Bitcoin’s short term investors are in extreme panic and fear

- BTC struggles as its worth continues with a drop by 1.4% over the previous week.

- Bitcoin’s quick time period traders have entered a interval of maximum panic and worry.

Over the previous day, Bitcoin [BTC] has declined to hit a low of $81k. The king coin remained within the pink zone, with a 1.40% fall on the weekly charts and 0.51% drop on each day charts.

These worth fluctuations and rising volatility has left short-term traders in a panic.

Excessive panic and worry

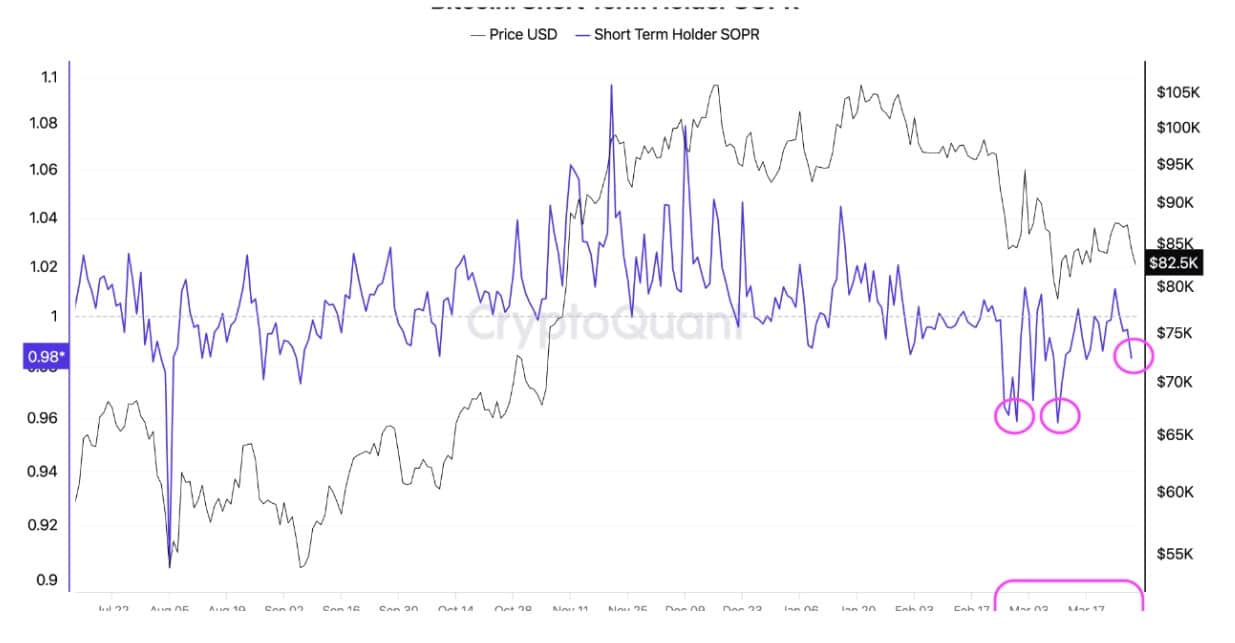

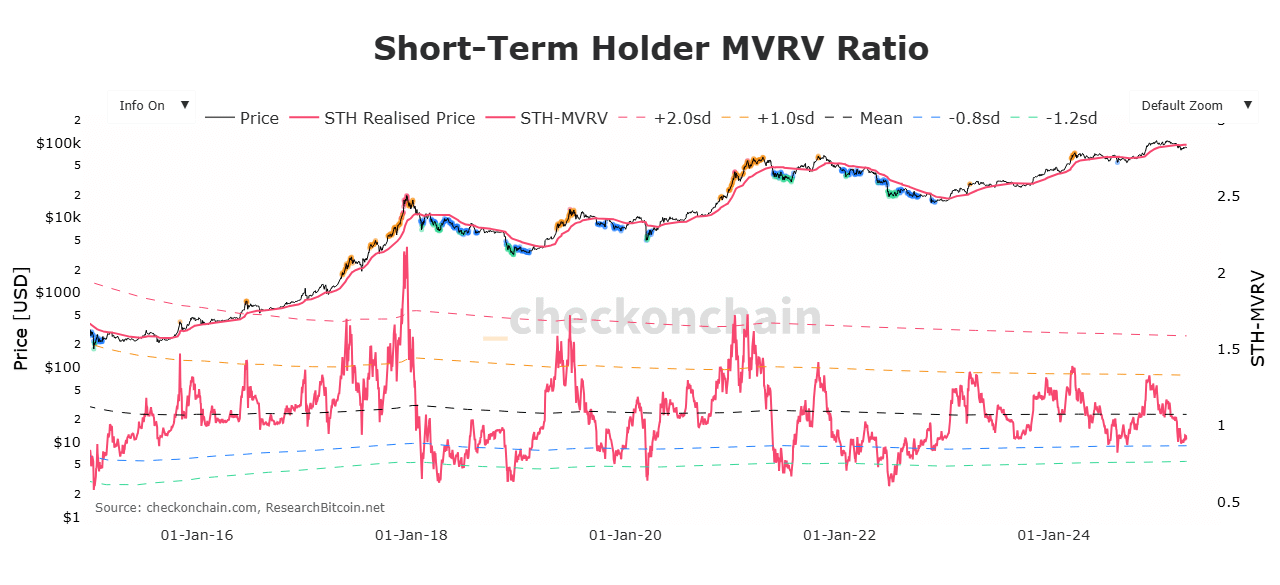

In line with CryptoQuant, Bitcoin’s short-term traders are in a state of maximum panic and worry. As per the evaluation, because the starting of February, short-term holders have been persistently promoting their cash at a loss.

Supply: CryptoQuant

With traders deciding to promote at a loss, it signifies their lack of market confidence. As such, this cohort seems to be missing a transparent route.

Inasmuch, they promote to keep away from additional losses, reflecting excessive worry over market uncertainty.

Taking a look at STH SOPR, it sat beneath 1 at press time, suggesting that the majority actions on-chain are at a loss.

In the course of the declines in March, short-term traders offered extra at a loss, indicating that panic and worry prevailed on their half.

