Bitcoin – Examining the true meaning of exchange reserves on Binance, Coinbase

- Bitcoin’s trade move and reserves have fallen over the previous few months

- A transfer in direction of $100k stays very seemingly for world’s largest cryptocurrency

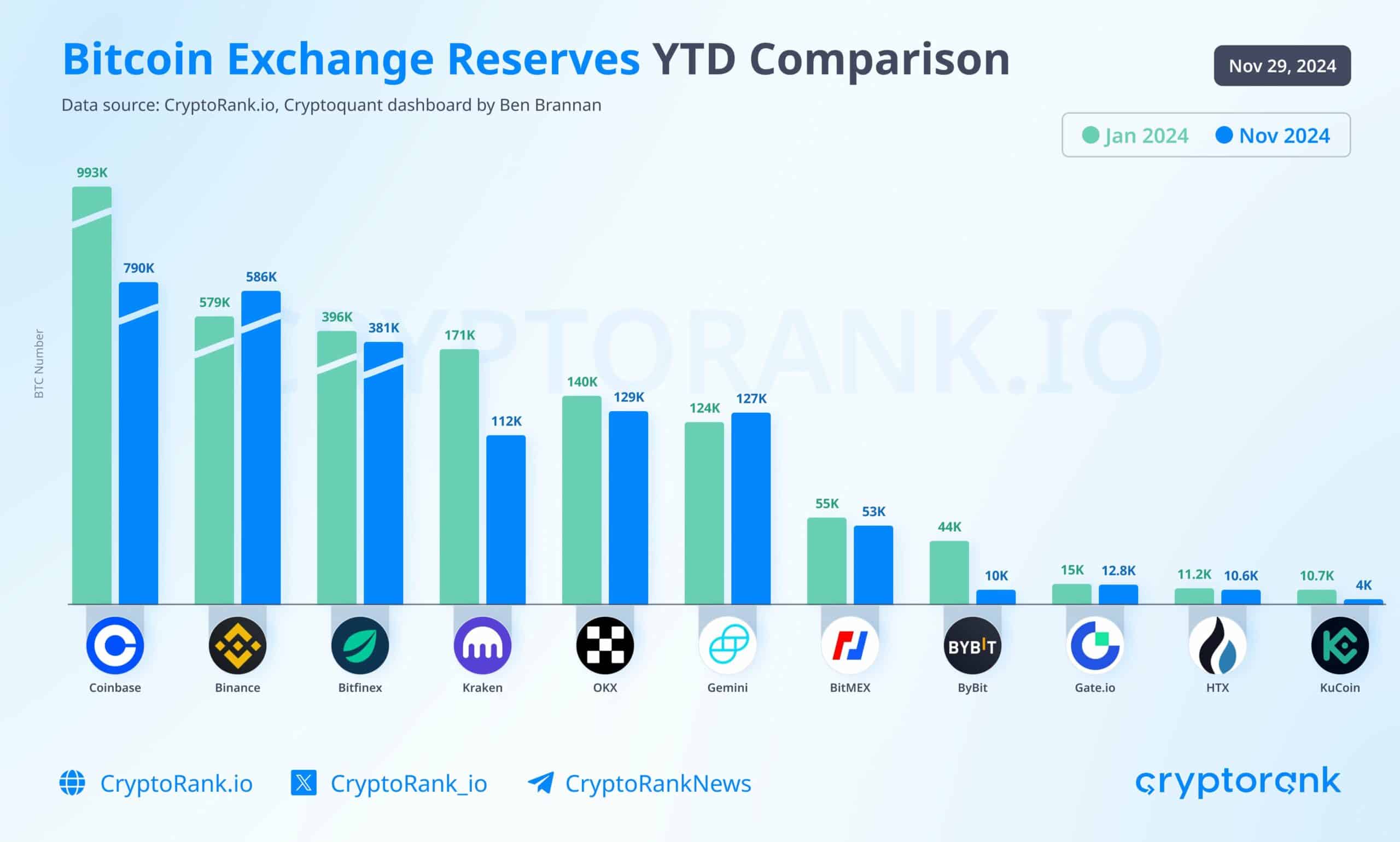

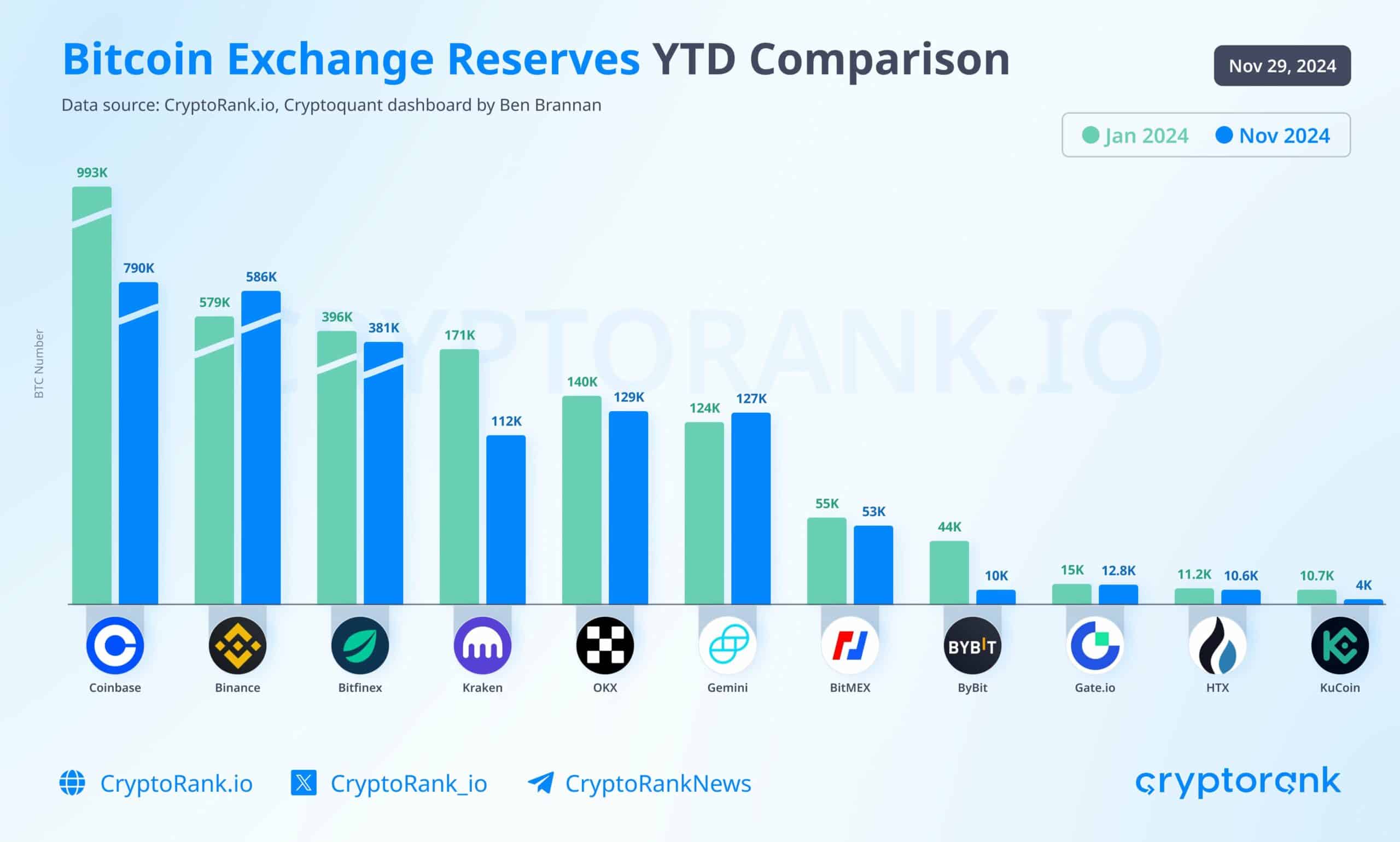

Bitcoin reserves throughout centralized exchanges (CEXs) have proven notable variations this 12 months. Whereas some exchanges like Binance have maintained comparatively steady reserves, others like Coinbase have seen main declines.

These developments have been accompanied by a big drop in exchange-to-exchange Bitcoin flows. This may be interpreted as an indication of a maturing market and larger confidence amongst traders.

Bitcoin trade flows and market sentiment

The exchange-to-exchange move metric, which tracks Bitcoin transfers between exchanges, dropped to unprecedented lows, in line with CryptoQuant. Traditionally, spikes in these flows have coincided with intervals of market turmoil, as merchants moved BTC to Binance throughout main worth declines.

Nonetheless, diminished flows may additionally allude to decreased panic-driven habits – An indication of a extra steady and assured market surroundings.

Supply: CryptoQuant

On the identical time, Bitcoin’s trade reserves, significantly throughout all centralized exchanges, declined sharply over the previous two years.

