MEW in focus: Analyzing the impact of whales cashing out on prices

- Whale purchased 416 million MEW for 10K SOL, sells for 16.27K SOL.

- Will profit-taking decelerate MEW momentum?

After the whale’s exit, Cat in a canines world [MEW] market efficiency exhibits reasonable volatility. The token traded between a 24-hour low of $0.009228 and a excessive of $0.009704, reflecting cautious market sentiment.

At press time, MEW was 25.4% down from its all-time excessive of $0.01288, achieved on seventeenth November, simply 12 days in the past. The massive query is, does the profit-taking set the highs for MEW coin?

Information from Lookonchain revealed {that a} whale offered 416.8 million MEW tokens for 16,270 SOL value $3.94 million, securing a revenue of 6,270 SOL which is $1.52 million.

The tokens have been initially bought on fifteenth July for 10,000 SOL utilizing a Greenback-Value Averaging (DCA) technique.

The selloff has seen gentle exercise in MEW’s value because the market reacted to the sudden inflow of tokens. This exercise triggered elevated volatility and buying and selling volumes, highlighting how whale transactions can considerably affect token costs and market stability.

What do the Charts say?

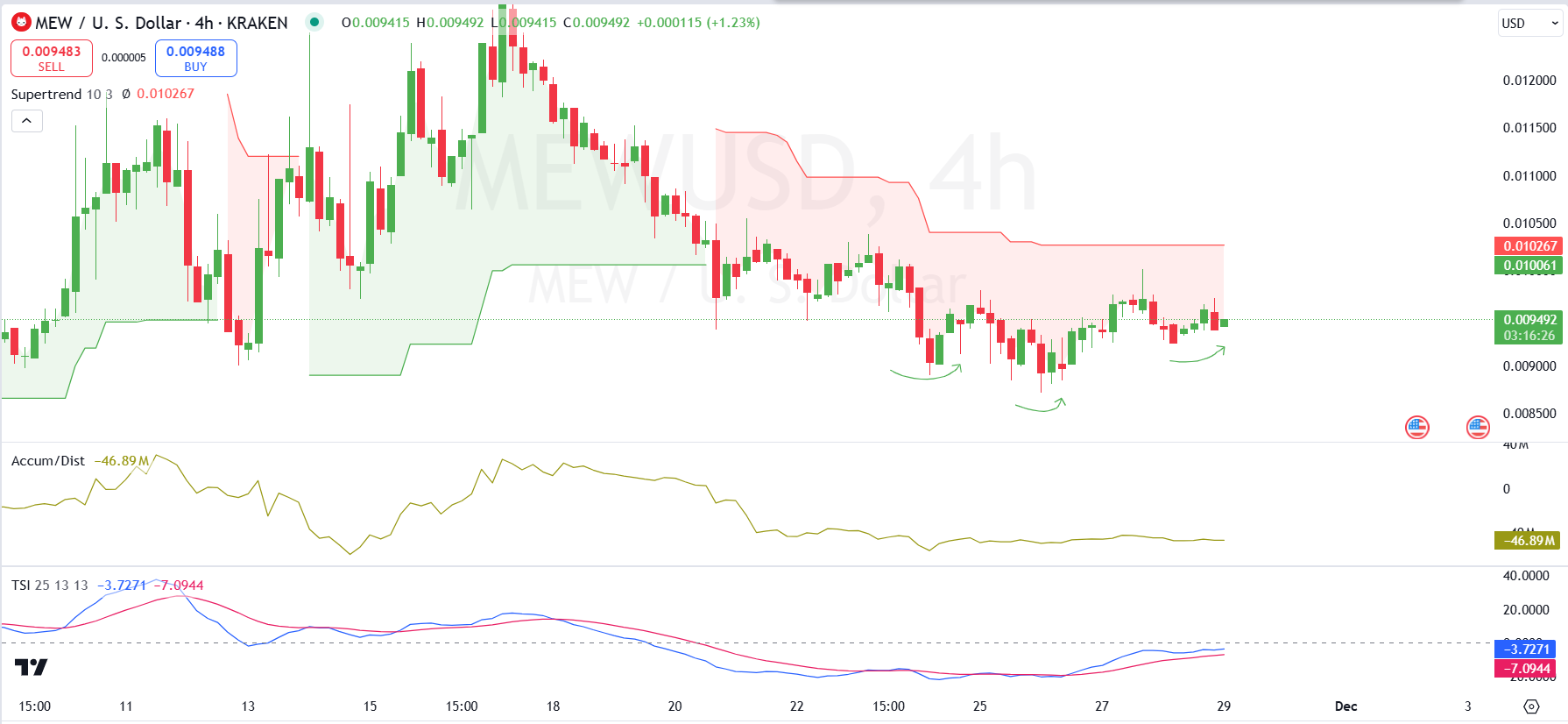

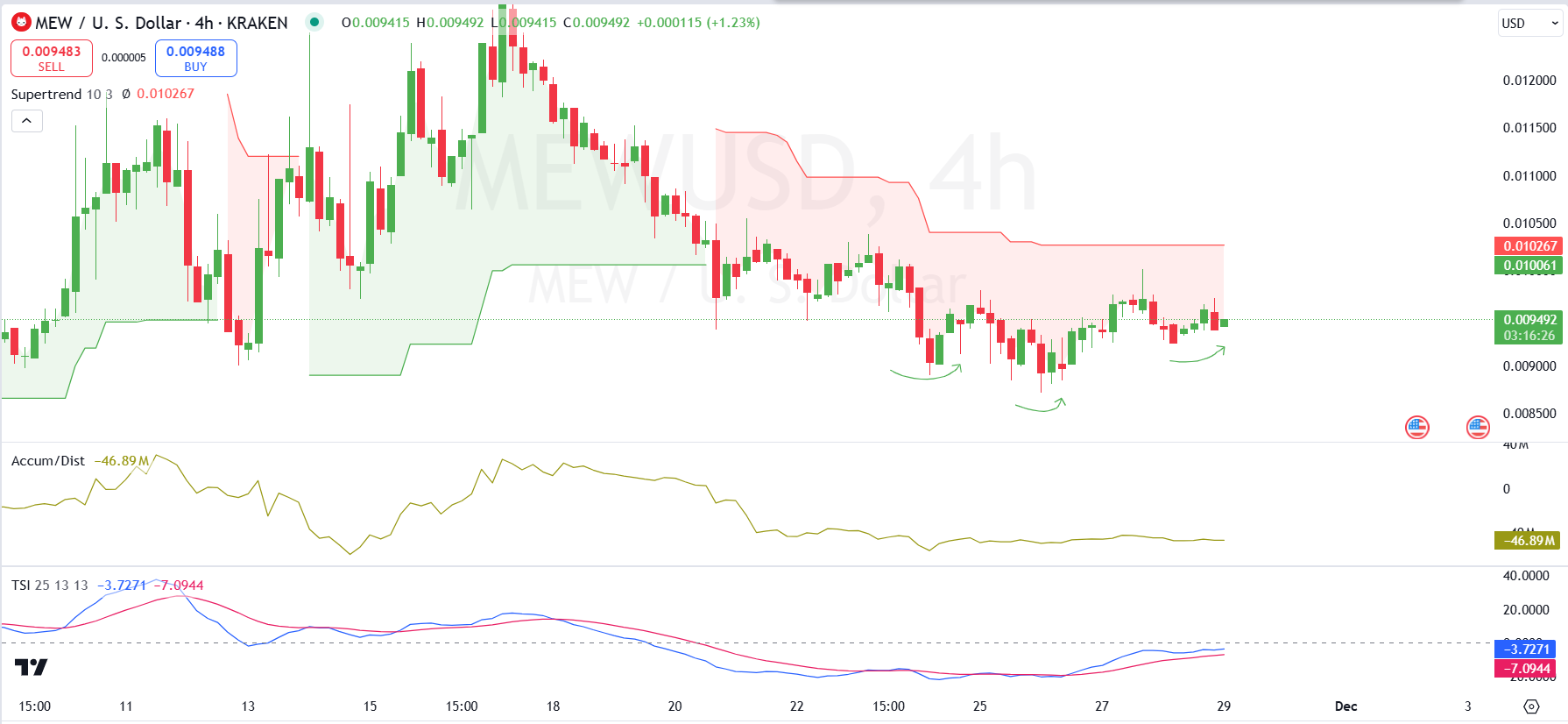

An AMBCrypto evaluation of the MEW/USD 4-hour chart reveals a consolidating value motion following latest market volatility.

The value is at present hovering round $0.0095, exhibiting makes an attempt to get better from Tuesday $0.0088 lows.

The Supertrend indicator highlights a bearish development so long as the value stays beneath the $0.0102 resistance zone, marked by the purple band. Nevertheless, latest increased lows recommend rising bullish momentum.

