MicroStrategy’s Bitcoin bet: Plans $2B raise to boost BTC holdings to 500K

- MicroStrategy goals to lift $2B to fund BTC buys.

- MicroStrategy’s Bitcoin holdings might quickly hit 500K BTC; will it enhance MSTR once more?

Technique, previously MicroStrategy, plans to raise $2B in capital via convertible notes to facilitate its Bitcoin acquisition.

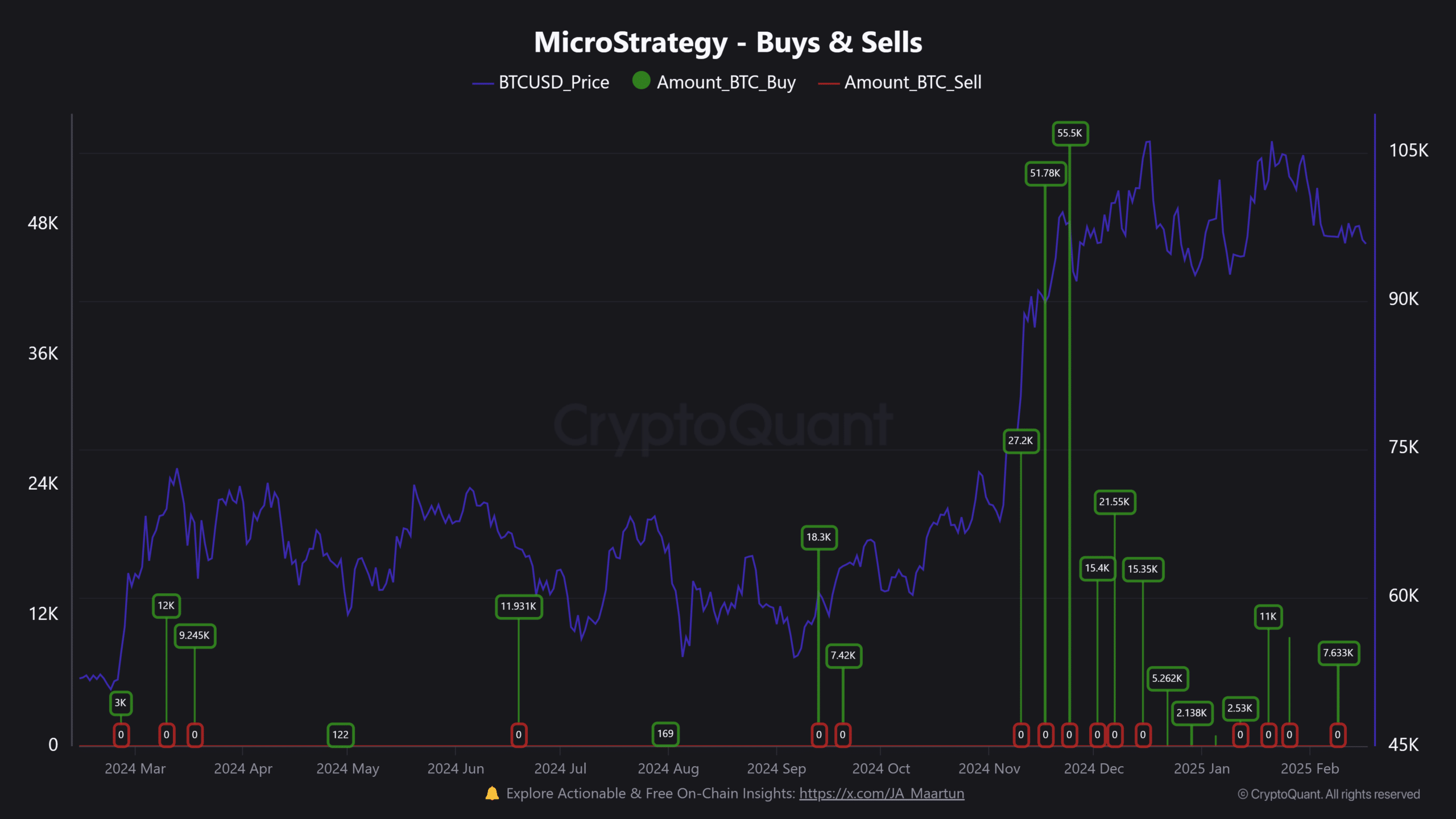

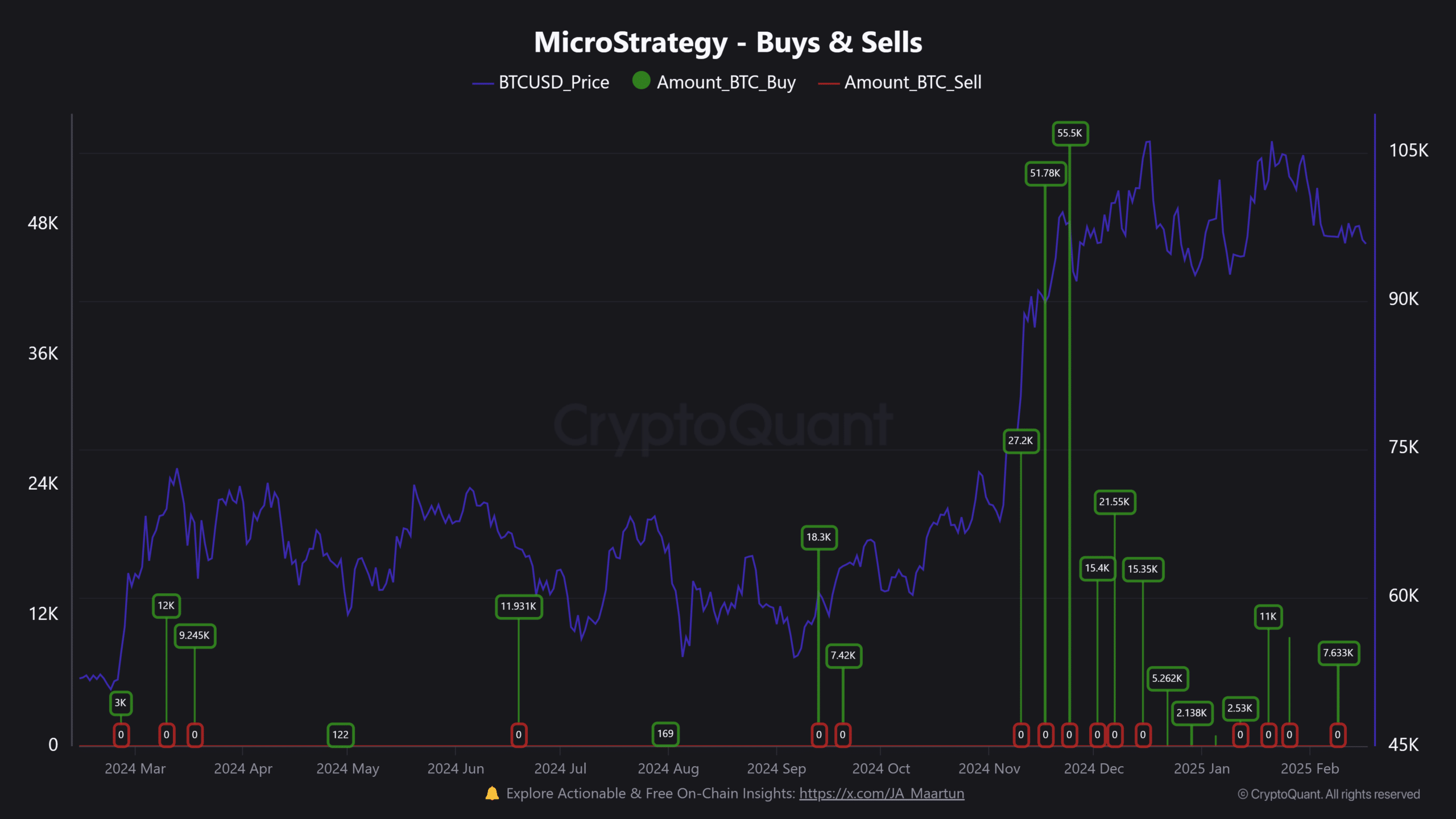

