Ethereum buyers are buying with a negative netflow of 150k ETH

- ETH dropped under $2k once more after remaining above this degree for 2 days.

- Ethereum patrons have been aggressively shopping for, with a detrimental netflow hitting 150,000 ETH.

Over the previous three days, Ethereum [ETH] noticed a shift in fortunes, reclaiming $2k. Amidst this pattern reverse, is the next exercise from the purchase facet.

In response to CryptoQuant, Ethereum noticed a detrimental netflow of over 150,000 ETH on by-product exchanges.

Supply: CryptoQuant

Such a big outflow signifies decreased promoting strain as buyers transfer ETH to chilly storage or DeFi. Due to this fact, the massive outflow signifies elevated accumulation by massive entities signaling bullish sentiments from these buyers.

This accumulation by massive entities is additional evidenced by the latest whale-buying exercise.

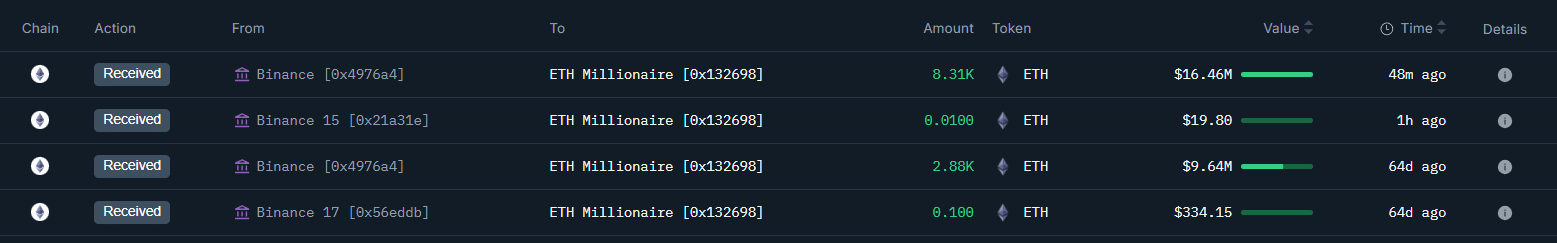

As per Onchain Lens, a whale withdrew 8,313 ETH price $16.46 million from Binance after two months of inactivity. After this transaction, the whale now holds 11,197 ETH price $22.17 million.

Supply: Onchain Lens

When whales start accumulating, it indicators robust bullish sentiment, indicating they imagine present costs are undervalued and prone to rebound quickly.

Sustained accumulation by sensible cash usually boosts market confidence, attracting elevated demand from speculative patrons.

What it means for ETH

Regardless of the rising demand from massive holders, ETH costs proceed to battle.

In truth, on day by day charts, ETH has dropped under $2k once more, hitting a low of $1,963. This means that different market contributors stay bearish and are much less optimistic about potential worth restoration.

