Dormant Ethereum whale awakens: $13M in ETH moves to Kraken amid market turbulence

- Dormant ETH whale has reemerged, transferring 7,000 ETH to Kraken because it plunged to $1,760.

- Given the turbulence in threat belongings, ETH merchants ought to carefully monitor alternate inflows.

Ethereum [ETH] has plunged under the $2,000 mark, erasing $46 billion in market worth inside every week. This drop brings ETH again to the $1,900 vary for the primary time in two years.

With a ten.64% weekly decline, ETH stands because the weakest performer amongst high-caps. However with RSI in oversold territory and buying and selling quantity surging 47%, may this be the right “dip-buying” alternative?

Dormant ETH whale awakens

Ethereum’s market simply noticed a big on-chain event. An ETH whale, dormant for the reason that preliminary coin providing (ICO), has resurfaced, transferring 7,000 ETH ($13.8M) to Kraken.

This transfer coincided with ETH plummeting to $1,760 – its lowest degree since October 2023.

Regardless of ETH rebounding to $1,900, the whale nonetheless holds 30,070 ETH ($50M). If extra promoting follows, ETH may face deeper corrections, which appears more and more doubtless within the near-term.

Why? Whereas declining exchange reserves verify accumulation, the broader market downturn and rising liquidations may put ETH’s restoration in danger.

Over $110 million in ETH lengthy positions have been liquidated up to now 24 hours and ETH funding charges turning adverse on three out of six high exchanges recommend short-sellers are tightening their grip.

Supply: CryptoQuant

Including to the bearish stress, 180-day dormant circulation spiked as ETH broke under $2,100, indicating a surge in long-term holder sell-offs.

In a risk-off surroundings, this aligns with a distribution part, additional weighing on ETH’s short-term value motion.

