Massive BTC buys – On-chain data reveals major institutions loading up on Bitcoin

- Prime institutional traders—Grayscale, Constancy, and Ark Make investments—have been accumulating Bitcoin.

- The market might see a bullish transfer as soon as Bitcoin recovers the short-term holder fiat foundation.

Bitcoin [BTC], which has failed to ascertain a notable market motion in both path, seems to now be leaning towards the bullish finish.

The asset has gained 0.92% as market confidence is regularly being restored. Latest market motion from whales and the potential of Bitcoin reclaiming key ranges stay excessive.

Prime traders prioritize BTC amidst minimal good points

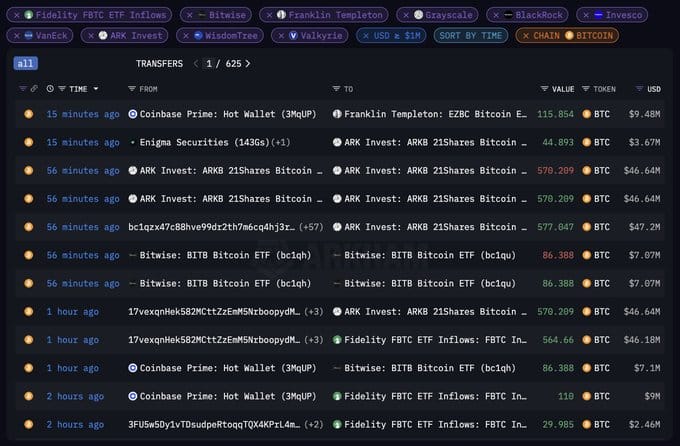

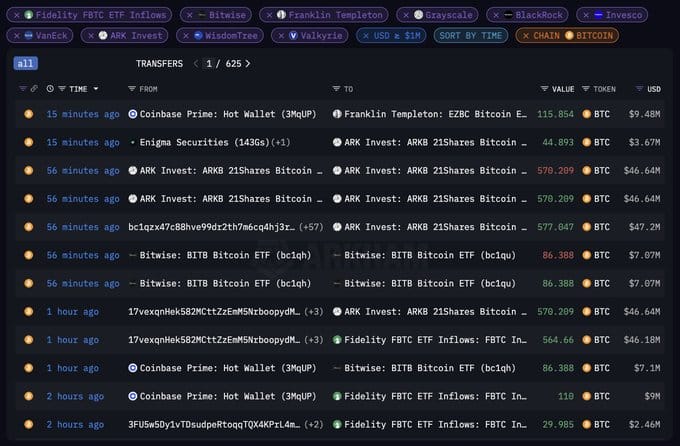

There was a notable buy of Bitcoin prior to now 24 hours from prime institutional traders out there, including to their current portfolios regardless of market-shaking tariffs carried out by President Trump.

In keeping with a report from Arkham, Grayscale, Constancy, and Ark Make investments are the primary traders concerned on this commerce. Institutional traders have bought no less than 2,099 BTC as of press time.

Supply: Arkham Intelligence

When massive traders recognized to drive liquidity out there select to purchase—particularly when the market stays at decrease ranges—it implies a worth rally could possibly be close to, with the asset trending greater.

Are the bulls totally in on BTC’s rally?