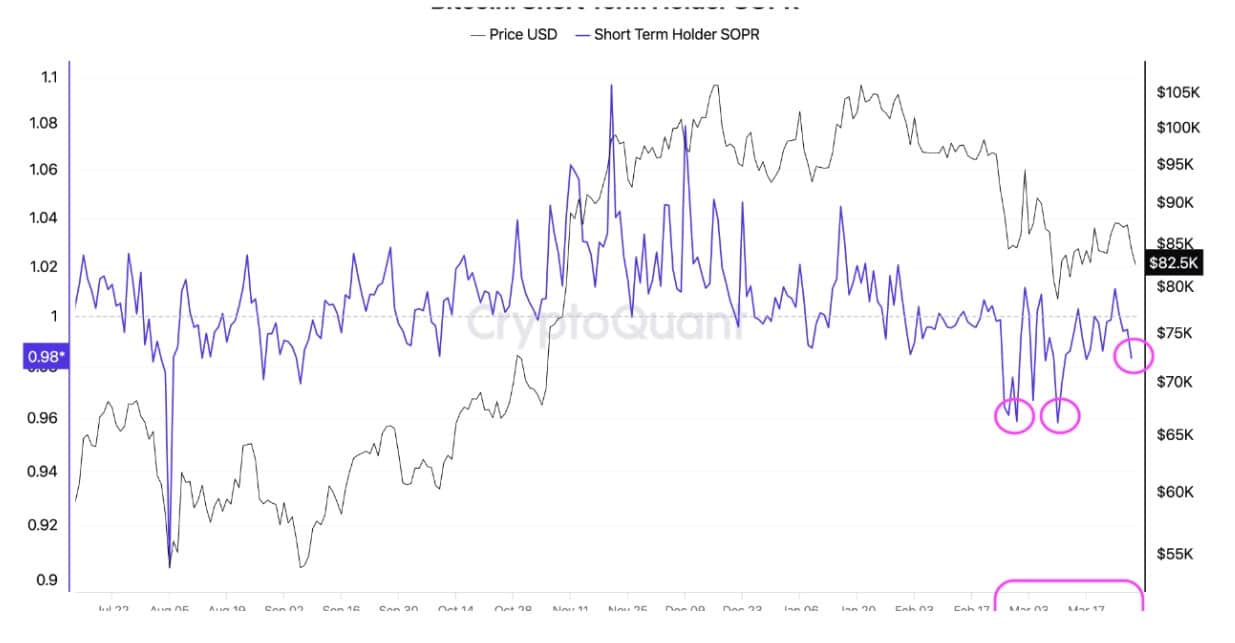

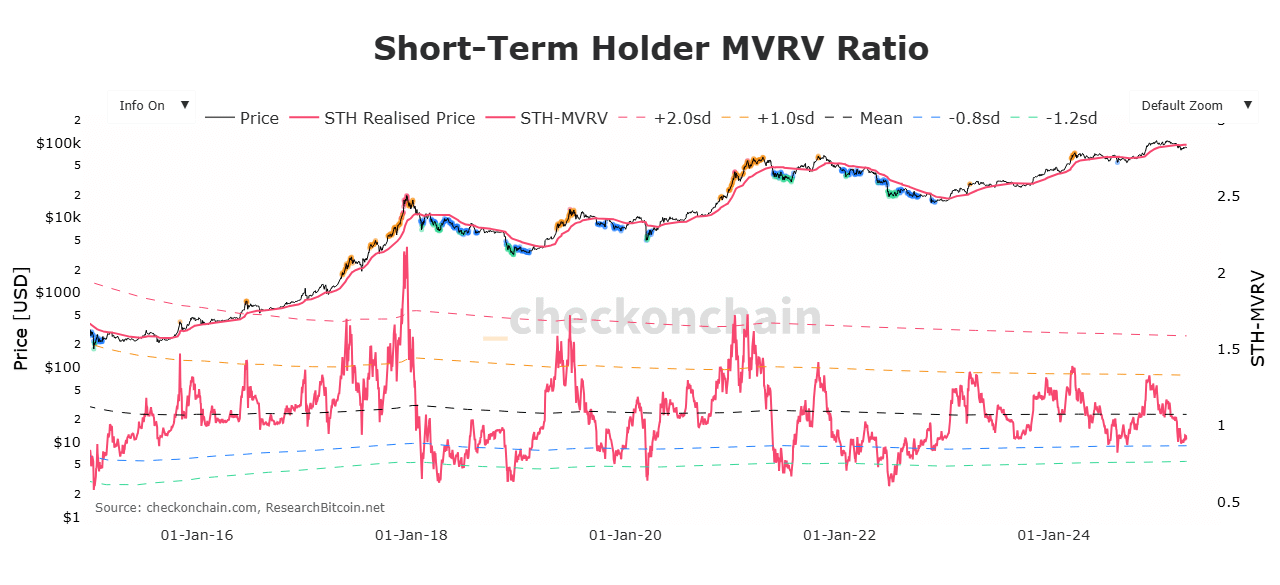

Supply: Checkonchain

This lack of market confidence amongst short-term traders is additional validated by a declining short-term holders’ MVRV ratio.

In line with Checkonchain information, STH MVRV has declined to 0.86, implying that STH holders are holding at a loss.

Traditionally, when STH MVRV drops beneath 1 for a sustained interval, it has been adopted by additional worth declines as Bitcoin sees weak demand. With a better promoting charge from STH than shopping for, costs drop additional.