Figuring out key help zone

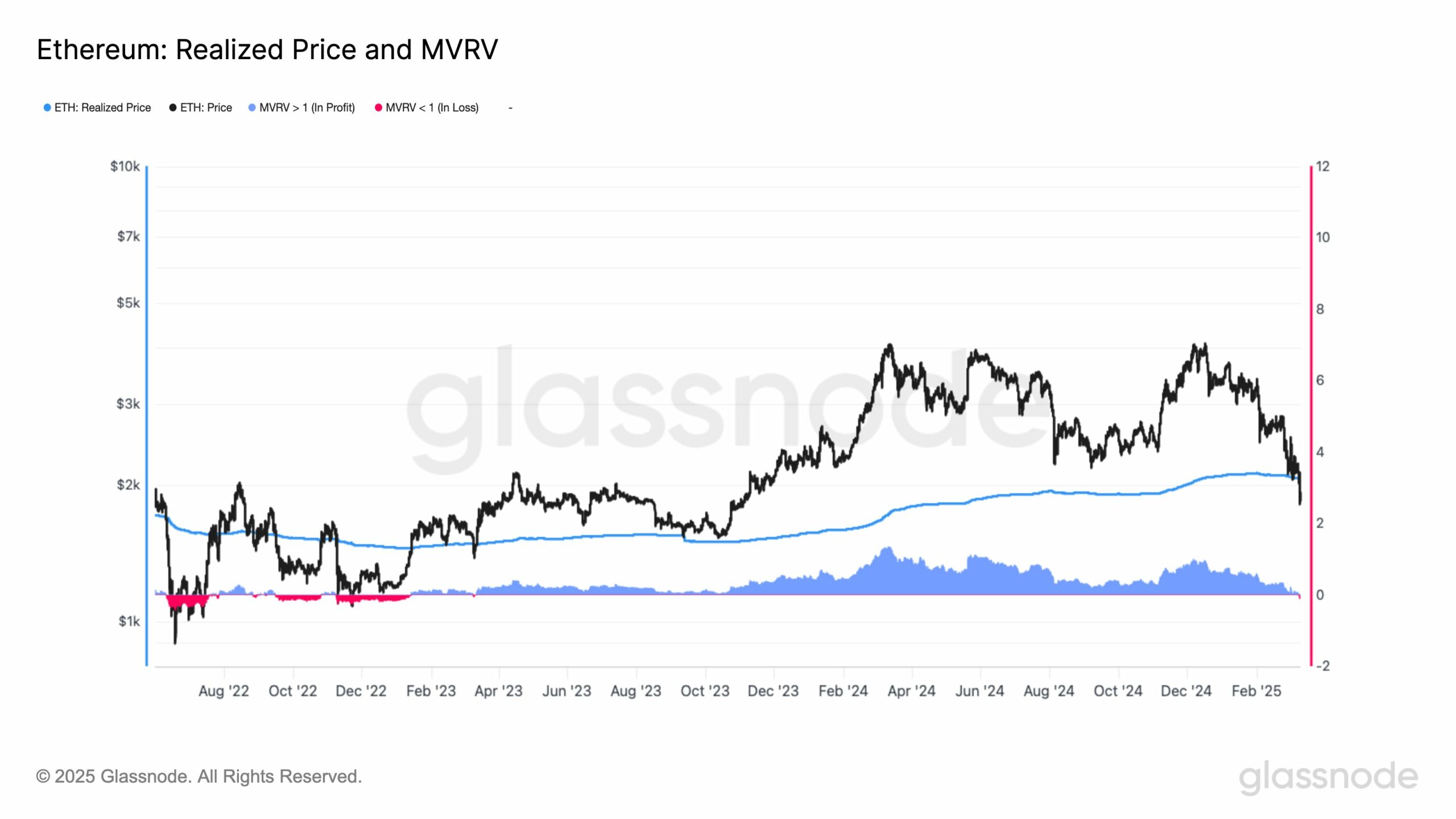

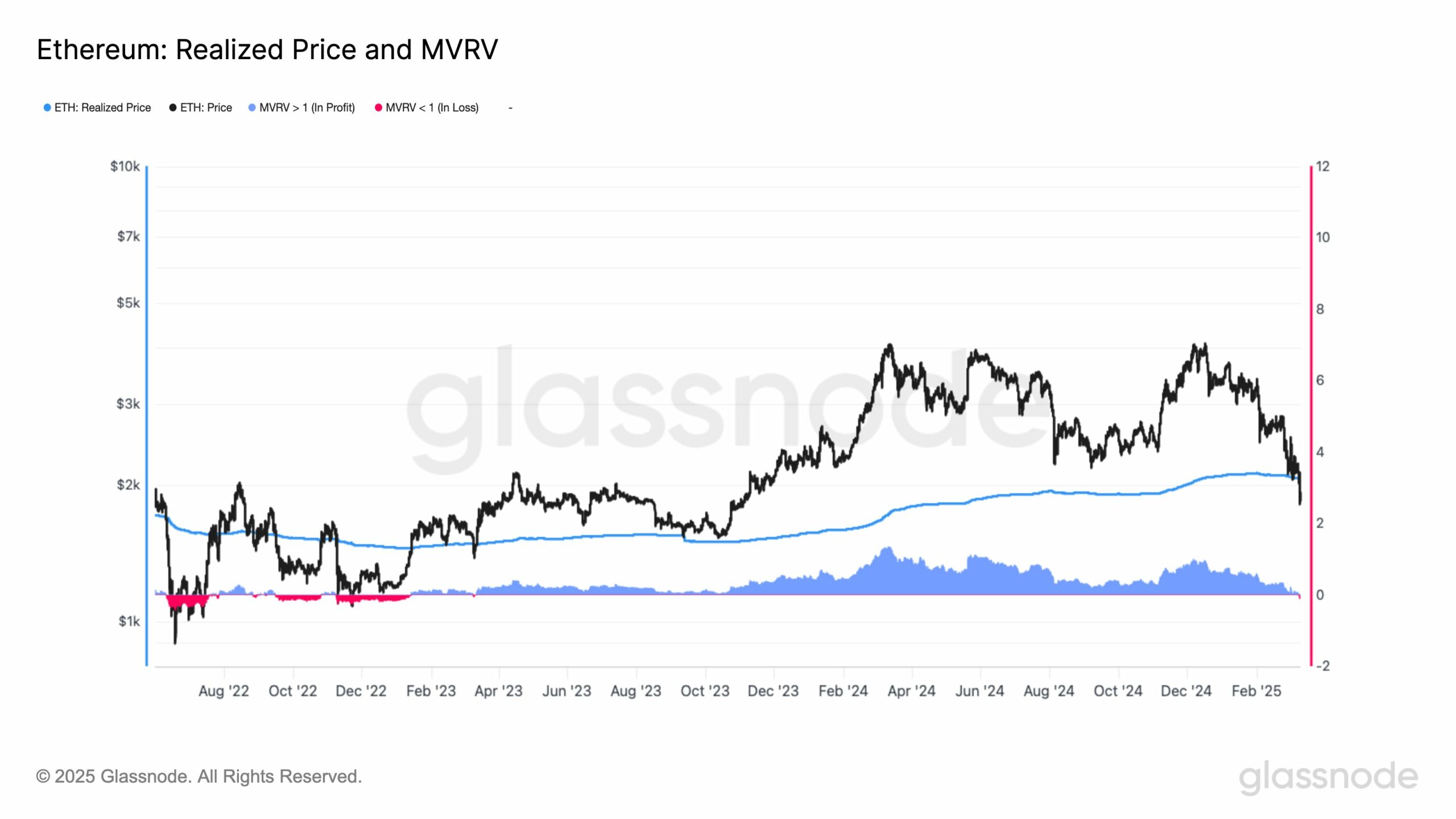

Ethereum has fallen under its realized value for the primary time in two years, which means the common holder is now at an unrealized loss.

At present buying and selling at $1,917, ETH sits under the realized value of $2,058, pushing its MVRV ratio to 0.93, reflecting a 7% network-wide unrealized loss.

Supply: Glassnode

Traditionally, dips under realized value have signaled capitulation zones. With dormant ETH whales promoting off, this pattern appears to be in place.

Fast help rests at $1,592 – a break under this degree may push 4.80 million ETH into loss. If breached, it may open the door for additional draw back.