Bitcoin falls below $100K amid Powell’s comments—What’s next for BTC?

- BTC drops under $100K amid Powell’s Fed feedback, triggering sell-offs and market-wide uncertainty.

- Whale exercise spikes as merchants monitor BTC resistance at $105,400 to verify restoration developments.

Bitcoin [BTC] dropped under the $100,000 mark on Wednesday night time, the 18th of December, following feedback by U.S. Federal Reserve Chair Jerome Powell.

Talking at a press convention, Powell stated that the Federal Reserve is just not allowed to carry Bitcoin and has no intention of in search of a change within the regulation to take action.

Responding to a question a few potential U.S. authorities Bitcoin reserve, Powell clarified,

“We’re not on the lookout for a regulation change.”

On the time of writing, Bitcoin was buying and selling at $101,292, down 2.01% over the previous 24 hours and 0.18% over the previous seven days.

Powell’s feedback and FOMC projections spur market uncertainty

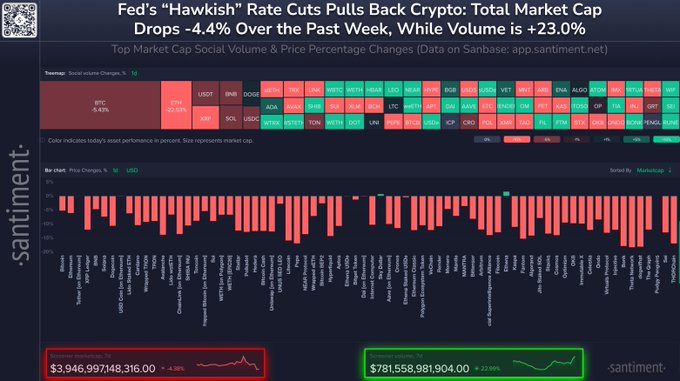

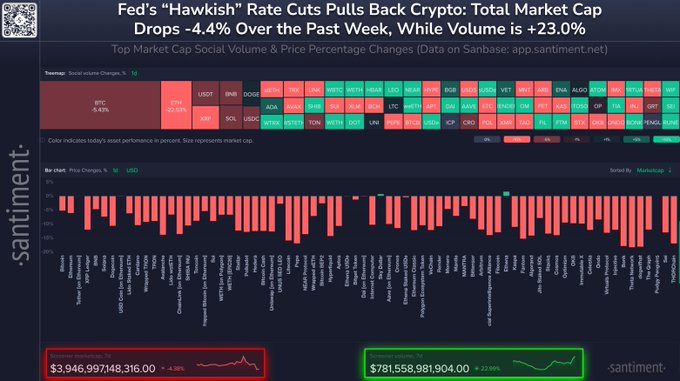

The broader crypto market reacted negatively to Powell’s remarks and the Federal Open Market Committee’s (FOMC) fee minimize projections for 2025.

Powell indicated that the variety of fee cuts anticipated in 2025 could be halved in comparison with earlier projections, resulting in unease throughout each cryptocurrency and fairness markets. In response to Santiment, the announcement triggered widespread sell-offs.

Supply: X

Altcoins have been hit hardest, with Avalanche, Chainlink, and Litecoin dropping 16% every, and Pepe falling 17% over the previous 24 hours.

Ethereum [ETH] fell by 6%, whereas XRP noticed a ten% drop. Bitcoin itself broke under the $100K psychological threshold, fueling bearish sentiment.

Technical evaluation: Bitcoin’s essential resistance ranges

Crypto analyst Ali noted that Bitcoin seems to have damaged out of a head-and-shoulders sample, which may undertaking a bearish goal of $99,000. Nevertheless, Ali emphasised that Bitcoin should surpass $105,400 to invalidate the bearish outlook.

The present worth motion means that merchants are intently monitoring these ranges for additional affirmation.

