Bitcoin at $96K: Is a $100K BTC rebound likely in December? Latest data shows…

- Shopping for strain was rising, which will help flip BTC’s charts inexperienced.

- A bullish development reversal can push BTC in direction of $100k once more.

After crossing $100,000 just a few days in the past, Bitcoin [BTC] has been witnessing a number of corrections. These pullbacks have as soon as once more pushed the king coin all the way down to $97,000.

In the meantime, a latest evaluation urged that BTC has a short-term assist close to $96k. Does this imply BTC will lose extra worth, or is it making ready a restoration rally to $100k?

Bitcoin is struggling

Bitcoin witnessed a greater than 2.5% value decline prior to now 24 hours, pushing it below the $97k mark. On the time of writing, the king coin was buying and selling at $96,970.58 with a market capitalization of over $1.91 trillion.

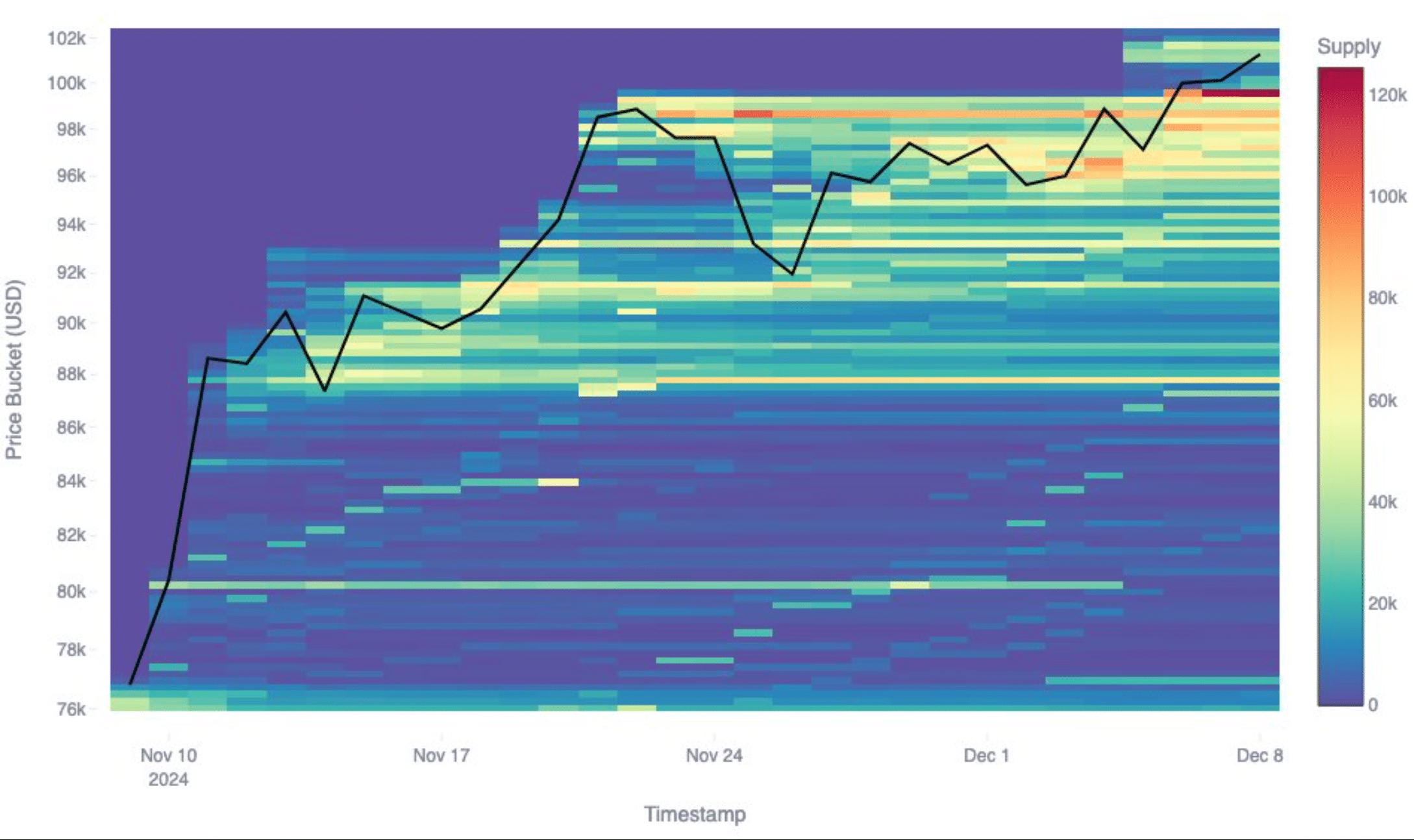

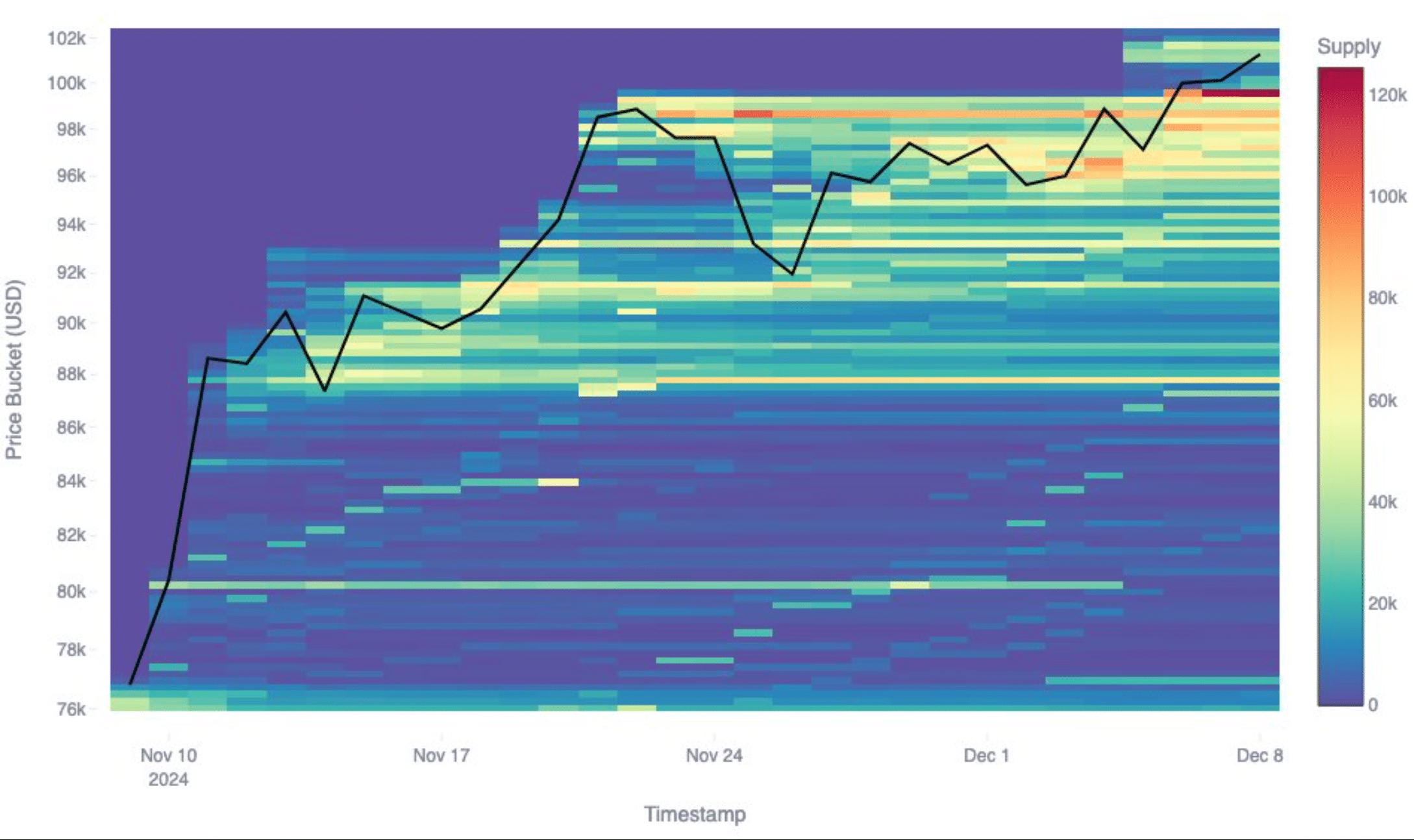

Glassnode, a knowledge analytics platform, posted a tweet highlighting a notable improvement.