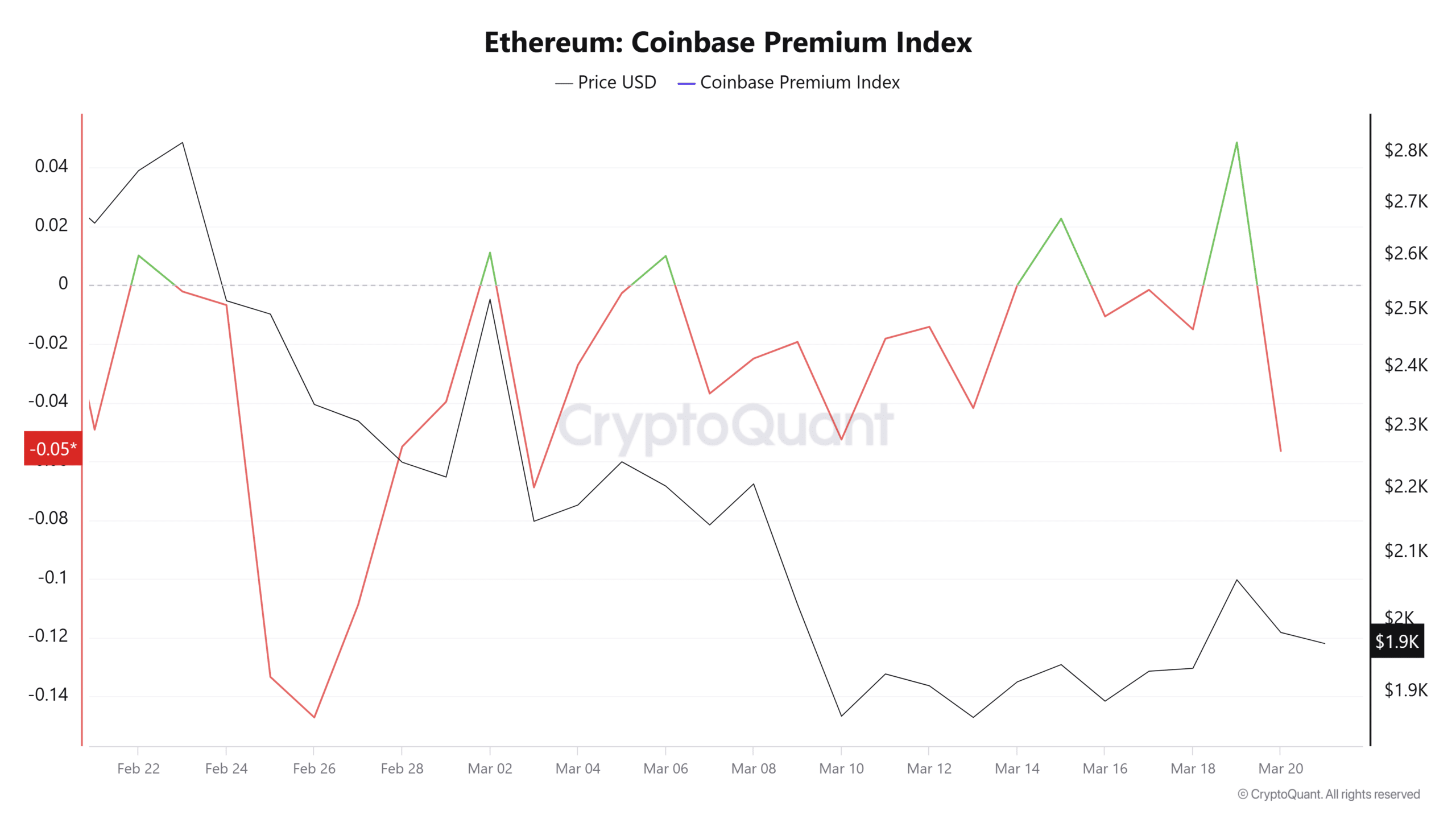

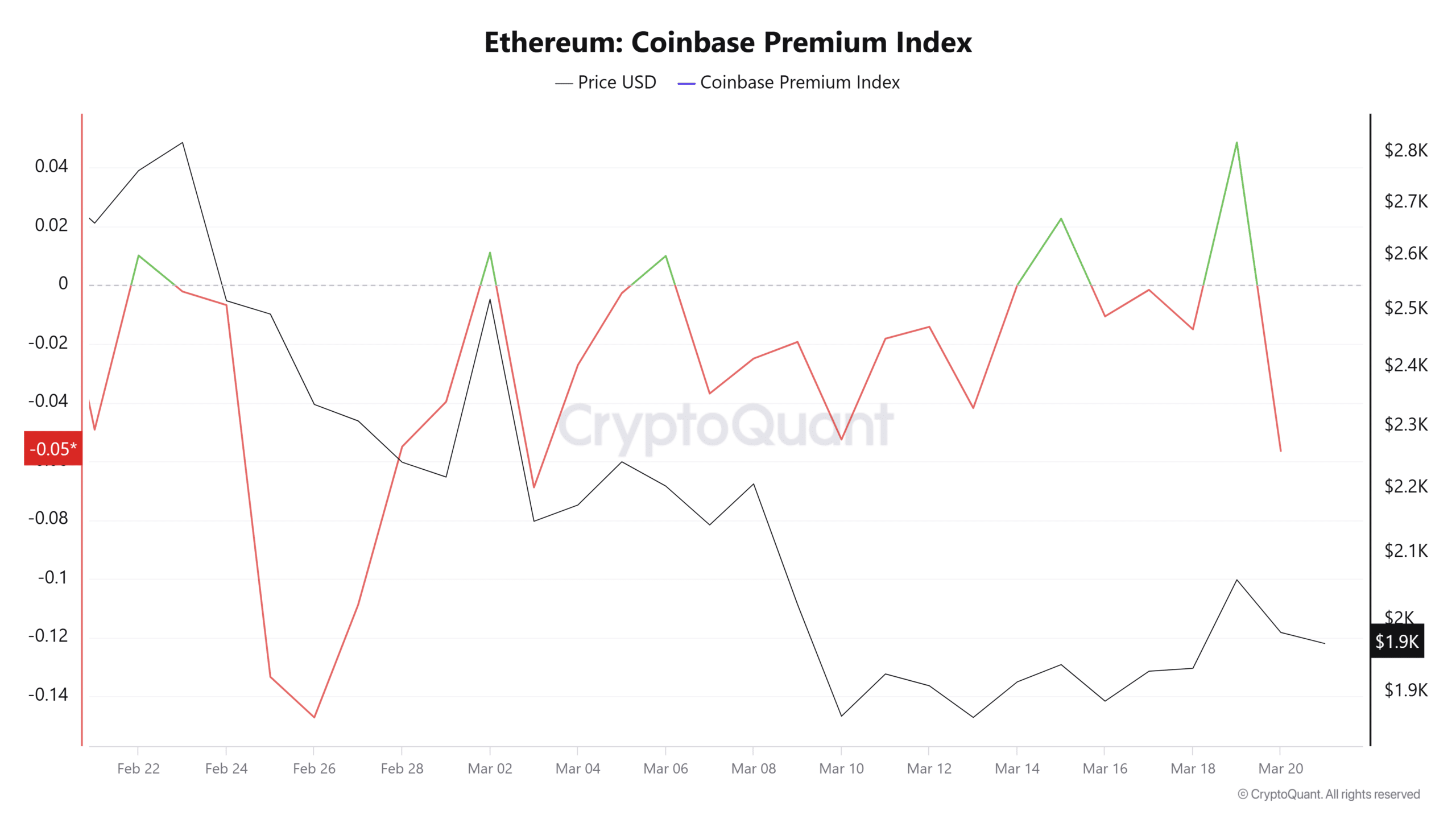

Supply: CryptoQuant

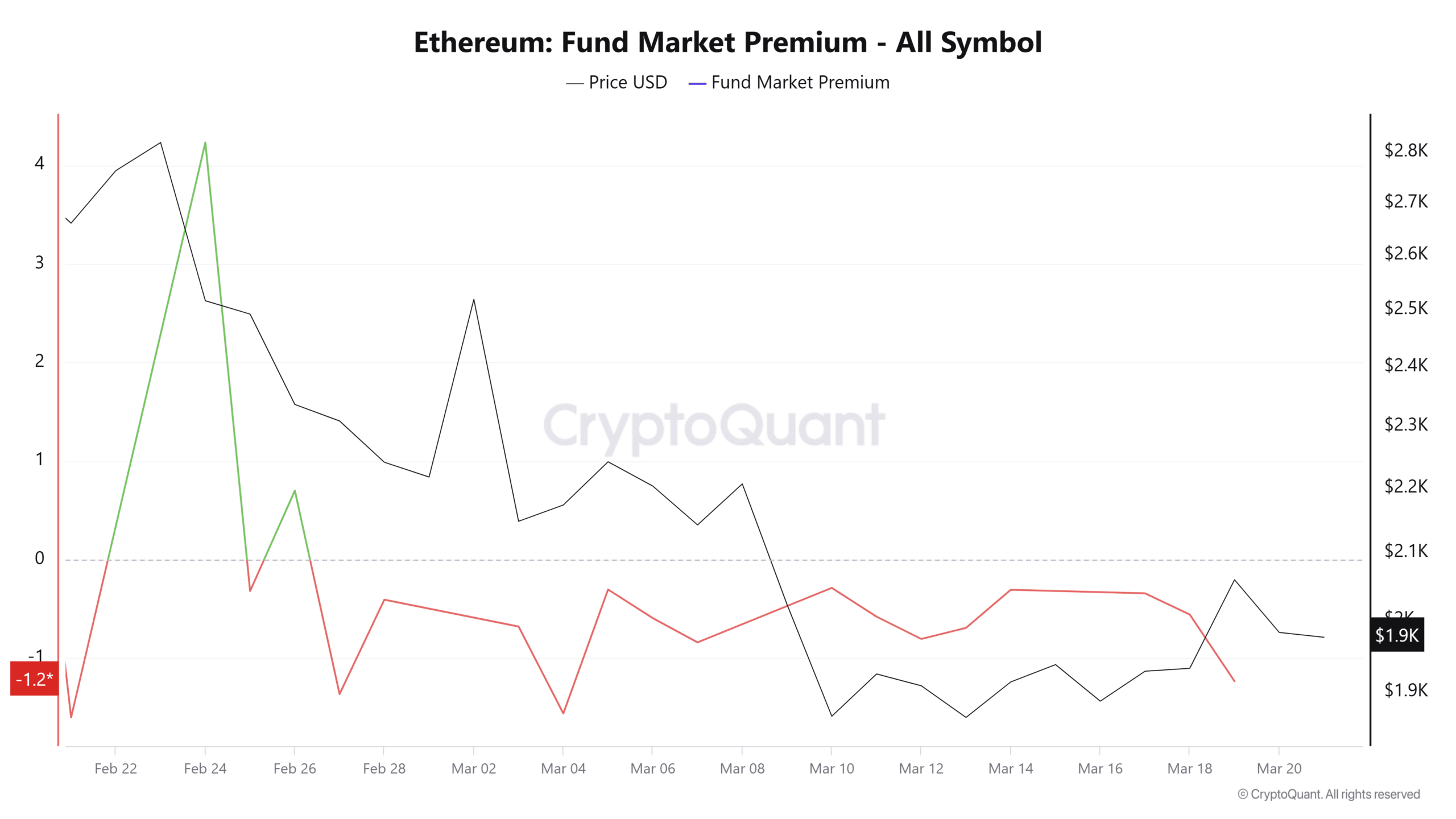

AMBCrypto noticed bearish market sentiment as Ethereum’s Fund Market Premium stayed detrimental all through the previous week.

A sustained detrimental premium signifies that buyers are closing positions sooner than new patrons are getting into, suggesting a choice to promote at a reduction fairly than maintain. Whereas patrons are taking part, vendor exercise stays notably excessive.

Supply: CryptoQuant

Bearish sentiments are significantly pronounced amongst U.S. institutional buyers. The Coinbase premium index, at present at -0.05, signifies energetic promoting by Coinbase buyers, reflecting a notable lack of market confidence.

This sentiment locations Ethereum beneath vital downward strain.

Regardless of elevated detrimental netflows and whale accumulation, Ethereum’s demand stays weak. The continued tug-of-war between patrons and sellers might preserve ETH costs confined to a consolidation vary.

Beneath present situations, Ethereum is prone to commerce between $1,862 and $2,100.