Ethereum ETFs soar to $428M in inflows: ETH a step closer to $4K now?

- Grayscale continued to have the most important market share in ETH spot ETFs.

- Shopping for strain was rising, and a metric recommended that ETH was undervalued.

Ethereum [ETH] ETFs have showcased commendable efficiency over the previous few days. In reality, its netflows have as soon as once more reached a brand new excessive, reflecting excessive adoption and buyers’ belief. Regardless of this, ETH has been struggling to cross the $4k barrier.

Ethereum ETFs set a brand new report

Lookonchain’s current tweet identified that previously month, 9 Ethereum ETFs have accelerated their holdings of ETH, totaling 362,474 ETH, which have been price over $1.42 billion.

This marked a 4,363% improve in comparison with the earlier month, throughout which solely 8,121 ETH, price over $31.8 million, have been added.

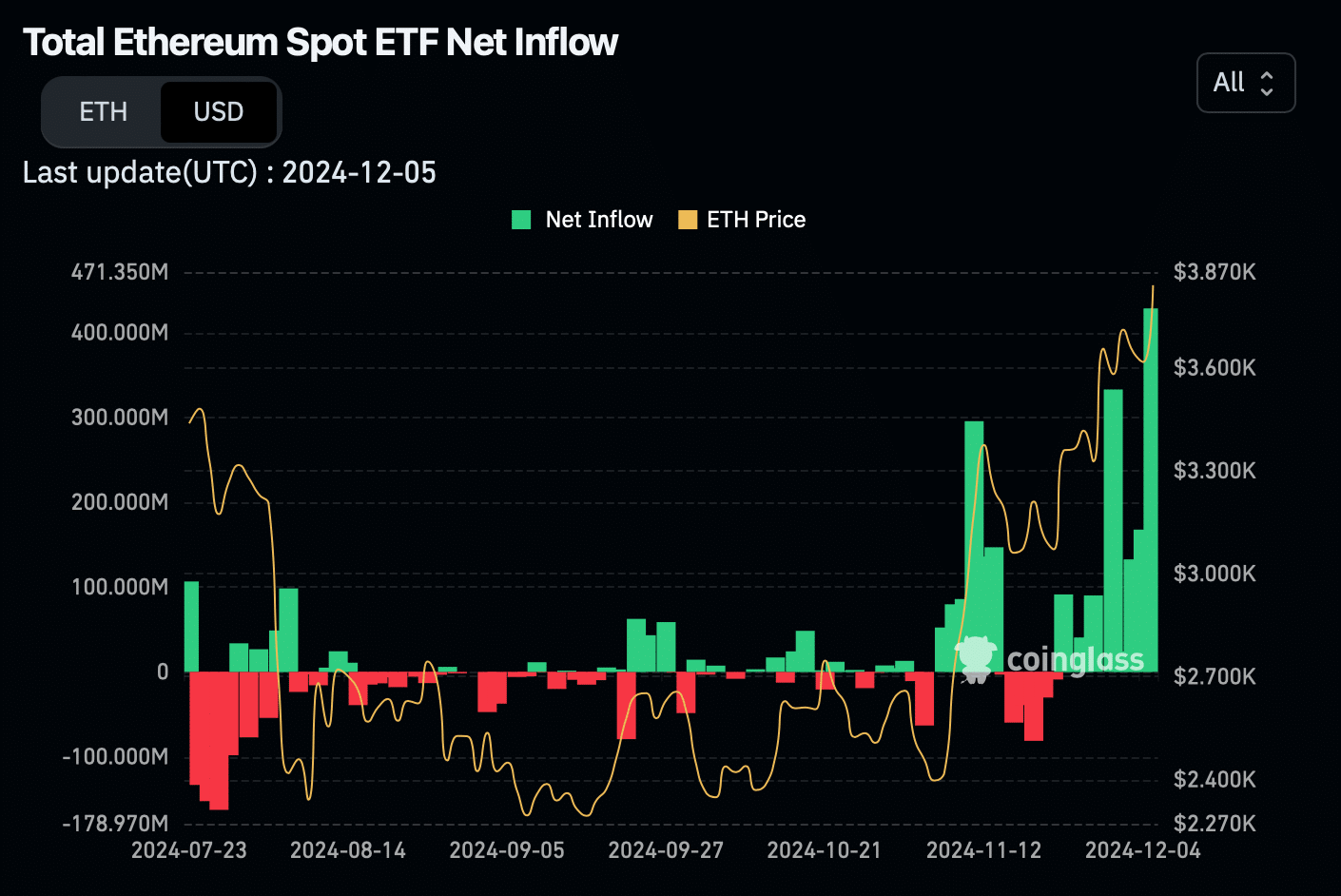

The higher information was that the ETH ETFs inflows reached a excessive. As per Coinglass knowledge, ETH ETF netflows have been on the rise for the previous few weeks. On the fifth of December, netflows hit a whopping $428.5 million, setting a brand new report.

