Solana (SOL) to $77 or What? Bulls and Bears Face Off

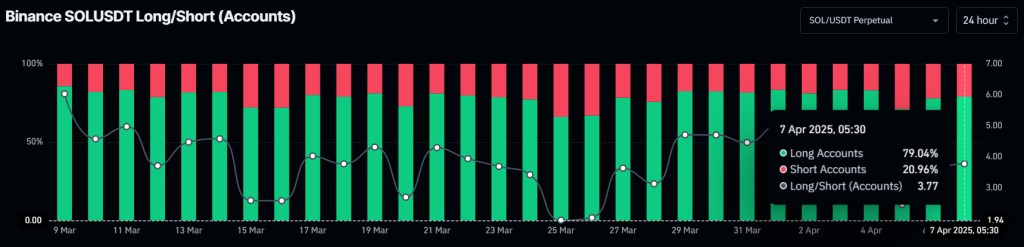

Solana (SOL), the world’s sixth-largest cryptocurrency by market cap, is gaining huge consideration from Binance merchants. Not too long ago, information from the on-chain analytics agency Coinglass revealed that 79% of high merchants on Binance are going lengthy on SOL, regardless of the bearish market sentiment.

Solana (SOL) Worth Motion and Upcoming Ranges

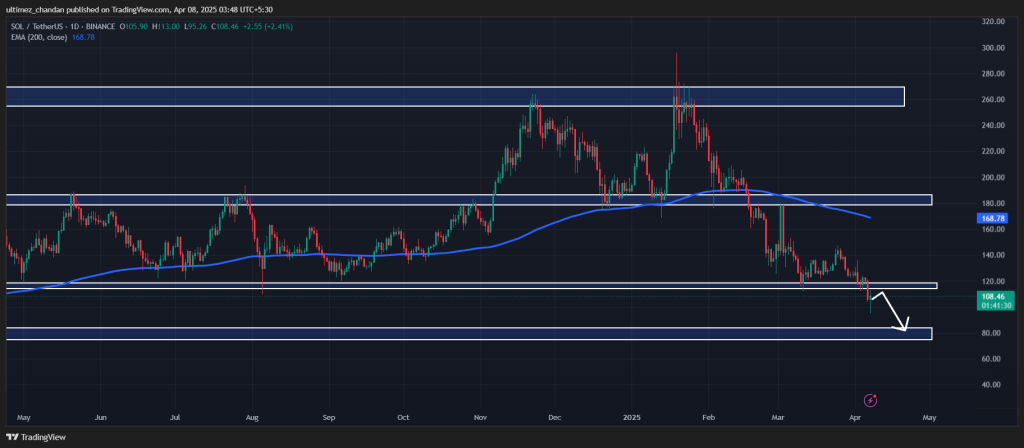

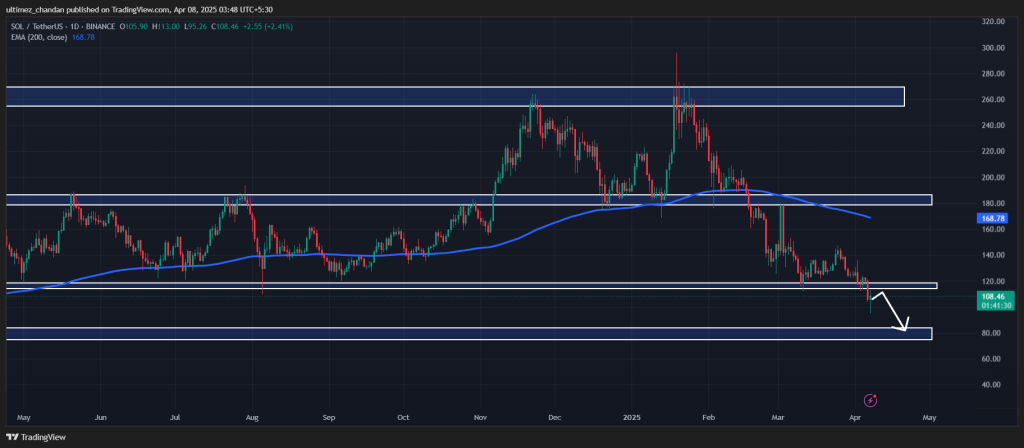

In line with knowledgeable technical evaluation, SOL seems bearish regardless of the continued worth restoration. On April 6, 2025, SOL broke down from its extended key assist stage of $115 and likewise closed a each day candle beneath that stage, a stage it had held since March 2024.

This breakdown has pushed SOL into an especially bearish part. Nevertheless, the continued worth restoration seems to be a retest of the breakdown stage.

Primarily based on the current worth motion and historic momentum, if SOL stays beneath the $115 stage, there’s a robust risk it might decline by 30% and attain the $77 stage within the close to future.

This bearish outlook is strongly supported by momentum indicators such because the Relative Power Index (RSI) and the 200-day Exponential Shifting Common (EMA) on the each day timeframe.

Present Worth Momentum

As of writing, SOL was buying and selling close to $107 and had registered a worth drop of over 1% up to now 24 hours. In the meantime, the asset confirmed a powerful restoration, having hit a low of $95.6 in the course of the Asian market session. Amid this vital worth fluctuation and market volatility, SOL’s buying and selling quantity has skyrocketed by 185% throughout the identical interval.

$140 Million Value of SOL Outflow

Whereas analyzing the on-chain metrics, it seems that whales, traders, and long-term holders have seized the chance to build up SOL on the present worth stage, in keeping with the on-chain analytics agency Coinglass.

Knowledge from spot influx/outflow reveals that exchanges have seen an outflow of roughly $140 million price of SOL over the previous 24 hours. This substantial outflow suggests potential accumulation and will result in shopping for stress.

Nevertheless, as a result of prevailing bearish sentiment, a powerful upside rally could also be troublesome to attain.