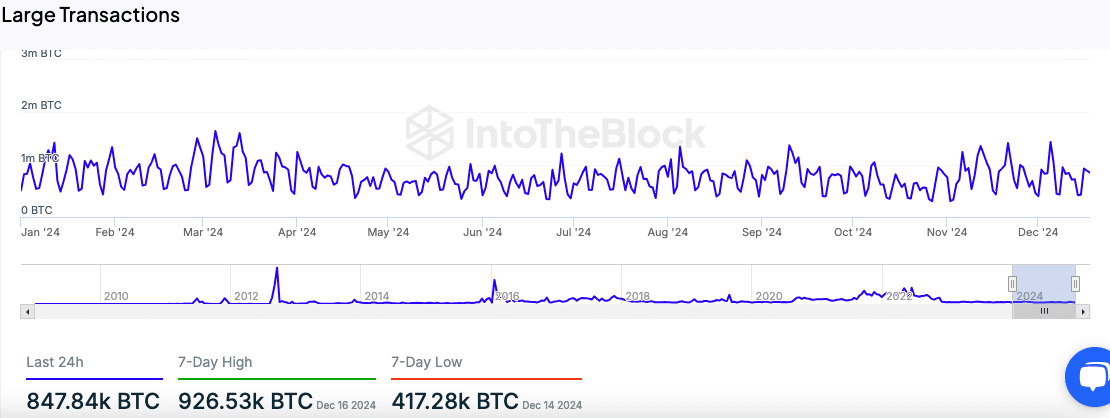

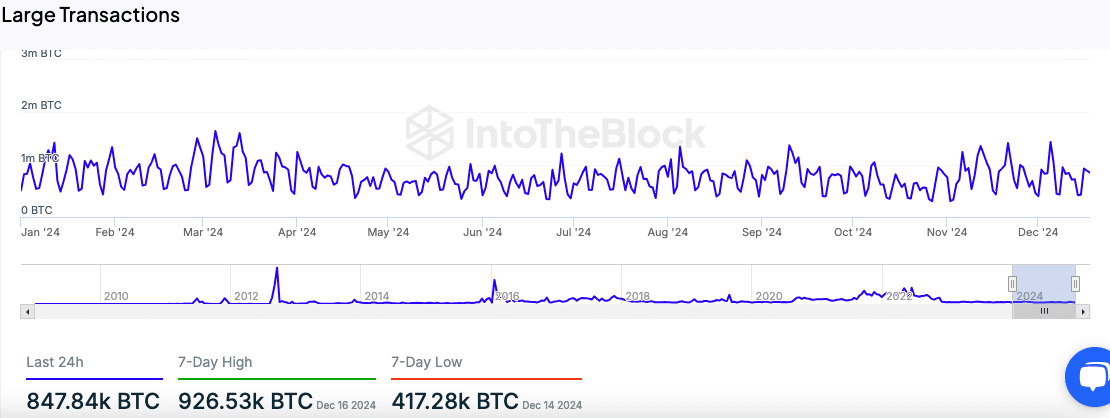

Regardless of the bearish sentiment, market members stay lively. Knowledge from IntoTheBlock confirmed that giant Bitcoin transactions, exceeding $100K, stay constant all year long.

Whale exercise reached a seven-day excessive of 926.53K BTC on sixteenth December, suggesting continued institutional curiosity.

Supply: IntoTheBlock

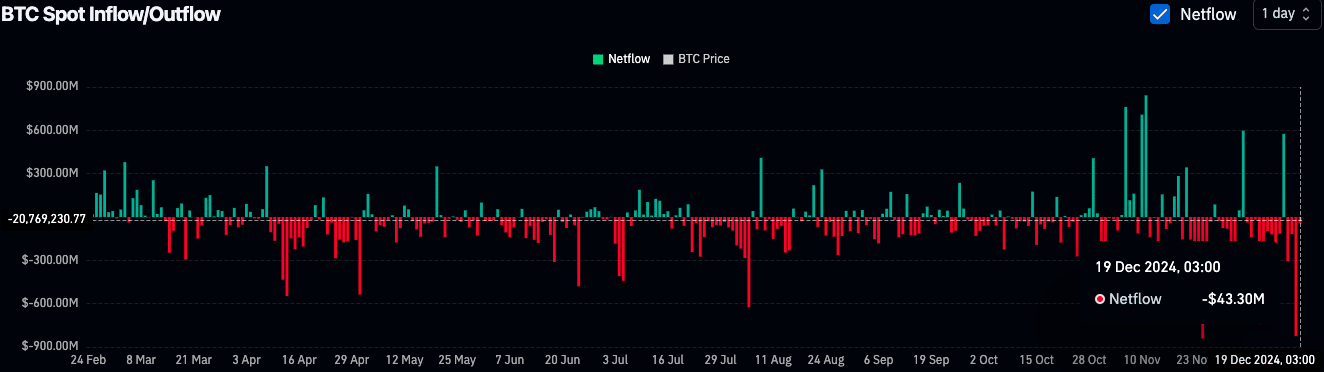

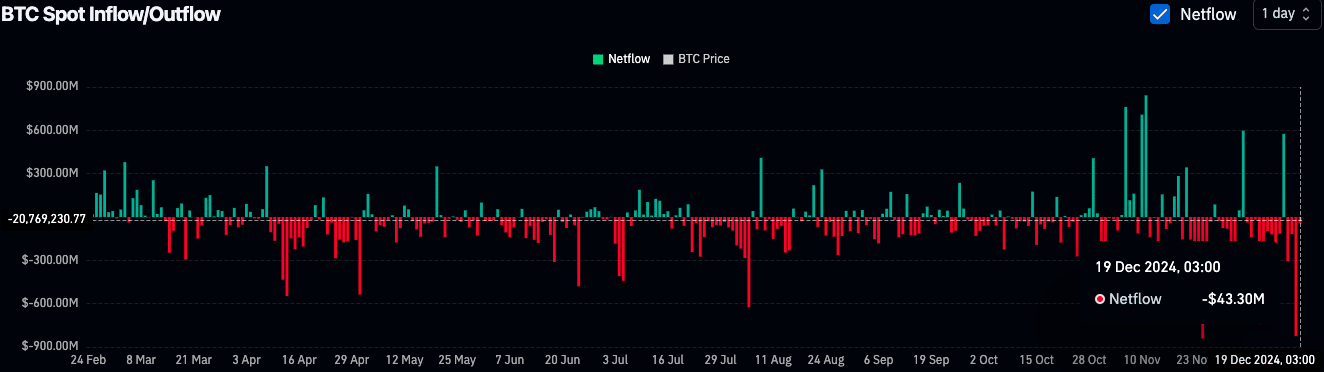

Market developments: Buying and selling quantity, open curiosity, and netflows

Coinglass data showed a 39.05% rise in buying and selling volumes, which reached $150.01 billion, reflecting heightened exercise. Nevertheless, open curiosity dropped barely by 1.10%, now at $67.77 billion.

Choices markets confirmed a rise, with choices quantity rising by 33.15% to $4.28 billion, whereas open curiosity in choices noticed a marginal improve of 0.84%, reaching $41.68 billion.

Alternate netflows point out robust accumulation developments. BTC outflows dominated in 2024, with constant crimson bars reflecting decreased promote stress.

On nineteenth December, internet outflows of $43.3 million prompt merchants transferring BTC into chilly storage, signaling confidence within the asset.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The general crypto market capitalization dropped by 5% to $3.44 trillion, whereas buying and selling volumes rose by 40%, hitting $251 billion.

The mixed knowledge reveals that whereas Bitcoin and the broader market face headwinds, merchants stay actively engaged, positioning themselves for the subsequent important transfer.