How will USDT’s growth impact Bitcoin [BTC]? According to this data….

- Tether invested a big portion of earnings into BTC.

- Nonetheless, BTC miners acquired skeptical.

After the collapse of the Silicon Valley Financial institution (SVB), Tether’s [USDT] largest competitor, Circle [USDC], acquired impacted severely. Because of the FUD brought on by this, USDT may seize a considerable amount of market share within the stablecoins sector.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

A win-win for BTC and USDT?

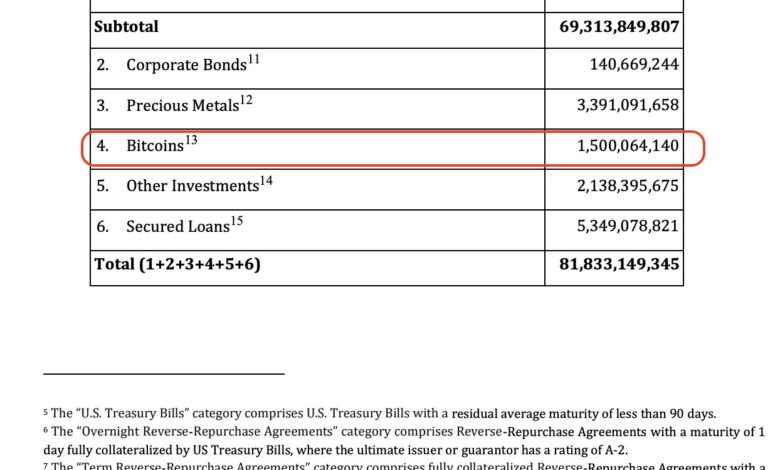

As the general earnings generated by Tether, its dad or mum firm, skyrocketed, a lot of those earnings have been allotted to purchasing U.S. treasury payments. Nonetheless, there have been different avenues the place Tether invested. An enormous quantity of their earnings have been invested in Bitcoin [BTC].

In accordance with the information, Tether has $1.5 billion value of BTC held in its reserves.

In Q1 alone, Tether acquired 52,670 BTC. If Tether continues to dominate the stablecoin market, there may very well be constructive implications for BTC’s value.

Inasmuch, Andrew Kang, CEO of Mechanism Capital, a crypto funding agency, stated that if Tether continues to purchase BTC with their earnings, it may undermine the promoting strain on BTC that might happen resulting from U.S. authorities’s holdings.

Supply: Tether

At press time, the united statesgovernment held giant sums of seized Bitcoin that it’s planning to promote in 4 phases all year long.

The U.S. authorities’s choice to promote these holdings has induced huge quantities of FUD out there, with many merchants believing that these sell-offs may drive down the value of BTC.

Nonetheless, if Tether continues its bullish conduct, there could also be a chance that the influence of U.S authorities’s actions may very well be negated sooner or later.

HODLers stay calm

At press time, there wasn’t plenty of promoting strain on Bitcoin, as addresses in revenue had declined and reached one-month lows. This indicated that many addresses at present holding BTC didn’t have a big incentive to promote their holdings.

📉 #Bitcoin $BTC Variety of Addresses in Revenue (7d MA) simply reached a 1-month low of 31,167,820.077

View metric:https://t.co/qLnvDYVzPt pic.twitter.com/zVTHt6mrKV

— glassnode alerts (@glassnodealerts) May 14, 2023

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Although BTC addresses continued to HODL, Bitcoin miners didn’t exhibit the identical conduct. In accordance with Glassnode’s information, Bitcoin’s miner outflow elevated. This conduct confirmed that many miners may face excessive quantities of promoting strain and have offered their holdings.

There might be a adverse influence on BTC if this conduct from miners continues.

Supply: Glassnode