In 2025, the pioneer in BTC company treasury technique made 5 bids (over 30K BTC), bringing its complete holding to 478740 BTC. That’s $46.15B price of BTC stash primarily based on present market costs.

Supply: CryptoQuant

MicroStrategy eyes 500K BTC holdings

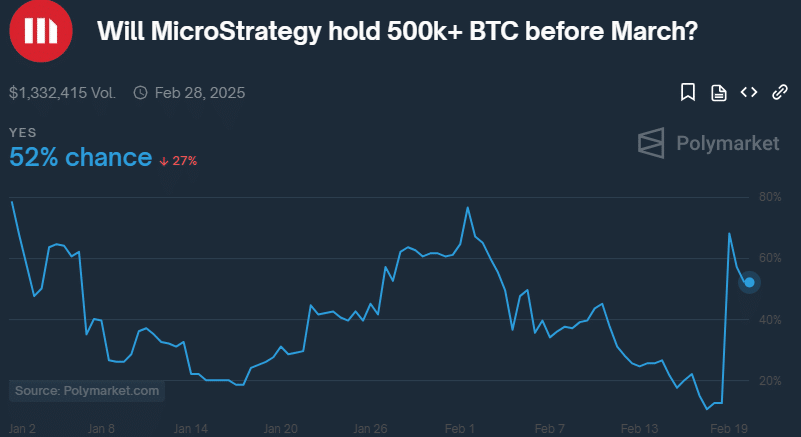

The most recent plan to lift capital for added BTC buys would broaden the agency’s holding to 500K BTC earlier than March. Nevertheless, as of this writing, the market appeared undecided on such an final result.

