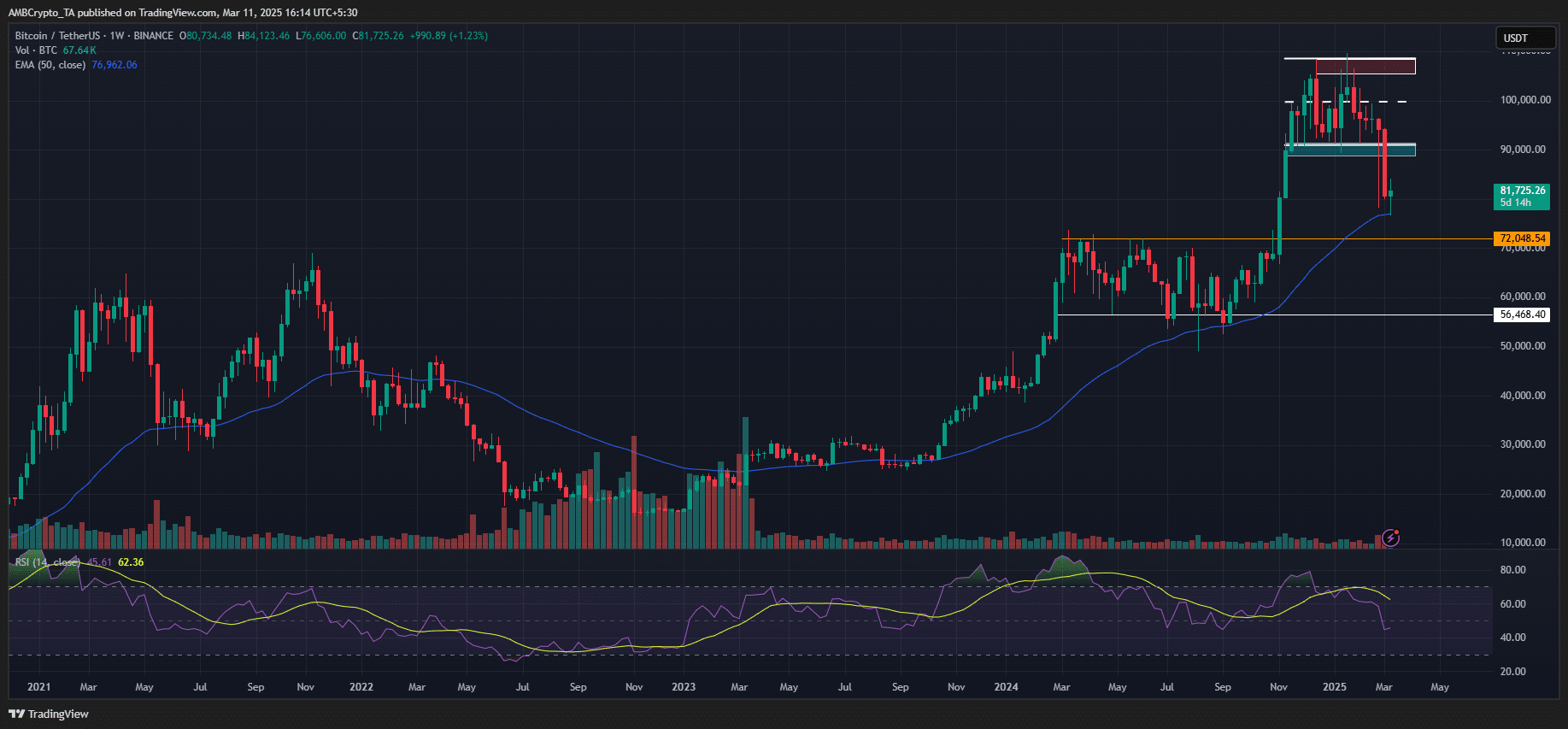

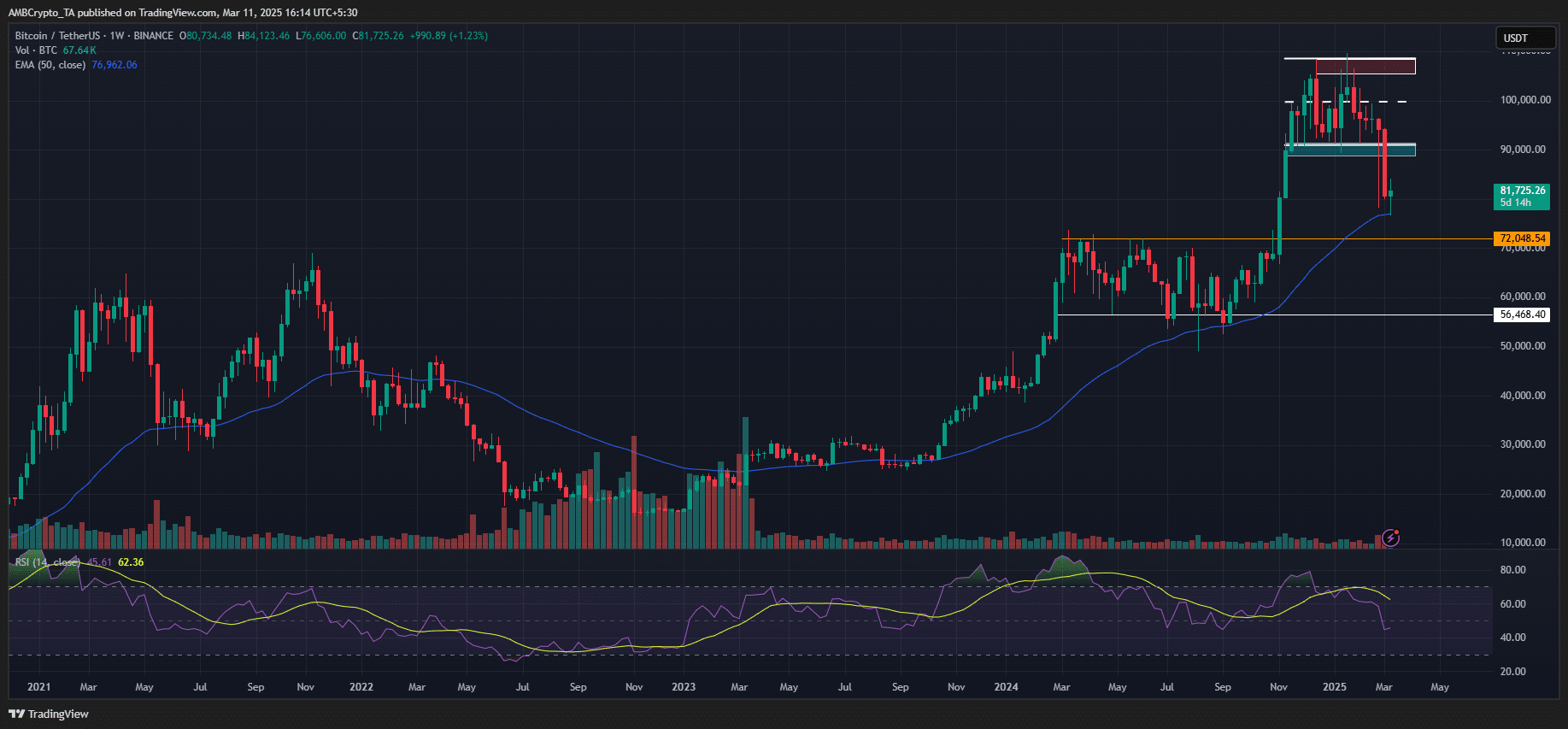

Bitcoin could retrace to $72K, matching election lows, analysts predict

- BTC may prolong losses to final November’s U.S. elections ranges of $72K.

- Cathie Wooden projected higher macro circumstances within the second half of 2025.

Bitcoin’s [BTC] may slip beneath $75k within the close to time period amid renewed U.S. recession fears. Actually, Greg Madagini, Director at crypto choices analytics platform Amberdata, projected that BTC may drop to $72K within the brief time period.

Bitcoin’s potential dip to $72K

In his weekly market report, Magadini stated,

“BTC costs look to be delivering a Bart Simpson sample, which might goal spot costs again to $72k, the Nov fifth election degree.”

Supply: Amberdata

The Bart Simpson sample refers back to the formation of a pointy rise, marched by consolidation, after which a pointy retrace.

If the sample is validated, BTC may faucet its final November U.S. election degree, like retracement seen amongst U.S. equities, added Magadini.

“On condition that the SPX (S&P 500 Index) has now retraced again to election value ranges, I feel this sample for spot BTC may very well be within the playing cards.”

An identical bearish outlook was shared by famend technical analyst Peter Brandt, arguing that BTC structurally topped out and should reclaim $95K to show market sentiment optimistic once more.

Amid the U.S. recession fears, Ark Make investments’s Cathie Wooden assured that the U.S. economic system would expertise a ‘deflationary growth’ within the second half of 2025. She said,

“In our view, the market is discounting the final leg of a rolling recession, which is able to give the Trump Administration and the Powell Fed many extra levels of freedom than buyers count on, organising the U.S. economic system for a deflationary growth within the second half of this 12 months!”

One other optimistic replace was the robust correlation between BTC and international cash provide (M2). Most analysts have famous that BTC lags behind international M2, and the latest drawdown mirrored M2’s drop final quarter.

Because the indicator surged in Q1 2025, BTC may bounce again if the correlation holds.

Supply: X

Jon Consorti, head of development at Theya Bitcoin, noted that with the BTC concern and greed index at typical ‘backside’ ranges, the cryptocurrency may very well be primed for a restoration.

“Concern and greed index at 20, a price reached in bull markets when bitcoin is on its technique to making a neighborhood backside.”

At press time, BTC was valued at $81.6K after a quick dip to $76K. The extent was additionally a 50 Exponential Transferring Common (EMA) on a weekly chart and essential help for previous bull markets. It stays to be seen if it should maintain within the brief time period.

Supply: BTC/USDT, TradingView