Analyst Releases Bullish End Of Year Forecast Despite Failure At $100,000

Este artículo también está disponible en español.

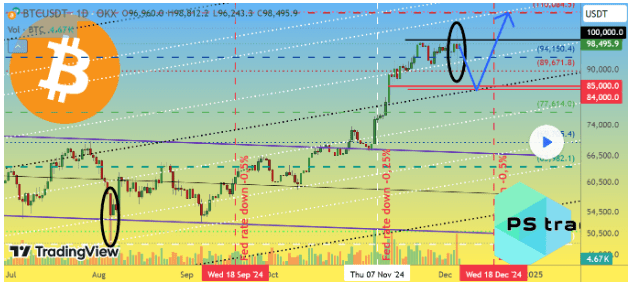

The Bitcoin value appears to be dealing with considerably of a value failure because it crossed above the $100,000 value stage. Within the few hours after crossing above this psychological threshold, the Bitcoin value confronted rejection and corrected till it reached $94,000.

Associated Studying

Nevertheless, this correction doesn’t essentially sign a bleak outlook for the world’s largest cryptocurrency, particularly as investor sentiment continues to hover within the excessive greed zone. In accordance with technical evaluation, the Bitcoin value remains to be open to climbing nicely above $100,000 by the tip of December 2024.

File Bitcoin Liquidations Shake The Market

Bitcoin’s broader market dynamics and investor sentiment counsel that Bitcoin’s failure at $100,000 might be a short lived pause reasonably than a long-term reversal. Apparently, a detailed analysis posted on the TradingView platform helps this outlook and affords a daring prediction for the yr’s finish.

The evaluation highlighted December 5, 2024, as a historic day for cryptocurrency liquidations. Complete liquidations reached a staggering $1.1 billion, surpassing the earlier report of $950 million set on August 5, 2024. The breakdown included $820 million in liquidated lengthy positions and $280 million in liquidated quick positions.

Though value knowledge from Coinmarketcap and CoinGecko reveals a backside round $93,600, the Bitcoin value dipped to $89,000–$90,000 relying on the change.

In accordance with the evaluation, such a dramatic transfer is described as a “helicopter” on the BTCUSDT chart, and it displays a cooling-off interval resulting from overheating from all technical indicators.

Regardless of the correction and loopy liquidations, the analyst maintained that Bitcoin’s uptrend stays intact. It is because the Worry and Greed Index, a well-liked sentiment indicator, remained within the “greed” zone at 71 regardless of Bitcoin’s sharp drop. On the time of writing, the Worry and Greed Index has elevated to the “excessive greed” zone at 82, suggesting that market contributors are nonetheless optimistic about Bitcoin’s future trajectory.

Daring Yr-Finish Value Prediction

Apparently, the altcoin market barely reacted to the Bitcoin value response, which additionally creates the potential of one other wave downwards earlier than a broader market restoration.

The analyst outlined a state of affairs for the Bitcoin value most likely occurring one other decline and break beneath $90,000. The forecast suggests Bitcoin may drop additional to the $84,000–$85,000 vary earlier than rallying to $110,000.

Adding to the bullish narrative is the upcoming Federal Open Market Committee (FOMC) assembly, which is scheduled to happen on December 18. Market expectations level to a 0.25% charge reduce by the Federal Reserve, a transfer that would inject additional momentum into Bitcoin’s value restoration very like the September and November charge cuts.

Associated Studying

On the time of writing, the Bitcoin value is buying and selling at $99,450 and is about to interrupt above $100,000 once more. On-chain knowledge reveals that Bitcoin whales have taken benefit of the value decline to load up extra BTC. Notably, addresses holding between 100 and 1,000 BTC have increased their collective holdings by 20,000 BTC previously 24 hours, valued at $2 billion.

Featured picture from Pixabay, chart from TradingView