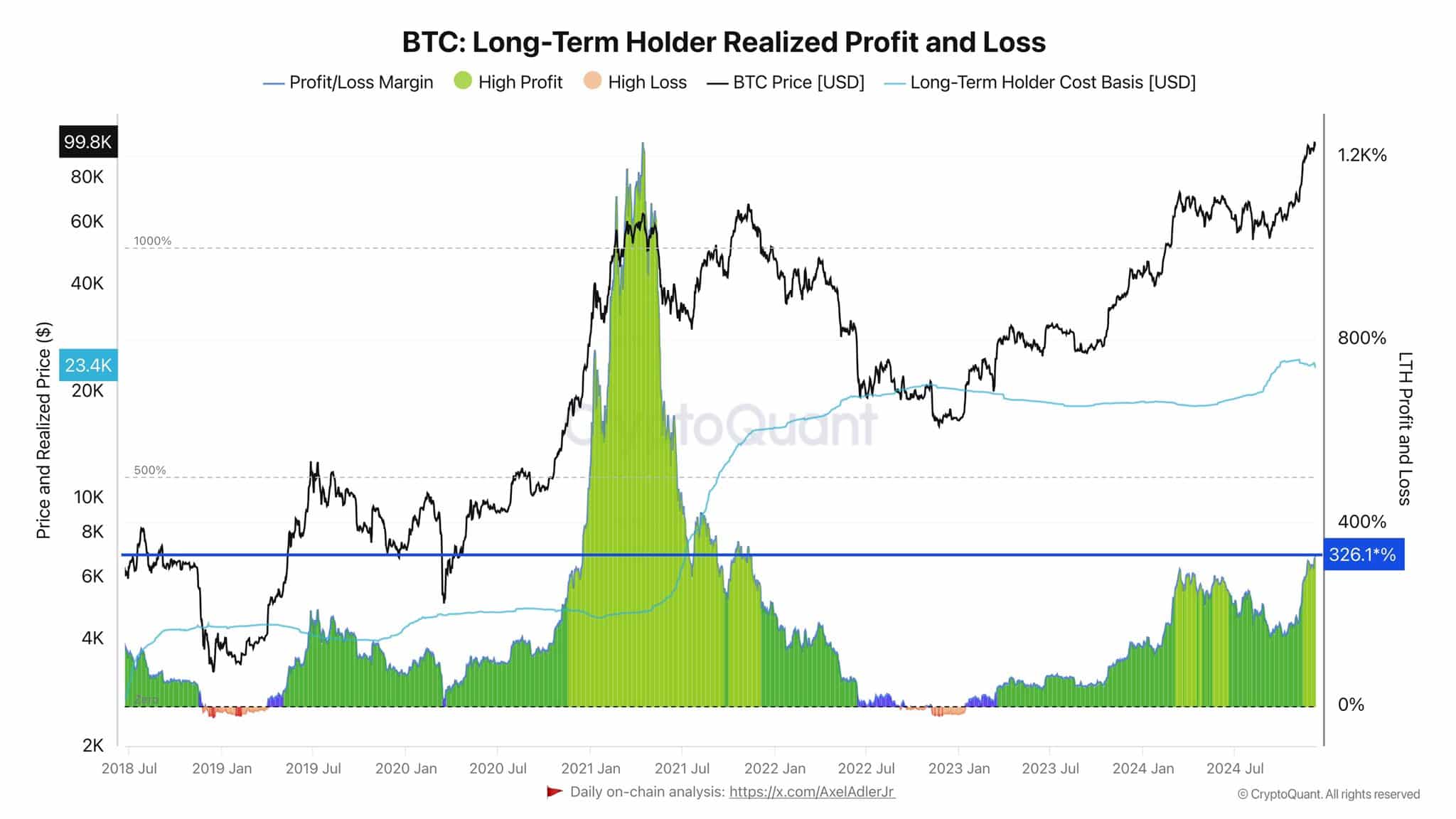

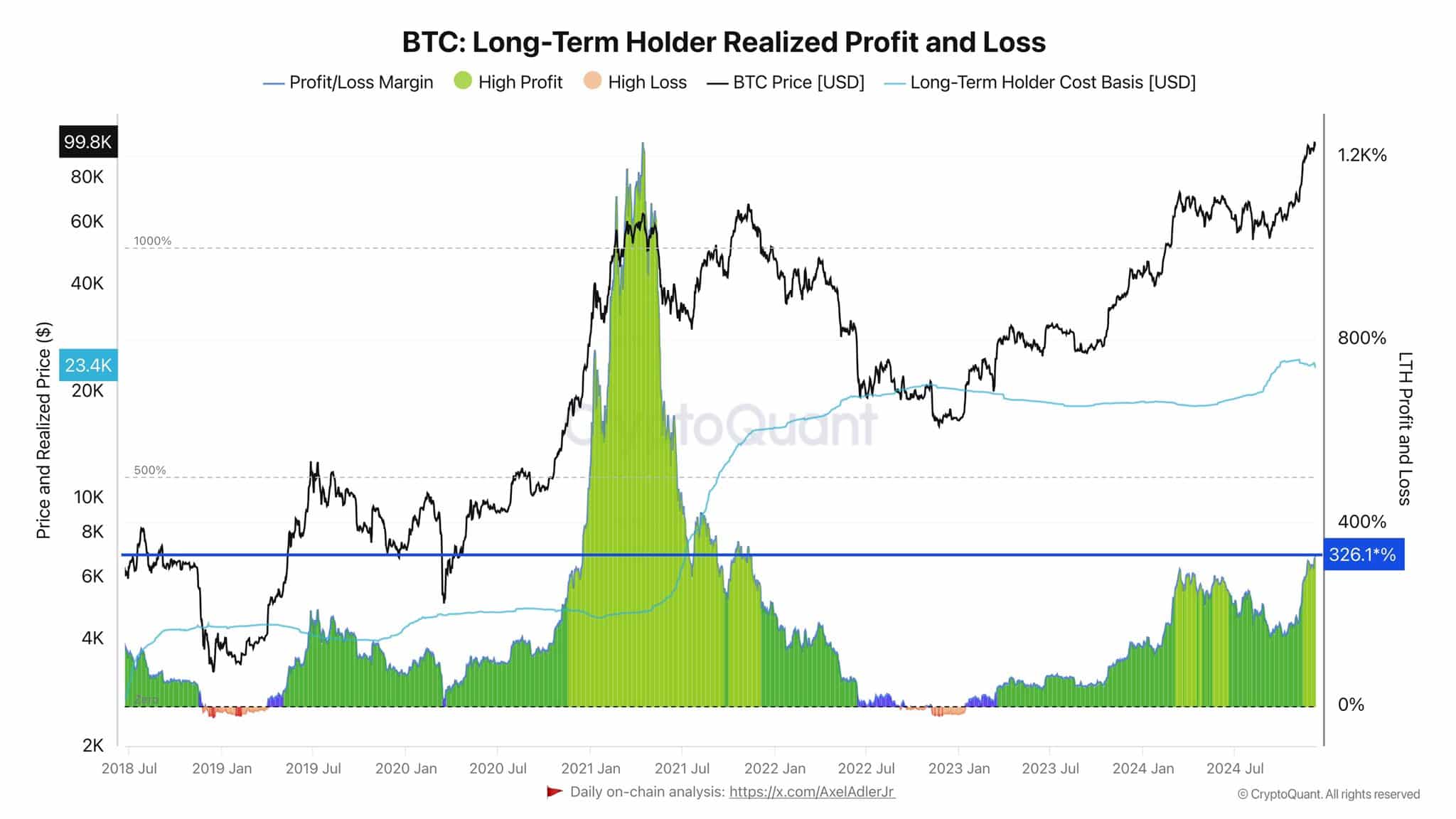

Bitcoin LTHs cash out at 326% gains: Can new demand keep BTC stable?

Strategic profit-taking or market pessimism?

Lengthy-term BTC holders are capitalizing on the present rally, realizing a median 326% revenue with an entry value of $23.4K. This habits aligns with historic patterns the place vital worth surges typically set off profit-taking.

Nonetheless, this wave of promoting seems extra strategic than reactive. With BTC buying and selling properly above the LTH value foundation, many are opting to de-risk amidst macroeconomic uncertainties, together with potential rate of interest shifts and market liquidity considerations.

Supply: X

Moreover, the cyclical nature of Bitcoin’s halving occasions could play a task, with some LTHs anticipating a plateau or non permanent downturn.

Regardless of this promoting strain, Bitcoin’s resilience – buoyed by robust demand from newer market entrants – exhibits a strong redistribution section quite than an alarming sell-off. This shift in market dynamics may redefine BTC’s near-term trajectory.

Function of latest traders in absorbing the availability

The current surge in BTC’s worth displays a shift the place demand, quite than simply provide constraints, is driving its progress. New traders, notably these leveraging institutional-grade monetary devices like Bitcoin ETFs, have performed a pivotal position in absorbing the obtainable provide.

For example, the iShares Bitcoin Belief by BlackRock amassed $10 billion in belongings underneath administration inside seven weeks, accounting for over 40% of spot ETF volumes. This fast adoption has spurred projections that Bitcoin ETFs would possibly surpass gold ETFs in whole belongings within the close to future.

With ETFs now channeling 75% of latest Bitcoin investments, their affect may develop even additional, particularly because the halving occasion heightened shortage. Anticipation of decreased provide coupled with growing demand positions new traders as key drivers of Bitcoin’s worth momentum.

BTC’s subsequent steps

As Bitcoin navigates heightened promoting strain from long-term holders, the street forward seems formed by essential developments. The halving occasion has tightened BTC provide, boosting shortage premiums.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Institutional curiosity, particularly by means of spot Bitcoin ETFs, could stabilize demand and promote adoption. Nonetheless, regulatory readability stays essential for BTC’s mainstream recognition.

Bitcoin’s rising hyperlink to macroeconomic tendencies and conventional belongings positions it as each speculative and maturing. Its capacity to maintain progress or navigate volatility will depend on balancing innovation, adoption, and the continuing rigidity between shortage and liquidity.