Bitcoin Primed for ‘Some Sort of Thanksgiving Rally,’ According to Crypto Analyst – Here Are His Targets

A intently adopted crypto analyst says he believes Bitcoin (BTC) could also be on the verge of a Thanksgiving breakout.

In a brand new thread on the social media platform X, crypto strategist Ali Martinez tells his 91,000 followers that Bitcoin might surge by practically 4% throughout the vacation.

He believes that Bitcoin holders will persuade relations at vacation gatherings to purchase the flagship digital asset, sending its value larger. The dealer additionally says that Bitcoin could also be flashing a bullish sign on its day by day chart.

“Tonight, coiners are going to inform their households about Bitcoin, triggering some type of Thanksgiving rally. For this reason I believe BTC is sure for a rebound to $99,000, and the technicals assist it. I might be improper, which is why I’m leaving a decent stop-loss.”

Subsequent up, the dealer uses the In/Out of the Cash Round Value (IOMAP) metric – which classifies crypto addresses as both profiting, breaking even, or shedding cash – to find out a key assist degree for Bitcoin.

“One key demand zone for Bitcoin to observe is $93,580, the place 667,000 addresses purchased practically 504,000 BTC. Staying above this assist degree is a should to stop these holders from promoting!”

Earlier this week, the dealer suggested Bitcoin could also be arrange for a brief squeeze. A brief squeeze occurs when merchants who borrow an asset at a sure value in hopes of promoting it for decrease to pocket the distinction are pressured to purchase again the property they borrowed as momentum strikes in opposition to them, triggering additional rallies.

“Over $409 million in lengthy positions have been liquidated up to now 24 hours [on November 25th]. Now, $772 million briefly positions danger liquidation if Bitcoin rebounds to $98,000!”

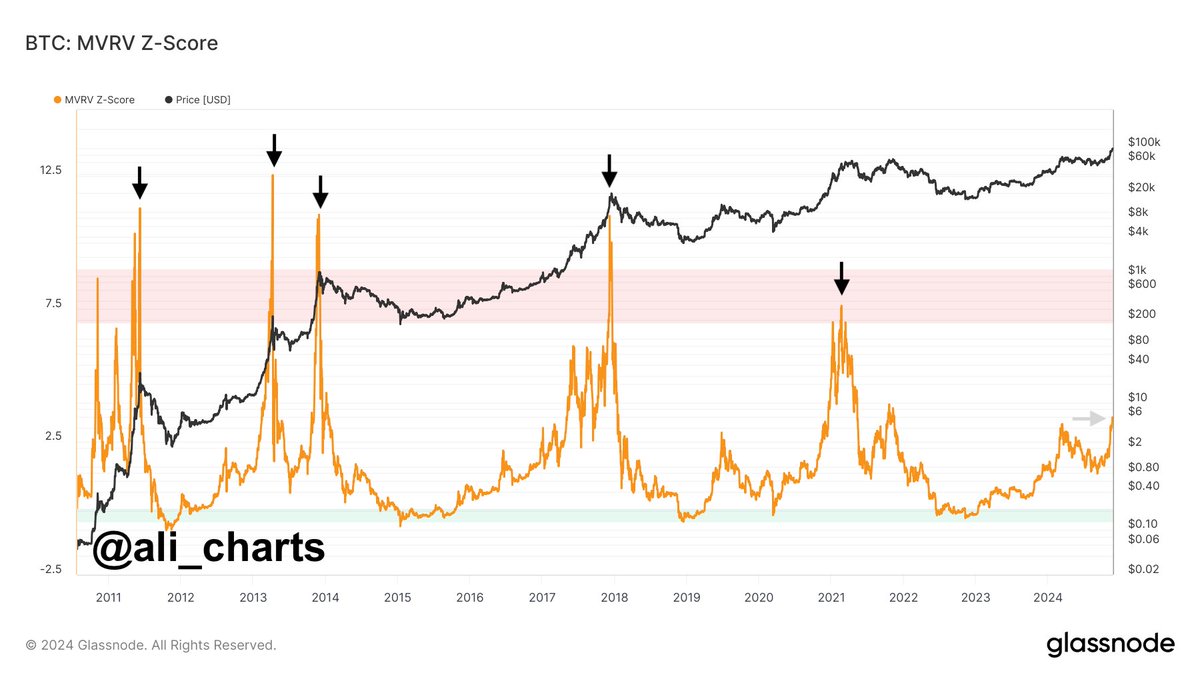

The dealer additionally says that Bitcoin could also be removed from its cycle peak primarily based on the MVRV (market worth to realized worth) Z-score, which goals to measure whether or not BTC is “undervalued” or “overvalued” by evaluating its market worth to its realized worth. An asset tagged with a low MVRV Z-score is seen as undervalued whereas these with a excessive MVRV Z-score are considered as overvalued.

“Bitcoin is way, far, far-off from a market prime!”

Bitcoin is buying and selling for $95,228 at time of writing.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney