Uniswap (UNI) price prediction – Here’s the case for a 30% rally

- An RSI discovering of 56 recommended UNI was buying and selling beneath the overbought zone

- At press time, 67.63% of high UNI merchants on Binance held lengthy positions, whereas 32.37% held quick positions

With the bigger cryptocurrency market rebounding throughout the board, Uniswap’s native token – UNI – broke out from a bullish worth sample. This signaled a possible upside transfer, with this breakout coming after a chronic wrestle the asset has confronted since December 2024.

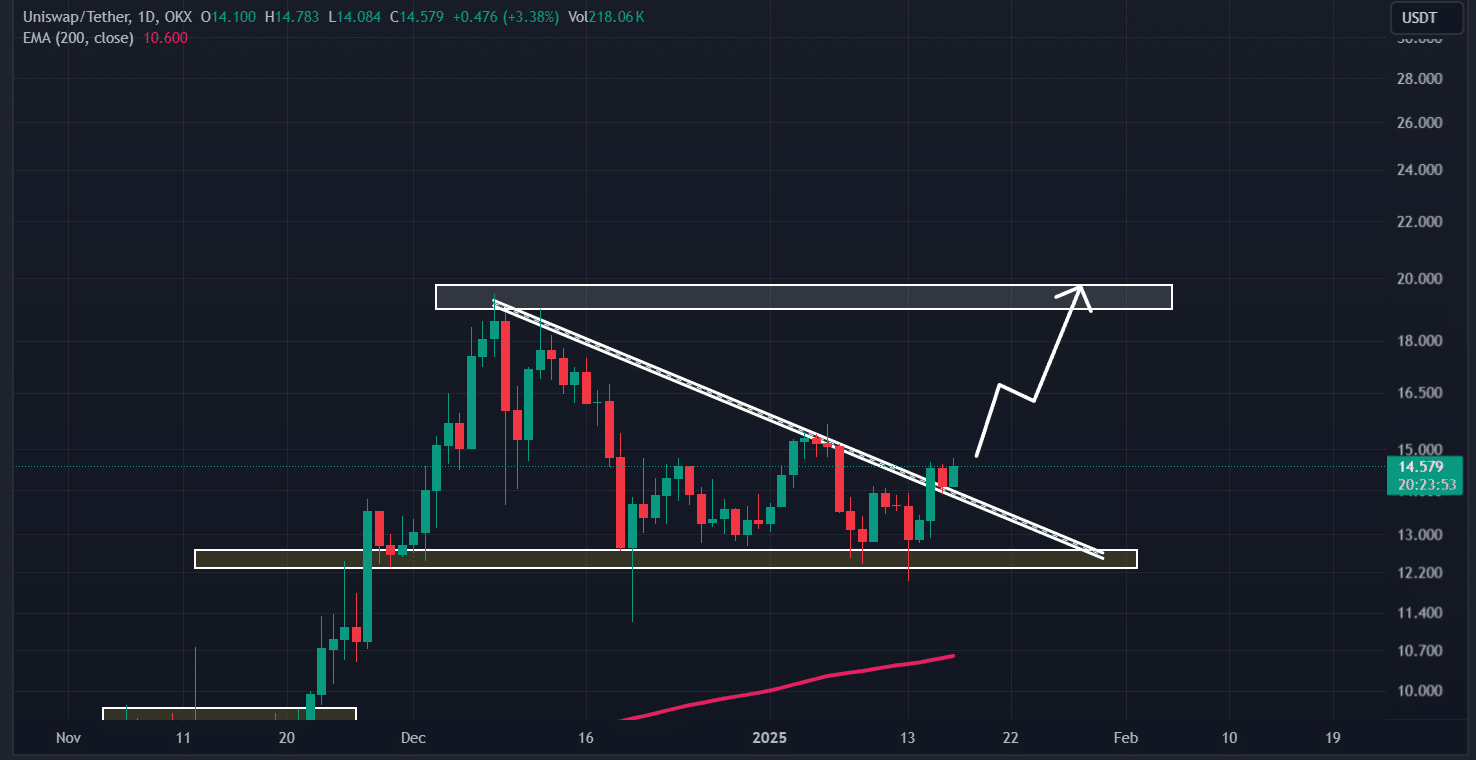

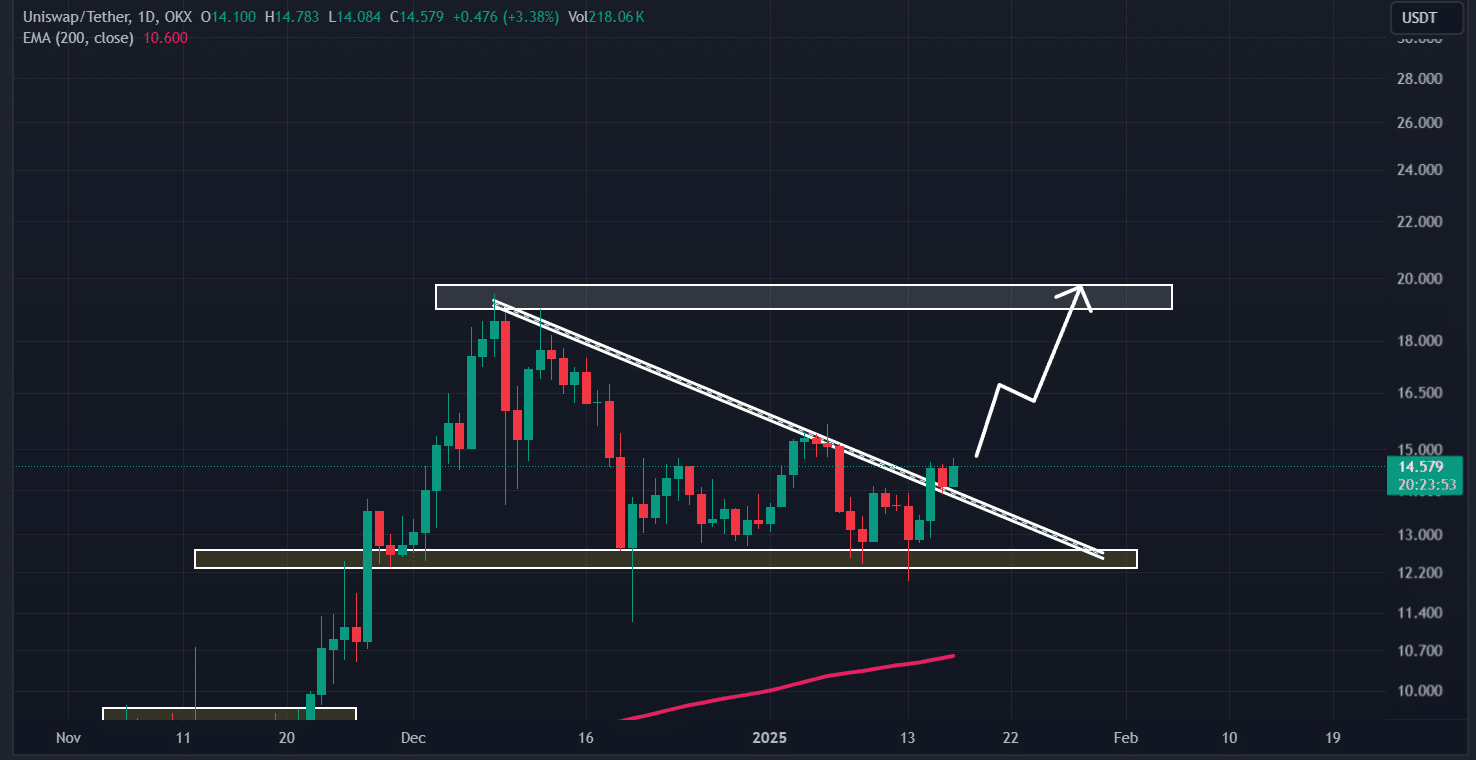

Uniswap (UNI) technical evaluation

In accordance with AMBCrypto’s technical evaluation, UNI broke out from a descending triangle sample on the each day timeframe, hitting the resistance degree of $15.20 for the third time since December 2024.

Nevertheless, the crypto’s historical past didn’t favor the bulls so far as this resistance degree was involved.

Supply: TradingView

UNI worth prediction

Based mostly on the altcoin’s latest worth motion, if UNI breaches the horizontal degree and closes a each day candle above $15.50, there’s a sturdy risk that it may soar by 30% to hit the subsequent resistance degree of $20 within the close to future.

Nevertheless, UNI’s efficiency has been fairly spectacular over the previous few days. In truth, information revealed that the asset surged by over 16% within the final three days alone.

Moreover, high property like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have additionally seen important worth surges of their very own. These property and their performances are having an affect on the broader market sentiment and by extension, UNI too.

On the constructive aspect, with an RSI of 56, UNI appeared to be nicely beneath the overbought zone – An indication that there could also be sufficient room for additional good points.