Supply: Coinglass

Mentioning the market share, Grayscale ETF had the most important market share of 47%, as per Dune Analytics’ data.

Grayscale was adopted by Grayscale Mini and BlackRock, which had 13% and 12%, respectively. Whereas Grayscale’s holdings touched $5.8 billion, BlackRock’s holdings stood at $2.9 billion.

ETH’s wrestle continues

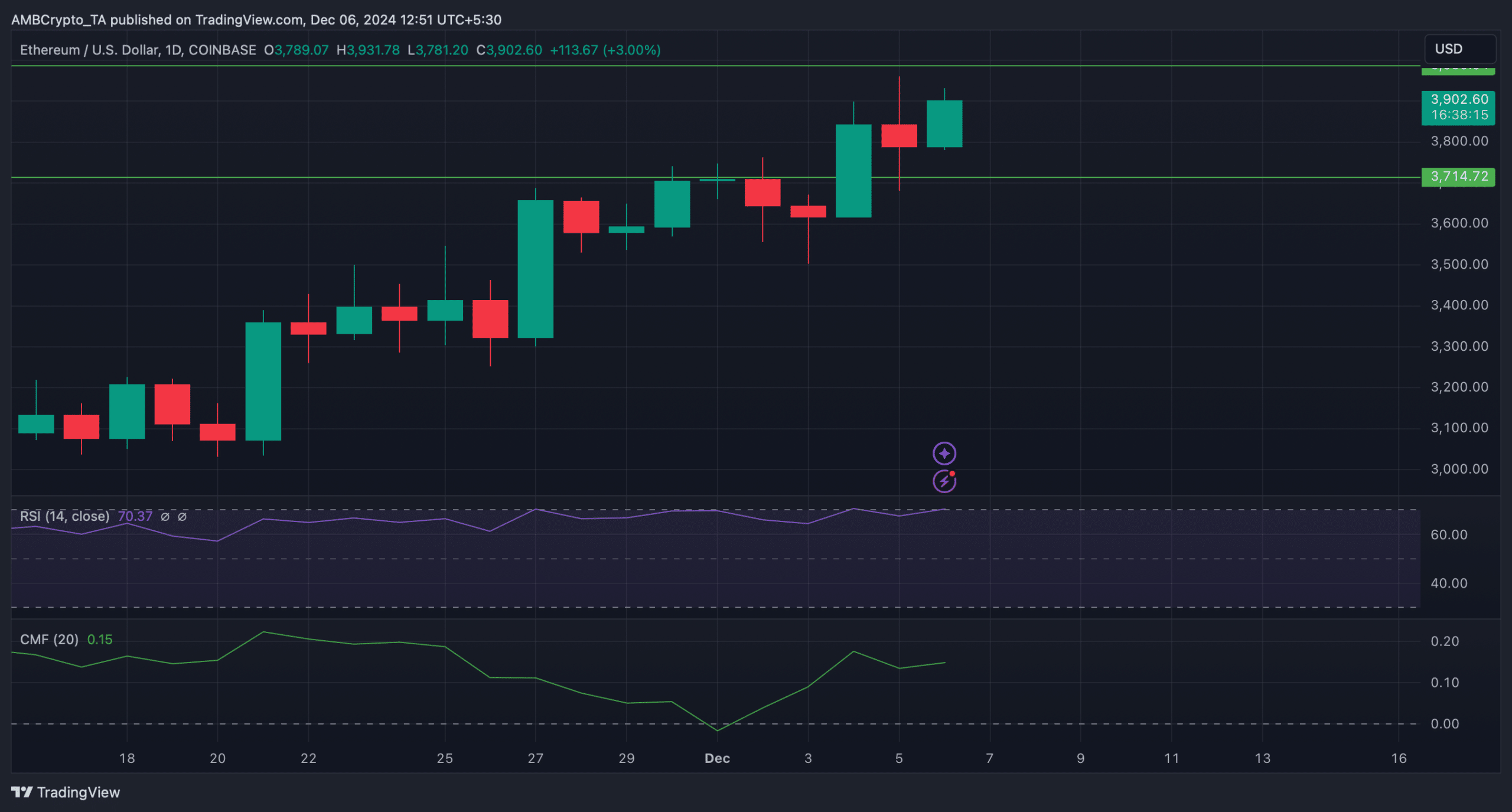

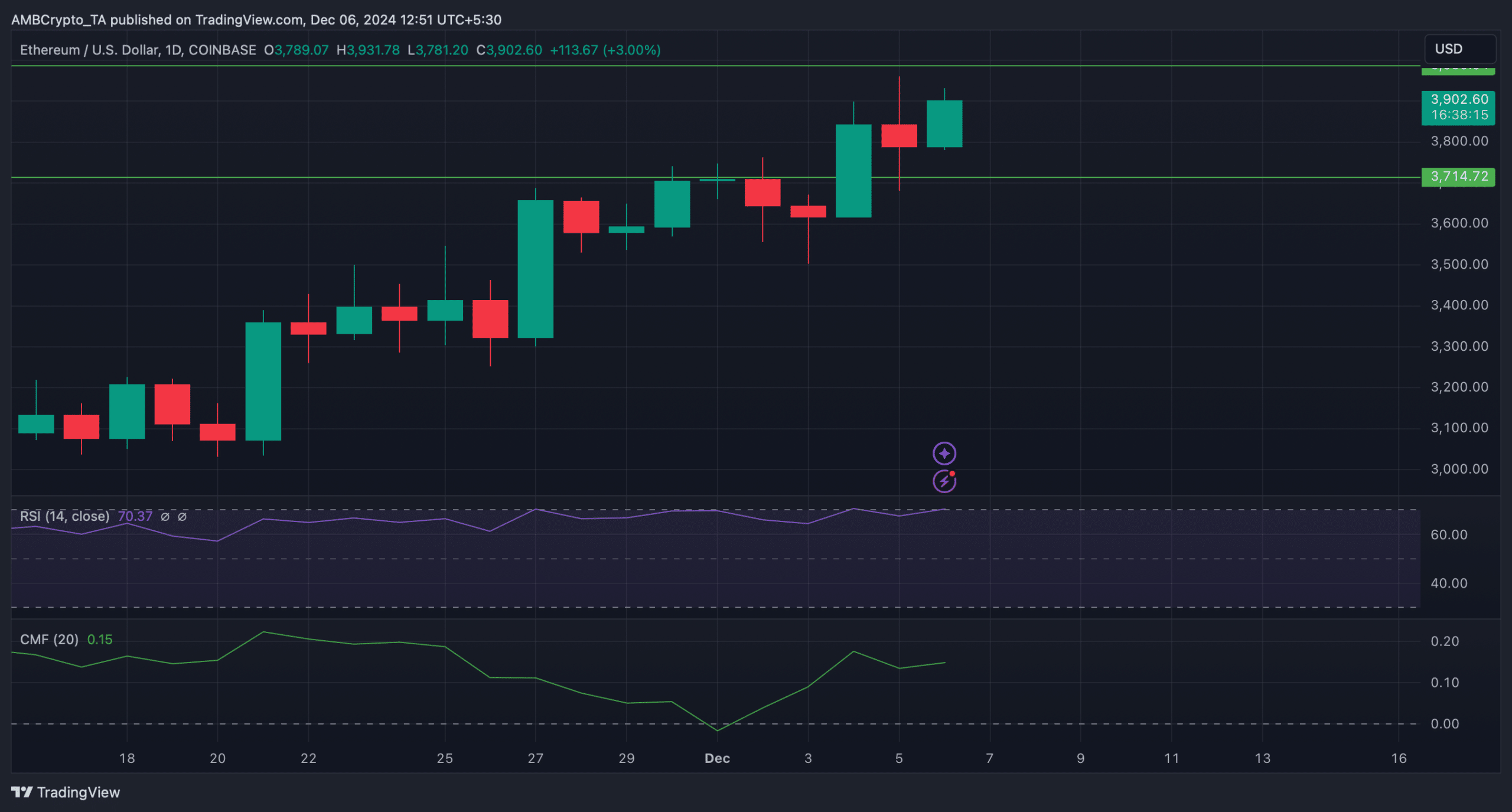

Whereas Ethereum ETFs set a brand new report, ETH was getting rejected on a number of events close to the $4k resistance. At press time, the king of altcoins was buying and selling at $3,912.25 with a modest 1.3% value rise previously 24 hours.

