Bitcoin Will Test ATH Once It Breaks This Strong Supply Zone – Details

Este artículo también está disponible en español.

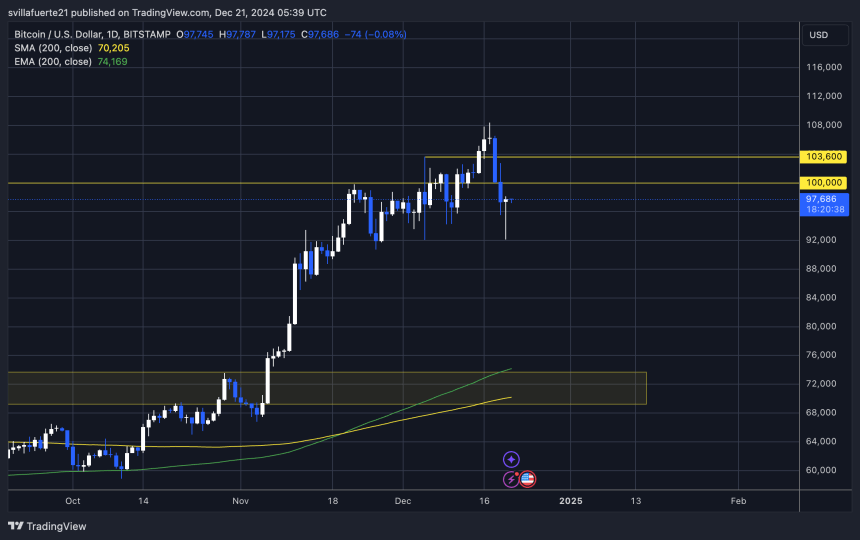

Bitcoin is at present buying and selling at $97,600, following a pointy dip from its all-time excessive and a modest restoration from the crucial $92,000 help stage. This latest worth motion highlights the market’s ongoing volatility as traders grapple with shifting sentiment and technical ranges. Regardless of the rebound, Bitcoin now faces a big problem in sustaining its upward momentum.

Associated Studying

Analyst Ali Martinez shared compelling information revealing that Bitcoin encounters an enormous resistance zone between $97,500 and $99,800. This “brick wall” is fortified by the exercise of 924,000 wallets, which collectively bought over 1.19 million BTC on this vary. Such sturdy on-chain resistance may hinder BTC’s means to reclaim the psychological $100,000 stage within the close to time period.

This crucial space will doubtless decide Bitcoin’s subsequent transfer. Efficiently breaking by this zone may pave the best way for one more rally, whereas failure to take action may result in heightened promoting stress and a retest of decrease help ranges. Because the market watches this pivotal part unfolds, all eyes stay on key technical and on-chain indicators to gauge whether or not Bitcoin’s restoration is sustainable or if a bigger correction looms forward.

Bitcoin Holding Sturdy

Bitcoin has skilled intense worth swings over the previous few days, with a 15% correction adopted by a swift 6% bounce in underneath three days. This speedy motion highlights the intense volatility gripping the market, with Bitcoin mirroring the broader uncertainty. Regardless of the turbulence, there’s rising optimism amongst analysts concerning Bitcoin’s outlook, as its restoration from aggressive promoting stress yesterday took only some hours.

Martinez shared key insights on X, shedding gentle on a big resistance zone that Bitcoin should overcome to regain momentum. In line with Martinez, Bitcoin faces a “brick wall” between $97,500 and $99,800.

This vary is fortified by 924,000 wallets that collectively bought over 1.19 million BTC inside these ranges. This substantial cluster of on-chain resistance may act as a barrier to Bitcoin’s upward trajectory.

Associated Studying

If Bitcoin can handle to interrupt above this crucial resistance zone, it may open the door to new all-time highs. Nonetheless, failure to surpass this vary might result in elevated promoting stress and additional consolidation under the $100,000 mark. For now, Bitcoin stays resilient, holding its floor amid market volatility, with many analysts cautiously optimistic about its potential for one more rally.

Technical Evaluation

Bitcoin is at present buying and selling at $98,200, exhibiting a robust restoration from the $92,000 mark, which has confirmed to be a big demand stage. This response from $92K indicators power in Bitcoin’s worth motion, indicating the potential for bullish momentum within the weeks forward.

If BTC manages to push above the crucial $100,000 stage within the coming days, it may set off an enormous surge, probably driving the worth to new all-time highs. This psychological and technical milestone is predicted to ignite a wave of shopping for stress as traders and merchants anticipate the subsequent leg of the rally.

Nonetheless, the market stays unsure, and the potential for Bitcoin coming into a sideways consolidation part can’t be dominated out. On this state of affairs, BTC may stay range-bound between its all-time highs and native lows, reflecting a interval of accumulation because the market recalibrates after latest volatility.

Associated Studying: On-Chain Metrics Reveal Cardano Whales Are ‘Shopping for The Dip’ – Particulars

For now, the $92,000 mark has offered a robust basis for Bitcoin, and all eyes are on the $100,000 stage as the subsequent main check. Whether or not BTC breaks out or consolidates, its present resilience means that Bitcoin stays poised for vital strikes within the close to time period.

Featured picture from Dall-E, chart from TradingView