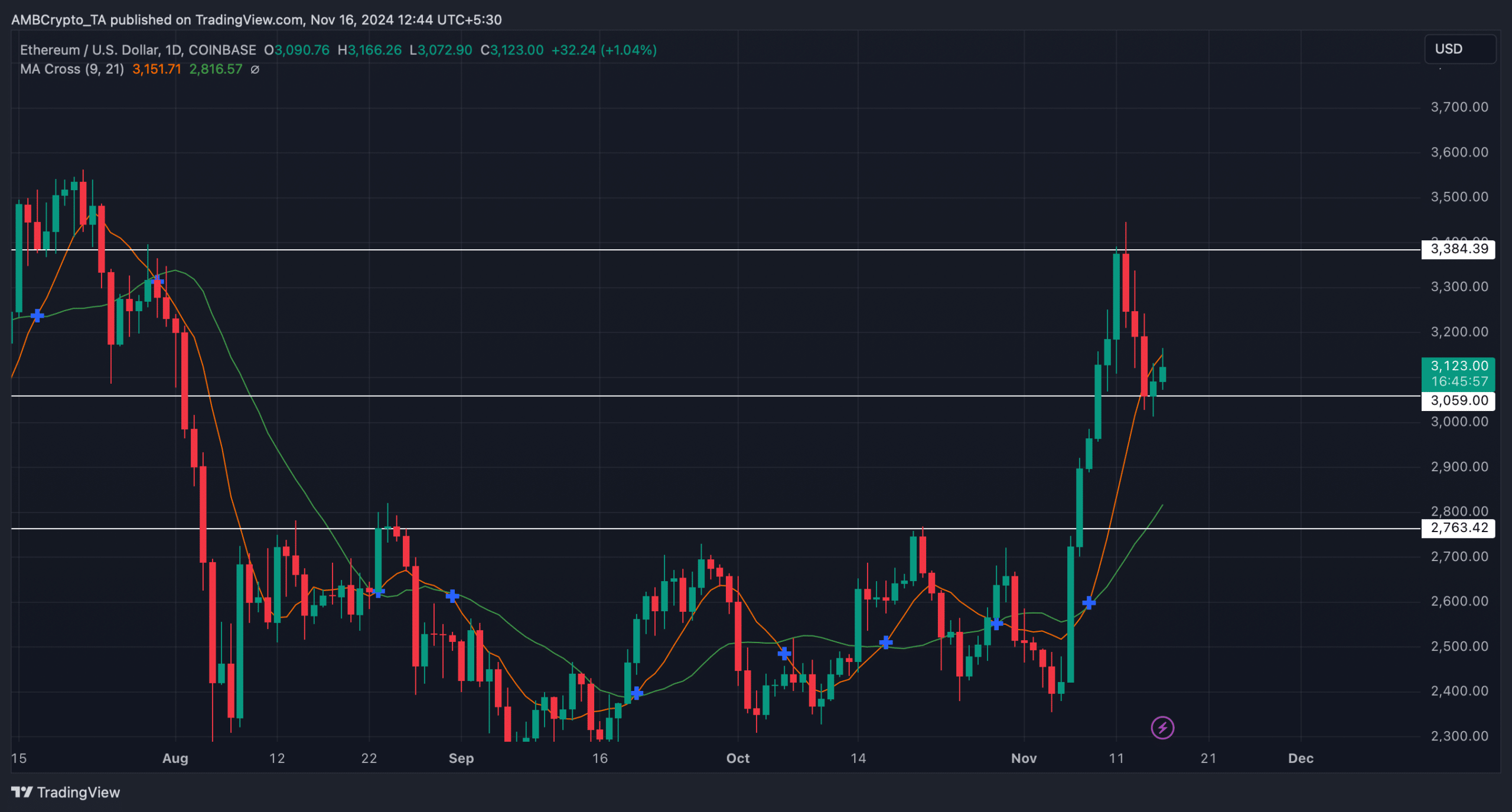

Lastly, the MA cross technical indicator identified that Ethereum’s 9-day MA was resting effectively above its 21-day MA.

If the indicator is to be believed, ETH may proceed its uptrend and shortly hit its resistance at $3.38k. Nevertheless, if ETH notes a pullback and falls beneath its help at $3k, the possibilities of it plummeting to $2.7k can’t be dominated out but.

Supply: TradingView