Solana crashes 36% to $120, but is the worst yet to come?

- Solana’ restoration is below stress from large-scale sell-offs and weak sentiment.

- Past technical, Solana discovered itself embroiled in controversy.

Solana [SOL] has plunged 36% this month, rating because the worst-performing high asset. A 2% uptick in buying and selling quantity, coupled with an oversold RSI and a bullish MACD crossover, indicators potential dip shopping for round $120.

Nevertheless, with threat urge for food nonetheless low, can SOL bulls leverage technicals alone to stage a restoration?

Past the charts: Key elements at play

Pumpfun continues to gasoline promoting stress on Solana, just lately transferring 196,370 SOL value $25.3 million to Kraken.

In whole, it has deposited 2,629,656 SOL value $511 million at $194 and offloaded 264,373 SOL for $41.64 million USDC at $158, contributing to the continued downturn.

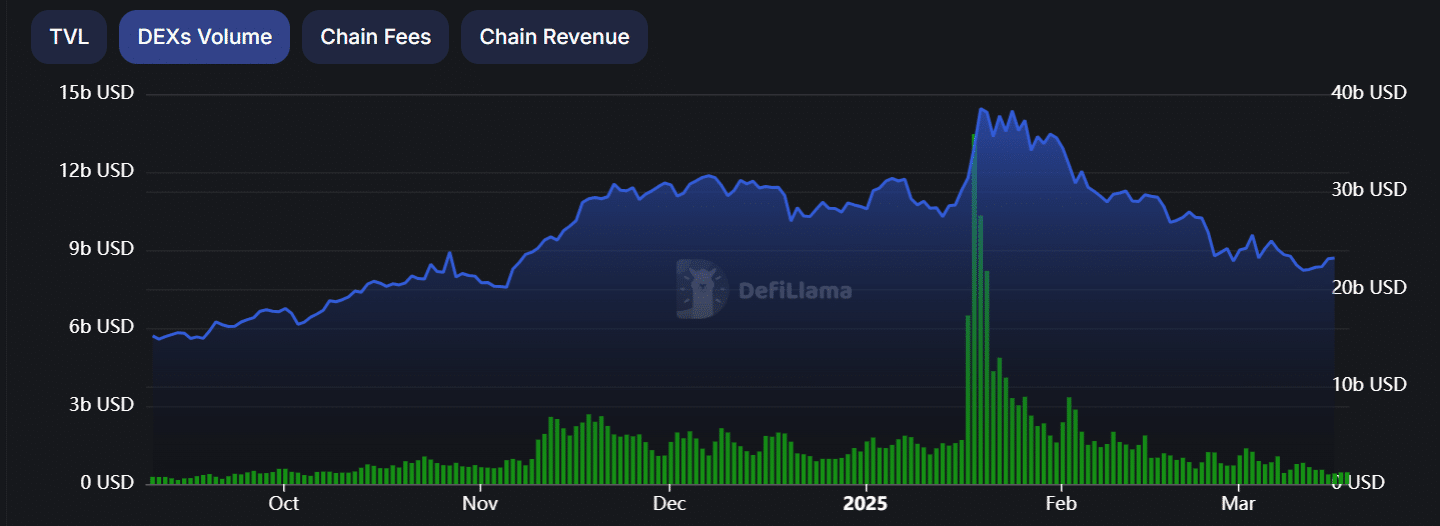

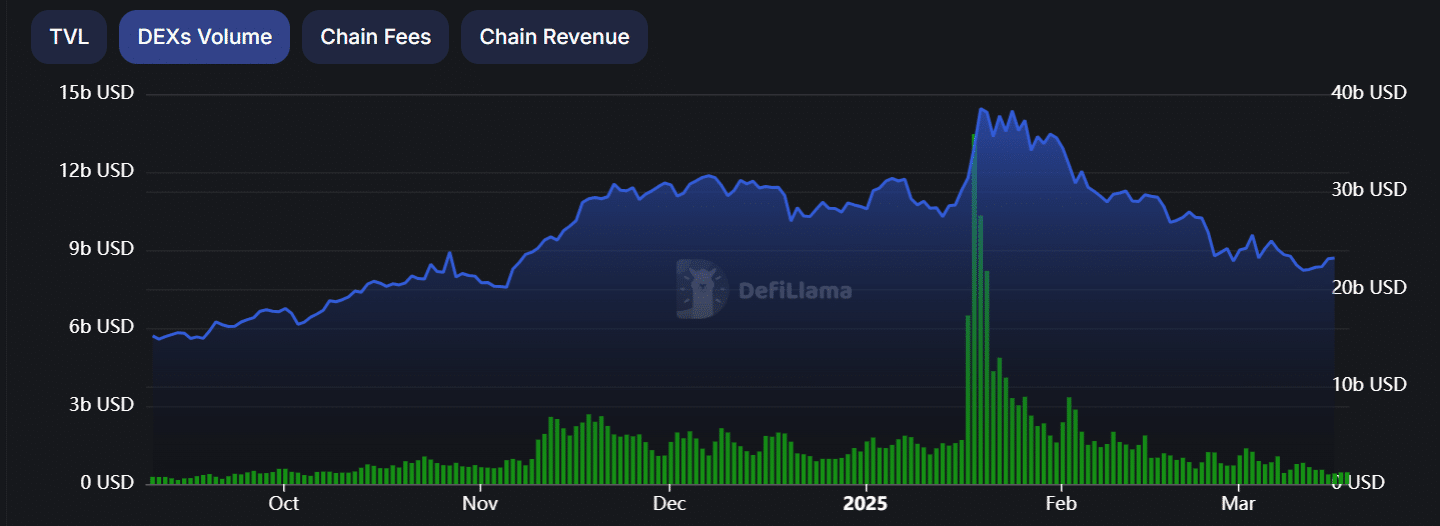

With growing sell-side liquidity in a risk-off market, a rebound seems unsure. In the meantime, Solana’s DEX quantity and TVL have slipped again to pre-election ranges, signaling weakening community exercise.

Traditionally, Solana’s restoration phases have been marked by double-digit progress in TVL and DEX quantity, usually signaling a market backside.

Nevertheless, on the fifteenth of March, its DEX quantity dropped beneath $1 billion, elevating considerations a couple of potential pattern reversal.

Supply: DefiLlama

Until merchants step in with sturdy buy-side momentum, additional draw back stays probably. Including to the uncertainty, Solana now faces backlash over a controversial advertisement on X (previously Twitter).

The advert, which amassed 1.2 million views, was met with overwhelming negativity, forcing Solana to delete it. Nevertheless, the injury was executed, impacting market sentiment.

Compounding bearish indicators, Weighted Sentiment has flipped detrimental, reinforcing the dearth of bullish affirmation and suggesting traders stay cautious a couple of potential rebound.