Prediction web site Polymarket priced a 53% probability of the agency hitting the $500K BTC goal by the top of February.

This was after a spike to 80% when the $2B elevate was introduced, suggesting that speculators have been 50/50 on Technique stash progress to 500K BTC inside every week.

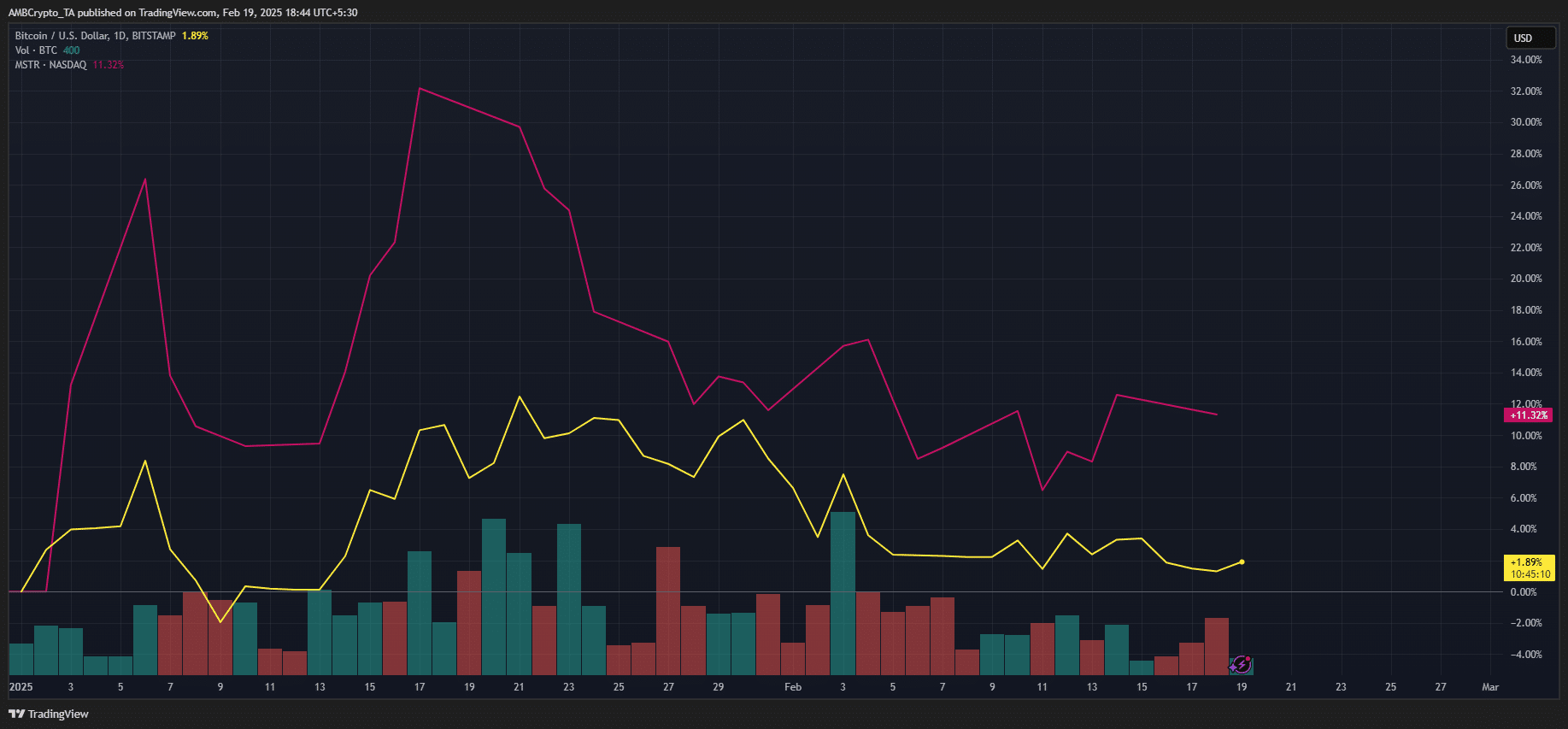

That mentioned, MSTR was down 16% from late January highs and was valued at $333 at press time. However macro analyst Felix Jauvin projected that MicroStrategy’s $2B capital elevate might mark BTC’s native backside.

