ETH’s recent downside could be more than just a meager event thanks to…

- The Ethereum Basis sells a big sum of ETH resulting in bearish hypothesis.

- Deal with exercise suggests that there’s some accumulation regardless of the FUD.

The quantity of FUD within the crypto market in the previous few days intensified, as investor confidence evaporated. This has been the case, notably for ETH following the Ethereum Basis’s massive sale.

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Current prevailing sentiments particularly relating to ETH urged that it lately hit a neighborhood prime. As such, draw back expectations are notably greater this week. The Ethereum Basis has traditionally offloaded a large quantity of ETH from its addresses close to the tops of a bullish development. The Ethereum Basis lately bought off 15,000 ETH.

Ethereum Basis’s large-scale promoting lately document: Not too long ago the Ethereum Basis bought 15,000 ETH. In 2021, EF did promote 20,000 ETH at a excessive level. However in 2020, 100,600ETH was bought at a worth of 657. pic.twitter.com/BCiSlutQ5F

— Wu Blockchain (@WuBlockchain) May 7, 2023

Though the inspiration contributed to promoting strain up to now, it wasn’t all the time on the prime of a bull development. There have been a number of situations the place shopping for strain prevailed regardless of massive outflows from Ethereum Basis addresses. In actual fact, a number of indicators confirmed that there was important demand out there.

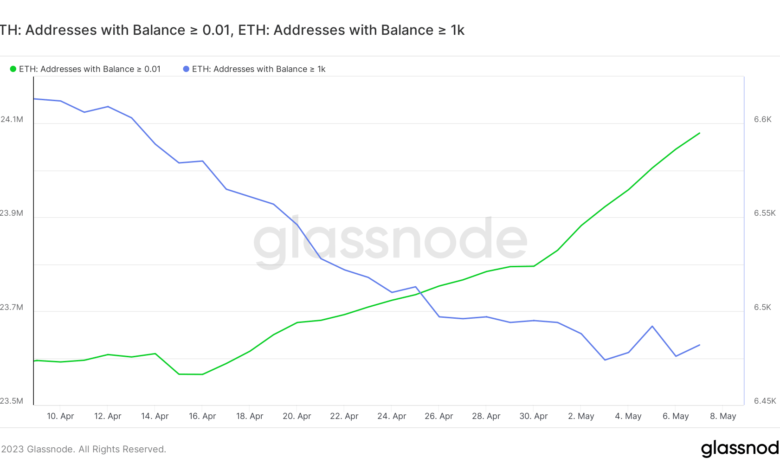

Addresses holding 0.01 ETH or extra simply reached a brand new ATH, confirming that merchants within the retail section had been shopping for. Whereas this will result in hypothesis that they’re offering exit liquidity, a look at whale exercise revealed that addresses holding 1000 or extra ETH have additionally began accumulating within the final two days.

The identical whales beforehand contributed to promoting strain within the final 4 weeks.

Supply: Glassnode

Are mid-to-long time period holders promoting?

Current knowledge urged that long-term holders had been bowing to the FUD and strain to take income. In response to the newest Glassnode alerts, ETH’s realized cap simply reached a brand new five-month excessive. This meant that the majority traders promoting their ETH had been promoting at a revenue.

📈 #Ethereum $ETH Realized Cap simply reached a 5-month excessive of $173,915,307,687.21

View metric:https://t.co/JEcbTHEjsD pic.twitter.com/baI1mZPc6M

— glassnode alerts (@glassnodealerts) May 8, 2023

The identical findings might be taken as an indication that a lot of the current patrons weren’t contributing to the prevailing promote strain. In different phrases, there was nonetheless important demand for ETH at its present worth stage. This will additionally clarify why the draw back is proscribed for now.

Reasonable or not, right here’s Ethereum’s market cap in BTC’s phrases

ETH bears have been encountering assist simply above the $1800 worth vary. A rise in promote strain could weaken the identical assist and result in decrease costs. There was a spike in lively deposits within the final 48 hours on the time of writing, which underscores greater promote strain.

Supply: Santiment

Community progress has additionally tanked considerably since 5 Could. That is probably attributable to decrease natural exercise amid the gradual market circumstances. The current memecoin hype contributed to a big quantity of exercise lately.