WLFI’s Ethereum dump: Analyzing ETH’s loss post Eric Trump’s endorsement

- Trump-backed WLFI offered Ethereum at a loss, elevating doubts about institutional confidence in ETH.

- Regardless of Eric Trump’s endorsement, Ethereum’s 46% drop indicators a possible retreat from high-profile crypto backers.

In a placing pivot, Donald Trump-affiliated World Liberty Monetary (WLFI) has offloaded a big portion of its Ethereum [ETH] holdings — at a notable loss.

This dramatic shift follows Eric Trump’s earlier declare that it was a “nice time” to purchase ETH. His assertion briefly sparked institutional curiosity.

Nonetheless, Ethereum’s sharp decline since February has introduced WLFI’s transfer into focus, elevating questions on market timing, political affect, and waning confidence amongst distinguished crypto supporters.

Ethereum’s slide since Eric Trump’s nod

Supply: X

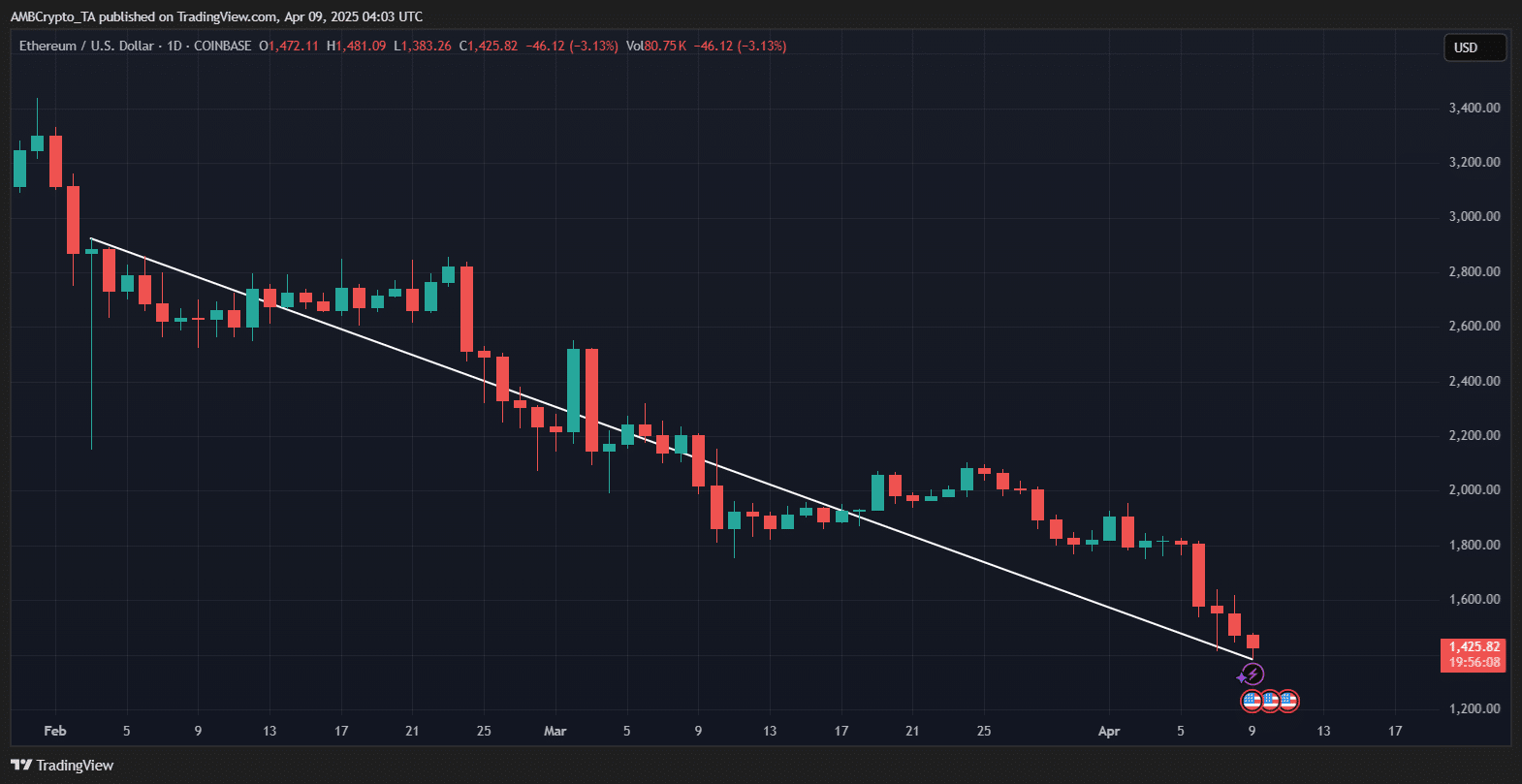

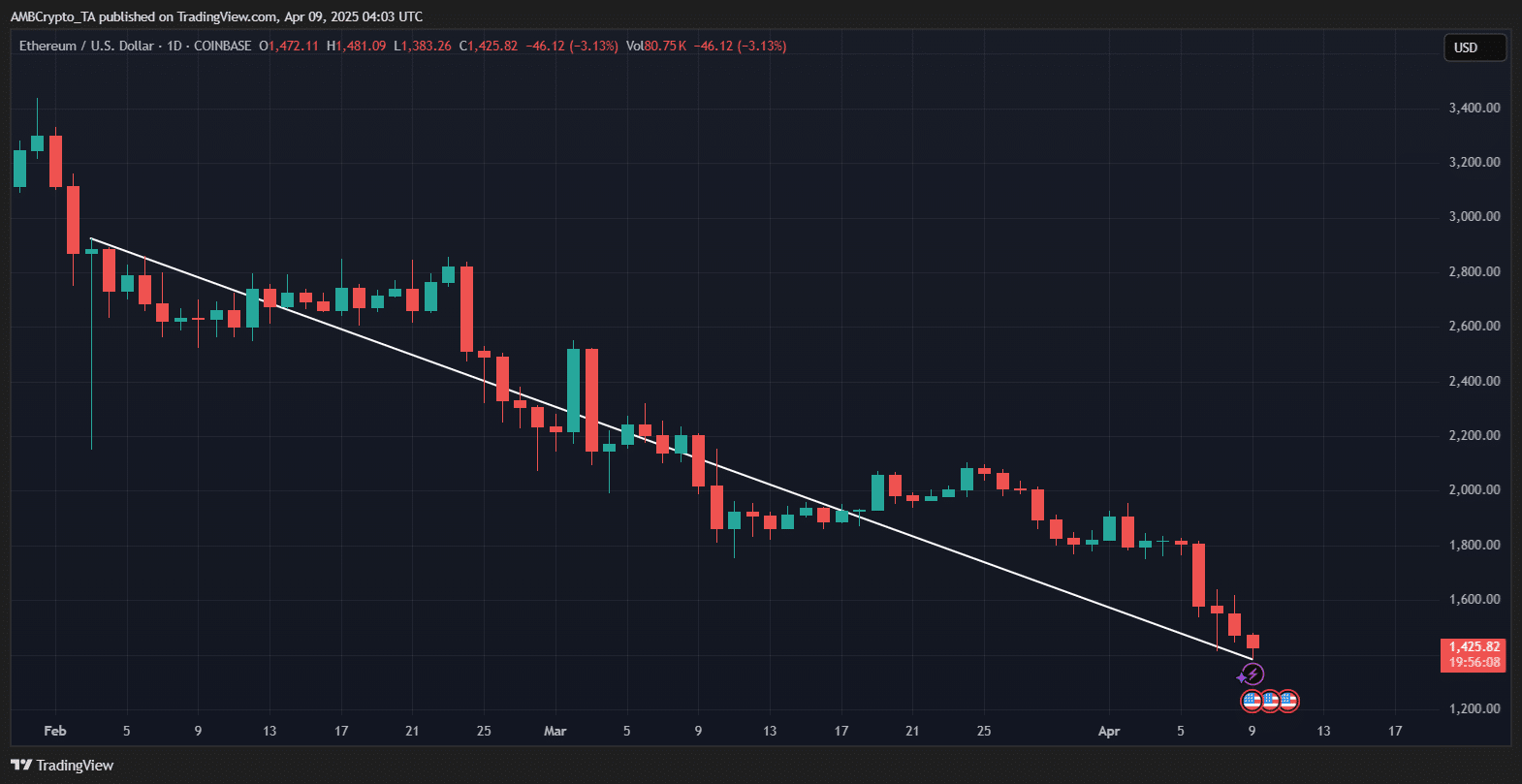

On the 4th of February, Eric Trump endorsed Ethereum through a then-viral put up, coinciding with ETH buying and selling near $3,000. Since then, the value has plunged about 46%, falling to roughly $1,425 at press time.

Supply: TradingView

Because the chart exhibits, ETH has struggled to get better from a constant downtrend, invalidating the transient optimism spurred by Trump’s endorsement.

The timing of WLFI’s exit solely fuels hypothesis that institutional help could also be thinning quicker than anticipated.

WLFI’s transfer contradicts Trump’s crypto rhetoric

Regardless of Eric Trump’s shining endorsement, the Trump-backed WLFI has since offered tens of thousands and thousands price of Ethereum at a steep loss.

