Bitcoin accumulation jumps, but why buying pressure is still a challenge

- Bitcoin’s accumulation pattern rating rises above 0.1, signaling a possible shift towards renewed shopping for curiosity.

- A convincing reversal nonetheless requires sustained demand.

Bitcoin’s [BTC] accumulation pattern rating has ticked above 0.1 for the primary time for the reason that eleventh of March – a modest however noteworthy shift in an in any other case bearish panorama.

Whereas distribution stays firmly in management, this uptick hints at a flicker of shopping for curiosity that would sign the early levels of renewed demand.

The important thing query now could be whether or not this marks the start of a market reversal, or merely a short lived pause within the prevailing downtrend.

Accumulation exercise reawakens after extended lull

Following a heavy wave of accumulation through the late This fall rally — mirrored in deep purple nodes on the chart — sentiment turned decisively risk-off as Bitcoin entered a distribution-dominant part in early 2025.

This transition is obvious within the growing frequency of yellow and orange markers, indicating widespread promoting or hesitation to purchase.

Supply: Glassnode

Nevertheless, March 2025 reveals a refined however notable shift: accumulation scores are starting to climb, with colours transitioning again towards purple.

Whereas nonetheless modest, this transformation suggests renewed curiosity from longer-term holders or entities steadily rebuilding positions.

It might symbolize early positioning forward of a possible pattern reversal — or just a short-lived deviation in an ongoing bearish cycle.

Market sentiment and potential reversal

Bitcoin’s ongoing downtrend has been outlined by prolonged distribution, with the ATS remaining beneath 0.5 – indicating dominant promoting strain.

The current climb above 0.1, although minor, alerts the reemergence of accumulation — a sample typically seen through the early levels of restoration after main corrections.

Traditionally, such transitions have adopted bear market bottoms, the place accumulation slowly builds as confidence returns.

At present, strategic strikes by institutional gamers and expectations of regulatory readability may very well be driving this refined shift.

Nevertheless, for the pattern to carry, accumulation should be sustained by continued institutional demand and supportive coverage alerts. Any abrupt regulatory setbacks or sharp volatility spikes might disrupt this nascent restoration.

Bitcoin: Weak momentum, restricted purchase strain

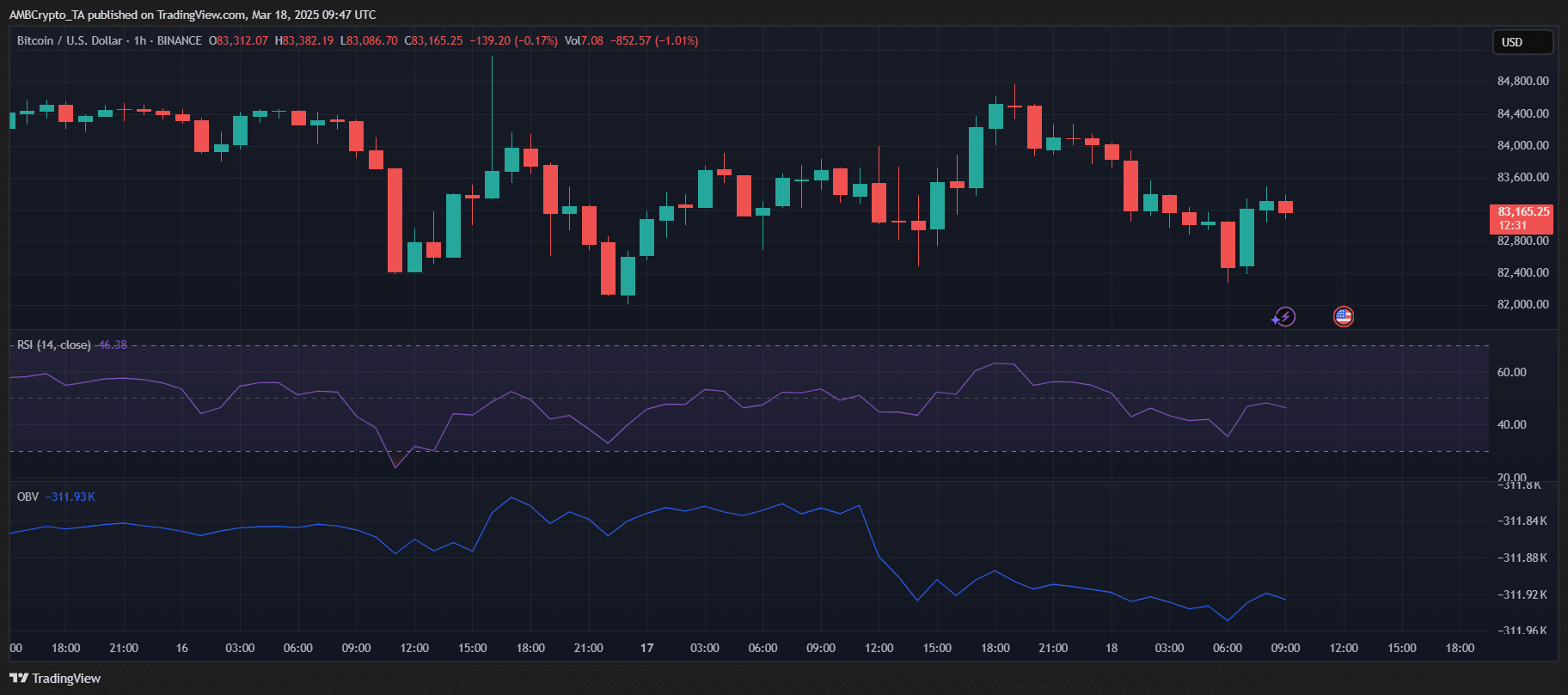

Bitcoin was at $83,165 at press time, down over 1% prior to now 24 hours. The hourly chart revealed a wrestle to reclaim upward momentum, with a sample of decrease highs persisting regardless of transient rebounds.

The RSI sat at 46, reflecting weak bullish strain and no clear indicators of the asset being oversold.

Supply: TradingView

In the meantime, the OBV remained firmly unfavourable at -311.93K, highlighting a scarcity of sustained shopping for exercise. Taken collectively, these indicators pointed to cautious sentiment within the quick time period.

For a convincing reversal to take form, BTC would wish to interrupt above $84,000, accompanied by rising quantity and an RSI push past the impartial 50 mark.