Bitcoin: Whales accumulate 22K BTC off the dip – More rally likely?

- BTC whales scooped 22K BTC in the course of the latest dip.

- Most whales have trimmed positions since final December.

Bitcoin [BTC] whale wallets noticed a spike in accumulation influx of over 22K BTC in the course of the dip on the twenty eighth of January.

The king coin dropped to a low of $97.7K in the course of the day’s buying and selling session, providing a slight low cost that was met with large whale demand.

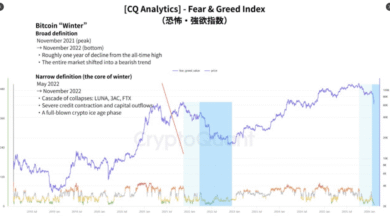

Supply: CryptoQuant

For context, such spikes in whale accumulation coincided with native bottoms.

Does that imply BTC marked $97K because the native backside for a probable springboard for a better transfer?

Effectively, the FOMC ahead steerage and key U.S. inflation information (scheduled for Friday) may decide the asset’s subsequent course into February.

Bitcoin whales decline

That mentioned, many whales with over 1K BTC have been cashing out since mid-December.

Glassnode information revealed these whale entities had dropped 4% from 1,724 to 1,655, underscoring elevated sell-offs previously week.

Supply: Glassnode

A continued drop within the metric might be a warning signal for a possible native or cycle high, as seen within the 2020-2021 cycle.

AMBCrypto additionally checked the community development for extra insights. Since December, the typical energetic addresses have dropped from almost 1.1 million to 957K.

Nevertheless, the metric appeared to have bottomed out on the 950K. A renewed surge may sign elevated market curiosity for BTC, which may drive the king coin worth to new highs.

Supply: CryptoQuant

Nevertheless, demand was almost flat as of this writing. Based on the Coinbase Premium Index (CPI), an indicator that tracks U.S. buyers’ urge for food for the world’s largest cryptocurrency, remained muted in January.

Supply: CryptoQuant

Traditionally, BTC has fronted a sustainable uptrend every time the CPI was constructive (inexperienced) for an prolonged interval.

At press time, the biggest digital asset was caught between $100K and $105K, forward of key U.S. inflation information.