Ethereum [ETH] ETF gets $500 mln boost in 2 days – What’s next?

- Institutional inflows highlighted Ethereum’s rising prominence in regulated monetary belongings like ETH ETF merchandise.

- Ethereum surged to $3,830 with $39.3B in 24-hour buying and selling quantity, signaling momentum.

Ethereum [ETH] has captured the highlight as soon as once more, as ETFs managed by monetary powerhouses BlackRock and Constancy have made a mixed buy of $500 million price of ETH in simply two days.

The transactions, executed primarily through Coinbase’s institution-focused platform, Prime, highlights the rising institutional urge for food for Ethereum.

With ETH surging to $3,830 and 24-hour buying and selling quantity climbing to $39.3 billion, this wave of ETF inflows marks a pivotal second for Ethereum’s trajectory, additional solidifying its place as a cornerstone of the digital asset panorama.

Impression on market efficiency

Supply: Yahoo Finance

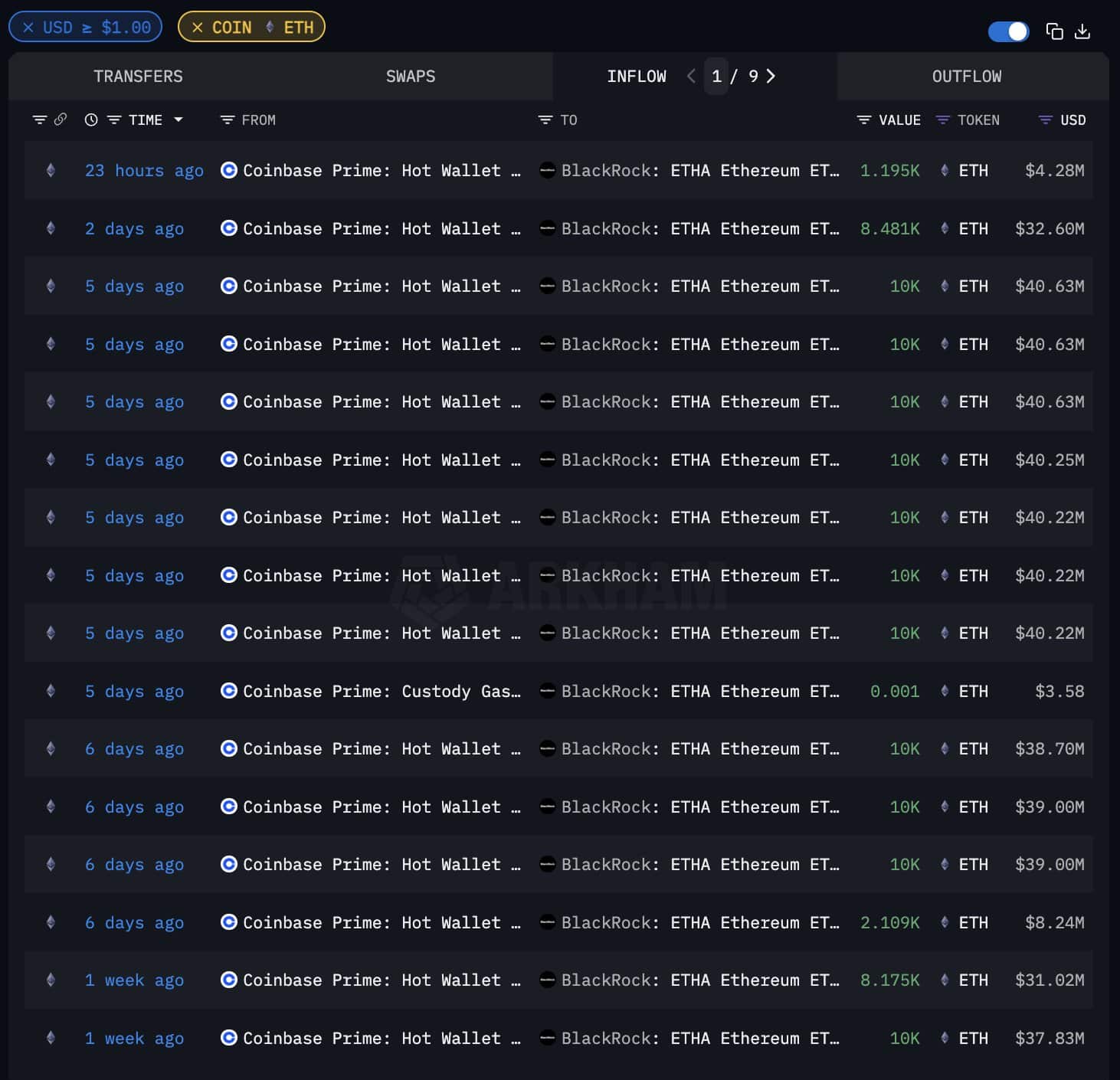

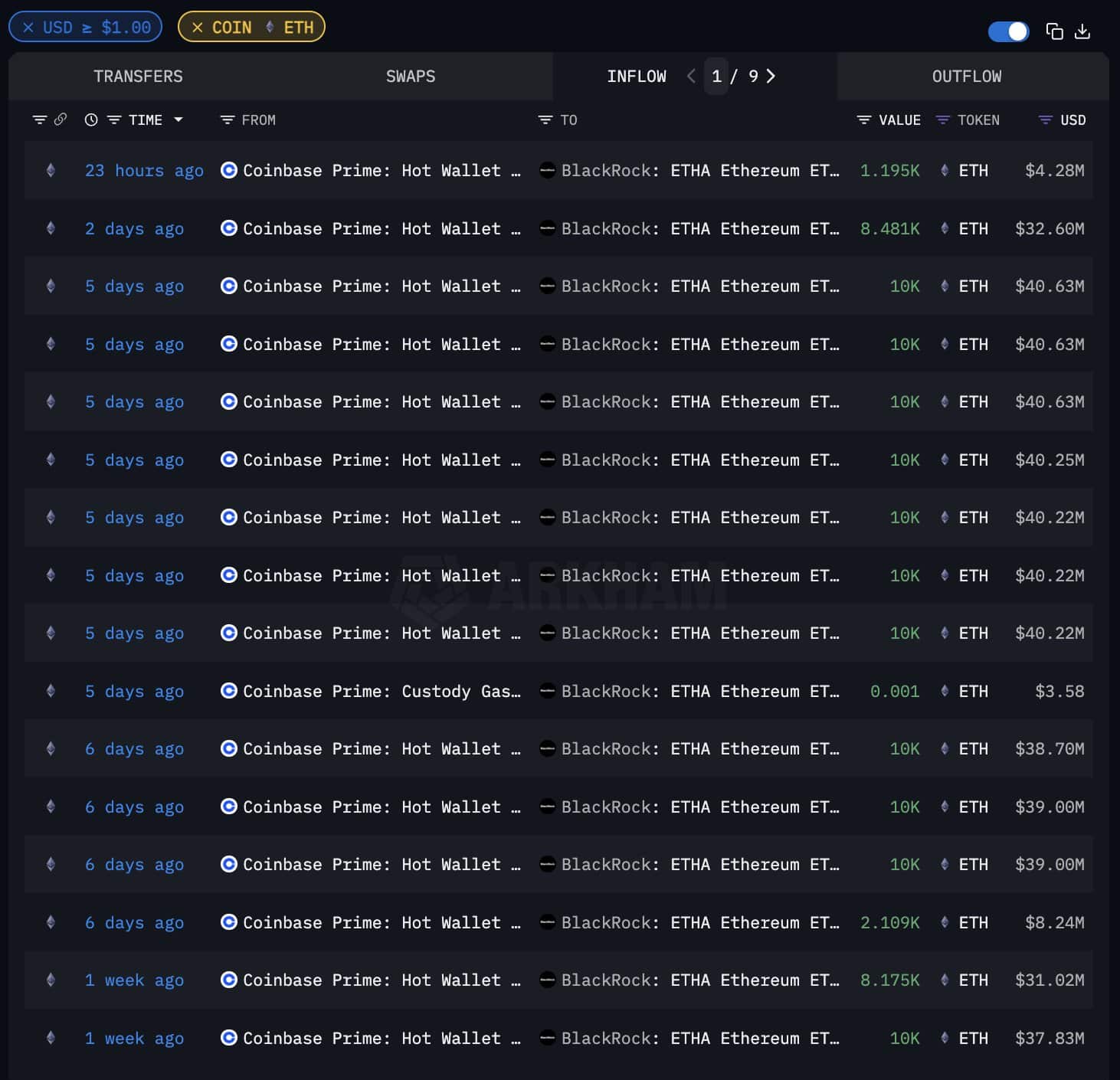

The mixed $500 million buy of Ethereum by BlackRock’s ETHA and Constancy’s FETH ETFs over the previous two days indicators a profound acceleration in institutional curiosity.

With buying and selling volumes for ETHA and FETH surging to $372.4 million and $103.7 million, respectively, on the tenth of December, the dimensions of those inflows marks a pivotal second in ETF exercise.

Ethereum’s value, at $3,830 at press time, mirrored a 5.1% rise, underpinned by 24-hour buying and selling volumes reaching $39.3 billion.

Supply: Arkham

These inflows additionally highlighted the dominant position Coinbase Prime performs in facilitating large-scale institutional transactions, strengthening its place as a key bridge between conventional finance and crypto markets.