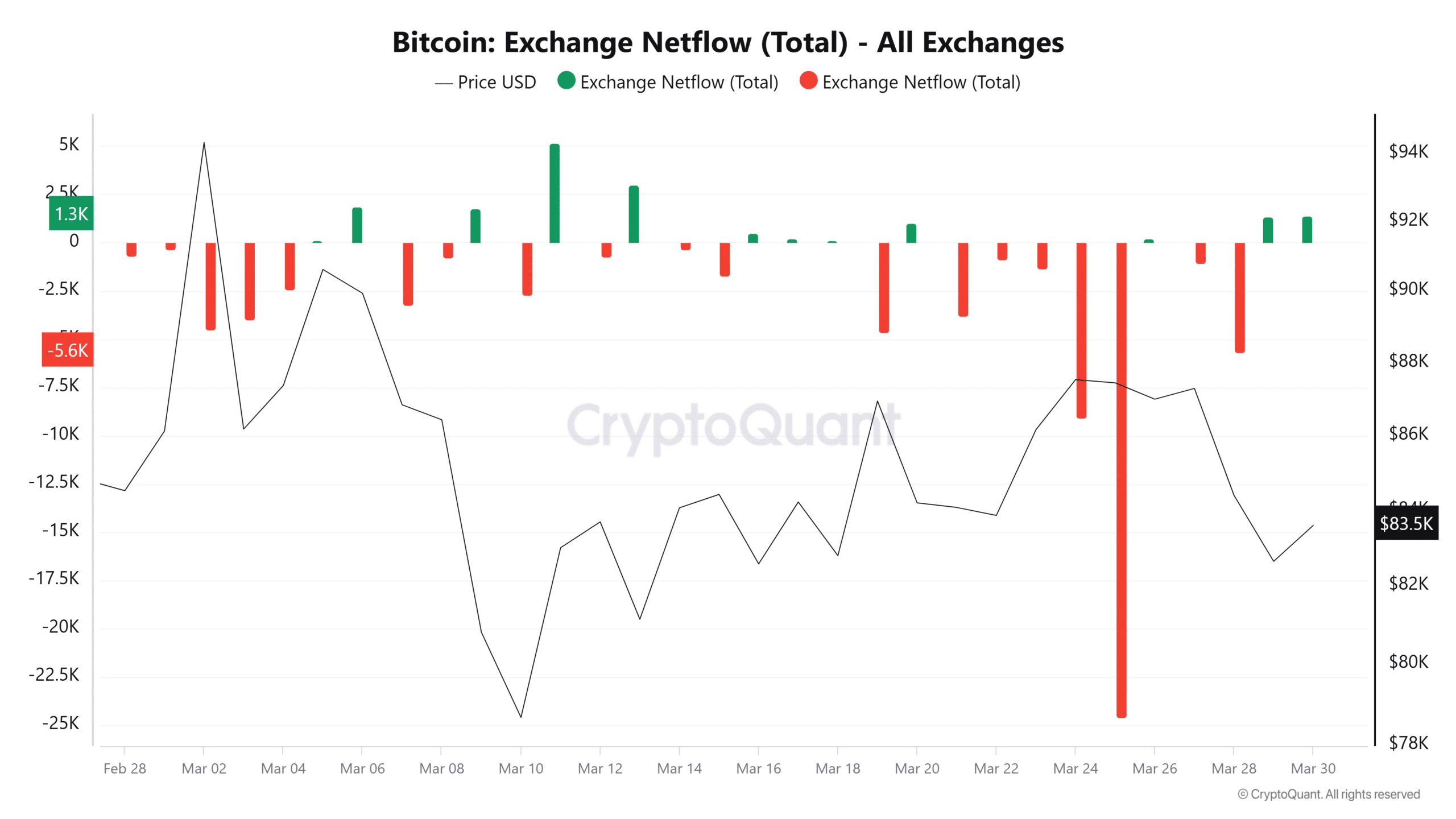

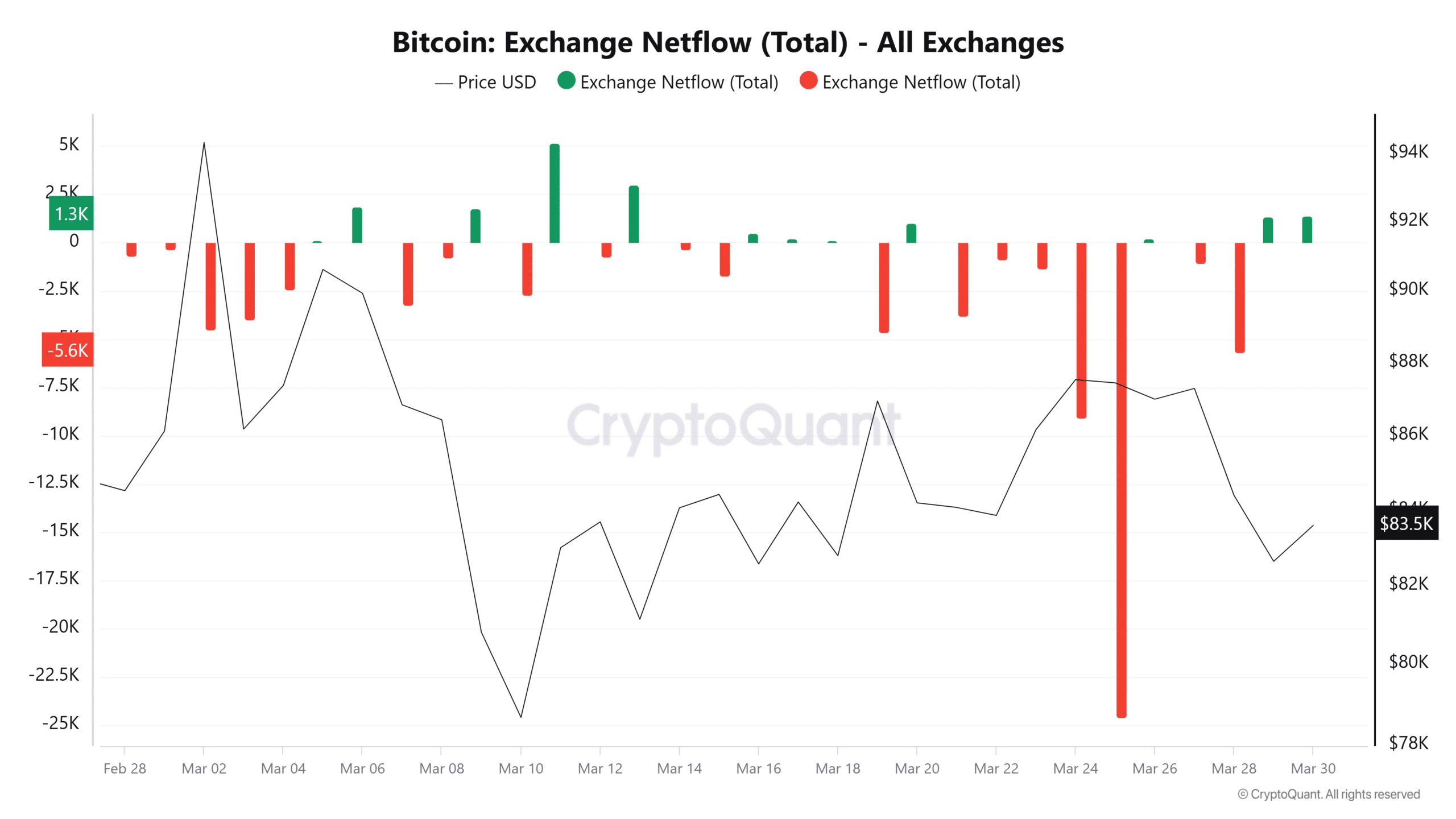

Supply: Cryptoquant

Taking a look at Bitcoin’s change netflow, we will see that traders have turned to aggressively promoting. As such, BTC has recorded two consecutive days of constructive netflow for the primary time in 12 days.

This means that panic amongst short-term traders has resulted in larger promoting exercise from the cohort, with change inflows outpacing outflows.