The Accumulation/Distribution exhibits a decline in demand with a worth of -46.89M, indicating ongoing promote stress.

MEW / USD supply: Tradingview

Regardless of this, the presence of a number of help bounces close to the $0.009 stage alerts that consumers are defending this key space.

If the value efficiently holds above $0.009, it may construct a basis for a bullish reversal.

Ought to MEW break above the $0.01 stage, the development could flip bullish, concentrating on an upside transfer towards $0.012.

The True Energy Index, whereas at present bearish, is approaching a possible crossover, which might verify strengthening bullish momentum.

MEW value struggles as liquidity and curiosity fall

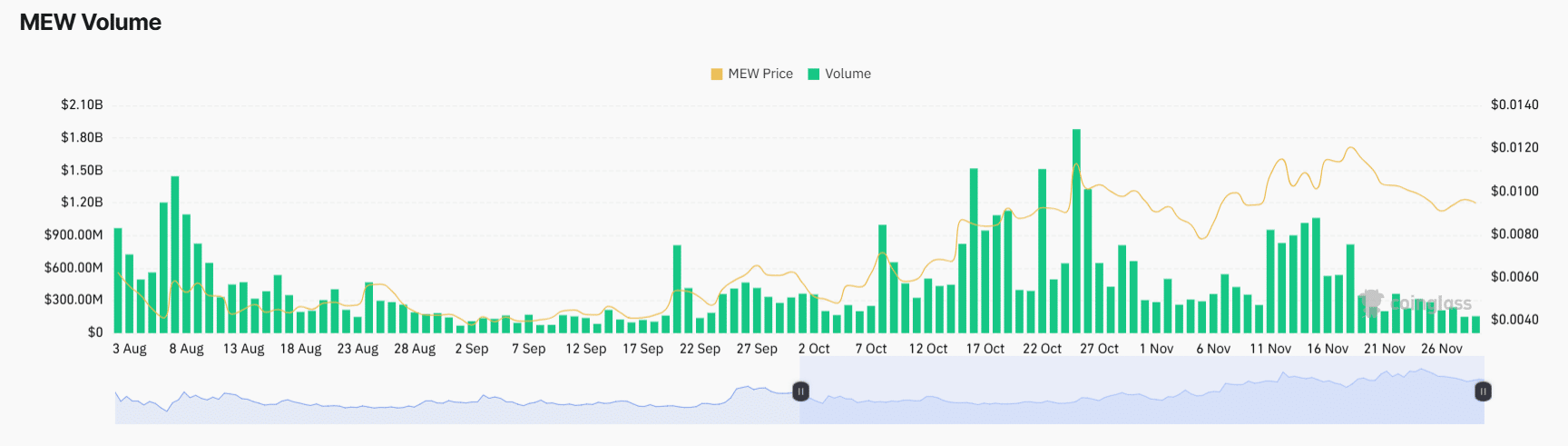

MEW’s buying and selling quantity skilled notable spikes throughout value rallies, corresponding to in early August when quantity exceeded $1.8 billion, and late October, reaching over $1.5 billion.