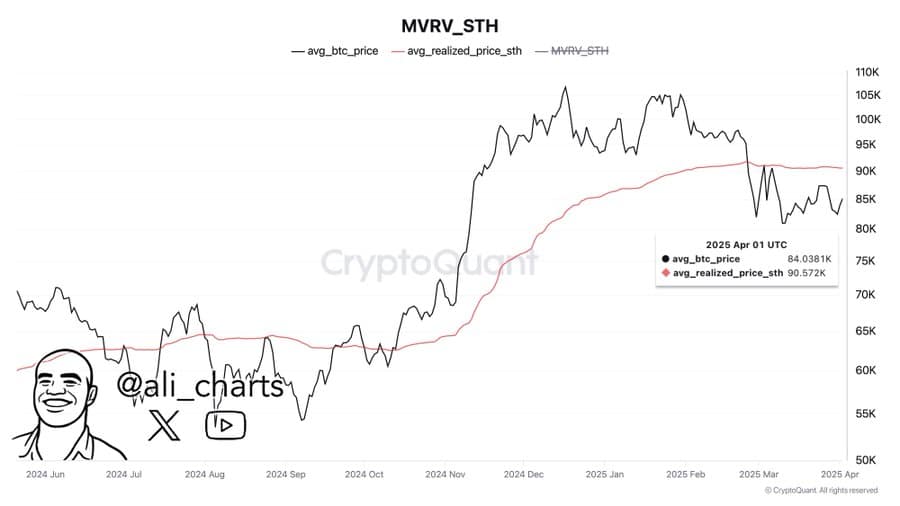

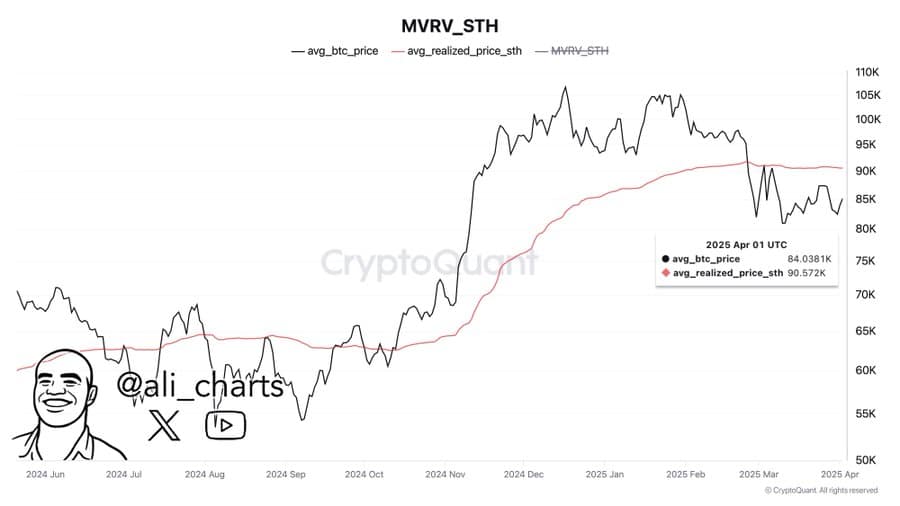

To substantiate whether or not the bulls are totally supporting a Bitcoin rally, AMBCrypto analyzed the short-term holders’ realized worth—a historic reference level used to find out whether or not the market is bullish or bearish.

Supply: CryptoQuant

At the moment, the market worth realized by short-term holders stays at $90,570. Because of this for Bitcoin to renew its rally, it might have to reclaim this stage.

As seen on the chart, Bitcoin is making an attempt to reclaim this stage, with its present worth at $84,580, pointing to the upside.

Evaluation of different key metrics suggests the rally might come earlier than anticipated.

