Examining The Network’s Growth, Challenges, And Future Prospects

Este artículo también está disponible en español.

Market intelligence agency Messari just lately launched its third quarter (Q3) efficiency report for Polkadot (DOT), offering insights into the blockchain community’s growth and monetary metrics throughout this era.

Polkadot Sees Robust Developer Engagement

One of many notable findings from the report is the developer exercise on Polkadot. In accordance with Electrical Capital, the community had roughly 2,400 month-to-month energetic builders in July 2024, with 760 categorised as full-time contributors. This positioned Polkadot fourth amongst main blockchain networks, trailing solely Ethereum, Base, and Polygon.

Moreover, Artemis tracked a mean of 630 weekly energetic core builders and 760 ecosystem builders throughout Q3, underscoring a vibrant growth neighborhood.

Associated Studying

Polkadot additionally made important strides in Q3 2024 with a number of key initiatives aimed toward enhancing its ecosystem. The Decentralized Futures program, backed by a considerable $20 million fund and 5 million DOT tokens, has been pivotal in driving innovation.

This initiative offered grants to numerous initiatives specializing in advertising and marketing, enterprise growth, governance, and know-how. Notable initiatives supported embrace AirLyft, DotPlay, and BlockDeep Labs.

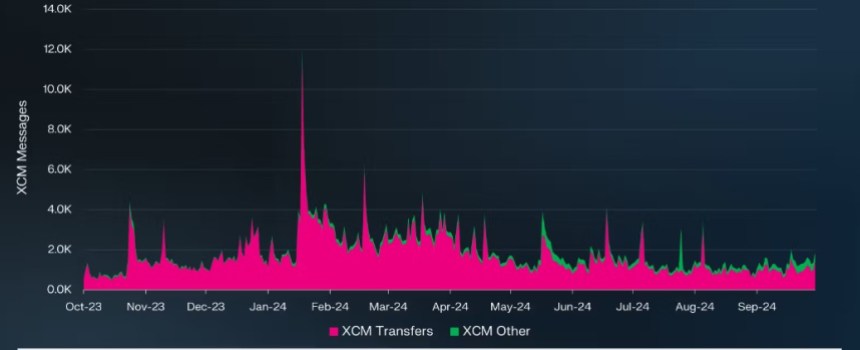

One other vital growth is the Cross-Consensus Message Format (XCM), a standardized messaging protocol that facilitates communication between completely different consensus-driven techniques, together with rollups.

Every day XCM transfers averaged round 1,000, representing a 34% decline quarter-over-quarter (QoQ). In distinction, non-asset switch use instances, known as “XCM Different,” skilled a 5% enhance, averaging 200 every day transfers.

Total, complete every day XCM messages averaged 1,300, reflecting a 29% drop QoQ. Regardless of these fluctuations, a good portion of exercise on the Polkadot community continues to happen by Polkadot rollups.

DOT Market Cap Plummets 27% In Q3

By way of market efficiency, DOT has skilled notable volatility by the 12 months. From Q3 2023 to Q1 2024, DOT’s market capitalization soared by 150%, rising from $5 billion to $13 billion.

Nevertheless, within the subsequent quarters, together with Q2 and Q3 2024, DOT retraced alongside the broader market, ending Q3 2024 with a market cap of $6.3 billion—a 27% decline QoQ. This drop additionally noticed DOT’s market cap rating fall from 14th to fifteenth, even because it stays the seventh largest base layer community.

Transaction charges on the Polkadot chain have usually remained decrease in comparison with rivals, attributed to the community’s structural design. In Q3 2024, transaction charges aligned with historic averages, totaling $84,000—a 44% lower QoQ. Charges denominated in DOT additionally declined by 21% to 17,000.

Associated Studying

The Polkadot Treasury however, noticed continued energetic utilization, with 9.5 million DOT allotted for proposals, 7.4 million for bounties, and a pair of.5 million burned.

A major growth was the approval of Polkadot Referendum 457 in Q2 2024, which diversified the treasury with USDT and USDC, enabling treasury proposals to be denominated in stablecoins. By the tip of Q3 2024, the treasury stability stood at $122 million.

Every day energetic addresses dropped to six,200 (-26% QoQ), every day returning addresses decreased to five,300 (-23% QoQ), and every day new addresses fell to 900 (-38% QoQ).

By way of quick worth motion, the DOT worth has traded on the $8 stage for the previous 4 days, and has since consolidated above it. The token has been probably the greatest performers since Donald Trump’s election on November 5, posting a considerable 96% acquire within the month-to-month time-frame.

Featured picture from DALL-E, chart from TradingView.com