Ethereum could drop to October 2023 levels around $1657

- ETH has declined by 46% over the previous yr.

- Ethereum might drop to October 2023 ranges of round $1657 as bearish sentiments persist.

Over the previous month, Ethereum [ETH] has skilled robust downward momentum. In reality, ETH is down by 46.06% on yearly charts.

Whereas different crypto belongings corresponding to Bitcoin are up over the previous yr, ETH exhibits no indicators of restoration. Quite the opposite, ETH might decline additional.

Supply: TradingView

As such, the altcoin has damaged down right into a symmetrical triangle. After the breakdown and a retest, ETH is now trying bearish.

This means that ETH is ready for additional losses on its worth charts. A breakdown right here means that the downward momentum is robust and will even proceed.

Supply: TradingView

The current decline is jeopardizing Ethereum’s market place, with continued downward motion doubtlessly weakening the altcoin additional towards its rivals.

ETH dominance is forming a descending triangle, a bearish sample generally noticed in technical evaluation. Whereas downward strain persists, there’s potential for ETH dominance to make a corrective transfer to the upside.

This pattern is additional supported by a drop in Ethereum’s circulating market dominance, which has fallen from 17.32% to 7.39%. Such a major decline highlights ETH’s underperformance in comparison with its opponents.

Supply: Messari

Due to this fact, with the crypto market excluding Bitcoin breaking down, it suggests a powerful bearish momentum amongst altcoins. With altcoins dealing with strengthening bearishness, we might see ETH make extra losses and drop additional.

What ETH’s on-chain information suggests

In accordance with AMBCrypto’s evaluation, Ethereum is seeing robust bearish sentiments throughout the charts.

Supply: Messari

For starters, Ethereum’s futures purchase quantity has declined to a two-week low of 6.17 billion. This can be a drop from 16.25 billion, suggesting that the altcoin is seeing fewer patrons out there.

As such, buyers aren’t shopping for the crypto, reflecting a powerful insecurity out there circumstances.

Supply: IntoTheBlock

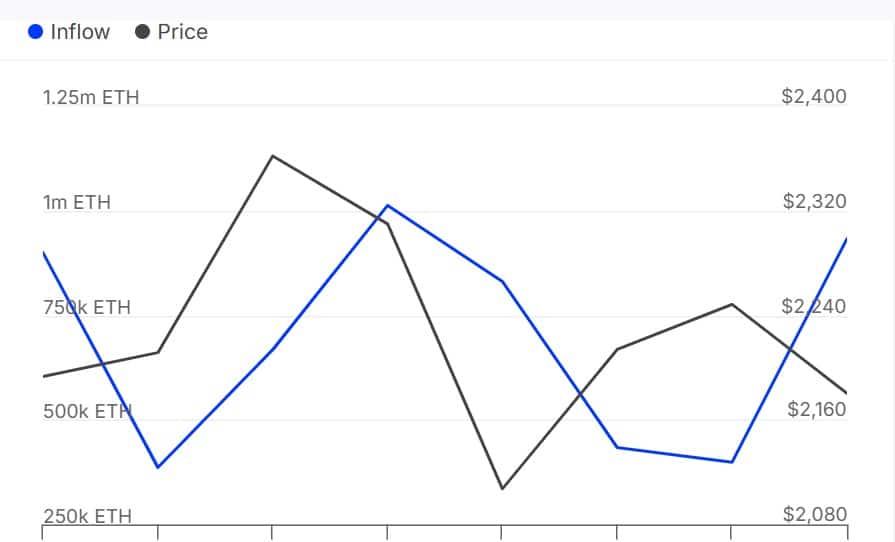

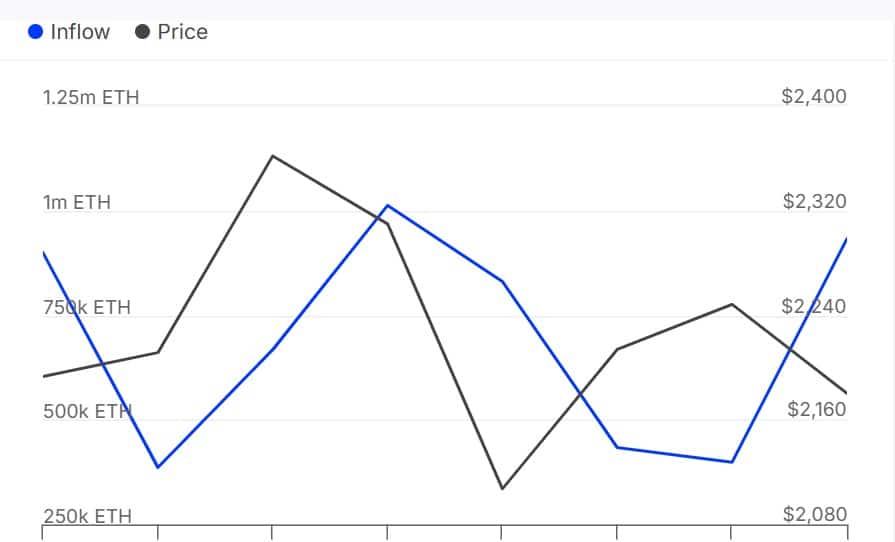

This low shopping for exercise is much more prevalent amongst Ethereum’s giant holders. As per IntoTheBlock information, ETH whales aren’t shopping for however promoting.