Assessing Solana’s subsequent transfer

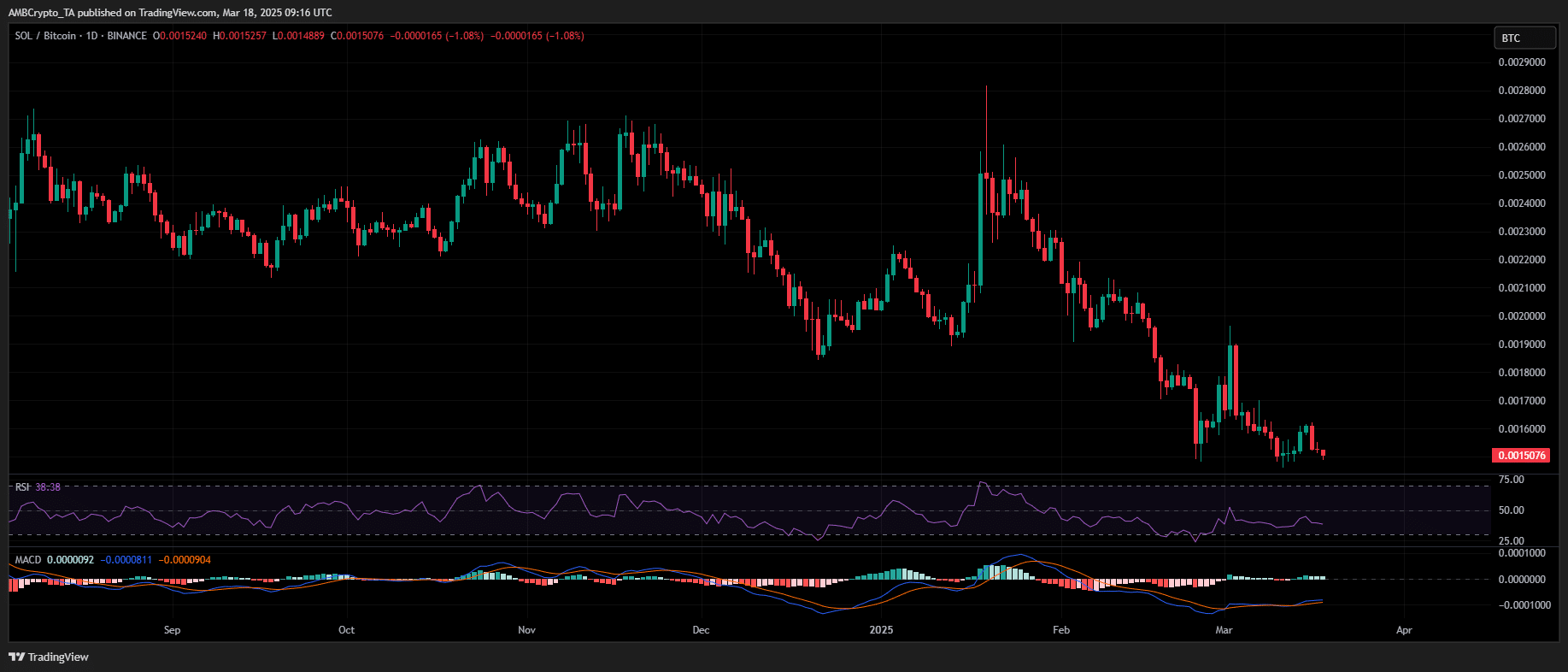

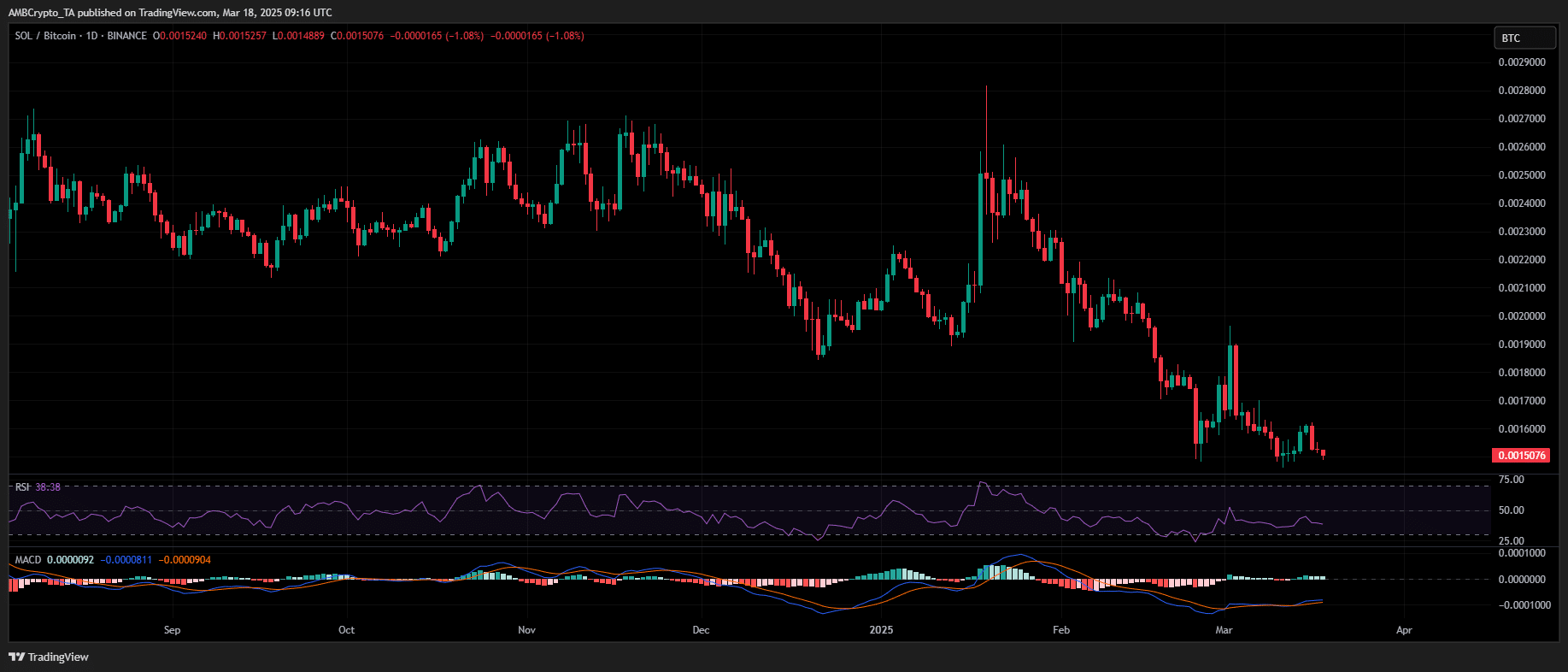

Solana’s value motion highlights a persistent supply-demand imbalance. Whereas Bitcoin consolidates, Solana has but to see sturdy capital inflows from strategic traders.

Regardless of a 30% month-to-month decline, discounted costs haven’t triggered sturdy accumulation. The SOL/BTC pair continues to print decrease lows, just lately plunging to a two-year low, signaling weakening relative power.

Supply: TradingView (SOL/BTC)

With large-scale sell-offs and bearish sentiment dominating, the absence of conviction from risk-managed merchants weakens SOL’s probabilities of reclaiming key resistance ranges.

Given the present market dynamics, an additional pullback towards $120 or decrease seems more and more possible.