Ethereum (ETH) Bearish Signal, $3,500 the Next Target?

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is exhibiting indicators of a possible worth decline after latest bearish worth motion. Along with the worth motion, whales and business specialists appear to be dropping curiosity within the altcoin, as revealed by the on-chain analytics companies IntoTheBlock and CryptoQuant.

Will ETH Value Decline?

Not too long ago, ETH skilled a worth surge of over 15% and hit the $4,100 mark for the primary time since March 2024, the place it confronted promoting strain and a notable worth decline. Traditionally, ETH has reached this stage 5 instances, and every time, it has encountered a worth decline and vital promoting strain.

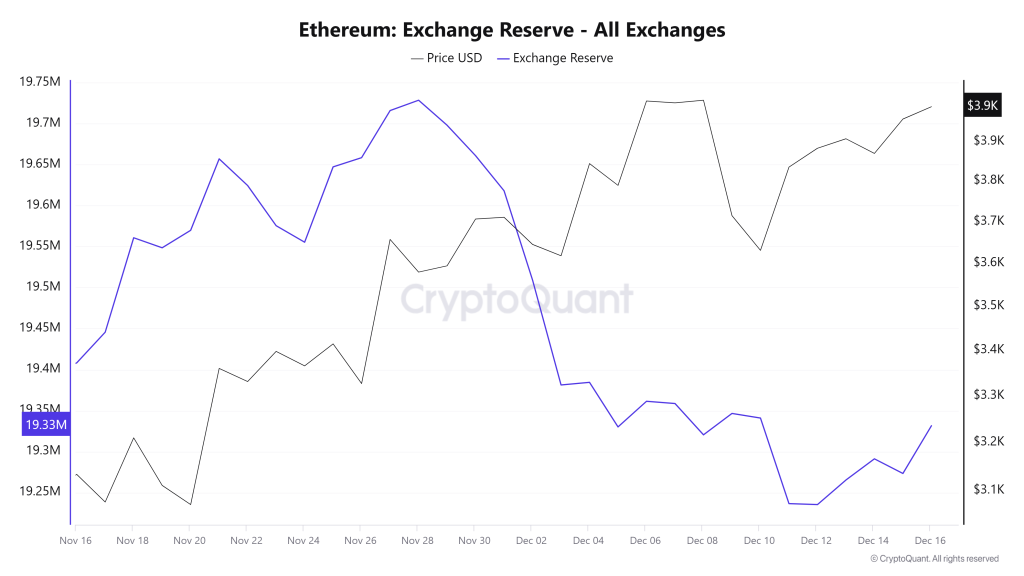

Ethereum (ETH) Rising Alternate Reserve

This time, previous developments whales and long-term holders seem to proceed depositing their ETH to exchanges, as revealed by CryptoQuant’s ETH change reserve metrics.

Knowledge reveals that change reserves have elevated by almost 100k ETH value $400 million which may sign elevated promoting strain as the worth nears a six-month excessive.

Rising Unstaking Exercise

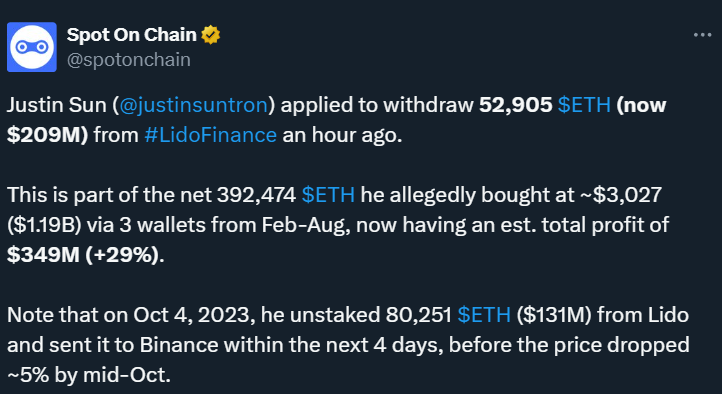

Along with the rising change reserves, whales have begun withdrawing tokens from staking, suggesting they’re progressively taking income as a result of latest worth surge or indicating a lack of curiosity in holding ETH long-term.

That is evidenced by the latest exercise of Justin Solar, the founding father of Tron. On December 16, 2024, the whale transaction tracker Spotonchain shared a submit on X (previously Twitter) stating that Solar’s linked pockets tackle requested to withdraw 52,905 ETH, value $209 million, from the staking protocol Lido Finance.

Ethereum (ETH) Technical Evaluation and Key Ranges

In keeping with knowledgeable technical evaluation, ETH seems to be forming a bearish double-top worth motion sample on the sturdy resistance stage of $4,100. Along with the double-top sample, ETH’s Relative Energy Index (RSI) is falling, indicating a bearish divergence, which additional suggests a worth decline and elevated promoting strain.

Based mostly on the latest worth motion, there’s a sturdy chance that ETH may decline by 12% to succeed in the $3,500 stage sooner or later.

Present Value Decline

At press time, ETH is buying and selling close to the $3,970 stage and has skilled a modest worth decline of 0.80% previously 24 hours. Throughout the identical interval, its buying and selling quantity has soared by 60%, indicating heightened participation from crypto fans amid the latest worth surge.