Ethereum’s [ETH] price could hike by 22% to hit $3,500 ONLY if…

- On-chain metric revealed that exchanges have seen outflows of $180 million value of ETH

- Intraday merchants are at the moment over-leveraged on the $2,712-level on the decrease facet and $2,870 on the higher facet

After a pointy value decline throughout the cryptocurrency market, sentiment has fully shifted. Amid this, Ethereum (ETH), the world’s second-largest cryptocurrency, may simply be altering its prevailing market sentiment because it has been gaining vital consideration from crypto specialists and buyers.

$180 million value of ETH outflows

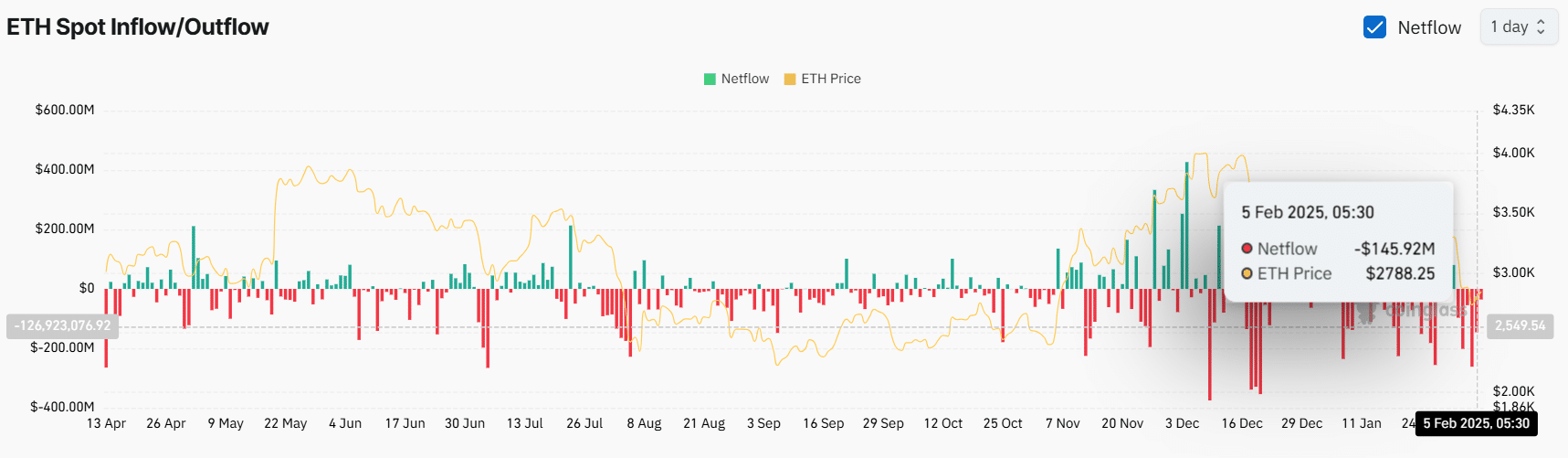

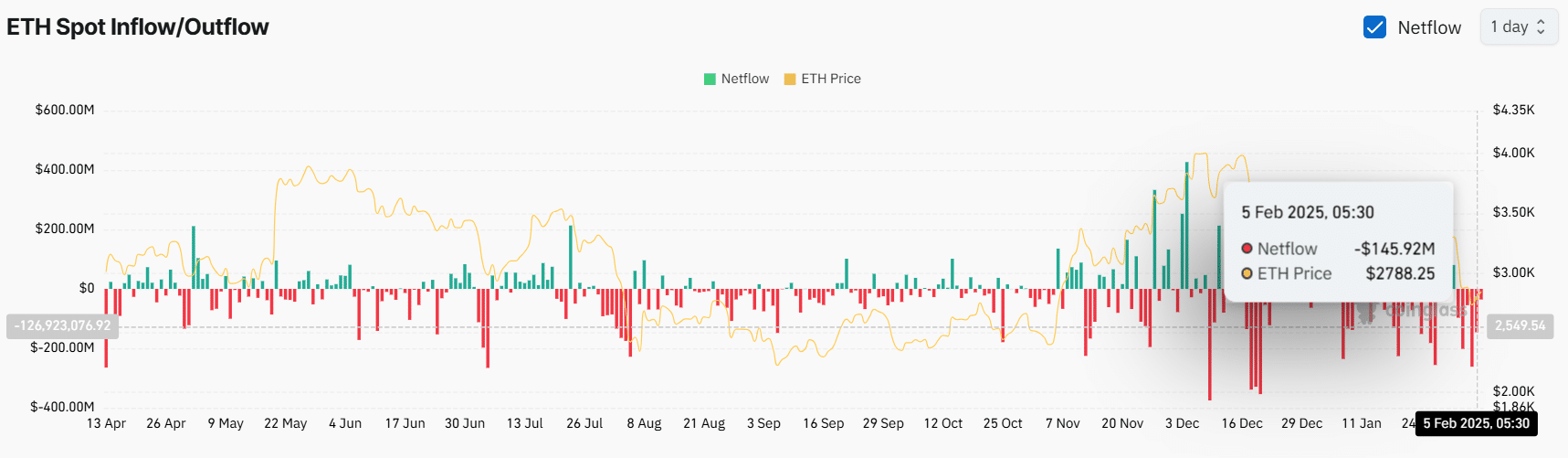

On 06 February, knowledge revealed that buyers and long-term holders have been on a shopping for spree, presumably making the most of the current value drop.

Information from spot inflows and outflows confirmed that exchanges witnessed outflows of $180 million in ETH within the final 48 hours, doubtlessly indicating accumulation.

Supply: Coinglass

Such outflows from exchanges can gasoline shopping for strain and result in an additional upside rally.

