Death Cross double-tap: Why Bitcoin’s downward spiral may not be over

- Quantity spikes verify stronger promoting strain throughout value declines.

- The loss of life cross and Fibonacci ranges level to extra declines in retailer.

Bitcoin’s [BTC] value continued its downward trajectory, buying and selling at $82,499 as of press time, after breaking under essential help ranges.

The cryptocurrency is now going through rising bearish strain, with technical indicators suggesting a chronic correction.

Including to the technical issues, well-known analyst Ali Charts tweeted that Bitcoin has witnessed a crossover between the 50-day and 100-day shifting averages on the every day chart.

Supply: X

This means continued shifts in momentum that merchants ought to watch intently.

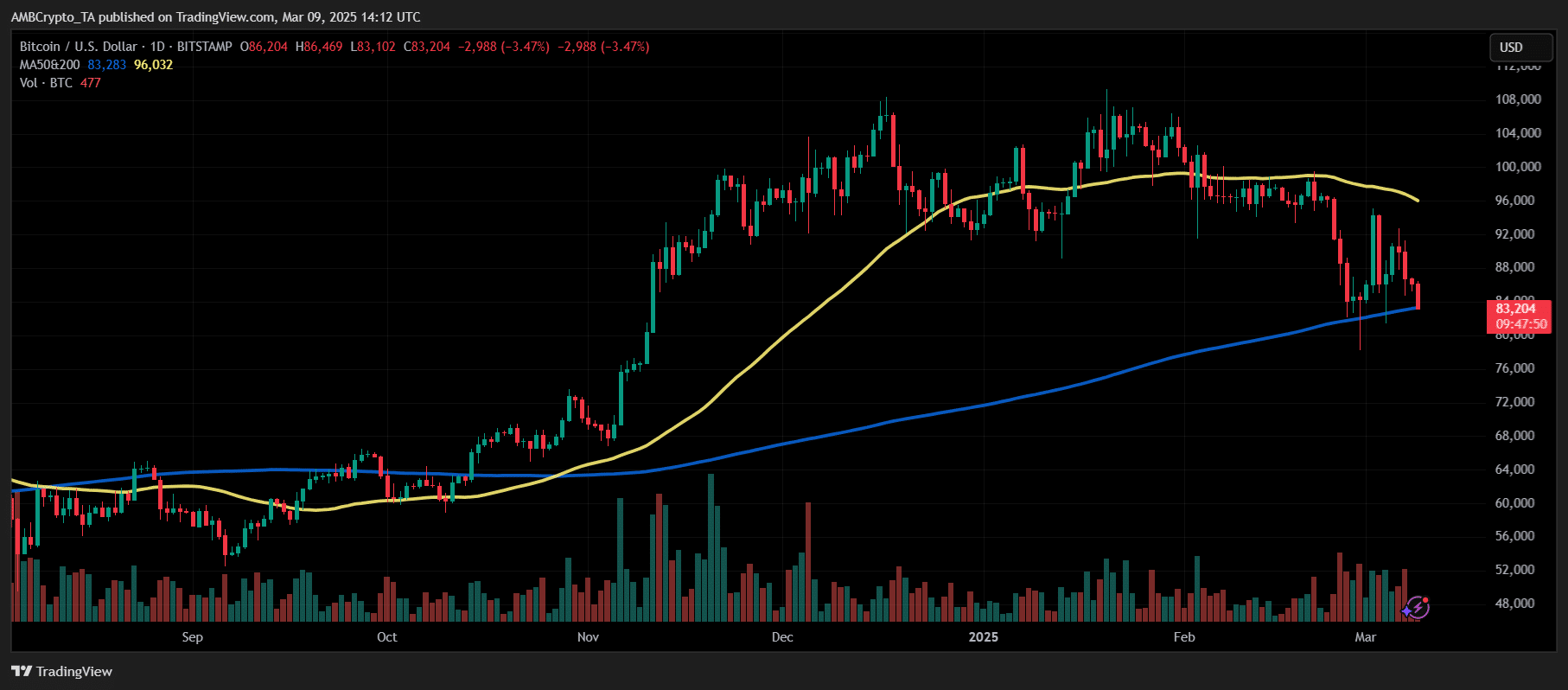

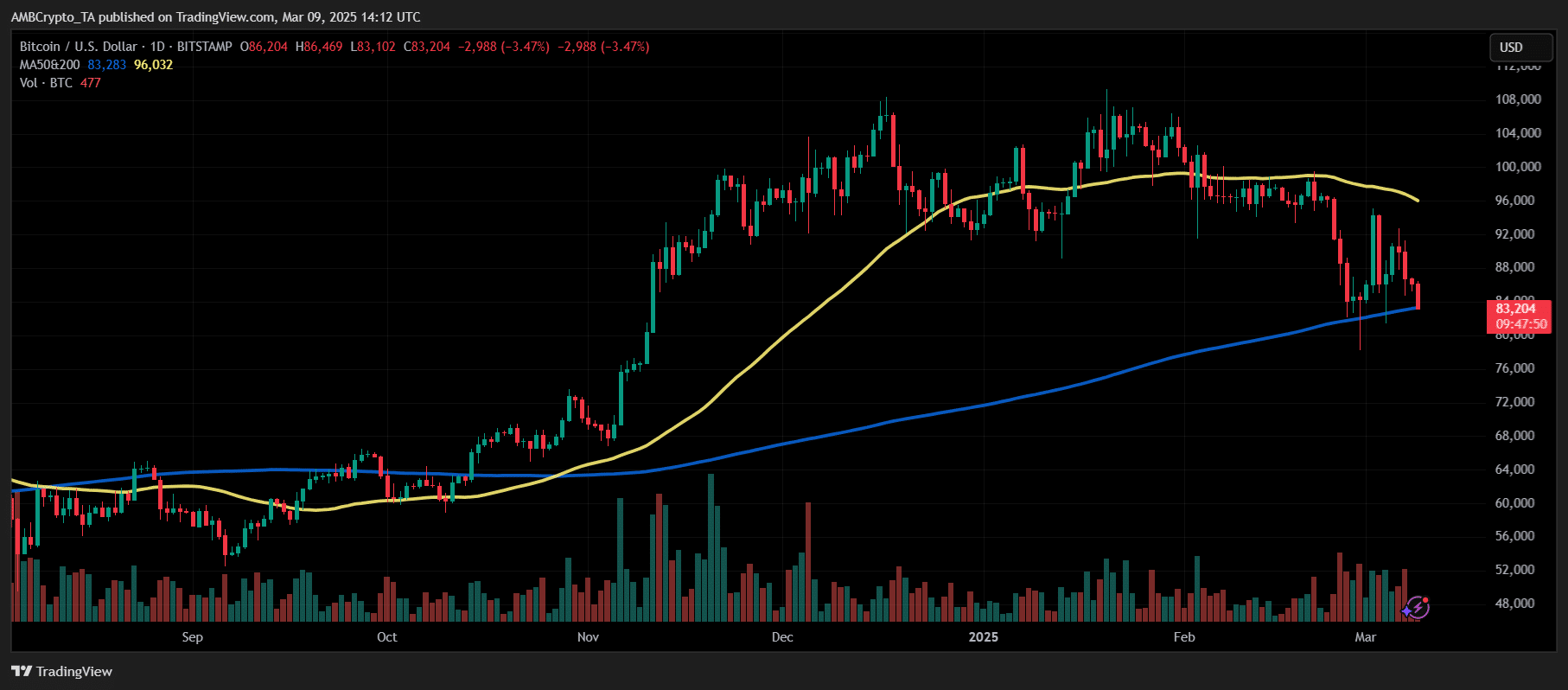

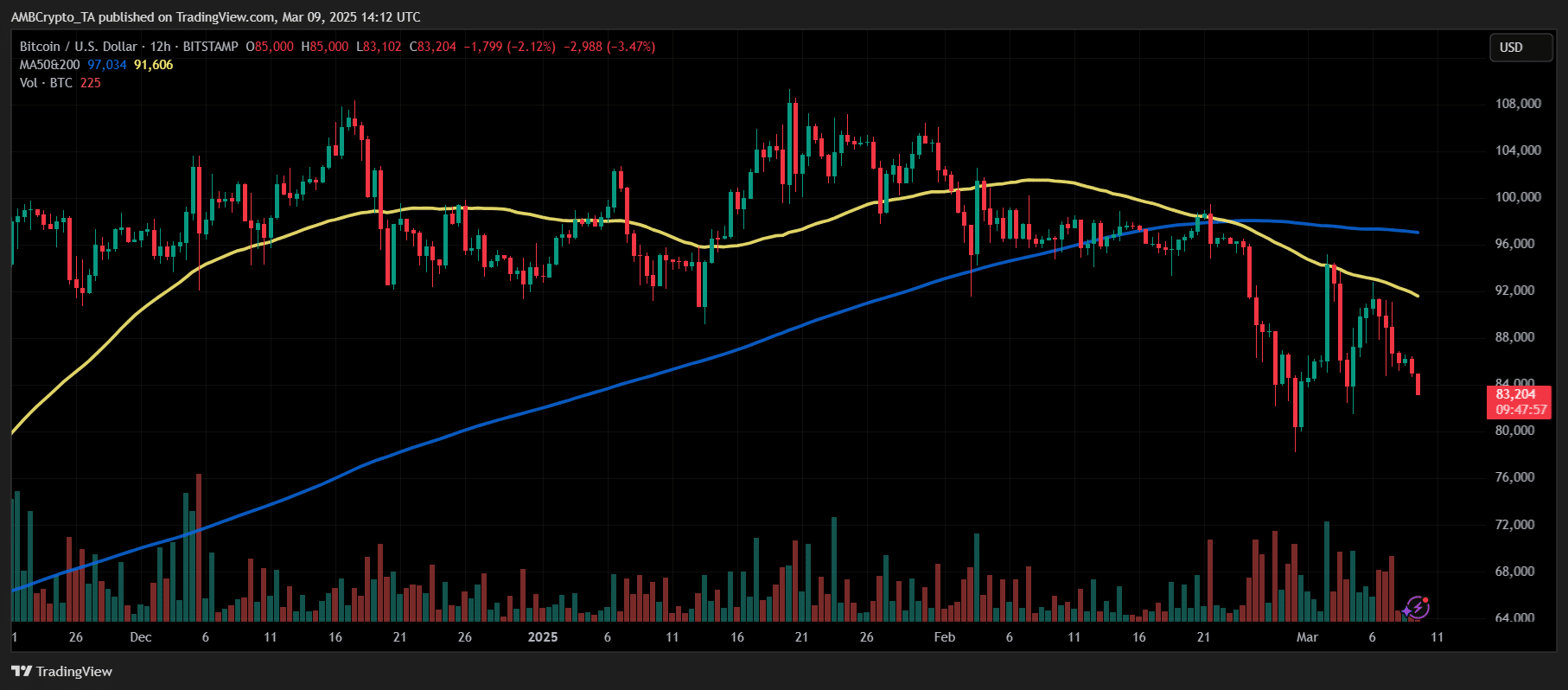

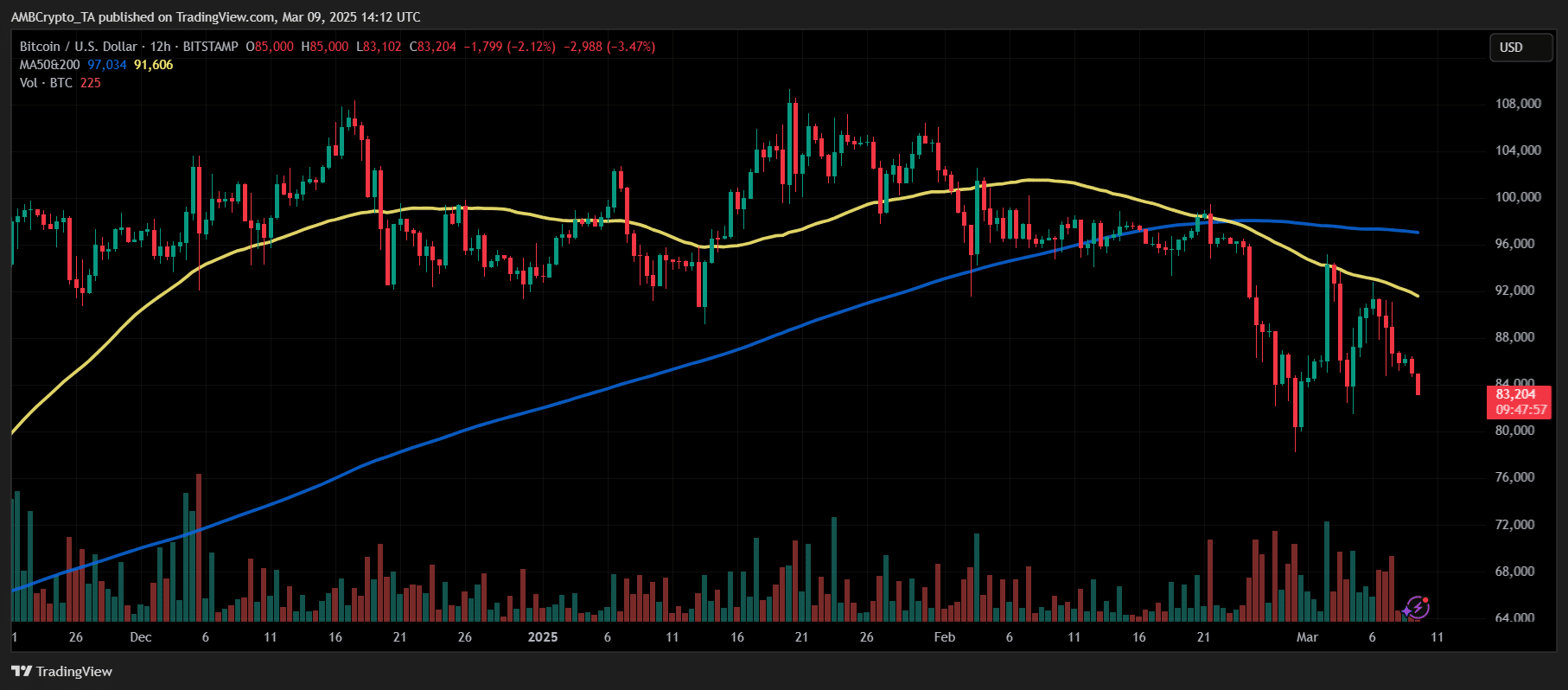

Demise cross confirms bearish pattern

