The fall of memecoins like DOGE: Top 3 reasons why they’re losing their edge

- Memecoins have struggled to outpace their rivals by failing to ascertain themselves as a real retailer of worth.

- Now, it appears they’re dropping floor on different fronts as properly.

Whereas most cash have rallied on the information of Trump returning to the White Home, memecoins have struggled to maintain up, sparking one more debate on their lack of long-term worth. Given the efficiency of different altcoins, that argument may truly maintain some weight.

Nonetheless, it will not be too late for a shift—memecoins have confirmed resilient earlier than, thriving on group help and hype. The actual query now’s: can that very same hype drive a shift in momentum, or are we witnessing the beginning of a development the place memecoins lastly lose their attraction for good?

Largest memecoin could also be dropping its largest asset

To really grasp the volatility of those tokens, Dogecoin [DOGE] stands out as the proper instance. Whereas many nonetheless affiliate DOGE with the excitement from high-profile endorsements, it could be dropping its strongest asset – the backing it as soon as had.

Even with a authorities division named after this dog-coin, the worth impression? It by no means actually took off. In reality, the $1 value goal appears to be slipping additional out of attain.

May this be a turning level for DOGE? A second the place its group strikes past the hype and evolves into one thing extra significant – a bunch with a long-term imaginative and prescient?

For now, the reply appears a transparent ‘No.’ A fast look at its value chart tells the story – it’s nonetheless extremely speculative. One pink candlestick is all it takes to erase the positive factors from an entire string of inexperienced ones.

As the biggest memecoin, with a market cap greater than that of different meme-tokens mixed, it’s exhausting to see memecoins overtaking altcoins anytime quickly.

These cash are simple goal of market manipulation

In a current report, AMBCrypto uncovered how main gamers with large stakes are conserving DOGE trapped in its consolidation part, utilizing a basic manipulation technique to stop any breakout.

This brings us to a vital level: Memecoins, like DOGE, rely closely on group help to thrive – however paradoxically, it’s this very dependence that causes their wild value swings.

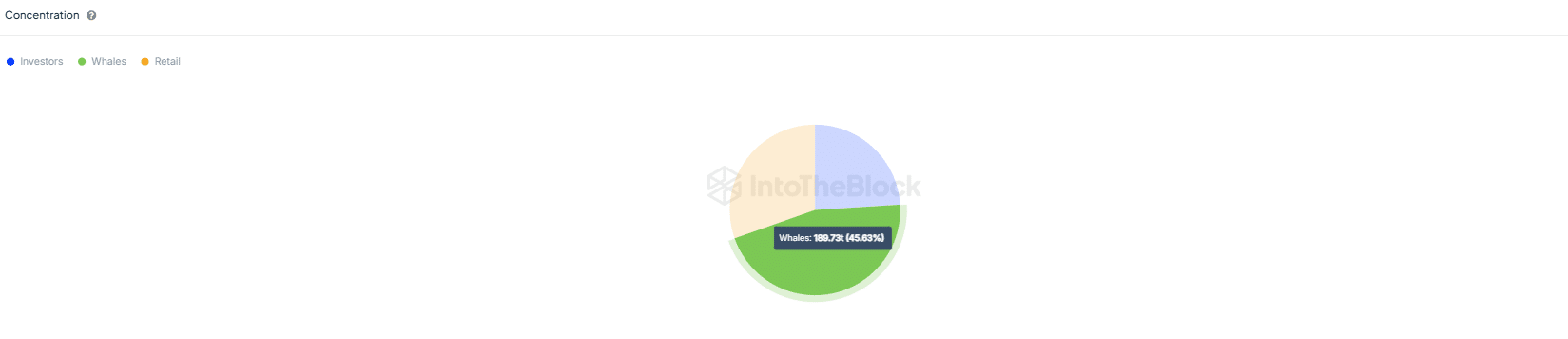

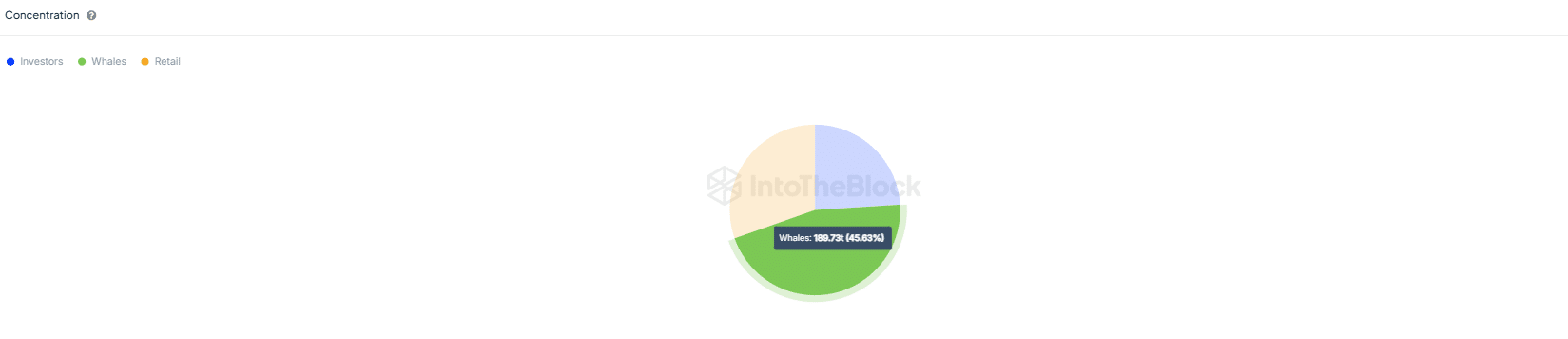

Take PEPE, for instance. With a market cap of $9 billion, practically “half” of its holdings are managed by whale wallets, accounting for about 190 trillion tokens. These whales maintain the ability to maneuver the market at will, tipping the scales of their favor.

Supply : IntoTheBlock

What’s much more putting is the scale of their transactions – whether or not shopping for or promoting – typically within the billions and even trillions.

This textbook manipulation technique, the place they purchase at a reduction and promote at a premium, retains memecoins trapped in a unstable cycle, leaving the market in a continuing state of uncertainty and retail traders on edge.

With all this in thoughts, predicting that these cash will hit new highs subsequent 12 months could be a little bit of wishful pondering.

Learn Dogecoin [DOGE] Value Prediction 2024-2025

The reasoning is evident: past dropping their attraction as ‘real-use-case’ property, memecoins are struggling on a number of fronts.

Massive gamers manipulate the market, stifling their true potential, whereas their failure to evolve into a real retailer of worth leaves the door huge open for altcoins to dominate.