Quick positions and liquidation ranges

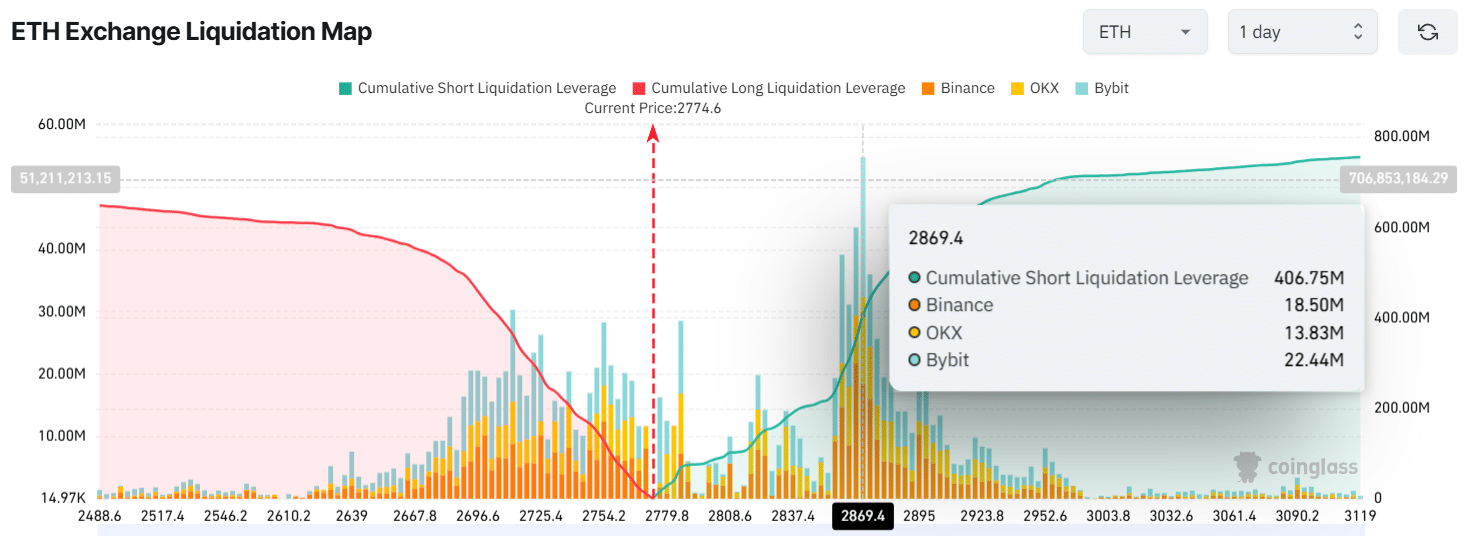

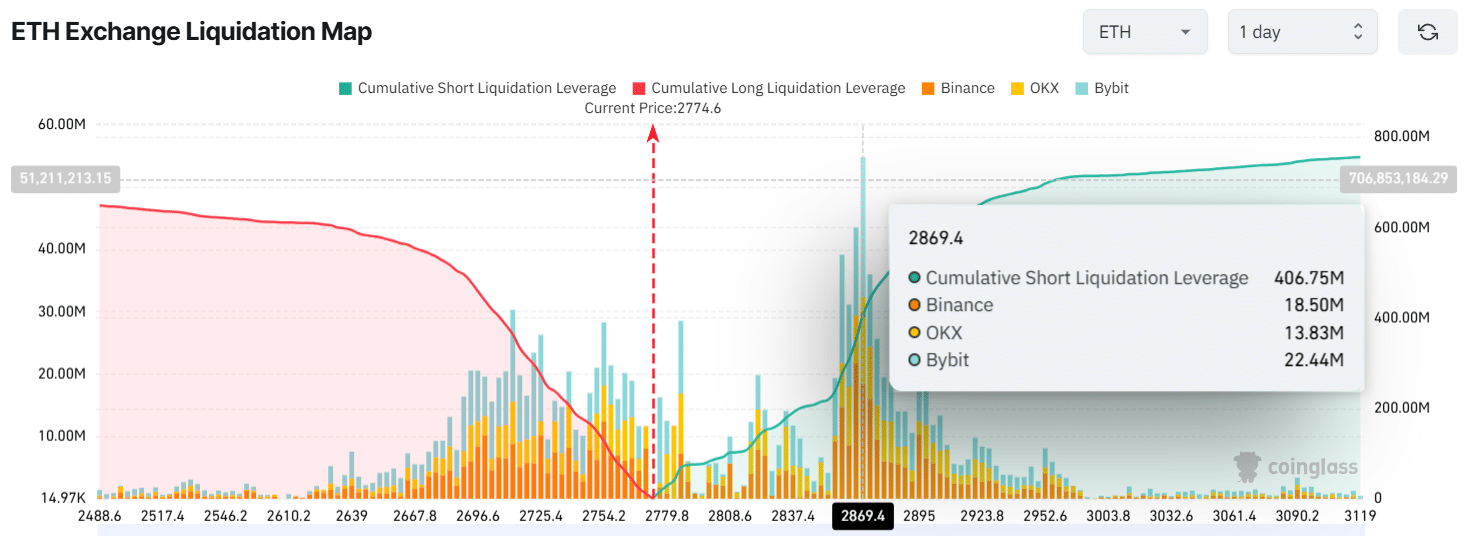

Moreover the bullish sentiment amongst long-term holders and buyers, intraday merchants appear to be betting on the bearish facet. Significantly because of the present market sentiment.

In truth, ETH’s change liquidation map revealed that merchants could also be over-leveraged on the $2,712-level on the decrease facet and $2,870 on the higher facet. This hinted on the precise help and resistance ranges for the altcoin.

Nonetheless, if the market sentiment stays unchanged and the value falls to the $2,712-level, almost $365 million value of lengthy positions shall be liquidated. Conversely, if the sentiment shifts and the value crosses the $2,870-level, roughly $406 million value of quick positions shall be liquidated.

Supply: Coinglass

These liquidation ranges prompt that the bulls have been weak, whereas merchants holding quick positions have been main the asset on the intraday stage.

