Working Through the Riddles of Tokenized Securities

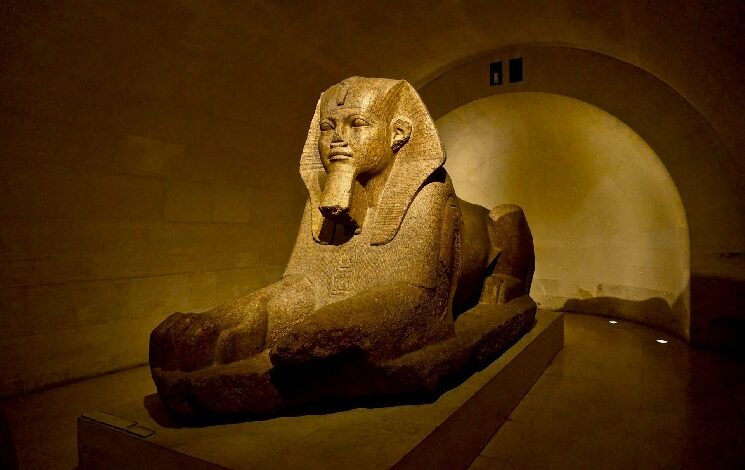

Within the Historical Greek story of Oedipus, nice rewards awaited vacationers capable of remedy troublesome riddles, however a robust sphinx posed the riddles and devoured those that failed to resolve them. Equally, in historical crypto instances, circa 2017, blockchain know-how stood to revolutionize finance and different fields. However two challenges stood in the way in which of this know-how having fun with its full potential: (1) securities legal guidelines that don’t simply map onto decentralized techniques, and (2) a securities regulator hostile to digital belongings, which frequently posed grave dangers to those that tried to resolve the primary problem.

Immediately, the sphinx has resolved to be extra useful, however the riddles stay. The Securities and Alternate Fee’s (“SEC”) Crypto Process Power has said that the company’s earlier regime created “an setting hostile to innovation” and has dedicated to working with trade individuals to craft wise laws. Whereas promising, vital challenges stay. U.S. securities legal guidelines are a mixture of statutes handed by Congress and guidelines adopted by the SEC. The Process Power has signaled the SEC’s willingness to make the latter extra workable by new guidelines and exemptions. Statutes, nonetheless, current many of the challenges and solely Congress, not the SEC, can change them.

Beneath is a primer on the extra widespread riddles at present going through builders of tokenized securities.

Regulatory Issues

For tokenized securities, the developer creates on-chain tokens that every symbolize a share of fairness in an organization or different safety, or one other asset that provides the precise to cashflows. This tokenization can open up potentialities—reminiscent of instantaneous settlement, share fractionalization, and every day dividend funds—that make the product extra environment friendly or functionally numerous than its TradFi counterpart.

Regardless that the SEC could also be extra receptive to concepts for tokenized securities, it doesn’t have the authority to alter statutes. Tokenized securities initiatives, subsequently, will nonetheless want to resolve or keep away from the riddles these statutes current.

The Funding Firm Act

If a token offers its holder financial publicity to belongings that the developer has pooled, that token challenge might be an funding firm lined by the Funding Firm Act, which regulates corporations, like mutual funds, that put money into securities and let buyers get publicity to these investments by shares that they problem.

This riddle existed effectively earlier than crypto, and most opted to navigate it by avoiding being categorised as an funding firm within the first place. That’s as a result of the necessities imposed by the Funding Firm Act don’t work effectively with enterprise fashions that contain greater than the shopping for and promoting of securities. There are substantial restrictions on debt and fairness raises, borrowing, and even enterprise with associates. For these unable to keep away from triggering these necessities, there are exemptions which may be accessible.

Dealer-Sellers Underneath the Securities Alternate Act

Anybody who buys and sells securities for others or stands prepared to purchase and promote securities for their very own account could also be a dealer or seller. There isn’t a shiny line rule for qualifying as a broker-dealer, however the SEC and courts think about as indicia whether or not you present liquidity, cost a charge associated to the commerce value, actively discover buyers, or play a job in holding buyer funds or securities.

Whereas there’s no sensible option to commerce digital belongings as a broker-dealer at present, the SEC might use its present authority to chart a sensible path for doing so. In the very best case, that may take time and nonetheless include some compliance obligations.

Exchanges Underneath the Securities Alternate Act

Whereas it could not appear like a conventional securities change, a platform utilizing sensible contracts to convey collectively orders for tokenized securities from a number of patrons and a number of sellers for matching and execution might qualify as one, relying on its construction.

At the moment, solely broker-dealers can commerce on exchanges, and exchanges can’t maintain buyer accounts or custody buyer securities. Even when the SEC is ready to rework these guidelines, some necessities would little doubt persist.

Safety-Based mostly Swaps Underneath the Securities Alternate Act

If a tokenized safety offers its holder publicity to the financial efficiency of a number of securities, it could have crossed over into the sophisticated world of security-based swaps. Typically, tokens that present for the change of future funds primarily based on the worth of a safety (or occasions regarding that safety) withoutconveying possession rights are prone to be swaps. Safety-based swaps are beneath the joint jurisdiction of the SEC and the Commodity Futures Buying and selling Fee. The necessities for them are many, with essentially the most notable being guidelines prohibiting retail buyers from buying swaps.

AML and KYC

Corporations concerned in buying and selling or transferring tokenized securities additionally want to contemplate the applicability of anti-money laundering and know-your-customer legal guidelines. Compliance necessities depend upon the position being performed within the transactions however can embrace amassing and verifying the identify, birthdate, and deal with of shoppers.

The Riddles Should Be Labored By way of, Not Round

Fixing these riddles just isn’t an finish in itself. When designing any tokenized securities challenge, builders make decisions primarily based on the economics, the know-how, and the regulatory framework. These areas are intertwined, because the know-how could make the economics potential and resolve the place a challenge falls throughout the regulatory framework. However as a result of these concerns are so interrelated, builders ought to analyze them holistically from the start. Leaving regulatory concerns for the top can flip right into a sport of Jenga the place problematic elements are eliminated solely to topple the advantages of and goals for the economics and know-how. The riddles posed in the present day aren’t merely obstacles to the numerous benefits of blockchain know-how, however essential elements of the reply.

The opinions expressed on this article are these of the creator(s) and don’t essentially replicate the views of Skadden or its shoppers.