Is Ethereum Ready to Break $4,000? Key Metrics Suggest a Bull Run Is Building

- Ethereum has surged practically 20% in two weeks, with important accumulation by buyers.

- Key metrics like lively addresses and whale transactions point out potential for value will increase.

Ethereum [ETH] has proven indicators of breaking out of its current interval of stagnation, lastly gearing up for what might be a major bull rally. After months of underperformance in comparison with Bitcoin, Ethereum is presently buying and selling at $3,558.

This follows a 20% value enhance over the previous two weeks, signaling renewed investor curiosity. Whereas ETH is down by 1.4% up to now day, it stays above the essential $3,500 help stage, highlighting market resilience.

Within the midst of this value motion, market analysts have identified key tendencies that reinforce Ethereum’s potential for sustained development. A CryptoQuant analyst, generally known as theKriptolik, shared insights that make clear ETH’s enduring attraction to main buyers.

The analyst emphasised that regardless of Ethereum’s lower cost ranges in comparison with earlier highs, the ETH Change Provide Ratio has dropped to ranges final seen in 2016. This lower signifies that buyers are transferring their holdings off exchanges, suggesting long-term accumulation.

Whilst circulating provide has elevated, the decline in exchange-held ETH highlights that buyers proceed to view ETH as a protected haven asset.