Specialists eye on essential ranges for long-term

For the longer time-frame, well-liked crypto expert Ali shared a submit on X (previously Twitter), stating that if ETH holds above the $2,500-level, there’s a robust chance it may rebound to $4,000 and even $6,000 sooner or later.

In the meantime, if the altcoin fails to carry this stage and closes a each day candle beneath $2,500, it may fall to the $1,700-level – Its subsequent help.

Value motion and upcoming ranges

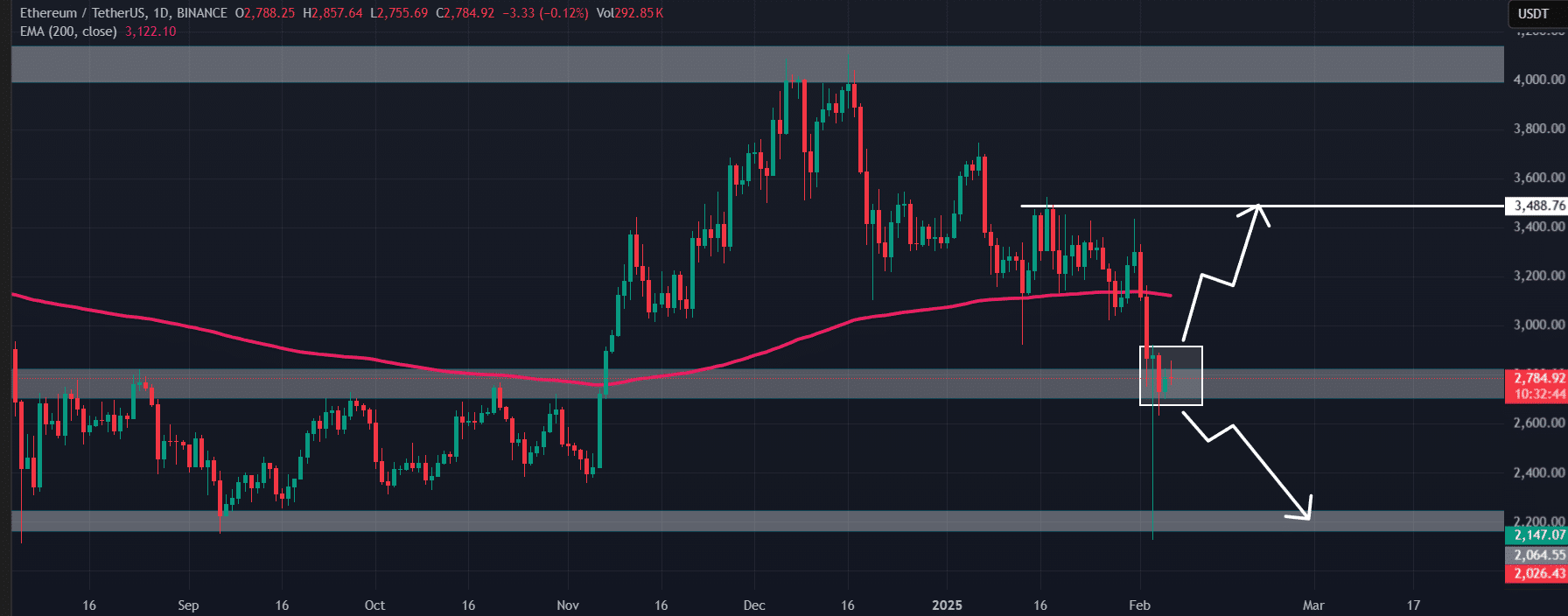

Moreover skilled predictions, AMBCrypto’s technical evaluation prompt that ETH was close to the essential help stage of $2,800 at press time. This seems to be a make-or-break state of affairs for the crypto because it has been consolidating at this stage for the final three days.

Supply: TradingView

Based mostly on the altcoin’s newest value motion, if ETH rallies and closes above the $2,880-level, it may see a value surge of over 22% to hit the $3,500-level sooner or later.

Nonetheless, if ETH’s value declines additional and closes a each day candle beneath the $2,720-level, we may see the asset drop to $2,200 sooner or later.