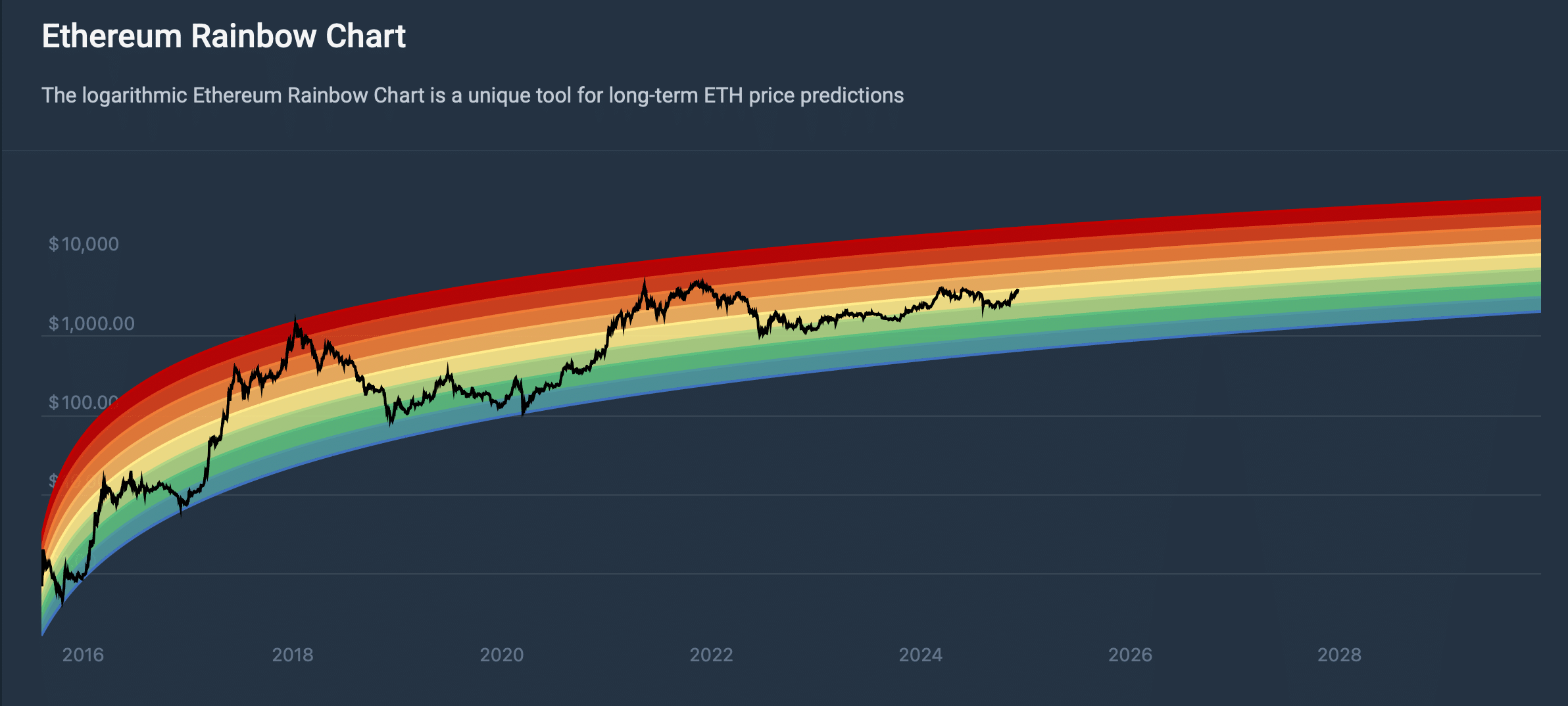

Although the token was struggling to breach a barrier, the Ethereum Rainbow Chart recommended buyers stay affected person. As per the chart, ETH value was within the HOLD zone, which means that the probabilities of the token marching upward within the coming days are excessive.

Supply: Coincodex

In reality, a couple of different knowledge units additionally hinted at an analogous chance. Based on Glassnode’s knowledge, Ethereum’s NVT ratio registered a pointy decline. At any time when the metric drops, it signifies that an asset is undervalued, indicating that the probabilities of a value improve are excessive.

The technical indicator Relative Power Index (RSI) moved northward. This meant that purchasing exercise was rising. A hike in shopping for strain typically leads to value upticks.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Notably, the Chaikin Cash Move (CMF) additionally adopted an analogous growing pattern.

If ETH as soon as once more approaches the $4k resistance and is backed by sturdy shopping for strain, then it gained’t be bold to count on the token flipping the $4k resistance into its new help within the coming days.

Supply: TradingView