Key metrics sign rising momentum for Ethereum

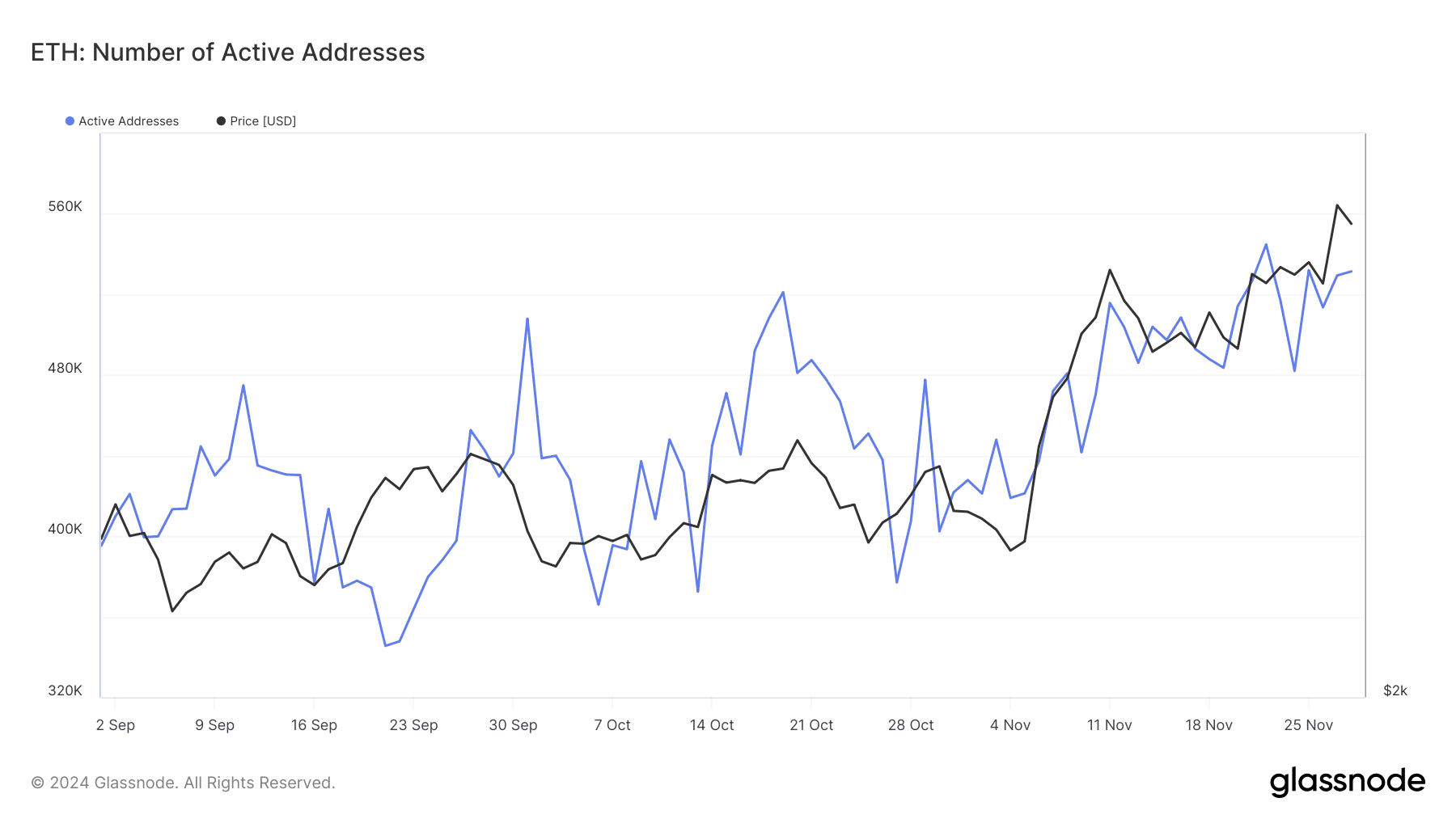

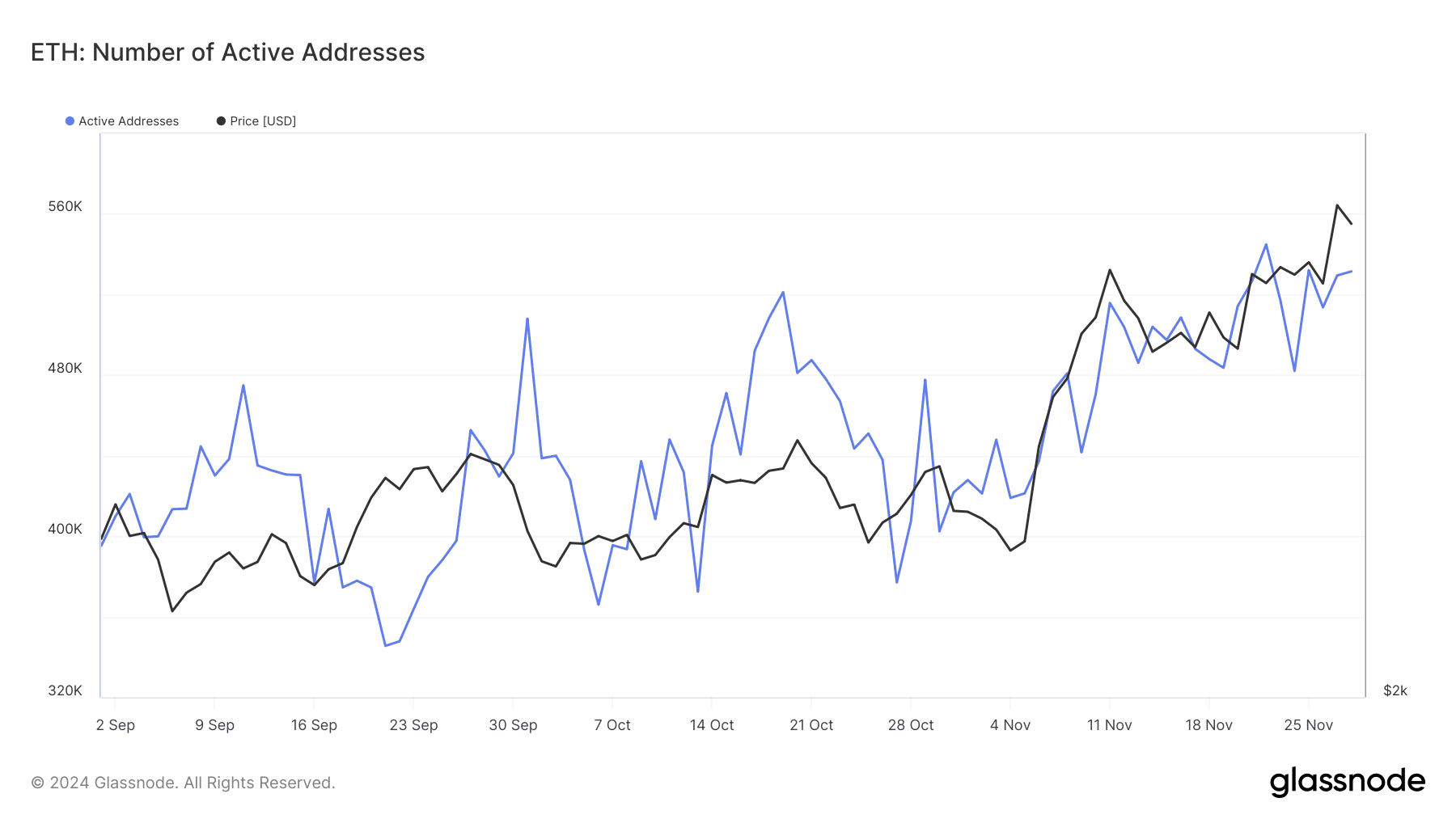

Analyzing Ethereum’s broader metrics reveals further insights into the asset’s efficiency and investor conduct. One notable indicator is the expansion in Ethereum’s lively addresses, a metric typically related to retail investor curiosity.

Based on Glassnode, the variety of lively Ethereum addresses has steadily elevated from beneath 500,000 in October to 531,000 as of twenty eighth November.

Supply: Glassnode

This upward trajectory indicators heightened community exercise, which usually correlates with elevated demand and potential value appreciation.

The rise in lively addresses signifies a rising variety of members partaking with Ethereum’s ecosystem, whether or not for transactions, decentralized purposes, or staking, additional strengthening the community’s fundamentals.