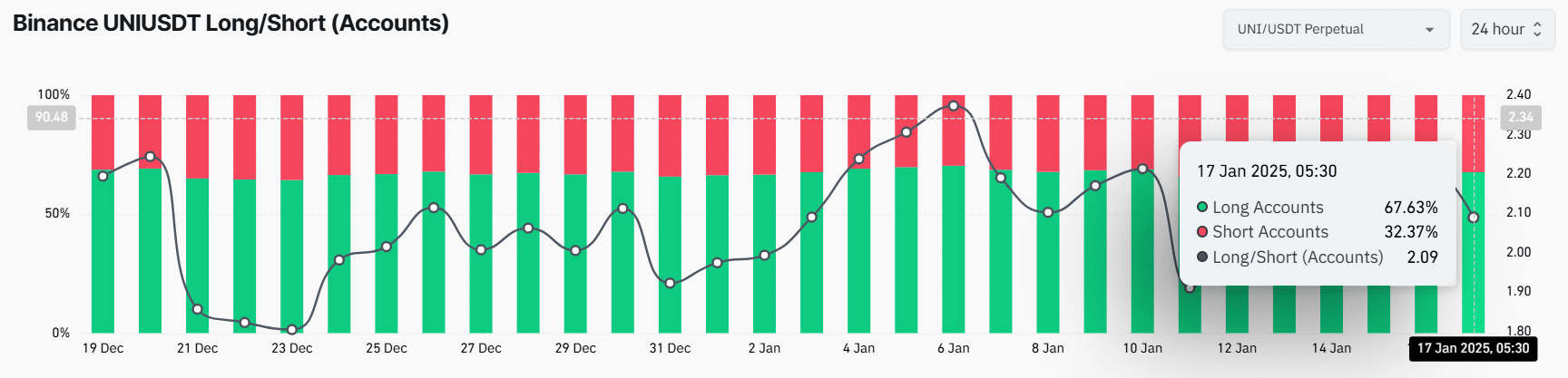

67.63% of high UNI merchants guess lengthy

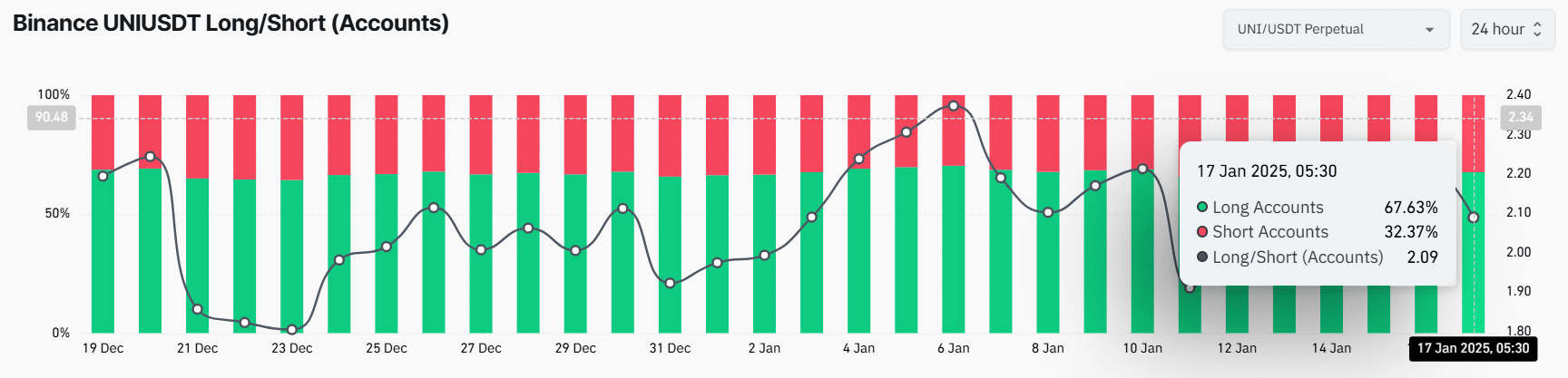

On the time of writing, it appeared that merchants’ curiosity and confidence have skyrocketed within the final 24 hours, as revealed by the on-chain analytics agency Coinglass.

In truth, Binance’s UNI/USDT lengthy/quick ratio had a studying of two.09 – Highlighting sturdy bullish market sentiment amongst merchants.

Supply: Coinglass

Moreover, 67.63% of high UNI merchants on Binance held lengthy positions, whereas 32.37% held quick positions, additional supporting the bullish sentiment throughout the market.

When combining these on-chain metrics with technical evaluation, it will appear that bulls are at present dominating the asset. Therefore, they will gas UNI’s breach of its $15 hurdle to hit their predicted goal.