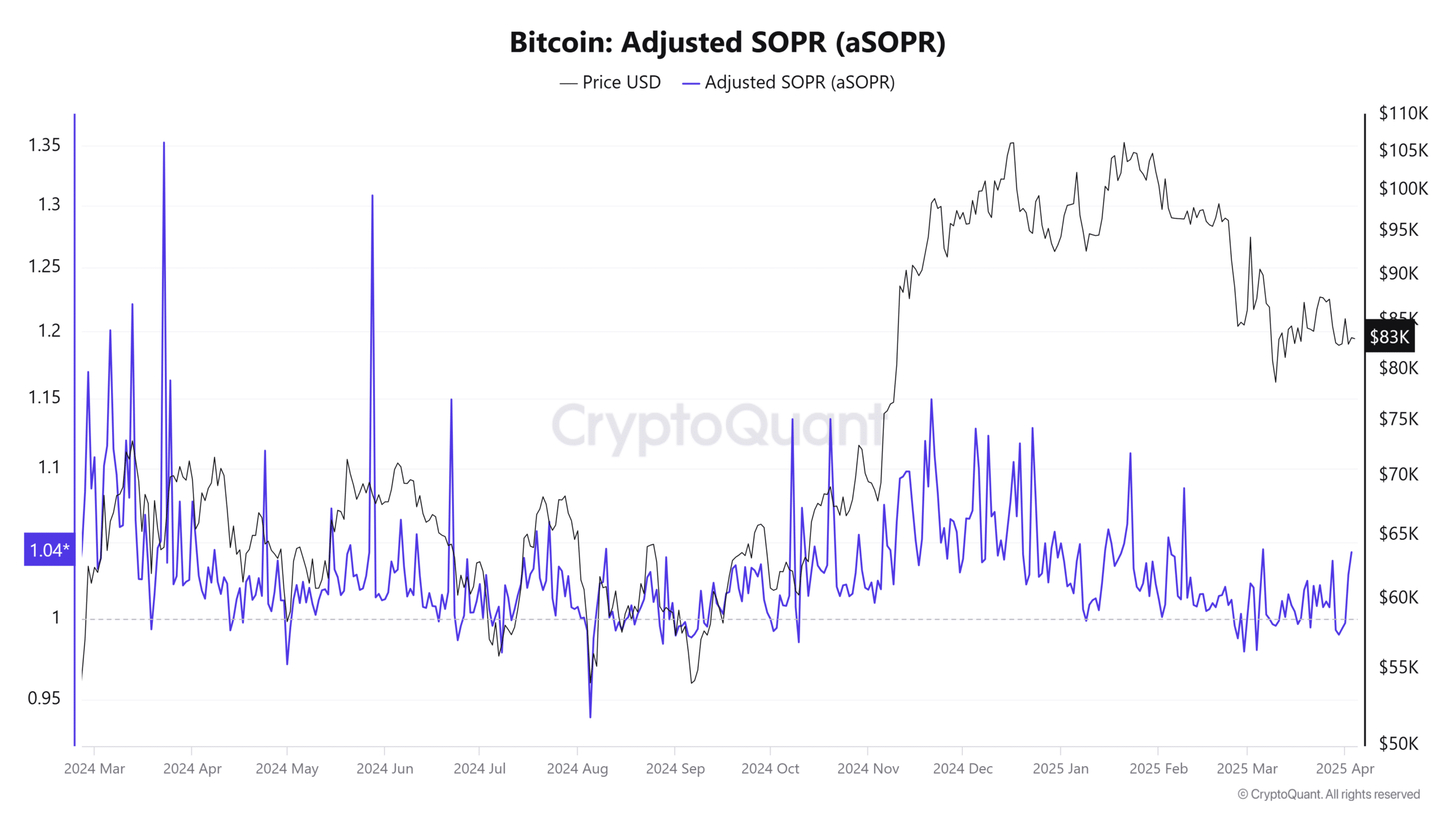

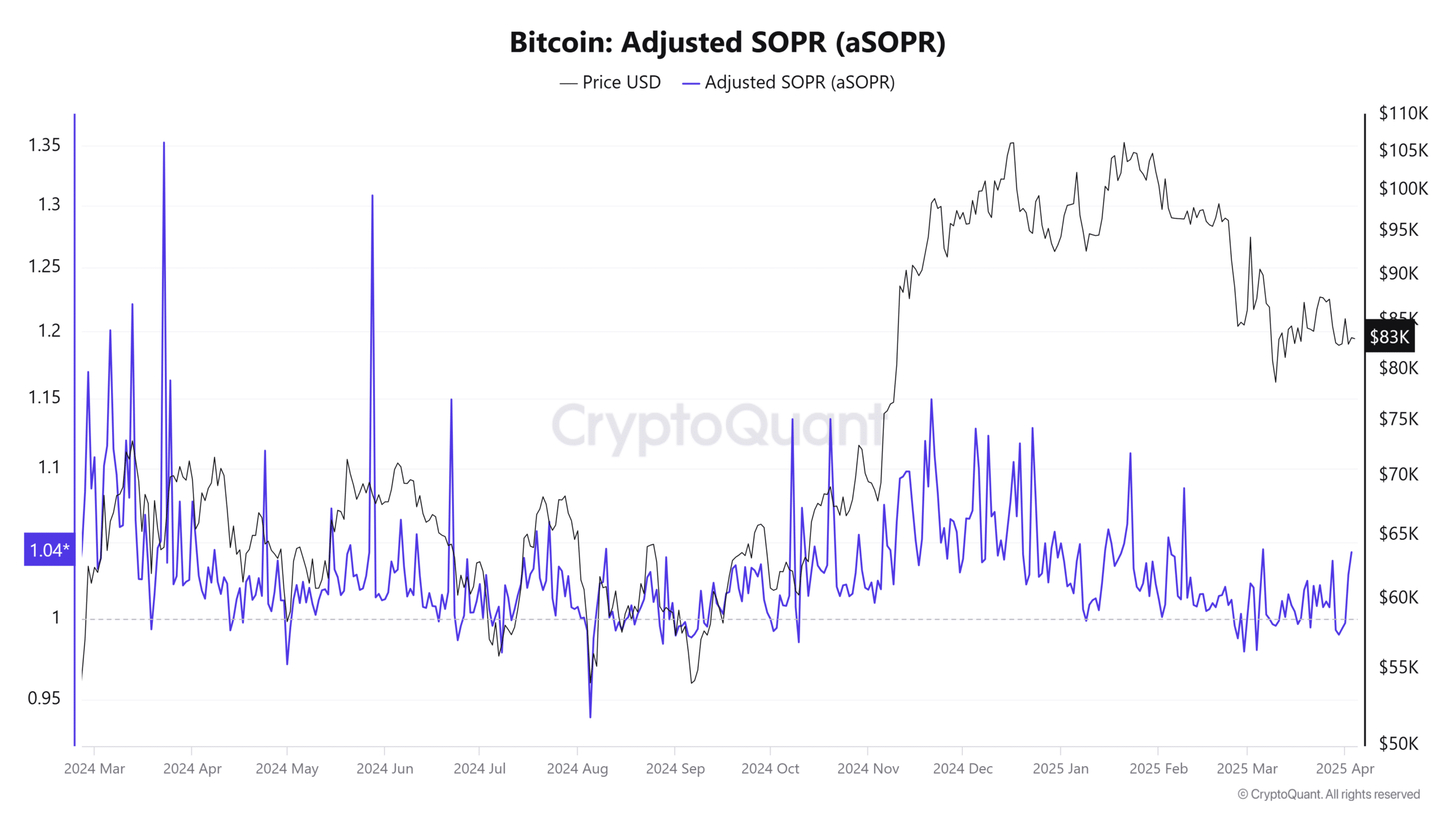

The Adjusted Spent Output Revenue Ratio (aSOPR), which tracks whether or not traders are promoting at a revenue or loss, exhibits that traders are promoting at a revenue.