The evaluation used BTC’s Price Foundation Distribution (CBD) metric, which reveals the place BTC’s provide has clustered at key value ranges.

Current knowledge confirmed $99,559 as the biggest accumulation zone beneath $100k (125k BTC), whereas $96k–$98k, with 120k BTC accrued, formed up as a possible assist within the quick time period.

Supply: X

In truth, AMBCrypto beforehand reported that BTC would possibly drop to its assist close to $96k quickly. This was the case because the king coin’s MVRV ratio reached a historic degree, which on previous events was adopted by value corrections.

Can BTC get better anytime quickly?

AMBCrypto then checked Bitcoin’s newest datasets to seek out out whether or not BTC will witness additional value drops or if it exhibits indicators of a restoration rally in direction of $100k once more.

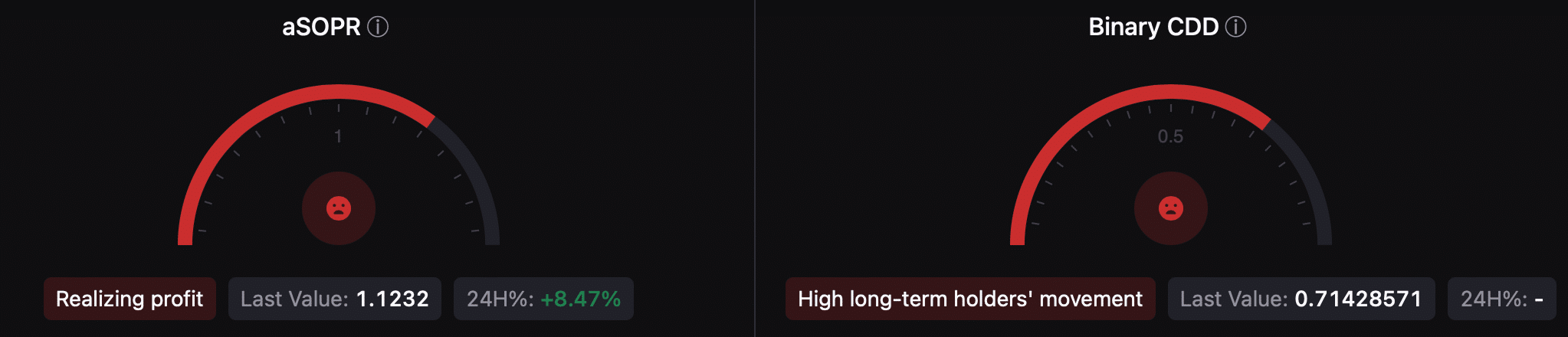

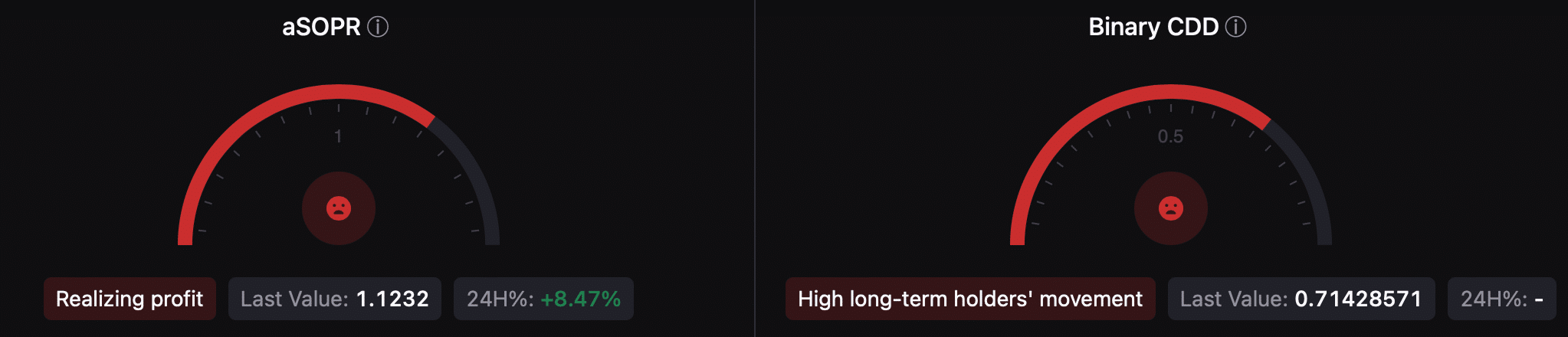

CryptoQuant’s data revealed that BTC’s aSORP was crimson. Extra buyers are promoting at a revenue. In the midst of a bull market, it might point out a market prime.

