$100M in Shorts Suggest Solana (SOL) May Not Cross $235

Amid the continuing market decline, Solana (SOL) is gaining consideration from crypto fanatics resulting from its present worth motion on the every day time-frame. On January 29, 2024, the blockchain-based transaction tracker Whale Alert posted on X (previously Twitter) {that a} crypto whale had moved a big 220,308 SOL value $52 million.

Crypto Whale Strikes $52 Million of SOL

This substantial quantity of SOL was transferred from the cryptocurrency alternate Bitfinex following the opening bell of the US market. Nevertheless, analysts and specialists view this transaction as an accumulation by the whale because the asset experiences a big worth decline.

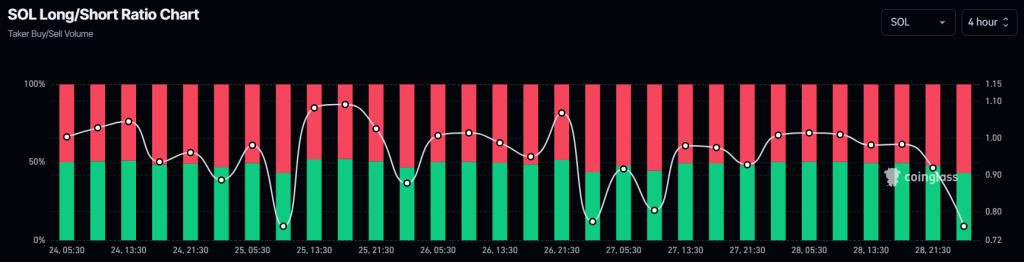

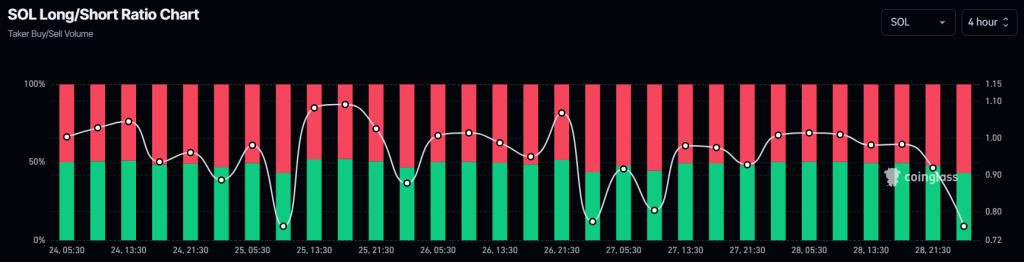

Regardless of the whale’s potential accumulation, SOL’s worth has continued its downward trajectory, struggling close to $227 with a 2.56% decline within the final 24 hours. In accordance with on-chain knowledge from Coinglass, the sentiment amongst merchants stays strongly bearish, with a Lengthy/Quick ratio of 0.77. This means that 57% of high merchants are holding brief positions, in comparison with 43% with lengthy positions.

Merchants’ Sturdy Bearish Sentiment

Nevertheless, not simply participation has declined however intraday merchants additionally appear to be betting on the brief aspect, as revealed by the on-chain analytics agency Coinglass.

At press time, SOL’s Lengthy/Quick ratio stands at 0.77, indicating robust bearish sentiment amongst merchants. Additional knowledge reveals that 57% of high Solana merchants maintain brief positions, whereas 43% maintain lengthy positions.

When combining these on-chain metrics, it seems that potential long-term holders are accumulating, taking benefit of the present worth decline. In the meantime, intraday merchants appear to be capitalizing on the prevailing market sentiment, resulting in notable bets on brief positions.

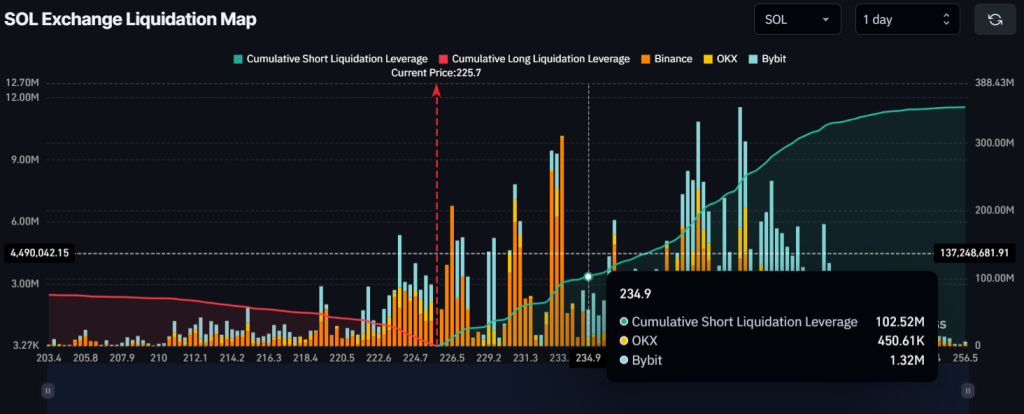

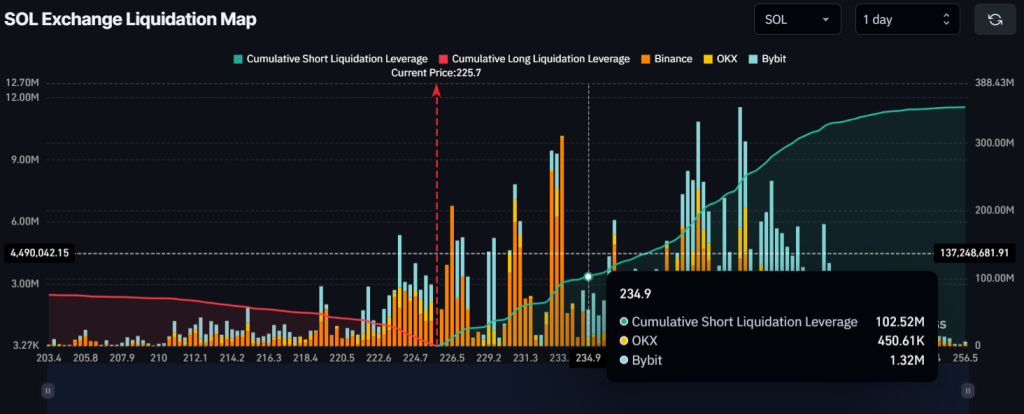

$100 Million Value of SOL’s Quick Positions

The present market sentiment seems to be bearish, with short-sellers holding over $100 million value of bets on brief positions at $235.

In the meantime, bulls appear exhausted, holding solely $40 million in lengthy positions on the $215 degree, which may very well be simply liquidated if the sentiment stays unchanged and costs proceed to say no.