Rising stablecoin inflows are a sign of Bitcoin reaching $100K – How?

- USDT managed over 70% of the entire stablecoin in circulation.

- Not too long ago, there was extra influx displaying shopping for sentiment.

Bitcoin’s [BTC] worth continued its upward momentum, nearing the psychological milestone of $100,000.

A vital driver behind this surge is the numerous influx of stablecoins into exchanges, which frequently alerts incoming shopping for strain.

Extra insights into Bitcoin’s energetic addresses and alternate netflows present a complete view of the market dynamics propelling this rally.

Stablecoin inflows point out excessive shopping for curiosity

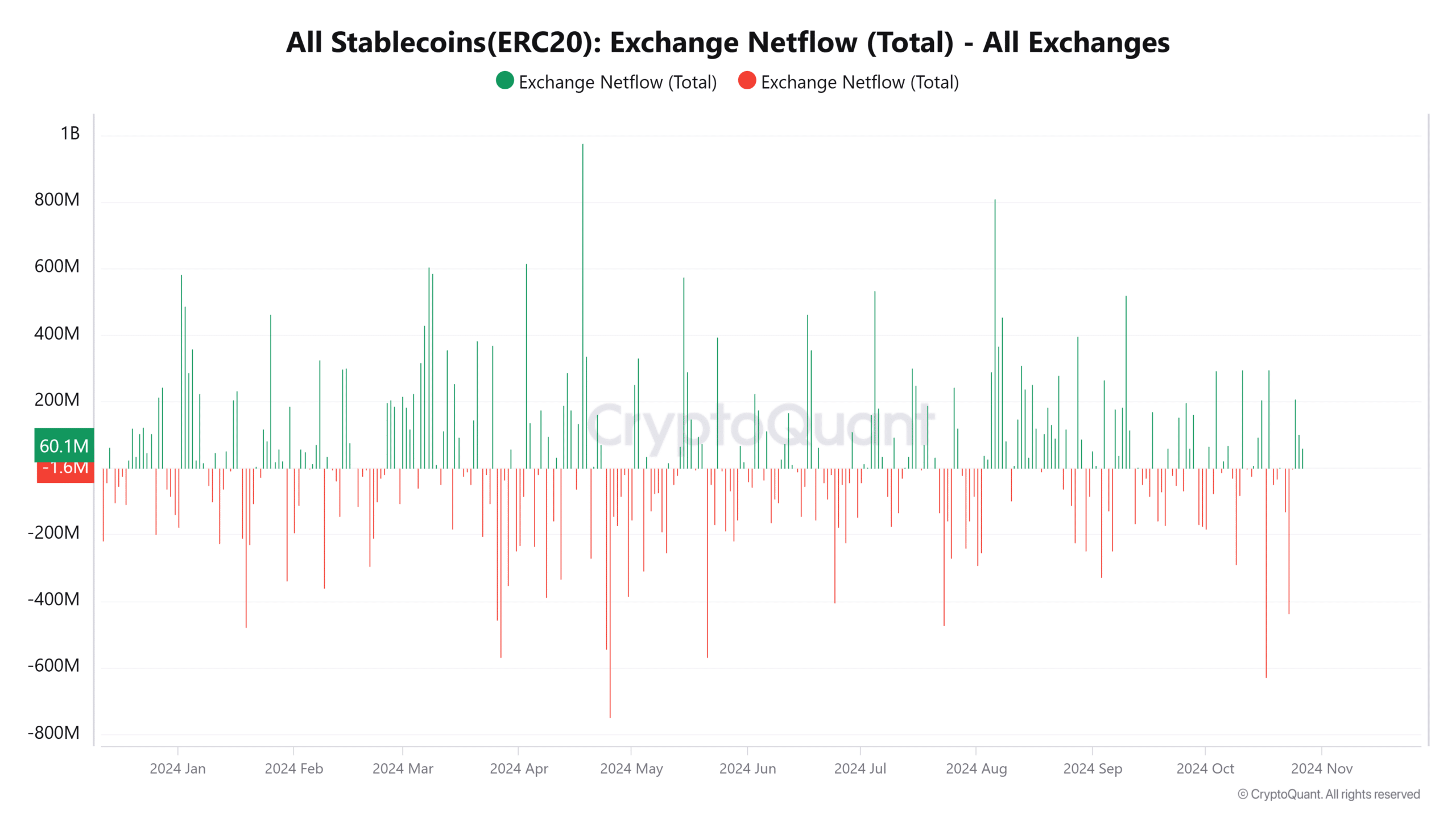

Evaluation of the stablecoin alternate netflows chart on CryptoQuant revealed a constant influx of stablecoins, significantly in the previous few weeks.

This pattern means that traders are getting ready to accumulate Bitcoin, as stablecoins are a main gateway for crypto purchases.

Supply: CryptoQuant

On the time of writing, an over $213 million influx has been recorded, signaling heightened market exercise.