From over 3.3 million BTC in early 2022 to simply 2.5 million BTC in late 2024, this drop underlined a broader pattern of self-custody adoption and decreased reliance on exchanges for storage. The accompanying chart illustrated this regular decline, correlating with Bitcoin’s bullish trajectory in direction of $100,000.

How exchanges maintain reserves in another way

A deeper dive into exchange-specific information revealed stark variations in how platforms handle Bitcoin reserves.

Coinbase, catering largely to institutional traders, has seen important outflows over the 12 months, with reserves dropping from 993,000 BTC in January to 790,000 BTC in November. This pattern pointed to the rising institutional desire for long-term self-custody options or chilly storage.

Supply: CryptoRank

Quite the opposite, Binance’s reserves have remained comparatively steady, dipping solely marginally from 579,000 BTC to 586,000 BTC.

The divergence between these two main exchanges reiterates the differing methods of their consumer bases – Coinbase for institutional custody and Binance for retail buying and selling.

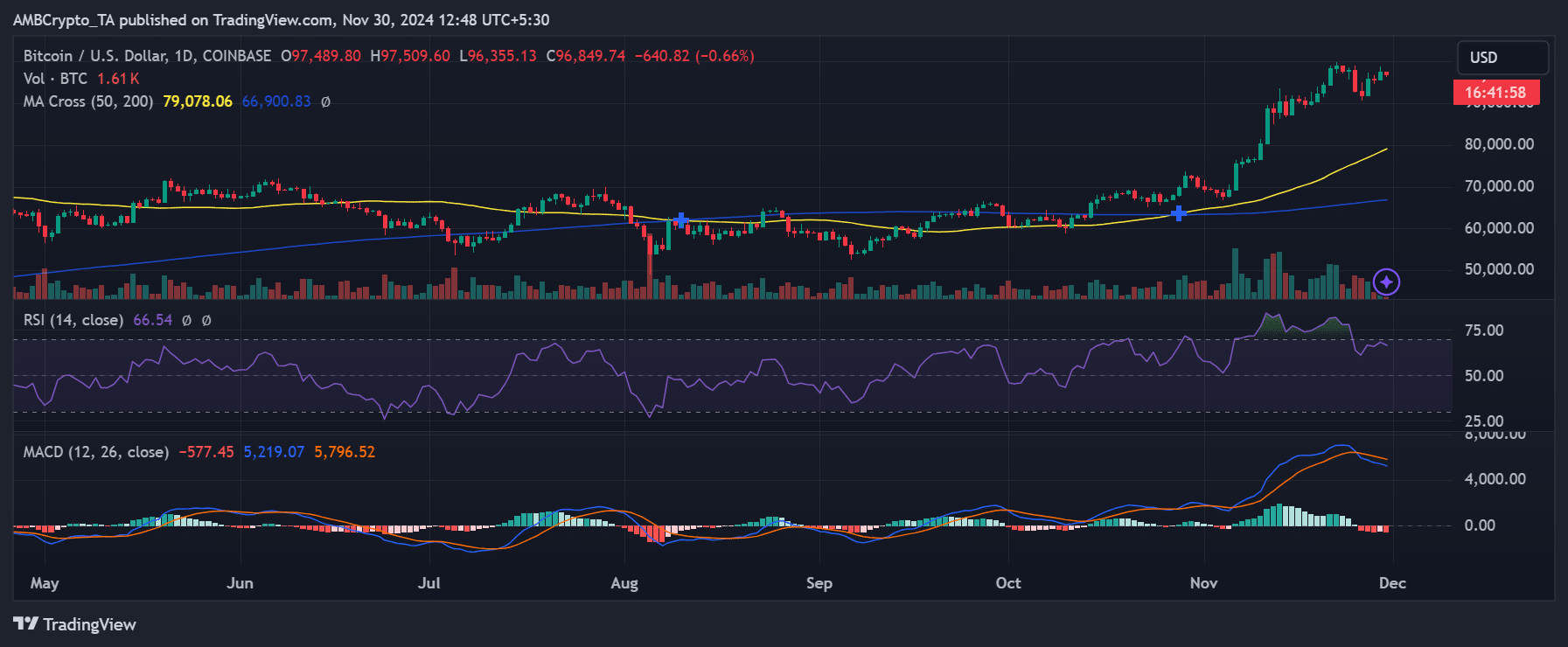

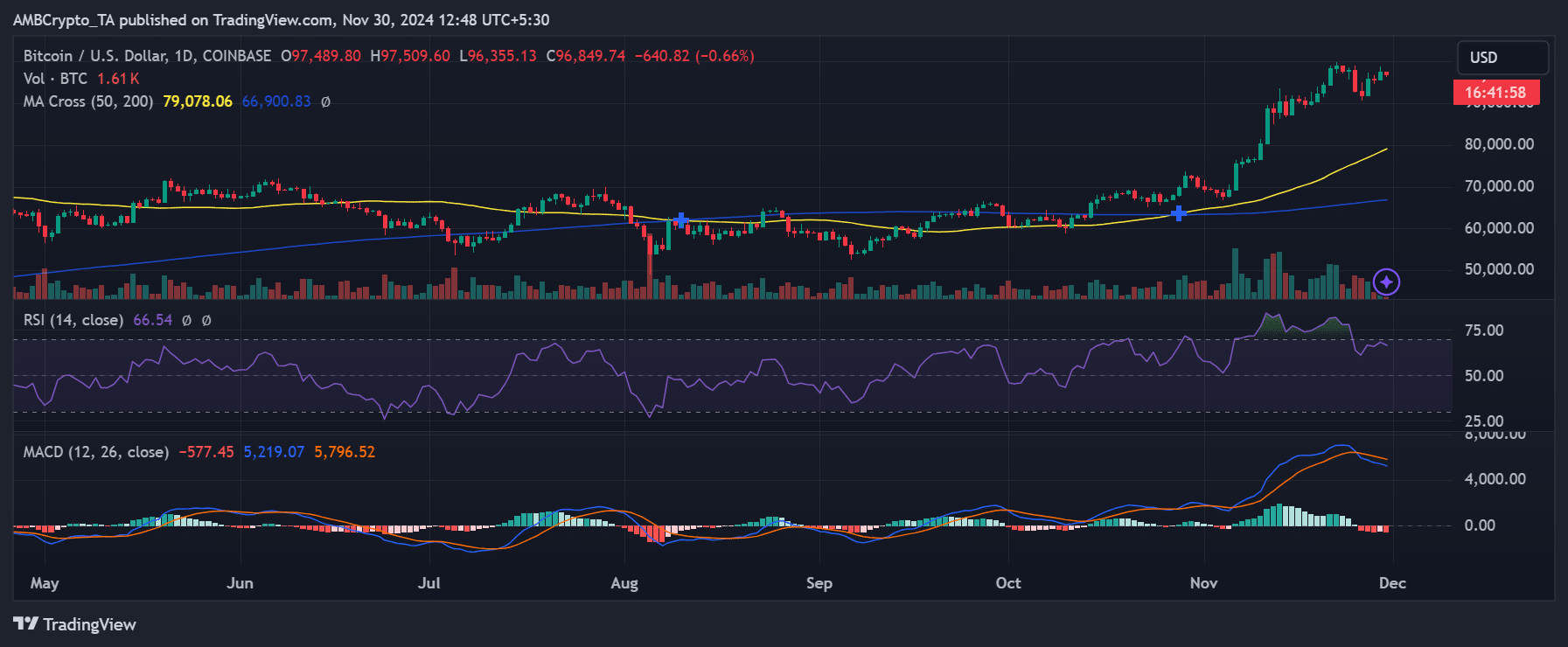

Bitcoin’s worth developments help market stability

Valued at $96,849 at press time, Bitcoin’s worth mirrored the broader market’s energy.

The RSI’s studying of of 66.54 advised the asset stays in overbought territory, however with out alarming divergence. The shifting common convergence divergence (MACD) additionally indicated sustained bullish sentiment – An indication of investor confidence.

Supply: TradingView

Regardless of worth corrections, decreased Bitcoin actions between exchanges means a scarcity of panic-driven promoting. This stability is a departure from earlier cycles the place heightened flows typically coincided with sharp worth declines.

The broader decline in trade reserves and decreased flows to Binance may allude to an evolving market dynamic. A decrease quantity of BTC on exchanges reduces fast promoting strain, doubtlessly paving the way in which for additional worth hikes.

Furthermore, the rise in self-custody is consistent with a maturing market, one the place traders are much less more likely to succumb to panic promoting.

– Learn Bitcoin (BTC) Value Prediction 2024-25

Nonetheless, the focus of liquidity on fewer exchanges like Binance poses its personal challenges. In occasions of heightened buying and selling exercise, liquidity constraints may emerge. Particularly because the market inches nearer to Bitcoin’s psychological $100,000-level.