Supply: Cryptoquant

Promoting at a revenue implies there could possibly be downward strain on Bitcoin, as extra tokens are anticipated to be offered with restricted demand.

Nevertheless, evaluation of Bitcoin’s Web Unrealized Revenue/Loss (NUPL)—a metric used to find out the variety of traders in revenue or loss—exhibits that solely a small share are presently in revenue.

The Bitcoin NUPL is barely above 0, with a studying of 0.4, indicating that solely a small share of merchants are in revenue. This means that profit-taking might decelerate quickly, thus having little influence on the general market.

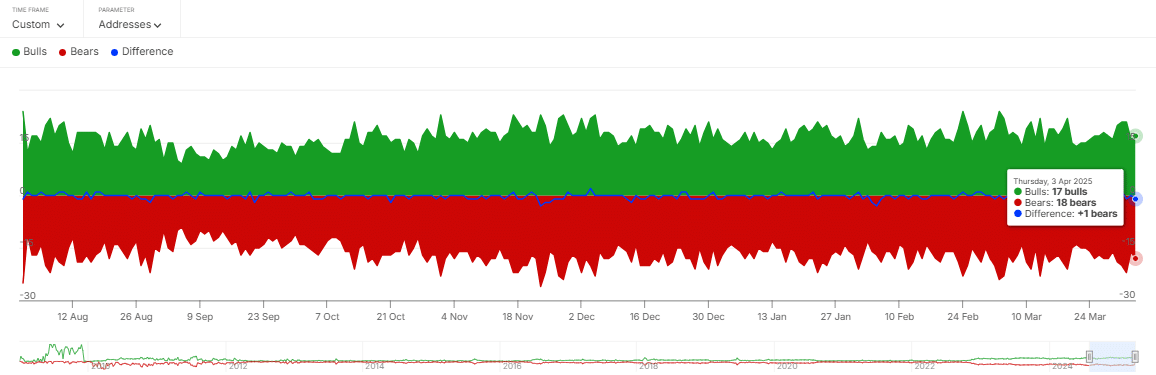

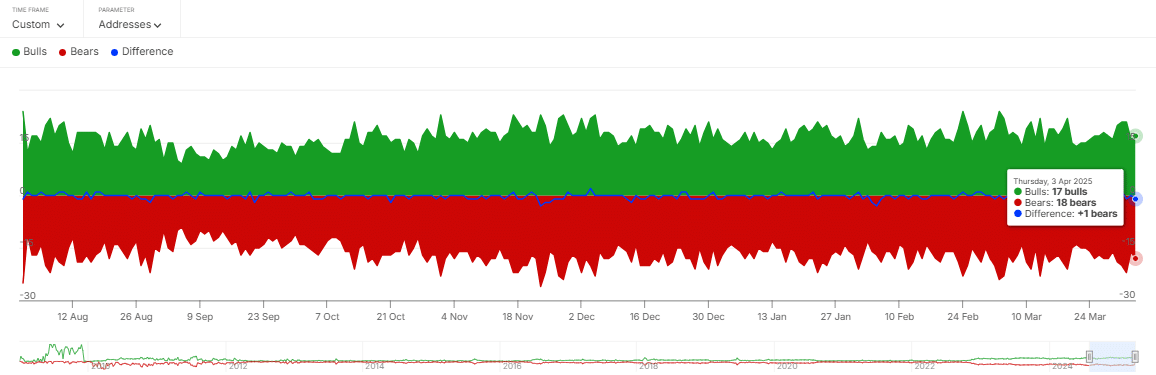

Supply: IntoTheBlock

As well as, the Bull-Bear Ratio—an indicator used to find out the variety of bullish and bearish massive traders out there—exhibits there are 17 bulls and 18 bears.

This minimal distinction suggests the bulls are closing in on the bears, and it’s solely a matter of time earlier than the market balances or the bulls overtake the bears.

Total, evaluation exhibits that the possibilities for a rally stay excessive, with promoting strain regularly waning. Ought to this development proceed, it presents a possibility for a significant worth breakout as shopping for sentiment grows.