Over the identical interval, BTC has shed 12% from latest highs and traded at $96K. This underscored that BTC carried out reasonably nicely below the present market sentiment.

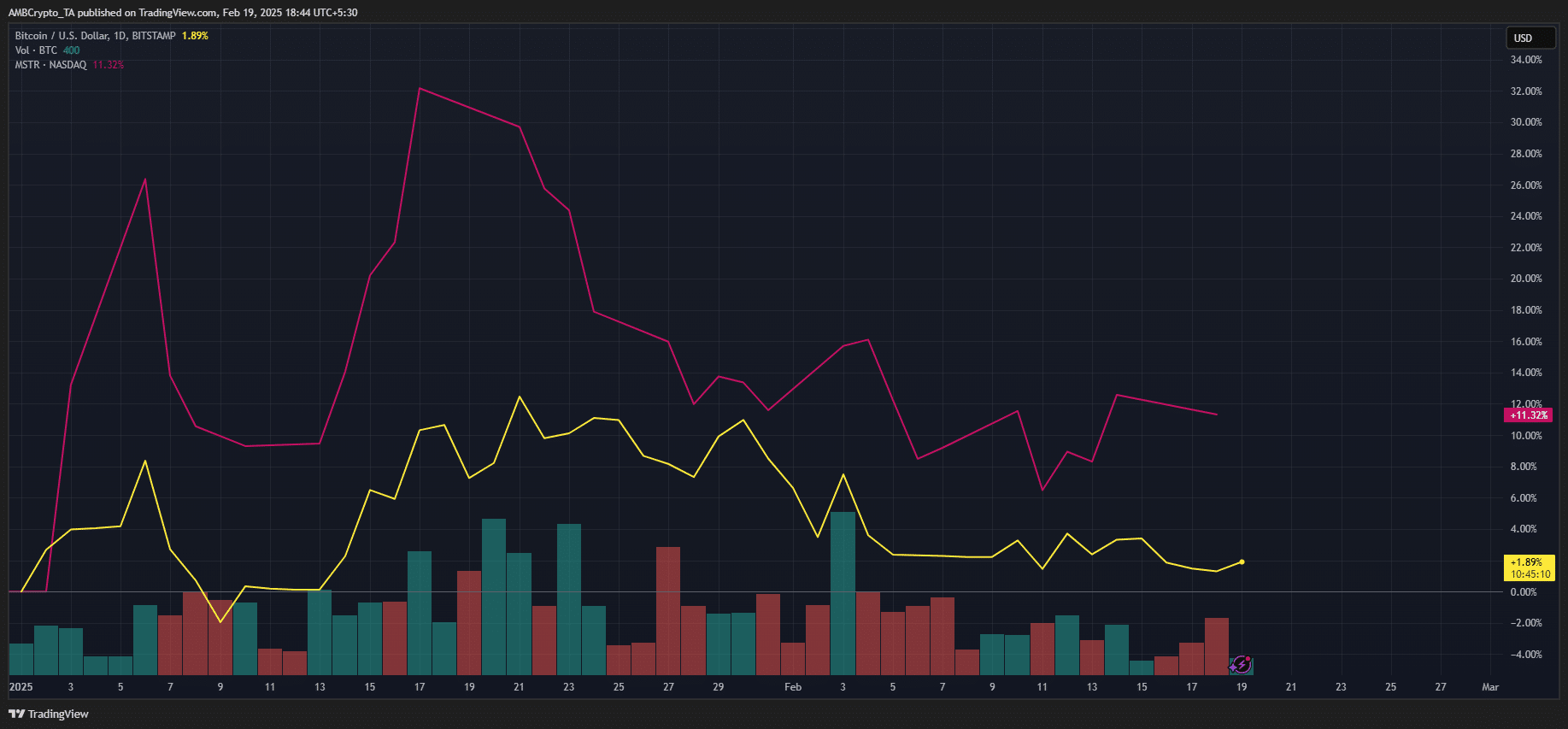

Nevertheless, on a YTD (year-to-date) foundation, MSTR logged an 11% achieve in 2025 in comparison with BTC’s 1.9%.

Supply: BTC vs. MSTR efficiency, TradingView

When zoomed to a YoY (year-on-year) foundation, MSTR was up 373% in comparison with BTC’s 85%. Merely put, the inventory was nonetheless a BTC beta, due to MicroStrategy’s huge holding on the cryptocurrency.

Actually, MSTR was one of many top-performing U.S. shares, given its BTC technique. Whether or not the stellar efficiency shall be repeated in This autumn 2025 stays to be seen.