Moreover, the king coin’s Binary CDD urged that long-term holders’ motion within the final 7 days was increased than the common. In the event that they have been moved for the aim of promoting, it could have a destructive impression.

Supply: CryptoQuant

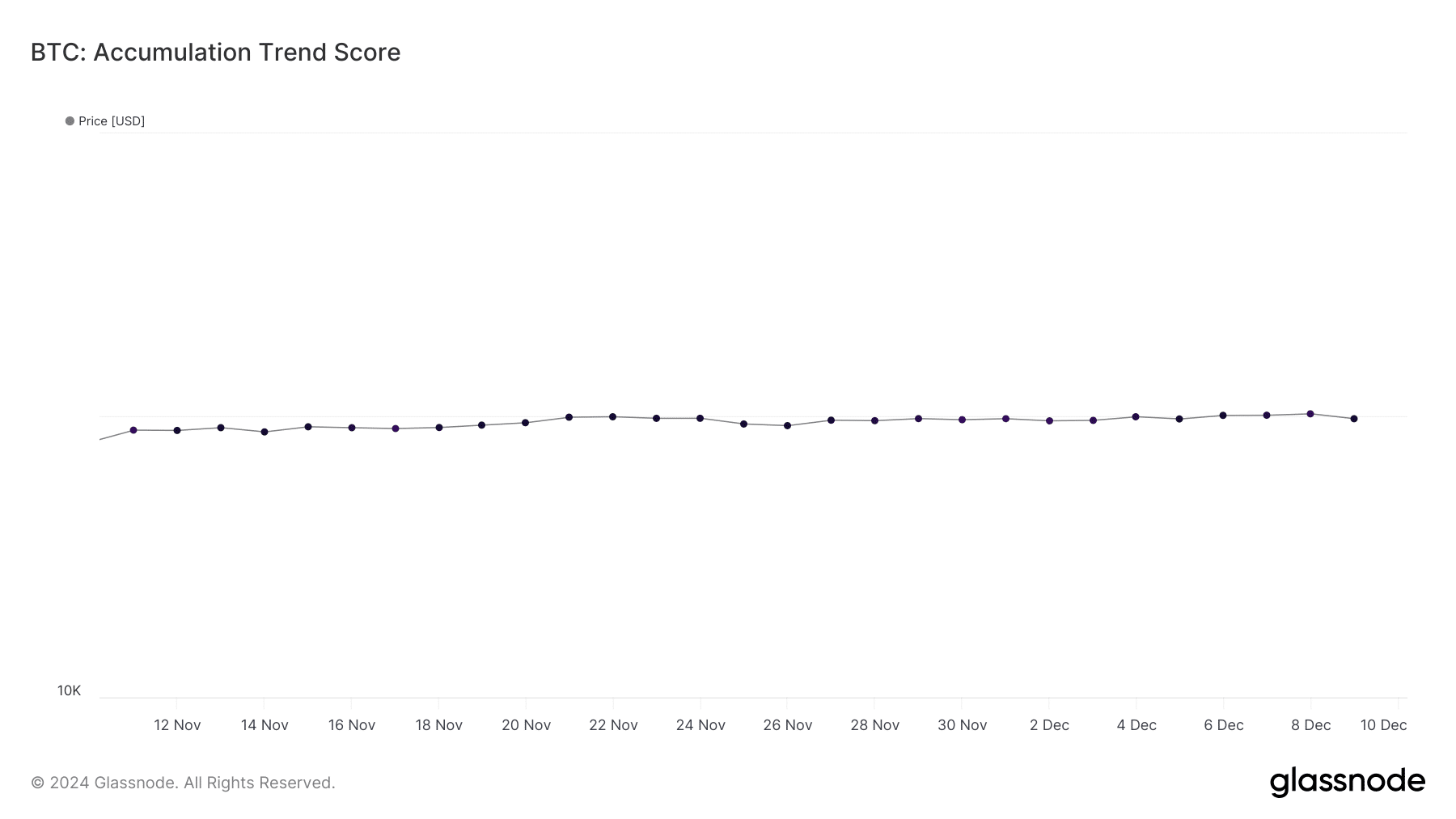

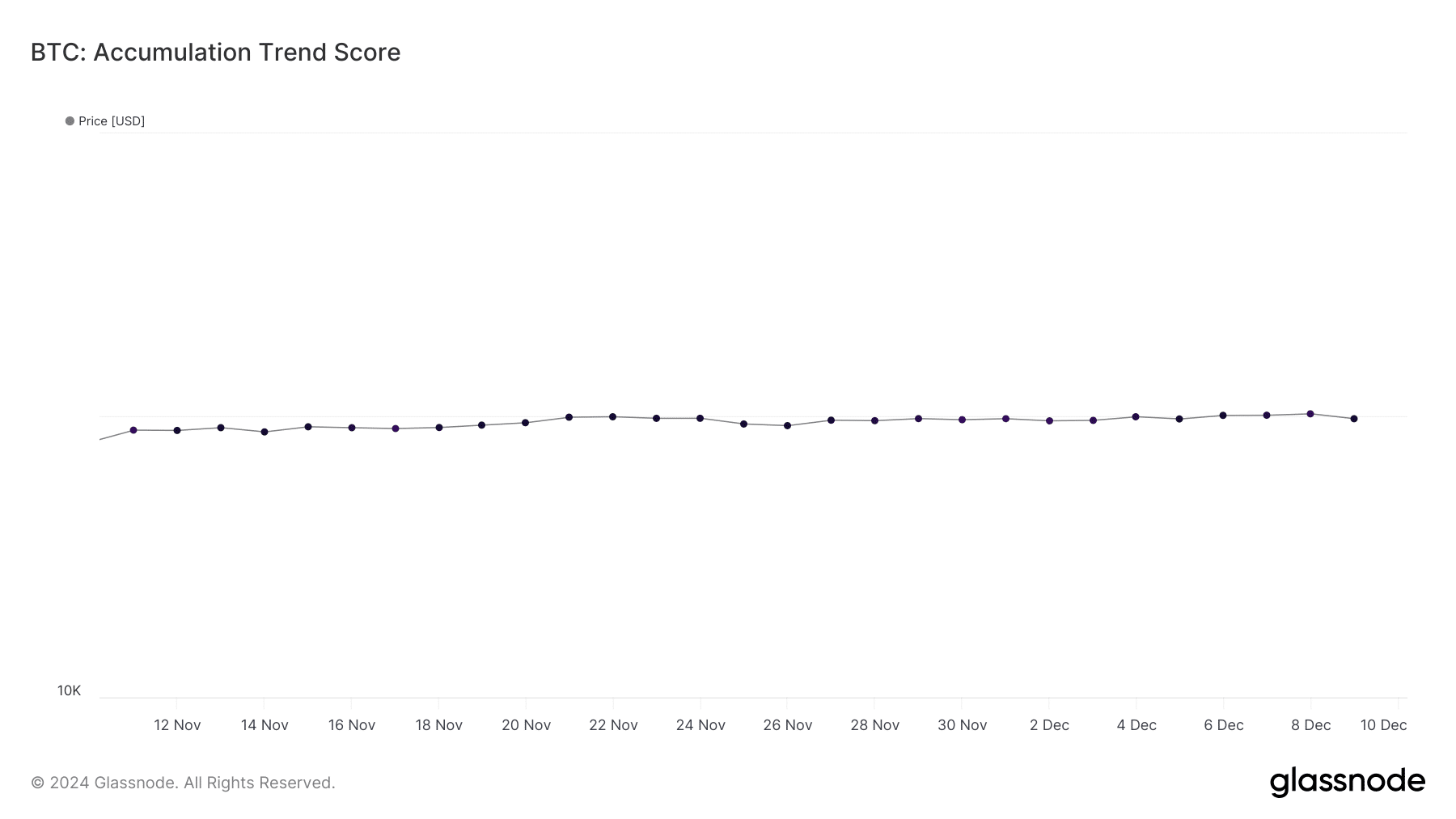

Nonetheless, BTC’s change reserve indicated that purchasing strain elevated within the final 24 hours because the metric was declining. Aside from this, BTC’s accumulation development rating had a price of 1.