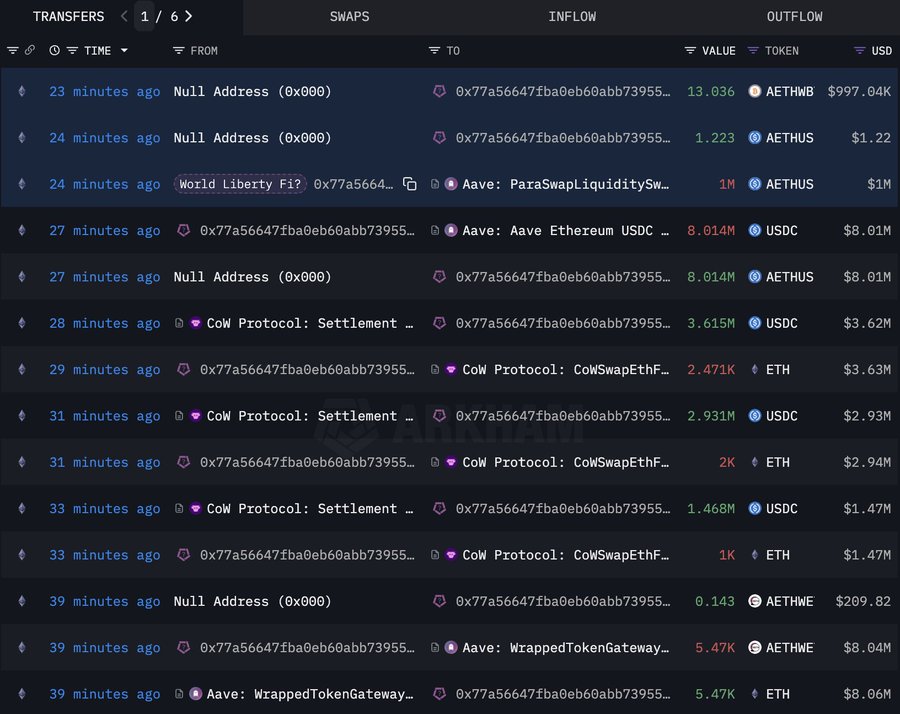

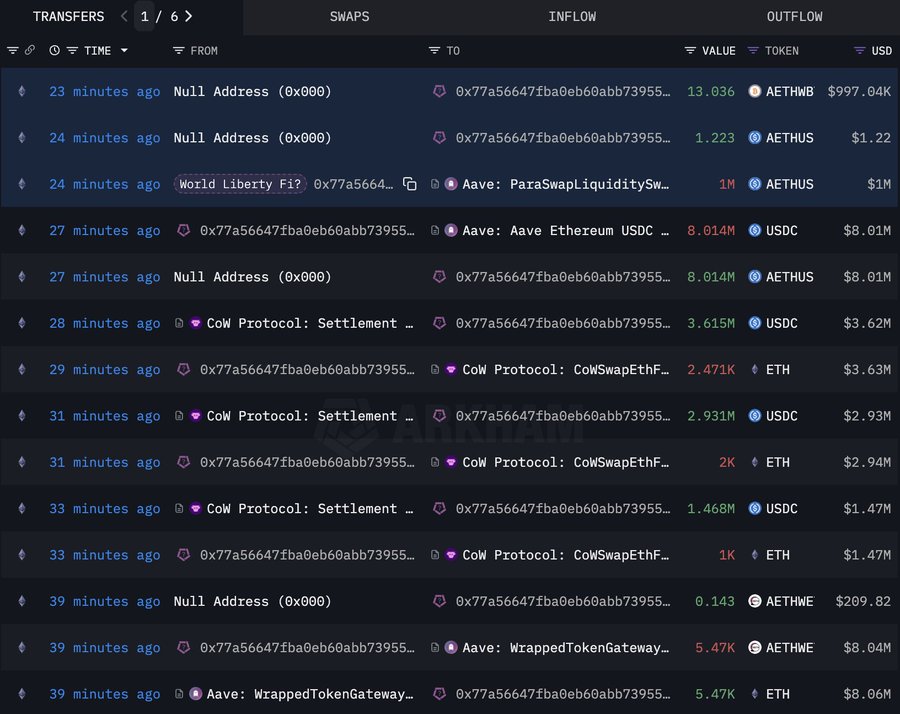

Information from Arkham Intelligence exhibits WLFI offloaded 5,471 ETH at $1,465 simply minutes earlier than press time — far beneath its common purchase worth of $3,259.

Supply: Arkham

The transfer highlights a rising disconnect between public crypto boosterism and behind-the-scenes positioning.

For buyers who took Trump’s tweet at face worth, WLFI’s silent exit feels much less like conviction and extra like capitulation.

Trump-linked wallets quietly again away

WLFI’s sell-off displays a broader pattern of withdrawals from Trump-linked crypto belongings.

Simply two days in the past, $30 million in MELANIA tokens, tied to group funds, was mysteriously moved and is now being offered with out clarification. This example poses greater than only a pricing subject for Ethereum—it’s a reputational problem.

As distinguished figures just like the Trump household scale back their crypto holdings, it raises crucial questions. Is institutional curiosity in ETH fading, or was confidence in it by no means absolutely established?