A Demise Cross—a well known bearish sign—was confirmed in February when Bitcoin’s 50-period shifting common (MA) fell under the 200-period MA on each the every day and 12-hour timeframes.

Supply: TradingView

Traditionally, this crossover has preceded prolonged intervals of downward value motion.

Supply: TradingView

Bitcoin’s 50-period MA was $97,041 at press time, whereas the 200-period MA was at $91,631. It strengthened sturdy resistance ranges above the value.

BTC has but to point out indicators of reversing the pattern, remaining under these key ranges.

Fibonacci ranges counsel additional declines

Bitcoin beforehand did not maintain a transfer above the 50% Fibonacci retracement degree at $85,723. It was now testing the 23.6% retracement degree at $82,902, a key short-term help.

A decisive break under this zone may result in a deeper correction towards $80,380, which marks the 0% Fibonacci retracement from current highs.

Supply: TradingView

BTC’s most up-to-date rejection close to $88,181, aligning with the 61.8% Fibonacci degree, means that bullish makes an attempt have been weak, additional validating the downward strain.

RSI nears oversold territory

The Relative Power Index (RSI) was 40.70 at press time, displaying weak momentum however not but getting into oversold circumstances (<30).

Supply: TradingView

Earlier RSI lows at 33.79 and 16.73 point out that Bitcoin has traditionally skilled deeper corrections earlier than important rebounds.

A drop under 30 RSI would counsel oversold circumstances, probably signaling a short-term reversal.

Quantity traits reinforce promoting strain

Quantity evaluation exhibits that promoting exercise spikes throughout downward strikes, confirming a market pushed by bearish sentiment.

Nonetheless, if Bitcoin experiences a quantity decline throughout additional value drops, it might point out vendor exhaustion, probably establishing for a aid bounce.

Bitcoin examined $82,902 on the time of writing, the 23.6% Fibonacci retracement degree, which serves as speedy help. Holding above this degree is essential to forestall additional draw back.

A breakdown under $82,902 may push Bitcoin towards $80,380, the 0% Fibonacci retracement degree, marking a crucial help zone.

Key help and resistance ranges to observe

On the upside, Bitcoin faces sturdy resistance at $85,723, the 50% Fibonacci degree. A decisive break above this resistance may shift momentum and permit Bitcoin to check $88,181, the 61.8% Fibonacci retracement degree.

Nonetheless, if Bitcoin fails to reclaim $85,723, bearish strain could persist, rising the probability of additional declines. Merchants ought to watch value motion intently at these ranges for affirmation of pattern continuation or reversal.

With the Demise Cross nonetheless in play and the 50/100-day shifting common crossover famous by Ali Charts, BTC stays in a medium-term downtrend except important shopping for strain emerges.

Merchants ought to monitor RSI ranges and quantity traits at key helps to gauge potential reversal alerts.