For starters, a price nearer to 1 is an indication of excessive accumulation, which exhibits buyers’ confidence within the coin and may set off a bullish development reversal.

Supply: Glassnode

Learn Bitcoin’s [BTC] Value Prediction 2024-25

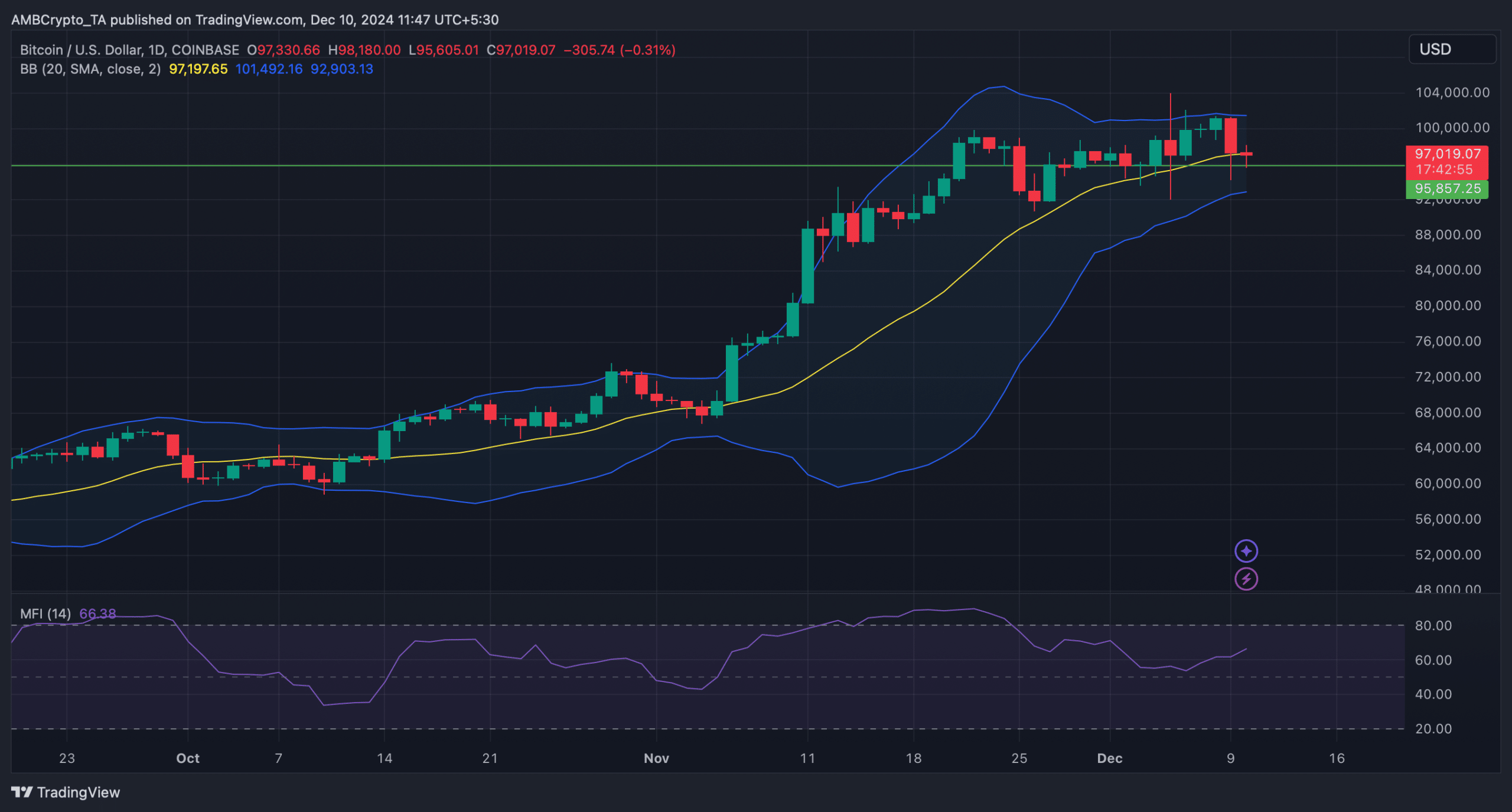

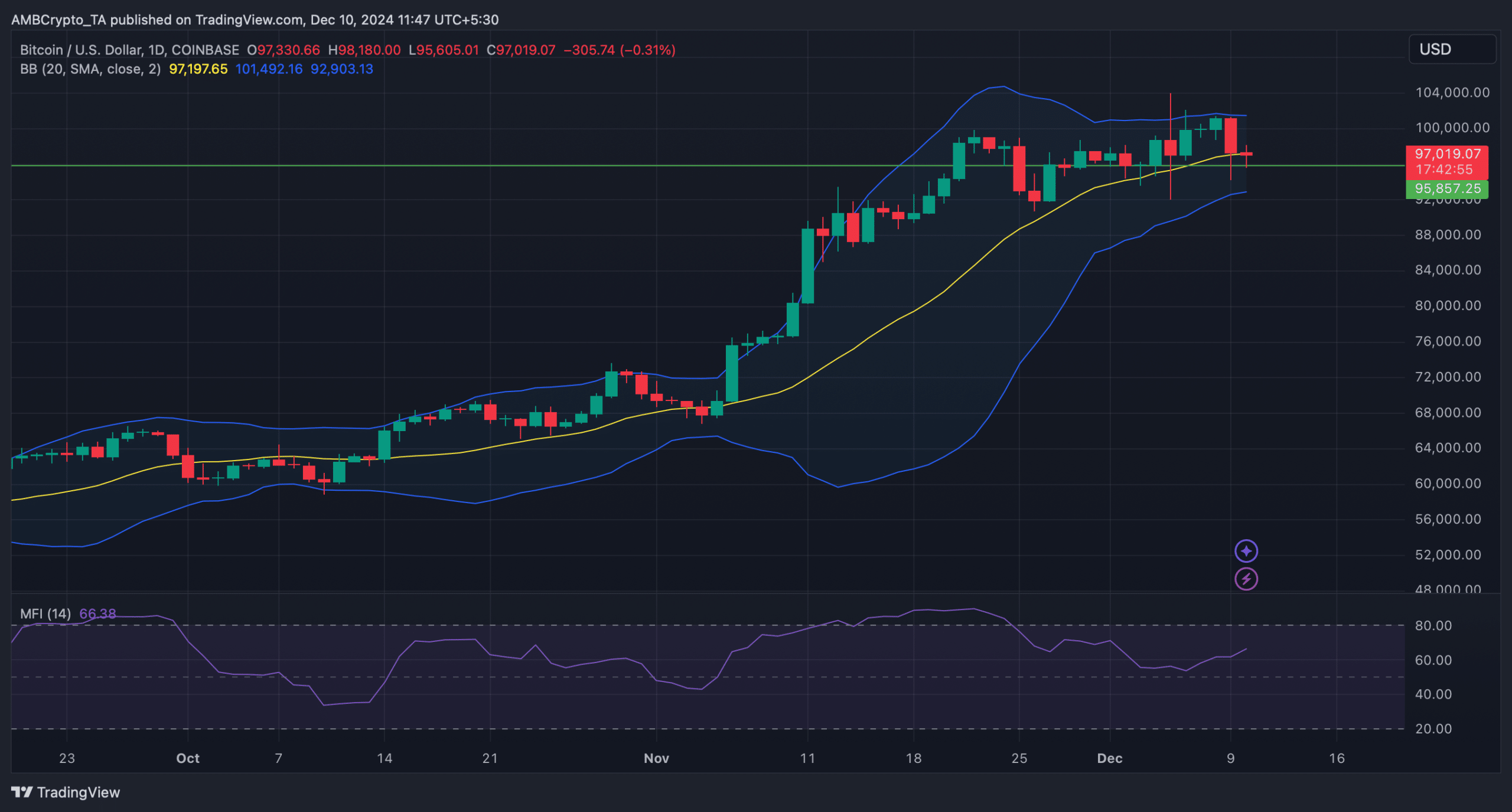

On the time of writing, BTC was testing its 20-day SMA assist. A profitable check may assist BTC change the development and transfer in direction of $100k once more.

In truth, the Chaikin Cash Move (CMF) registered an uptick—a sign that BTC would possibly handle to check the assist. Nonetheless, if promoting strain rises within the close to time period, then BTC would possibly drop to $96k once more.

Supply: TradingView