This capital injection just isn’t solely driving liquidity but additionally lowering market volatility, reinforcing Ethereum’s enchantment to each retail and institutional members.

Supply: Arkham

What these purchases imply for ETH and the market

This $500 million funding represents greater than a short lived uptick — it underscores a strategic shift within the notion of Ethereum as a monetary asset.

The timing of those purchases, coinciding with Ethereum’s value close to $3,830, displays a rising perception in its resilience and utility as a decentralized computing community and retailer of worth.

Moreover, these inflows amplify Ethereum’s standing within the post-approval period of spot ETFs, the place regulatory readability has catalyzed confidence amongst institutional buyers.

The surge in ETF inflows additionally units a precedent for broader adoption throughout world markets, positioning ETH as a core asset in diversified crypto portfolios.

As ETFs combine Ethereum into conventional monetary merchandise, they additional validate its position as a cornerstone within the evolving digital asset financial system.

ETH ETF: Worth surge and market sentiment

Supply: TradingView

The $500 million inflows into ETH ETFs have considerably impacted its value and market sentiment. ETH’s rally to $3,830 represented a 5.1% improve, breaking earlier resistance ranges and signaling robust upward momentum.

Learn Ethereum [ETH] Worth Prediction 2024-2025

The RSI on the worth chart confirms bullish sentiment, with a studying above 60, suggesting continued shopping for curiosity. In the meantime, the OBV development exhibits rising accumulation by each retail and institutional buyers.

This confluence of rising costs, buying and selling volumes, and optimistic technical indicators illustrates rising market confidence in Ethereum as a long-term asset, additional solidifying its position as a number one participant within the crypto financial system.