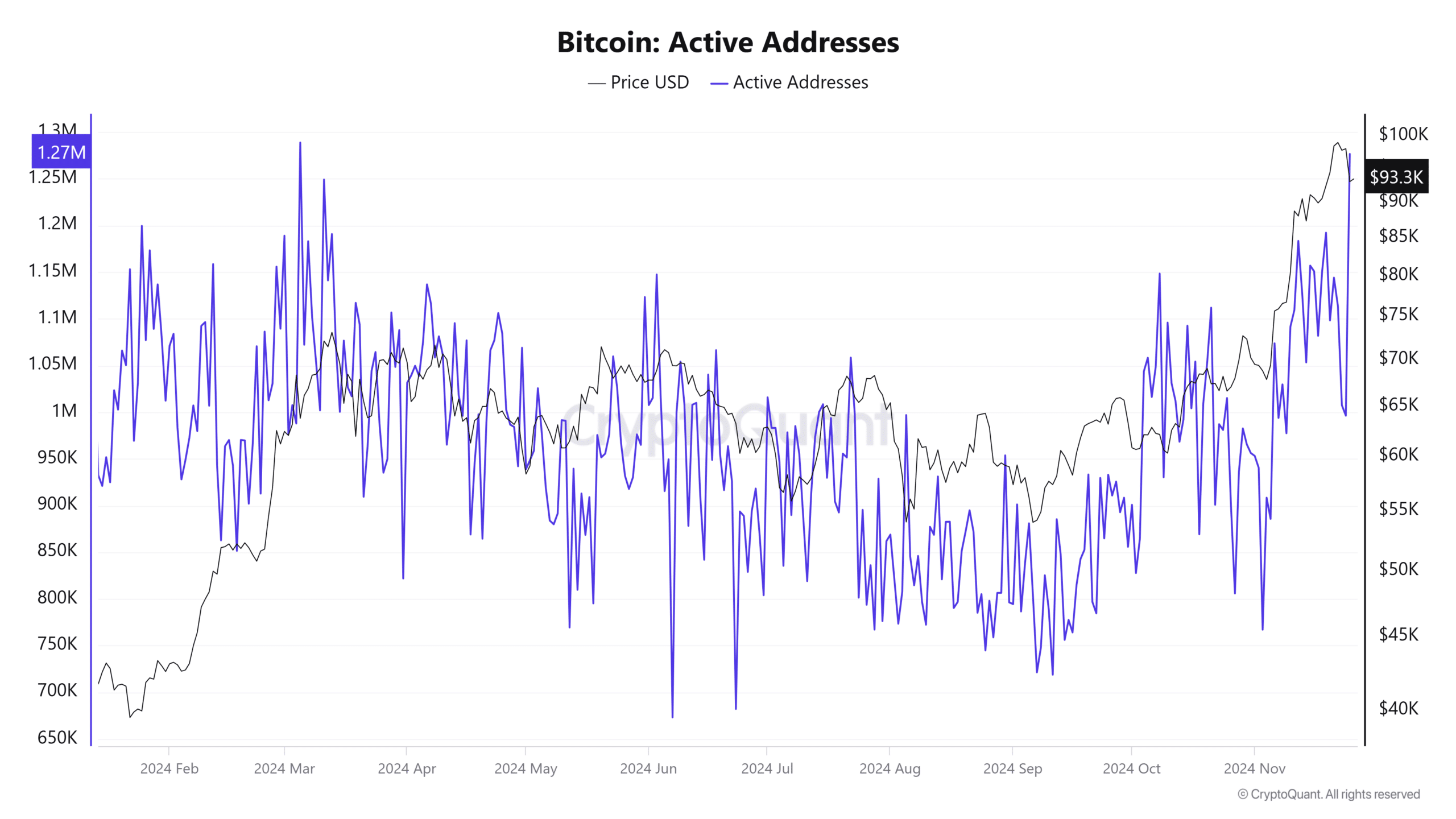

Lively addresses surge as community exercise will increase

Bitcoin’s energetic addresses, a measure of community utilization and exercise, have steadily risen with its worth and stablecoin influx.

Supply: CryptoQuant

Evaluation of the energetic tackle knowledge reveals it has spiked to round 1.27 million energetic addresses. This was its highest quantity since March, underscoring elevated participation within the community.

This progress in energetic addresses suggests heightened investor curiosity. It aligns with historic patterns of worth will increase during times of heightened community exercise.

Moreover, Bitcoin’s alternate netflow knowledge presents a blended narrative. Whereas the entire inflows spotlight elevated buying and selling exercise, outflows have additionally risen, indicating accumulation and diminished promoting strain.

This stability helps Bitcoin’s regular climb towards $100,000. As of this writing, the netflow was detrimental, with over 5,000.

Buying energy on the rise?

The technical evaluation of Bitcoin’s worth highlighted key Fibonacci retracement ranges at $80,450 and $74,455, providing potential help zones if a pullback happens.

The Parabolic SAR confirmed the bullish pattern, whereas the Shifting Averages (MA) supplied a robust base for continued worth appreciation.

With rising quantity and constant larger lows, Bitcoin’s rally stays well-supported.

Supply: TradingView

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Additionally, Bitcoin’s Stablecoin Provide Ratio (SSR) remained low at 10.42, indicating strong buying energy towards Bitcoin’s provide.

The stablecoin metrics and different key indicators present that reveals that stablecoins will play a key function in Bitcoin’s try to achieve $100,000.