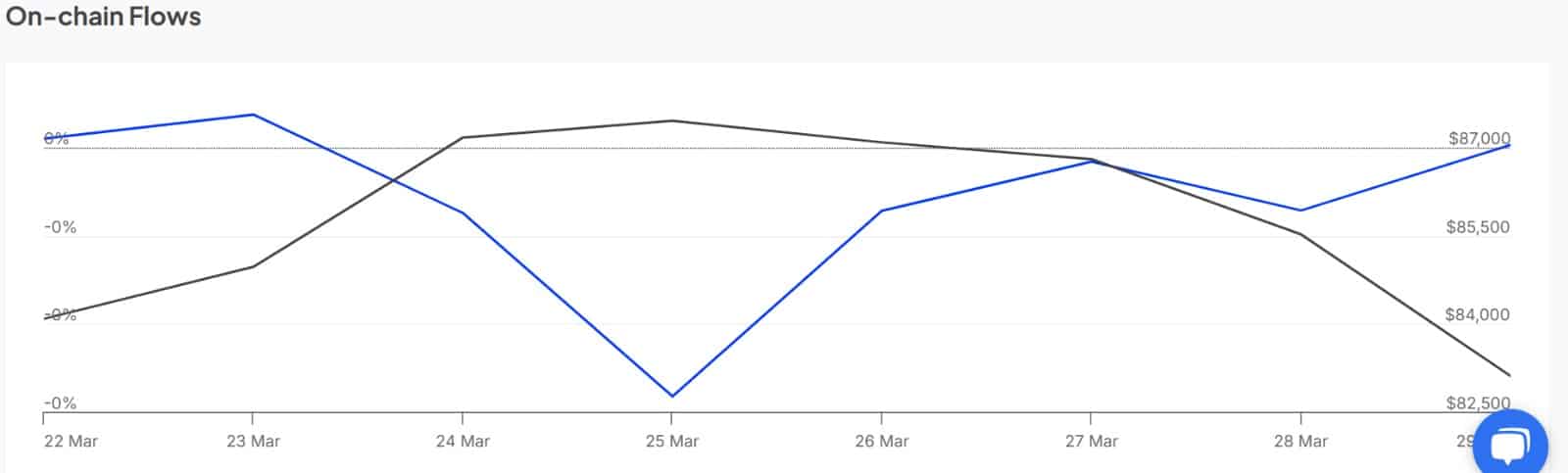

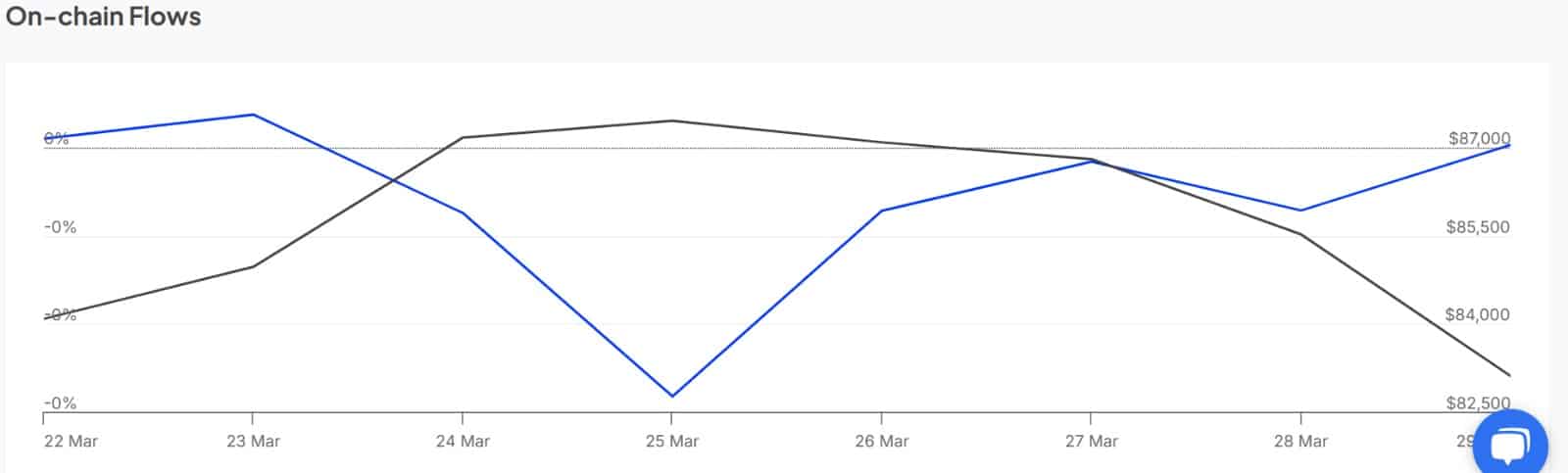

Supply: IntoTheBlock

This market habits isn’t remoted to retailer merchants but additionally whales. In line with IntoTheBlock information, Giant Holder’s Netflow to Alternate Netflow Ratio has turned constructive over the previous day, mountain climbing from -0.09.

A shift to the constructive facet right here implies that whales are sending extra BTC into exchanges, additional inflicting stress on its worth charts.

What it means for BTC

In line with AMBCrypto’s evaluation, as short-term traders enter a interval of maximum worry and panic, Bitcoin is experiencing vital bearish sentiments.

This bearishness is seen amongst whales and retailers in equal measures. Often, when whales and retailers enhance their change influx, it displays a powerful insecurity available in the market.

Traditionally, a mix of each small traders and whales on the promote facet has resulted in larger promoting stress.

Subsequently, if the prevailing worry holds available in the market, we may see BTC report extra losses on its worth charts. A decline right here may see BTC drop to $81617.

Nonetheless, if consumers take the drop in STH MVRV as a shopping for alternative, Bitcoin will reclaim $84900 and try a transfer in direction of $87k.