These intervals of excessive exercise coincided with value will increase, demonstrating sturdy shopping for curiosity.

Nevertheless, since mid-November, buying and selling quantity has declined considerably, averaging under $500 million, as the value dropped from its peak of roughly $0.013 to its present vary round $0.009.

Supply: Coinglass

The decline in quantity exhibits lowered market participation and decrease liquidity.

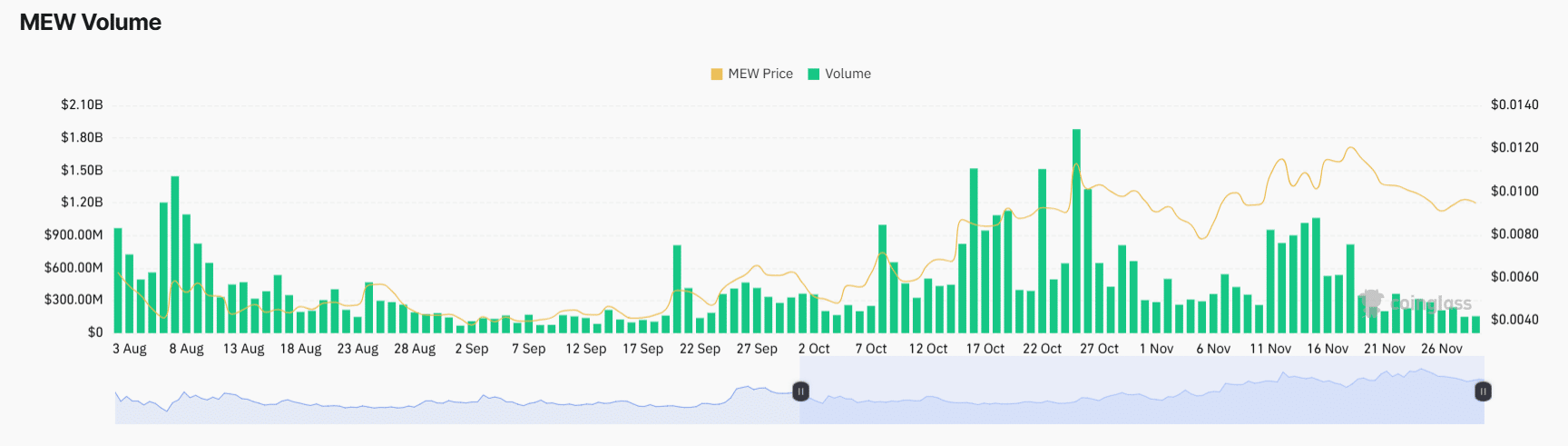

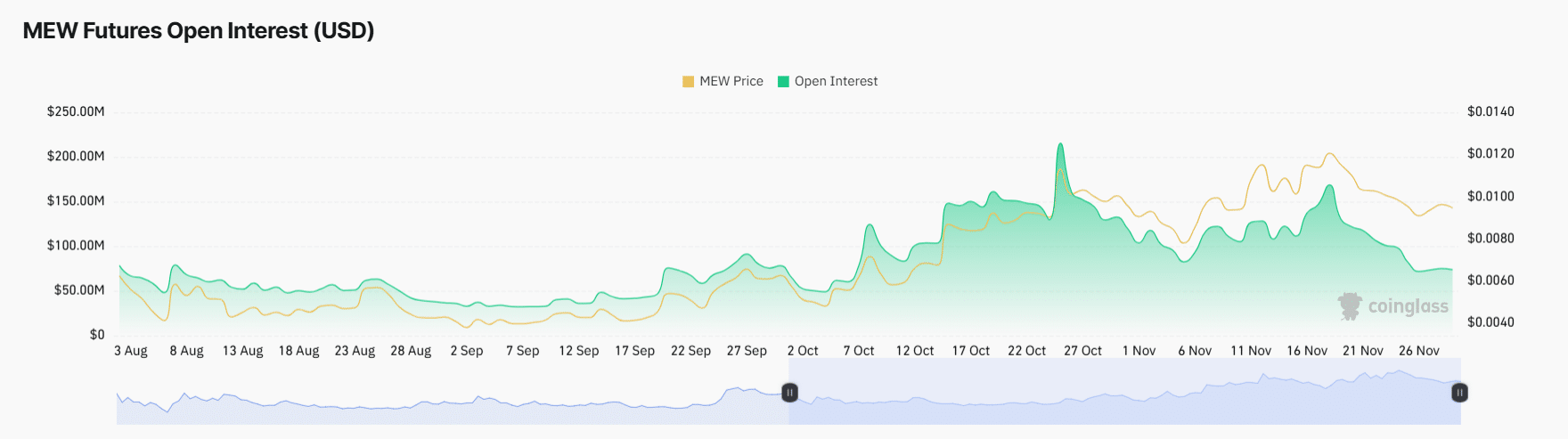

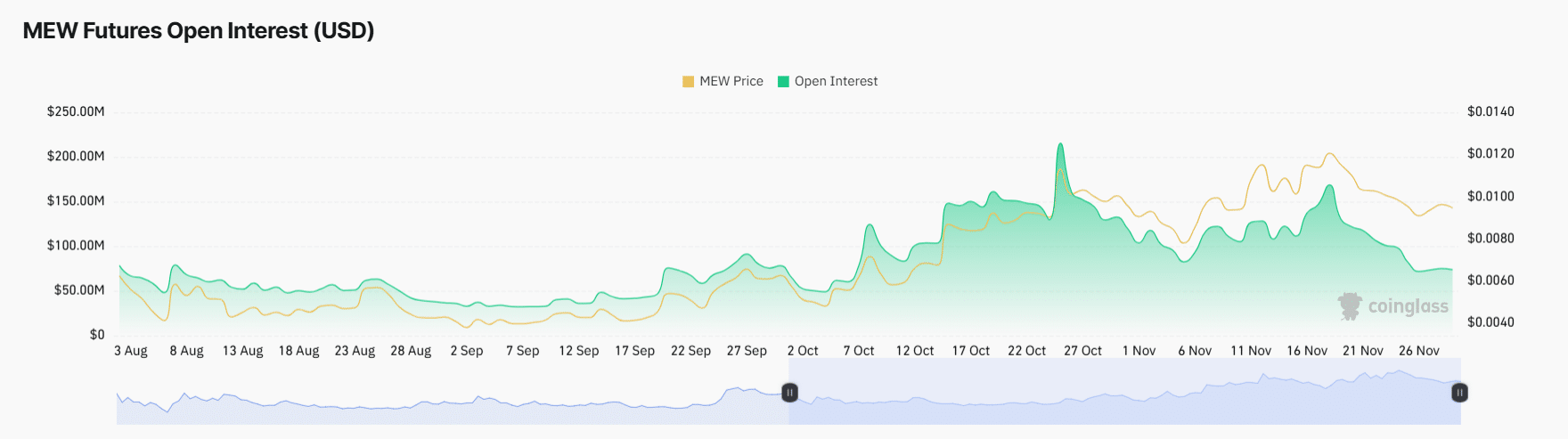

Open Curiosity in MEW Futures mirrored the value motion, peaking at roughly $230 million throughout late October’s rally.

This rise in OI indicated sturdy speculative curiosity, with merchants opening positions throughout the value surge.

Supply: Coinglass

Nevertheless, OI has since declined alongside the value, falling under $50 million by late November.

Life like or not, right here’s MEW’s market cap in BTC’s phrases

This discount displays a scarcity of latest positions being opened and merchants closing current contracts, an indication of decreased confidence in sustained upward momentum.

The mixed information highlights a bearish shift in market sentiment. These tendencies recommend that for MEW to regain upward momentum, it requires a major improve in each buying and selling exercise and speculative curiosity.