In reality, giant holders’ netflow has dropped into detrimental territory, hitting -1.65k. Such a dip suggests there’s extra cash outflow from whales into ETH than influx.

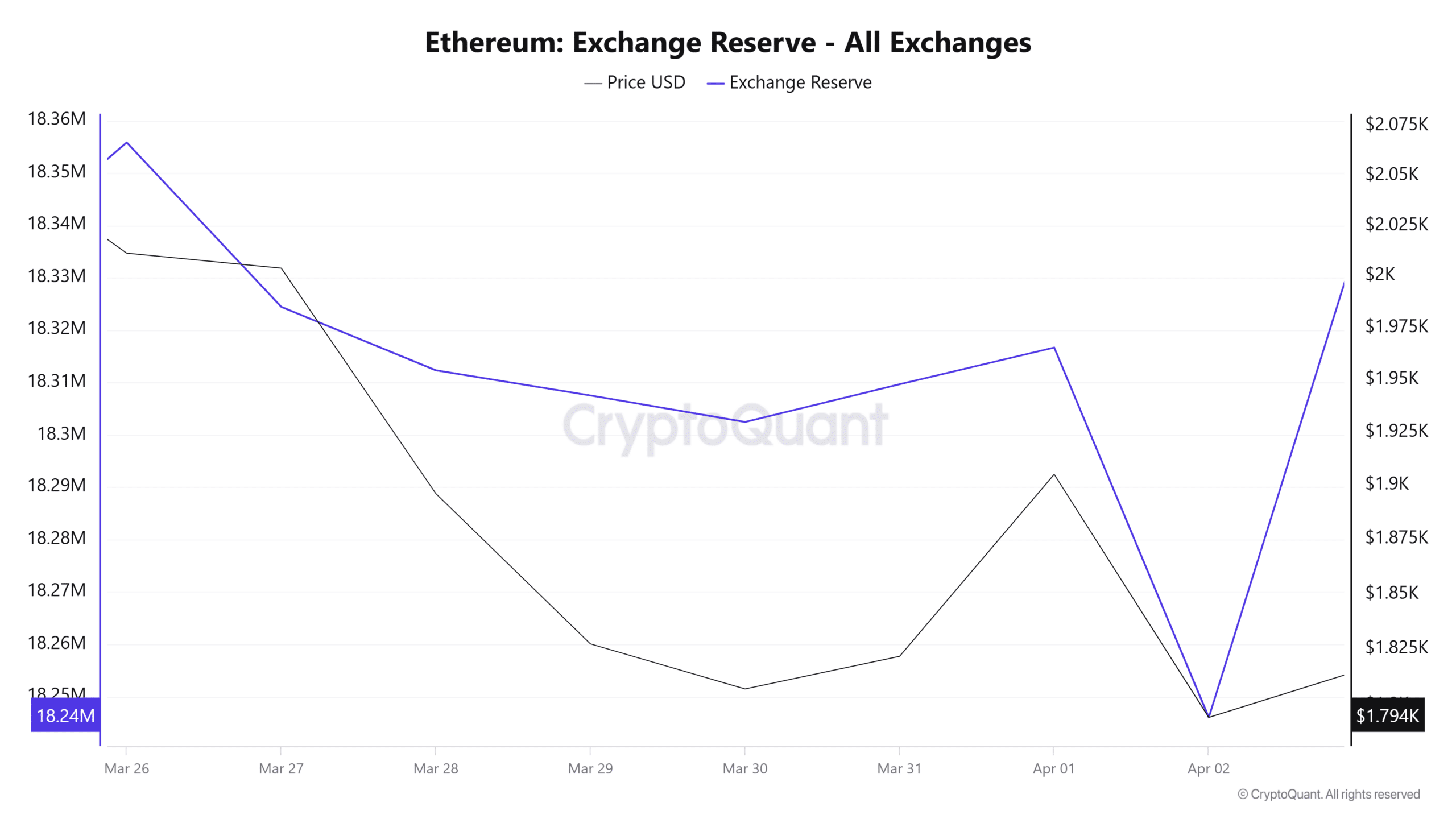

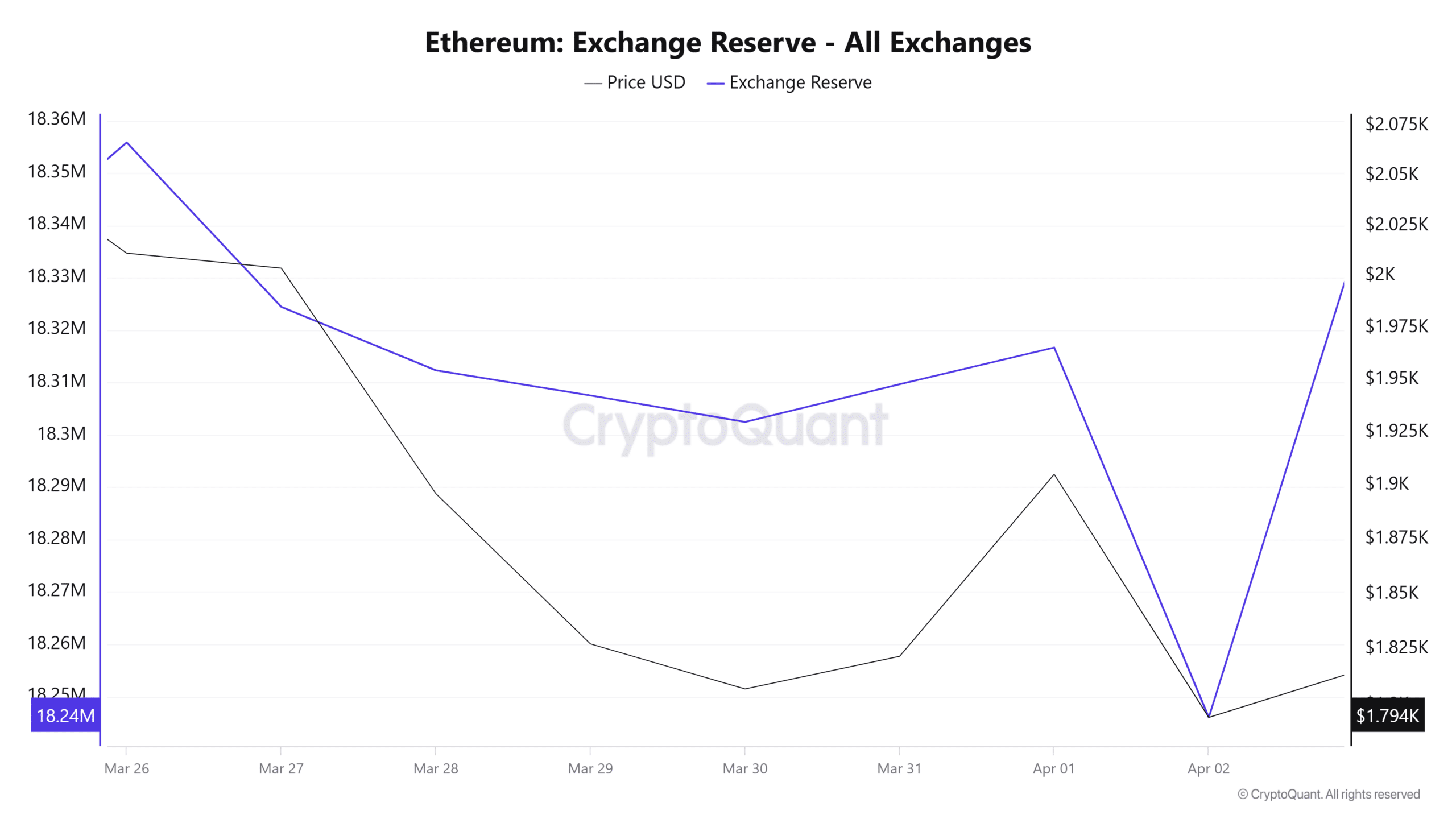

Supply: CryptoQuant

Ethereum’s trade reserve is rising, reaching 18.4 million—an increase of 200 million ETH tokens previously day.

This surge in reserves signifies that extra ETH tokens are being deposited into exchanges. It means that buyers are promoting their holdings to mitigate additional losses, reflecting a rising bearish sentiment for ETH.

Is Ethereum Set for Extra Losses?

With Ethereum’s buyers turning bearish with elevated promoting exercise and lowered demand, the altcoin might see extra losses on its worth charts.

Supply: TradingView

ETH is experiencing rising downward momentum, as highlighted by the current bearish crossover on its Stochastic RSI.

The continued decline within the Stochastic indicator suggests additional losses may very well be on the horizon, particularly with the RVGI signaling a bearish pattern.

Present market circumstances place Ethereum for a possible additional draw back. With its worth dropping to $1,788, a breach of the $1,757 assist stage might push ETH towards October 2023 ranges round $1,657.

For a bullish reversal, ETH would require a day by day shut above $1,800.