Bitcoin ETF Demand Bounces Back In 2025: What’s Driving The Surge?

Este artículo también está disponible en español.

Demand for US Bitcoin ETFs has considerably elevated as we enter 2025, signifying a notable reversal following a lackluster begin to the yr.

Associated Studying

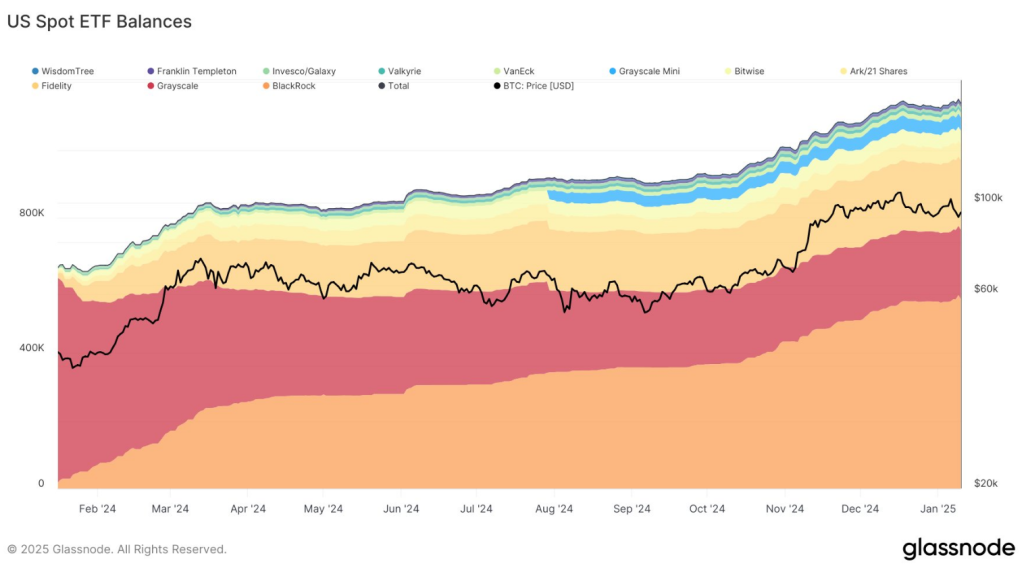

Primarily based on current figures from Glassnode, internet inflows for the week ending January 6 amounted to 17,567 BTC, equal to round $1.7 billion.

This improve surpasses the weekly common inflows of 15,900 BTC documented within the closing quarter of 2024 and signifies a resurgence of investor enthusiasm.

A Turbulent Journey Of Inflows

Inflows into Bitcoin ETFs have proven an erratic sample. These inflows confirmed notable fluctuations in late 2024. In September, there was a major decline as Bitcoin costs dropped under $64,000, resulting in massive withdrawals.

Nonetheless, issues started to vary by October. Inflows elevated dramatically; in few weeks, they topped 24,000 BTC. With the typical weekly influx settling at round 15,900 BTC, the rise continued into November and December, demonstrating the excessive demand for Bitcoin investments.

After a sluggish begin to the yr, demand for US spot #Bitcoin ETFs has normalized. Within the week of January 6, inflows reached 17,567 #BTC ($1.7B), which is barely larger than the weekly common of 15.9K $BTC ($1.35B) from October to December 2024: https://t.co/0Cpfm8lpak pic.twitter.com/u4FksOSLuZ

— glassnode (@glassnode) January 13, 2025

As the value of Bitcoin elevated, so did ETF inflows. In December 2024, the preferred digital asset on this planet reached a record-breaking excessive of $108,135.

This affiliation means that as extra folks switched to exchange-traded funds, buyers’ confidence in Bitcoin’s value grew, resulting in a constructive market sentiment.

Bitcoin ETFs: Who Possesses The Most?

The overall holdings of US spot Bitcoin ETFs as of early January 2025 are roughly 1.13 million BTC. Grayscale has 204,300 BTC, Constancy holds 205,488 BTC, and BlackRock has 559,673 BTC, making it the biggest holding.

In 2024, BlackRock’s Bitcoin ETF (IBIT) garnered consideration by accumulating $37.25 billion in belongings throughout its inaugural yr, securing the third place on the High 20 ETF Leaderboard for that yr. This important surge highlights the rising institutional demand for cryptocurrency-backed monetary options.

Will 2025 Be A Good 12 months For ETFs?

Bitcoin ETFs appear to be they may do nicely in 2025. Consultants within the discipline suppose that this yr there could also be plenty of new, progressive choices available on the market.

There can be at the very least 50 new bitcoin ETFs this yr, in accordance with Nate Geraci of the ETF Retailer. These will cowl a variety of methods, equivalent to lined name ETFs and Bitcoin-denominated fairness ETFs.

Moreover, there’s conjecture that Bitcoin spot ETFs could quickly exceed bodily gold ETFs in asset dimension. This could symbolize a pivotal development within the improvement of digital belongings as standard funding devices.

Such a change would spotlight a rising confidence in Bitcoin as a sound retailer of worth and funding instrument, subsequently difficult the long-held view of gold as one of the best hedge.

Associated Studying

As monetary establishments equivalent to Vanguard examine cryptocurrency ETF options, it underscores a wider development of acceptance and incorporation of cryptocurrencies into established monetary methods.

Featured picture from Reuters, chart from TradingView