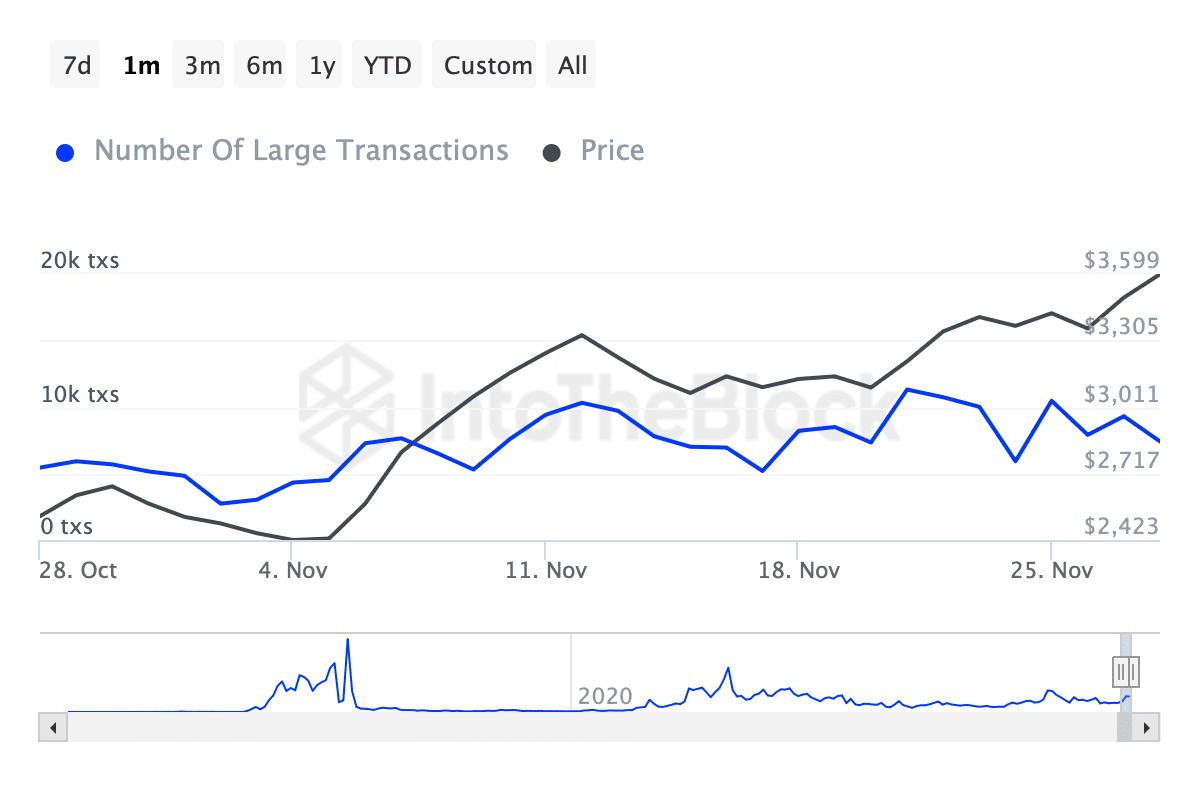

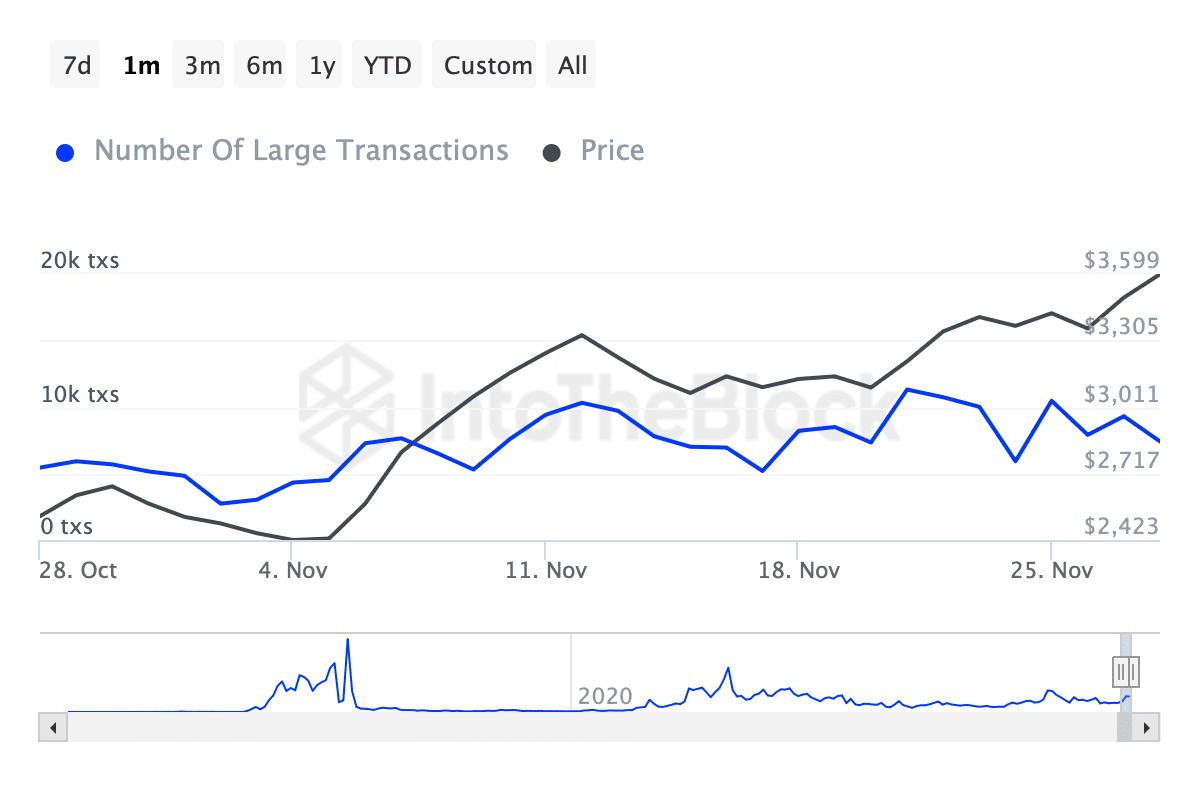

One other important metric is the exercise of Ethereum whales—buyers conducting transactions exceeding $100,000. Data from IntoTheBlock reveals that the variety of whale transactions noticed a peak of 11,210 earlier this month, reflecting heightened institutional exercise.

Nonetheless, this determine has not too long ago declined, with Ethereum recording 7,410 whale transactions as of November 28.

Supply: IntoTheBlock

Learn Ethereum [ETH] Value Prediction 2024-2025

Whereas the slight lower may point out short-term profit-taking, the sustained exercise of large-scale buyers suggests continued curiosity and confidence in Ethereum’s long-term worth proposition.

Usually, an uptick in whale exercise can result in increased value volatility, whereas a discount might sign consolidation or preparation for the following market transfer.